Interest in progressive wealth taxation has grown as a way to combat inequality and generate revenue, especially in the post-COVID-19 era (e.g. Czajka et al. 2021). Yet, there is no consensus on the effects of such taxation. Scholars views’ differ: some highlight enforcement challenges and potential tax evasion (e.g. Bastani and Waldenström 2024), while others emphasise enduring impacts on wealth distribution and government revenue due to wealth accumulation dynamics (Jakobsen et al. 2020, Saez and Zucman 2019).

In a recent paper (Londoño-Vélez and Avila-Mahecha 2024), my co-author and I help fill this gap by estimating behavioural responses to wealth taxation in Colombia. We use extensive administrative tax microdata and leverage cross-sectional and time variation in individuals’ exposure to the wealth tax. Colombia featured average wealth tax rates and discrete notches at certain wealth thresholds. For instance, a taxpayer reporting slightly below 1 billion pesos in 2010 ($520,830) owed no tax, but an additional peso led to a 1% tax on all taxable wealth. Significant policy changes in four separate years, including tax duration, exemption thresholds, and rate schedules, create substantial identifying variation and provide one of the world’s largest wealth tax policy experiments.

Bunching below wealth tax brackets

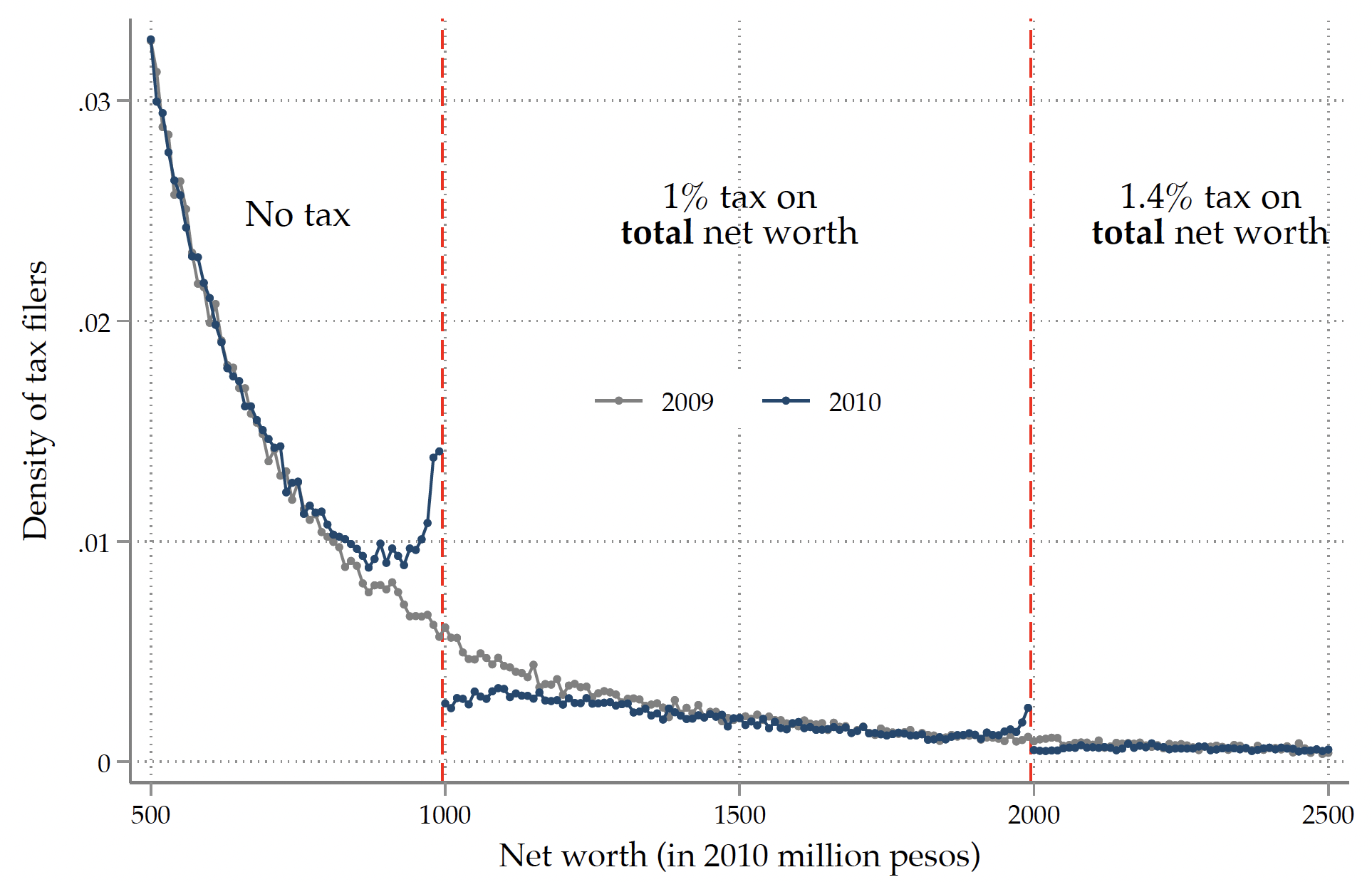

Figure 1 compares individuals’ wealth holdings before and after Colombia’s temporary wealth tax. Taxpayers promptly reduce their reported wealth to fall below higher tax brackets when faced with wealth tax increases. A 1% increase in (one minus) the wealth tax rate leads to an immediate 2% rise in reported wealth for the marginal buncher, with one-fifth of revenue lost due to taxpayers’ instant response.

Figure 1 Wealth taxation causes an immediate response by taxpayers

Source: Londoño-Vélez and Avila-Mahecha (2024, Figure 2).

Hysteresis

Moreover, we find a lasting impact of wealth taxes that persists even after the tax policy has ended, providing the first empirical evidence of a hysteresis effect resulting from a transitory tax policy.

