Jacuqeline Dupre’s godmother, after purchasing a $90,000 Stradivari cello (The Davidov) for her in 1964, recognised its worth:

‘You know, dear child, this instrument is extremely valuable, very expensive. You must hang on to it as it’s the only thing you’ve got. If anything should happen to you you’ve got this to sell.’ p. 218, Faber

But just what is the return to holding a violin? A previous academic study of violin prices by Myron Ross and Scott Zondervan (1989) examined a dataset of 17 Stradivaris that were bought and sold a total of 29 times between 1803 and 1982. They found an average real return over this period of approximately 2 percent, equal to the long-run real rate of interest.

In order to examine this question in more detail, Philip Margolis of Cozio Publishing and I have analysed two new datasets of violin prices. One dataset includes 75 observations on repeat sales of the same violins at auction starting in the mid-19th century and the other dataset includes over 2000 observations on individual violin sales at auction since 1980. Our research finds that overall real return (using repeat sales) for Old Italian violins for the period 1850-2006 have been approximately 3.3%. Real returns to the overall portfolio of individual sales since 1980 have been nearly 4%.

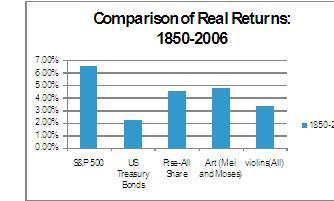

The figure below compares these returns to other assets for the period 1850-2006:

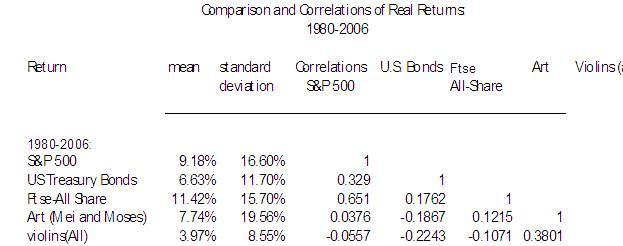

The real returns to violins are lower than standard investments, other than treasury bonds, and even lower than the returns to art. The returns do not include the effect of commissions; as commissions for stocks and bonds are relatively low, the differences in returns will be magnified if commissions are taken into account. But this does not necessarily mean that they are a poor investment. Using detailed data from 1980, we can compare the mean returns, the standard deviation of returns, and very importantly, the correlation of violin returns with other assets. As demonstrated below, violins have provided a relatively stable return, with low, and in some cases negative, correlation to other assets.

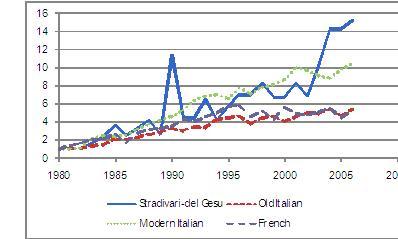

Different types of violins also provide different returns. While volatile, the subset of violins made by Stradivari and Guarneri (del Gesù) --widely considered to be the two top old Italian violin makers-- have outperformed in return the violins of other makers. However, the Modern Italian School also appears to be doing extremely, and consistently, well.

The reasons for these differences may be as follows. There is a large absolute price difference between Modern Italian and Old Italian instruments and Old Italian instruments are unaffordable to many musicians. Priced out of the Old Italian market, many professional musicians are instead choosing modern Italian instruments, or even instruments made by contemporary violin makers. A lively debate is taking place within the market about whether such instruments are acoustically equal to the Old Masters. Hence, there may be a shift in demand toward Modern Italian instruments. The fact that Stradivari’s and del Gesù’s continue to outperform other violins may be due to the fact that they really operate in a different market: the buyers in this market are wealthy individuals and collectors rather than working musicians

References

Faber, T. (2004) Stradivarius. Macmilan: London

Graddy, K., and P. Margolis (2007) “Fiddling with Value: Violins as an Investment?”, CEPR Discussion Paper 6583.

Mei, J and M. Moses (2002) “Art as an Investment and the Underperformance of Masterpieces”, American Economic Review 92: 1656-1668.

Ross, M. H. and S. Zondervan (1989), “Capital Gains and the Rate of Return on a Stradivarius”, Economic Inquiry 27: 529-540.