Each year, many US households do not owe federal income taxes. Further, a substantial fraction receives income transfers from the government – ranging from cash welfare to unemployment compensation. The estimate for 2009 that 47% of Americans paid no federal income tax drew considerable attention during the 2012 presidential election cycle, especially due to Republican candidate Mitt Romney’s comment:

“All right, there are 47% who are with him, who are dependent upon government, who believe that they are victims, who believe that government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you name it. […] These are people who pay no income tax. Forty-seven percent of Americans pay no income tax”.1

Romney’s viral quote is part of a broader public discussion of whether the US has a class of ‘takers’ who do not contribute tax dollars and who depend on government largesse.2 Romney’s comment suggests that US fiscal policy has yielded a class of dependent citizens reliant on transfer income and fully detached from the tax rolls. The years since the 2012 election have brought numerous proposals to reform the tax code and to strengthen the work incentives of transfer programmes. Whether a class of takers is in need of a push back into the workforce and away from the dole depends on the circumstances of those not paying tax or receiving transfers, and importantly on the persistence of years with zero tax liabilities and positive transfer receipt.

In this column, we address exactly this question. How many of those who pay no taxes or who receive transfers do so for a short period of time, and how many are really ‘dependent’ on these forms of public largess over longer periods?

Prior studies of a single year

Studies using annual data have detailed the characteristics of those who do not pay tax in a particular year, explaining that many are very low-income individuals, elderly, and students. In 2011, half of those not owing federal taxes were rendered non-taxable by structural features like the standard deduction and personal exemptions, while the other half had their tax liabilities eliminated by tax expenditures like the Earned Income Tax Credit (EITC) and the Child Tax Credit (Johnson et al. 2011). Many of these individuals nonetheless are subject to payroll tax.3 Greenstone and Looney (2012) analyse data from 2007 and found that only 22% of tax units paid neither federal income nor payroll tax.

On the transfer side, the US Congressional Budget Office (2013) found that in 2010 transfers other than old-age benefits are concentrated among low-income households, but old-age benefits are received more broadly – households in the lowest quintile received 36.2% of total Social Security and Medicare benefits, while the middle quintile received 16.7%, and the highest quintile claimed 11.4%. For other transfers, the bottom two quintiles received 47%. This category includes food-stamps, Medicaid, Children’s Health Insurance, and Temporary Assistance for Needy Families (TANF). The CBO’s analysis also found that the bottom quintile in 2010 paid an average income tax of less than $50 per household, despite after-tax-and-transfer incomes that averaged $30,800.

Newer studies of multiple years

The studies discussed above all draw on a single year of data and consistently show that poor households each year contributed little federal tax and received the overwhelming share of federal transfers. A one-year snapshot is not representative of a person’s typical circumstances or lifetime income, however, and does not reveal if or when they start paying tax again or leave social safety net programmes. Recent work by Heim et al. (2014) addresses the persistence question, at least for tax liabilities, using data from actual tax returns for the ten years from 2001-2011. They find that 51% of tax units had no positive federal tax liability in 2009.

In contrast, in a recent paper we turn to PSID data for two reasons: these data afford a longer window of 40 years, and they track transfer receipts (Fullerton and Rao 2016). The PSID does not report exact tax payments, but PSID income data can be used to calculate tax liabilities.4 In this paper, we see whether people with zero tax liability and those receiving transfers do so for just part of their lives or for most of their lives. This analysis can help us understand whether government policies lead to chronic dependency, or whether the insurance aspects of the progressive federal income tax and social safety net are providing temporary assistance to individuals with temporarily low income.

The long panel of data provided by the PSID allows us to take an expansive look at household tax status and benefit take-up, and how they evolve over as many as 40 years. The long window better accounts for social mobility and random income shocks, the implicit lifecycle patterns of some transfers like Medicare and Social Security that are formally targeted at older individuals, and transfer and tax provisions targeted at just young families with children – temporary programmes like TANF, the EITC, and Child Tax Credit. Even though the PSID provides very long panels of data, it isn’t lifetime data, so the duration analysis we conduct is censored at some high number of years.

If the transfer and tax systems are providing temporary relief to households for short periods of low income, we would expect to see that households that do not pay tax or that receive transfers do so for only a limited number of years. However, the provisions of tax and transfer systems changed many times over this 40-year period, and we can’t separate the effects of changes in these rules from the effects of changes in household circumstances. We instead focus on documenting the frequency and concentration of receiving transfers or not owing federal income tax. What we find is that many households at some point do not owe federal income tax or do receive public transfers.5 About 68% of PSID households owe no tax in at least one year. Roughly 78% receive some type of transfer in at least one year, and more than 58% receive a transfer other than Social Security.

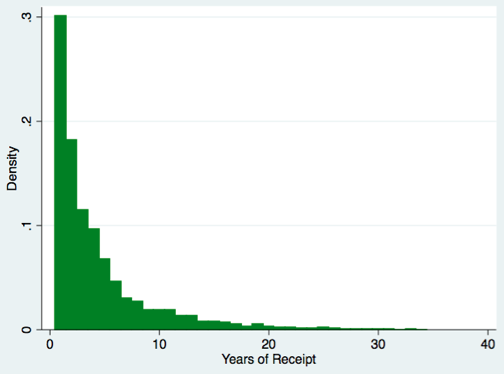

For the two-thirds of households that do not owe tax in at least one year, Figure 1 reports the distribution of years they have zero tax liability. Among these households, 19% pay no tax for only one year, and about 52% do not pay tax for five years or fewer. A meaningful minority does not pay taxes for many years. For example, nearly 30% fail to owe federal income tax for ten or more years.