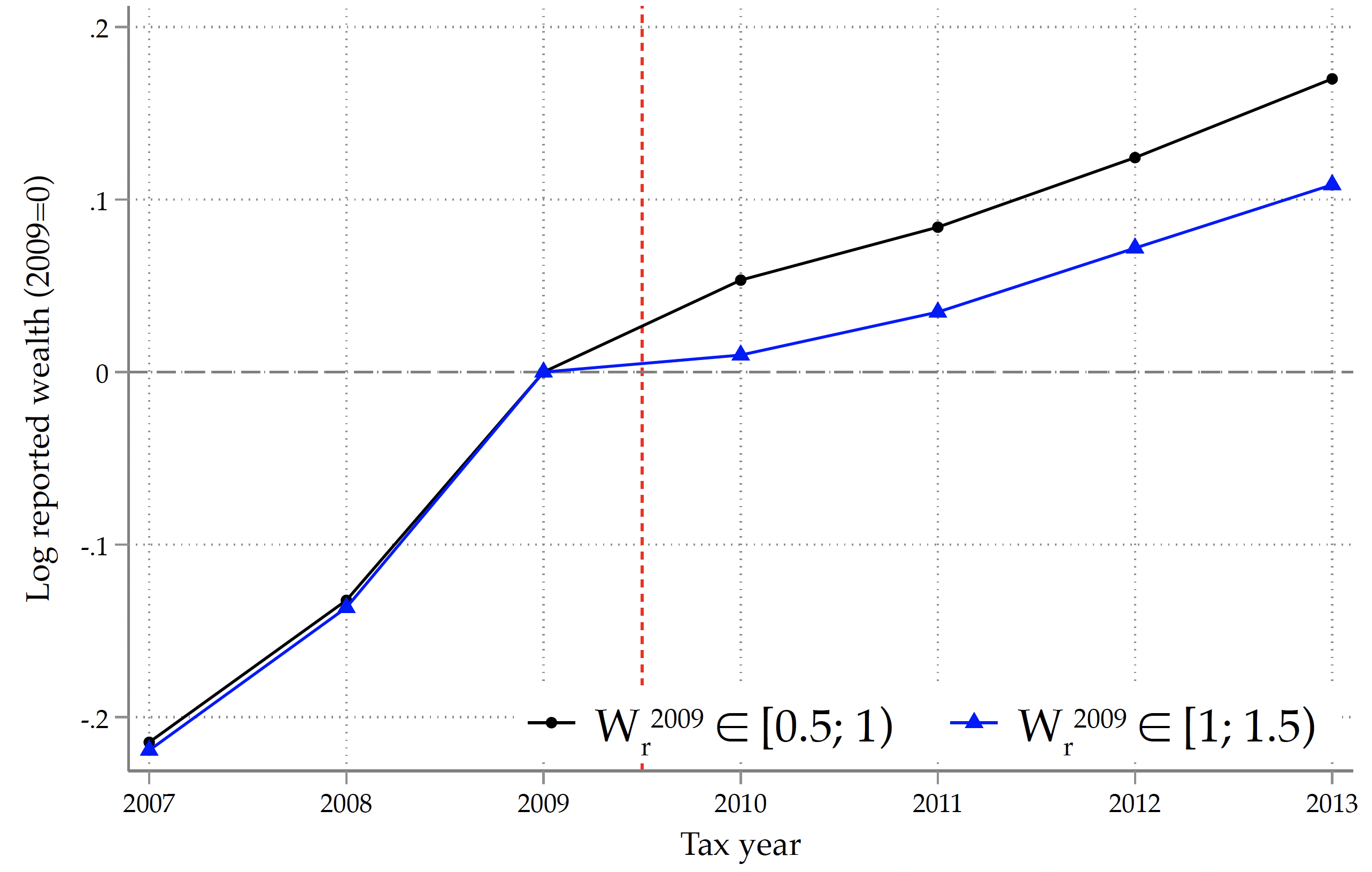

Figure 2 illustrates the significance of hysteresis in the realm of wealth taxes, showing that taxpayers continue to report lower levels of wealth for years following the tax’s implementation. This effect persists beyond the tax’s expiration and cannot be attributed to tax incentives or fixed adjustment costs. Instead, taxpayers strategically adjust their reported wealth to avoid detection and future taxation. Those who initially bunched in response to the tax persistently report lower wealth, while even those initially below the exemption threshold also avoid surpassing the expired threshold as a preemptive measure against future taxes. This implies that a temporary wealth tax can have enduring impacts on wealth distribution and government revenues through hysteresis effects.

Figure 2 Wealth taxes can cause persistent effects

Source: Londoño-Vélez and Avila-Mahecha (2024, Figure 5A).

Misreporting unverifiable assets

Taxpayers’ response to the wealth tax is driven by their misreporting of assets that authorities cannot verify. Leveraging the panel structure of the microdata and the variation induced by the reform using instrumental variables, we characterise the taxpayers who engage in bunching as a response to the wealth tax and those who do not. Unlike Switzerland and France, Colombia has third-party reporting of financial wealth. However, coverage of non-financial assets is only partial and valuation of certain assets, like stocks in closely-held private businesses, poses challenges – a common issue among wealth-taxing countries (OECD 2018). We find that bunchers tend to possess more non-third-party-reported assets, which are easier to adjust, and fewer fixed assets (like real estate) that are not easily modifiable. Moreover, by breaking down the response of bunchers to the wealth tax, we shed light on their evasion strategies. Specifically, bunchers underreport business assets not subject to third-party reporting and artificially inflate liabilities. Consistent with some of the evidence from Europe (Brülhart et al. 2019, Seim 2017), Colombian taxpayers capitalise on the differential coverage of third-party information trails to underreport what is less likely to attract authorities’ attention.

