The Eurozone is living the most crucial time since its establishment.

- Sovereign debt spreads are spiralling up despite the reforms undertaken both at the Eurozone and national levels.

- Financial markets are almost closed to foreign capital in many member states that are suffering a sudden stop only mitigated by the liquidity made available by the Eurosystem.

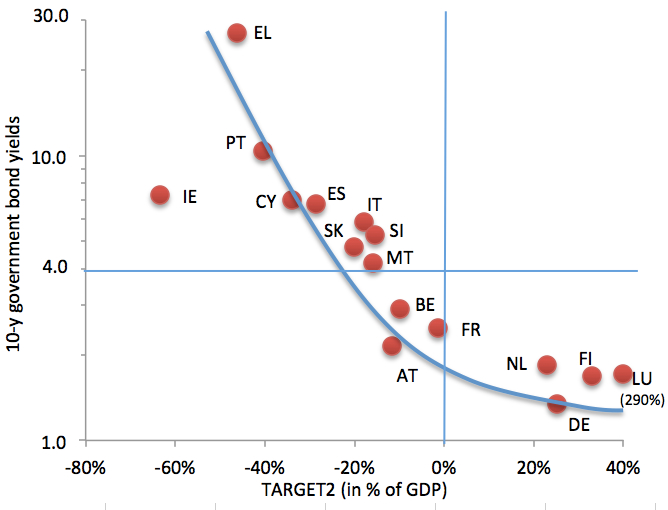

The consequence is a vicious cycle of self-fulfilling expectations whereby higher interest rates and TARGET2 imbalances reinforce each other (Figure 1).

In times like this fiscal adjustments and structural reforms implemented by countries with large imbalances are self-defeating (Padoan et al. 2012). This situation should not be allowed to continue. Not only does it threaten the weakest members of the Eurozone, expectations of a partial Eurozone breakup portend disaster for all Eurozone countries – and the world economy.

Figure 1. 10-years government bond yields (in %, logarithmic scale) and TARGET2 balances (in % of GDP, latest data available).

Source: ECB and euro Crisis Monitor (Osnabrück University)

The markets have over-reacted

The spreads are clearly overshooting with respect to any sustainable long-run level. Differences in fundamentals are not enough to explain the differences observed in the prices of sovereigns in the Eurozone, as De Grauwe (2011) has shown comparing Spain and the UK. This reflects the importance of institutions capable of anchoring expectations of economic agents, reducing the uncertainty about prices and bid-to-cover ratios.

Since the financial crisis started, Eurozone leaders have shown the flexibility to deal with unexpected problems, but they have not done enough to banish uncertainty about the future of the Eurozone. The interventions of Greece, Ireland, and Portugal have covered the funding needs of the public sector, but at the cost of expelling private demand from the market. These advances have not worked because they are running against the market belief that the euro can indeed break.

An alternative solution

An alternative strategy should be implemented to restore the functioning of sovereign bonds markets and reduce the interaction between banking and sovereign risk. This strategy should avoid past mistakes ensuring:

- Long-run consistency. Short and medium-run policies should be consistent with a long-run design of the Eurozone.

- Risk premia based on fundamentals. Sovereign prices should reflect differences in fundamentals and not expectations of a euro break up.

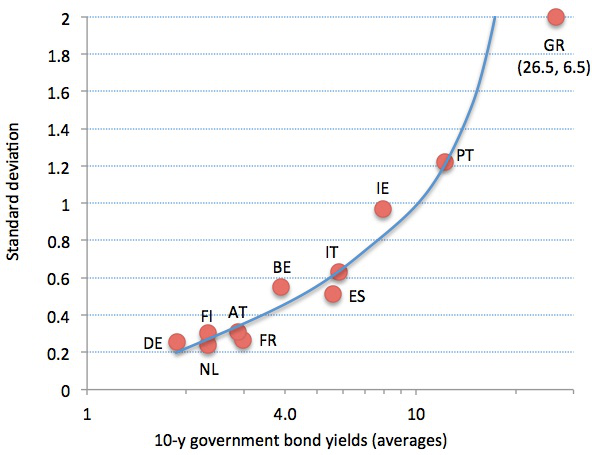

- Anchoring the expectations of sovereign debt prices. Reducing the excessive size and volatility of government debt yields – that are positively correlated as Figure 2 shows – is essential to incentivise its demand in primary and secondary markets.

Figure 2. Average and standard deviation of ten-year government bond yields from August 2011 to June 2012.

Source: Bloomberg

Long-run consistency requires a clear roadmap for the Eurozone, but a correct design of the future is not enough. Economic policy should put the economy onto the path to the right equilibrium. This can be understood as a standard dynamic programming problem that entails identifying the appropriate steady state of the economy and solving backwards to implement the plan that guarantees that the good equilibrium is achieved. The Eurozone needs to identify the short-run policies and institutions that facilitate greater integration in EMU, avoiding the diverging track towards a breakup of the euro, as markets are discounting now with a significant probability.