Figure 1. Years of non-tax status, conditional on not paying at least one year

Of the households that receive some kind of transfer in at least one year, Figure 2 shows that 14% receive transfers for just one year, and about 48% of households receive transfers for five years or fewer.

Figure 2. For households that ever receive any federal transfers, the number of years any federal transfer is received

How many years in a row?

Retired individuals are supposed to receive Social Security benefits for the rest of their lives, but that status is probably not best called ‘dependency’! Transfers other than Social Security are received by many fewer households, and these other transfers are typically received for fewer years. Nearly 42% of households never receive a transfer other than Social Security. Of those that do, Figure 3 shows that about 48% receive them for only one or two years, and more than 76% receive such transfers only for five years or less.

Figure 3. For households that ever receive transfers other than social security, the number of years that any such transfer is received

The panel nature of the PSID data also allows us to track each individual’s status over time. Table 1 shows survival rates for the ten years following the beginning of transfer receipt or the beginning of zero tax liability.

Table 1 Tax and transfer status survival rates

Source: Fullerton and Rao (2016). This table reports the share of households in each status remaining in that status 1 to 10 years later, without a transition out of that status. The sample includes all households over the 1970 to 2010 period that are ever in each status and for which we have at least 10 years of continuous data. “Obs.” denotes the number of observations per year, while “Hh.” denotes the number of households. Attrition is not necessarily similar among households in different states. The tabulations are weighted using PSID household weights.

Not paying federal tax is temporary for many, but not all, households. Of all those who pay no tax, more than 18% pay tax the following year, and nearly 47% pay tax within ten years. However, roughly 53% of those not paying federal tax continue in that status over the subsequent ten years. Overall, transfer receipts are reasonably sticky, in part because Social Security benefits are intended to last. Other transfers are far more temporary. Of those receiving only transfers other than Social Security, 44% stop receiving such transfers the following year, and more than 90% stop within ten years.6

Summary

The tabulations in our study stand in contrast to the concerns that a stagnant ‘47%’ of Americans do not contribute to the tax system and just receive benefits. Even though many households find themselves not paying tax or receiving public benefits in at least some years, only a small fraction consistently pay no tax or consistently receive public transfers. Reform proposals should keep in mind that the experience of not owing income tax or receiving transfers are common to many Americans. Most transfer recipients and many of those not paying tax move quite quickly out of such status, so it appears that these government policies operate as short-term insurance programmes. In effect, as well as by design, they buffer households against temporary income declines and short-term bad shocks – rather than creating a permanent dependent class.

References

Fullerton, D and N Rao (2016), “The Lifecycle of the 47%”, NBER Working Paper 22580.

Greenstone, M, and A Looney (2012), “The Truth about Taxes: Just about Everyone Pays Them”, Brookings on Jobs Numbers, Washington, DC: The Hamilton Project, The Brookings Institution.

Heim, B T, I Z Lurie, and J Pearce (2014), “Who Pays Taxes? A Dynamic Perspective”, National Tax Journal, 67 (4), 755.

Johnson, R, J Nunns, J Rohaly, E Toder, and R Williams Jr. (2011), “Why Some Tax Units Pay No Income Tax”, Urban-Brookings Tax Policy Center, Washington DC.

New Yorker (2012), “Mitt’s forty-seven-per-cent problem”, 18 September.

Williams, R Jr. (2009), “Who Pays No Income Tax?”, Tax Notes, 29 June, p. 1583.

Williams, R Jr. (2013), Who Doesn’t Pay Federal Taxes?, online video.

U.S. Congressional Budget Office (2013), The Distribution of Household Income and Federal Taxes, 2010. Washington, DC: CBO Publication No. 44604.

Endnotes

[1] For the full quote see New Yorker (2012). This widely reported share of tax filers not owing federal tax is from the Urban-Brookings Tax Policy Center (TPC) Microsimulation Model estimates for 2009. For further background on the TPC estimate, see Williams (2009). As we discuss later, the TPC looks at ‘tax units’, which are different from household data in our PSID data.

[2] For example, Representative Paul Ryan said earlier at the Heritage Foundation: “We’re coming close to a tipping point in America where we might have a net majority of takers versus makers in society” (quote from National Review).

[3] For tax units without federal income tax liability in 2013, for example, Williams (2013) finds that two-thirds do incur payroll tax. Only 14% of Americans pay neither income nor payroll tax—two-thirds of whom are over age 65, retired, and do not have sufficient income to keep them on the tax rolls. Of those remaining, nearly all have very low income (earning less than $20,000 a year). Tax expenditures like the EITC serve to zero out their liabilities.

[4] Transfers other than Social Security include the following cash transfers: AFDC/TANF, Supplemental Security Income, Unemployment Compensation, and Other Welfare Income (as defined by the PSID). The PSID does not delineate what comprises “Other Welfare Income”, but no valuation methods are disclosed, so we presume it consists of cash transfers and not in-kind benefits.

[5] We do not include Medicare or Medicaid services in our analysis of transfers, because the PSID does not provide a dollar value for a household’s receipt of those medical services.

[6] These durations partly reflect time limits on benefit receipt for programmes such as cash welfare and SNAP. Time limits differ by state in the US, and even within states, as some individuals qualify for waivers. But they are part of the design of safety net programmes, so they help determine the ‘dependence’ on the system.