Hiding assets in hard-to-track entities in tax havens

Additionally, wealth taxation spurs the wealthiest individuals to obscure assets in hard-to-track entities situated in tax havens. To investigate this margin of response, we combine the Colombian tax records with the leaked Panama Papers, which detail clients of Mossack Fonseca, one of the world’s top creators of hard-to-trace companies, trusts, and foundations. Notably, Panama had been a preferred tax haven for Colombians, rendering the Panama Papers highly pertinent for studying oshoring in our study population (Londoño-Vélez and Avila-Mahecha 2021). Once again, we leverage tax changes resulting from reforms to identify causal effects.

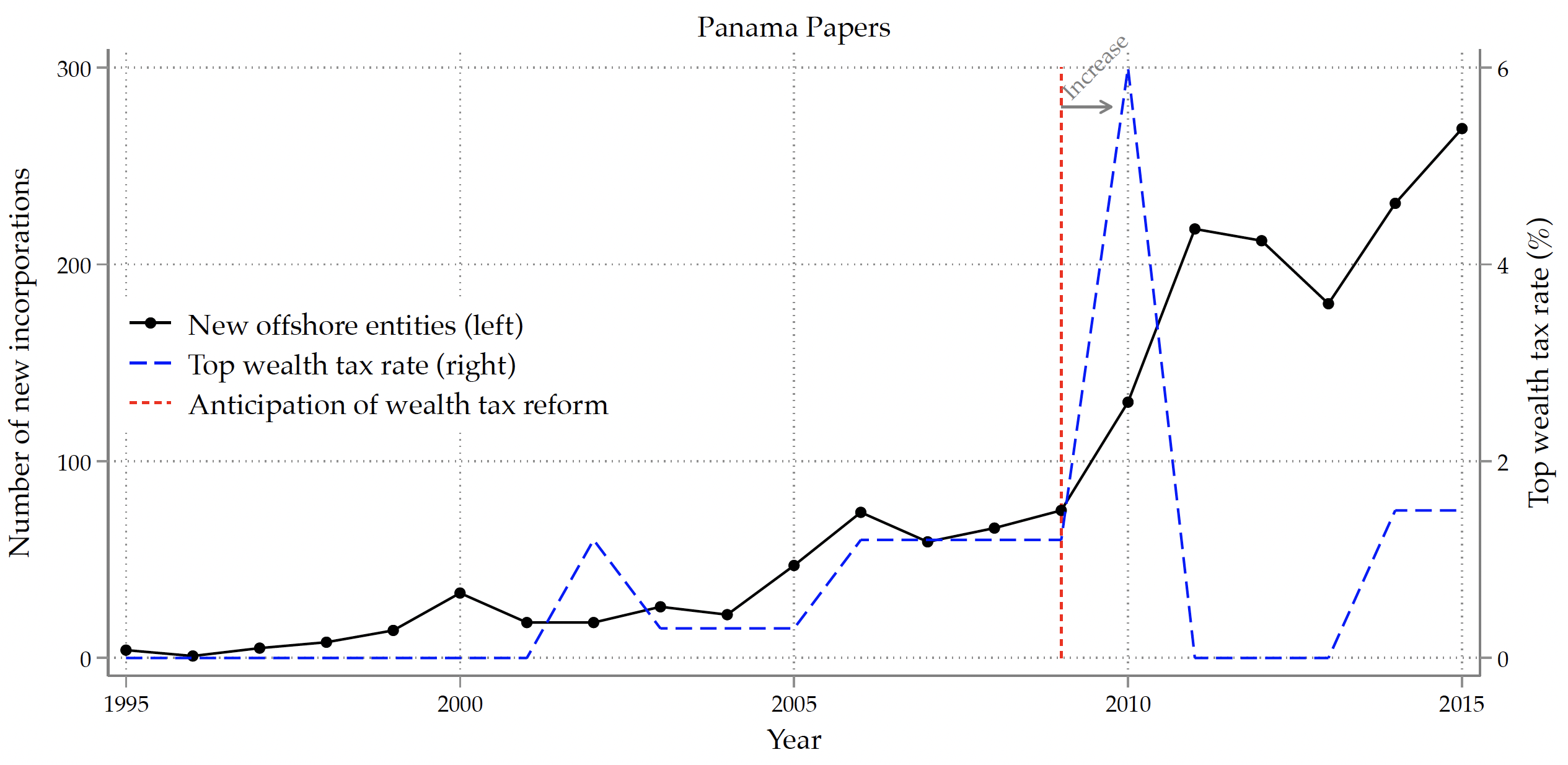

Figure 3 reveals that since the reinstatement of the wealth tax in Colombia, an increasing number of Colombians have established offshore entities annually (this feature distinguishes them from counterparts in other countries, even after flexibly controlling for general time trends).

Figure 3 The use of offshore entities is correlated with the wealth tax

Source: Londoño-Vélez and Avila-Mahecha (2024, Figure 7A).

Furthermore, escalations in wealth tax rates have prompted affluent Colombians to shift their assets to tax havens. Employing an event-study design, we demonstrate that individuals who incorporate offshore entities in years when wealth is taxed subsequently report fewer assets to Colombian authorities, indicating a strategy of concealing assets in hard-to-track entities to minimise the impact of the wealth tax.

Final thoughts

The renewed interest in wealth taxes following the COVID-19 pandemic underscores the relevance of comprehending the effects of these taxes. Colombia is a valuable case study for understanding responses to wealth taxation due to its longstanding history of taxing wealth, multiple policy reforms, and tax schedules conducive to impact analysis. Additionally, as an upper-middle-income country, it occupies a position in the midrange of global income distribution and offers insights relevant to a substantial number of other countries, some of which – such as Argentina, Bolivia, and Ecuador – have introduced temporary wealth taxes in the pandemic aftermath.