Eurobonds should be part of the long-run solution, once Eurozone countries have undergone a similar convergence process as in the run-up to the euro. Then, convergence in interest and inflation rates was a necessary condition for a single monetary policy. Now, fiscal convergence and the reduction of other imbalances are key to support a process of sound – limited – mutualisation of debt. The long-run solution will take time to be implemented. Until it is ready, the Eurozone needs a mechanism capable of addressing the short-run risks. A modified European Stability Mechanism (ESM) can be such a mechanism intervening in the sovereign debt markets to anchor expectations, with explicit objectives, in the same vein as the ECB anchors inflation expectations. The ESM should announce country-specific caps to the spreads of troubled Eurozone members based on the health of the fundamentals. Alternatively, to provide better information to the market, the ESM could announce a soft upper bound so that the limit does not have to be changed very often. These fundamentals can be inferred for each country from the indicators in the alert mechanism by the European Commission. To increase the effectiveness of these interventions, the ESM should not have preferred status (Gross 2012) and should have unlimited access to the ECB, if needed.

Design, pros and cons

- First, the ESM would stabilise debt markets assuming the sovereign risk of weakest countries, letting the ECB to control inflation. This preserves the independency of the ECB and improves efficiency with respect to the current Securities Markets Programme (SMP).

- Second, whereas the SMP does not create any investment safe asset the ESM will issue a safe asset thus contributing to reduce the world scarcity of this type of securities (Caballero 2010, IMF 2012) and to attract funds to the Eurozone.

- Third, it will have the advantages of a big market player and, if the buying of the public debt of countries with higher risk premia were necessary, by issuing debt at a lower interest rate the ESM would make substantial profits.

- Fourth, the ESM would reinforce the incentives of countries to correct imbalances if these qualify as determinants of the explicit objectives for bond yields (Muellbauer 2012).

- Lastly, by reducing financial tensions, the ESM would contribute to increase the effectiveness of fiscal adjustment and structural reforms in countries with larger imbalances.

Among the potential caveats, it is said that the unlimited funding by the ECB through the collateral discount of the ESM may be a very big risk for the central bank. These risks might be exaggerated since this collateral is of much better quality than those of commercial banks and the sovereign debt of the SMP. Commercial banks may buy ESM securities improving their collateral and contributing to disconnect their balances from their sovereign. Second, ESM interventions will distort the market, but markets are already heavily distorted and transitory interventions by the ESM should help to correct this. Third, ESM interventions would not be incompatible with the no-bailout clause since they would be limited to support national sovereign debts that are sustainable under a proper conditionality, and at normal levels of interest rates. Additionally, this mechanism does not exclude the possibility of public debt restructuring when needed as proposed by Wyplosz (2012). Finally, given the costs of the current economic recession, it is clear that the perils of moral hazard do not correspond with reality (Wolf 2012).

Still an effective mechanism through the ESM may not be ready in a few weeks or months. In the meantime, both the European Financial Stability Facility (EFSF) and the ECB may intervene in sovereign debt markets. The ECB should activate its SMP again, but this time with a clear political commitment and support by EMU countries: this should be a temporary arrangement until its portfolio of sovereign bonds can be handed over to the ESM once it is operative.

Conclusions

In successive meetings, European leaders have put forward good and workable ideas for a better design of the EMU. But these blueprints might never see the light of day if the euro actually breaks down. Time is of the essence. European leaders must take the necessary steps to ensure that confidence in these initiatives gathers momentum. They should make them operative without further delay. This is what the world expects from the next European Council meeting that will take place on 28 and 29 June.

The strategy proposed here is ambitious and challenging, and will require bold political determination. Costs and benefits will be different across members. Core countries will have to support flexible European institutions and contribute to limited mutualisation of public debt, to benefit from a more stable and balanced monetary union, in which to lay the foundations of a more solid economic recovery. Peripheral countries will have to implement ambitious adjustments and structural reforms, losing sovereignty in favour of European institutions, to benefit from much better access to financial markets. But, with a well-designed roadmap, benefits may exceed the costs for all members.

References

Caballero, R (2010), “Understanding the global turmoil: It’s the general equilibrium, stupid”, VoxEU.org, 21 May.

De Grauwe, P (2011), “Debt Sustainability Inside and Outside a Monetary Union”, Mimeo.

Gross, D (2012), “Why an ESM Programme Could Be a Kiss of death: Recovery Values and Subordination”, VoxEU.org, 22 June.

International Monetary Fund (2012), "Safe Assets: Financial System Cornerstone?", Global Financial Stability Report, c. 3. April.

Muellbauer, J (2012), “A Eurobond medicine Ms Merkel could swallow”, Financial Times, 11 June.

Padoan, PC, U Sila, and P van den Noord (2012), “The euro’s future begins now: Escaping debt traps and moving towards sustainable growth”, VoxEU.org, 19 June.

Wolf, M (2012): “The German response”. Financial Times, 7 June.

Wyplosz, C (2012), “The Eurozone’s May 2010 strategy is a disaster: Time to pay up and end this crisis”, VoxEU.org, 20 June.