From a policy perspective, enhancing the tax authority’s information about taxpayers’ wealth becomes crucial. This involves measures like expanding third-party reporting and cross-validating data for enforcement. Alongside wealth taxation efforts, effective strategies against offshore evasion are vital. These include measures like creating registries of beneficial ownership, foreign asset reporting, and international cooperation through automatic tax information exchange agreements to combat offshore tax havens’ role in wealth concealment.

References

Bastani, S and D Waldenström (2024), “Taxing the Wealthy: The choice between wealth and capital income taxation”, VoxEU.org, 5 March.

Brülhart, M, J Gruber, M Krapf and K Schmidheiny (2019), “Wealth taxation: The Swiss experience”, VoxEU.org, 23 December.

Czajka, L, A Gethin and A Chatterjee (2021), “Taxing wealth in a context of extreme inequality legacy: The case of South Africa”, VoxEU.org, 24 April.

Jakobsen, K, K Jakobsen, H Kleven and G Zucman (2020), “Wealth Taxation and Wealth Accumulation: Theory and Evidence from Denmark,” Quarterly Journal of Economics 135: 329–388.

OECD (2018), The Role and Design of Net Wealth Taxes in the OECD, OECD Publishing.

Londoño-Vélez, J and J Avila-Mahecha (2024), “Behavioral Responses to Wealth Taxation: Evidence from Colombia”, NBER Working Paper 32134.

Londoño-Vélez, J and J Avila-Mahecha (2021), “Enforcing Wealth Taxes in the Developing World: Quasi-Experimental Evidence from Colombia,” American Economic Review: Insights 3(2): 131–48.

Saez, E and G Zucman (2019), The Triumph of Injustice, W. W. Norton & Company.

Seim, D (2017) “Behavioral Responses to Wealth Taxes: Evidence from Sweden”, American Economic Journal: Economic Policy 9(4): 395–421.