Rarely has an episode of financial turmoil generated such economic havoc as the 2008 financial crisis. The wealth destruction was unique – estimated at $50 trillion, the equivalent to one year of world GDP (Loser 2009) – which resulted from the plunge in the value of stocks, bonds, property, and other assets. The crisis was unprecedented in its global scale, synchronicity, and severity. It hindered credit access to businesses, households, and banks – and choked economic activity.

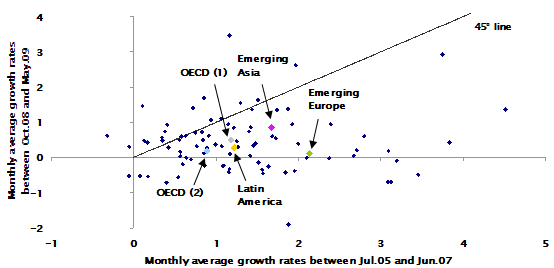

Banks in particular faced unparalleled liquidity stress damaging their ability to lend. Libor-OIS spreads, a conventional measure of liquidity stress and confidence between banks, hit an all time high of 366 basis points (in dollar rates) in October 2008, soon after the Lehman Brothers bankruptcy on 15 September. Bank credit decelerated significantly in several regions, with emerging Europe presenting the lowest average growth rate in the period post-crisis. Bank credit in OECD countries also slowed down especially in countries where banks received public support in the form of capital injections (Figure 1). Displaying high synchronicity, bank credit contracted in 95% of all countries in at least one of the eight months after September 2008.

Figure 1. Real bank credit growth (percentage points)

(1) OECD with banks not receiving public capital support. (2) OECD with public capital support. Source: Authors’ calculations based on IFS data.

Based on Figure 1 and the impressive cross-country variability, we are able to divide the worldwide experiences on the evolution of bank credit into three different groups depending on their performance: good, poor, and extremely poor. In the first group, which corresponds to the north-west area of the 45° line of Figure 1, we find countries where bank credit grew at a higher rate (slightly higher in most cases) after the Lehman Bros. collapse than before . Members of this group include, among others, Germany, Indonesia, Japan, Thailand, Peru, and Poland. The poor performers are in the area south-east of the 45° line and above the X-axis, meaning that their bank credit decelerated after Lehman Bros. bankruptcy, but it did not contract. Members of the second group include, for example, Brazil, Bulgaria, Italy, Ireland, UK, and Spain. And between the extremely poor performers, which are those countries below the X-axis meaning that their bank credit contracted after Lehman Bros. collapse, are Colombia, France, Greece, Hong Kong, Mexico, Netherlands, Turkey, and Venezuela.

New insight on bank credit during the crisis

Building on this worldwide variability, in recent research (Aisen and Franken 2010) we examine the main determinants of bank credit throughout the 2008 financial crisis. We use a dataset covering 83 countries with the aim of providing answers to four questions:

- which countries were able to maintain healthy bank credit growth despite the crisis?;

- what were the main factors that enabled some banking systems to maintain credit flows to the economy?;

- to what extent is this ability dependent on what happened to bank credit growth during the period previous to the crisis?; and

- has macroeconomic policy (monetary and fiscal) played a role in mitigating the severity of the slump in credit?

Answers to these questions will help assess the quality of a banking system. We will be able to compare banking performance across countries, focusing on the critical task of granting loans to businesses and households – an essential ingredient for economic growth.

Credit where credit is due

There is a large literature emphasising the role credit plays on the process of economic growth (for example Rajan and Zingales 1998 and Levine and Zervos 1998). There is also a significant body of work on the existence of lending booms and busts (for example Tornell and Westerman 2002). Berkman (2010) describes how some countries fared better than others during the 2008 financial crisis due to differences in trade or financial openness, economic policies, as well as other factors. But despite this large literature, articles researching the determinants of credit growth are relatively scarce. One example is Moghadam (2010) who analyses the factors behind differences in performance within emerging economies during the recent financial crisis. He concludes that countries with domestic credit booms prior to the crisis tended to experience credit busts during the crisis. Although we reach a similar conclusion, our research focuses on all countries with available data.

To investigate the main macroeconomic, structural and banking determinants (explanatory variables) of bank credit growth following the Lehman Bros. bankruptcy (the dependent variable), we estimate standard OLS cross-section regressions.

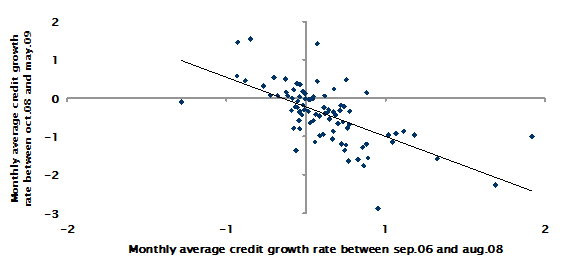

Credit boom and bust cycles made the problem worse

The main determinant of bank credit growth post-crisis is credit growth 24 months prior to Lehman Bros. bankruptcy. This single independent variable can explain 45% of the evolution of bank credit after the crisis (Figure 2). This evidence strongly supports the existence of lending booms and busts, a stylised fact typical of several financial crisis episodes as suggested by Tornell and Westerman (2002). Moreover, this effect is strikingly robust among different specifications and is of quantitative relevance. In particular, an extra monthly increase of credit growth of one percentage point above the trend for the 24 months prior to the crisis leads to a reduction of around two percentage points relative to trend in the growth rate of credit after the crisis.

Figure 2. Real bank credit growth post Lehman Bros bankruptcy (deviation from trend; percentage points)

Source: Authors’ calculations based on IFS and CEIC data.

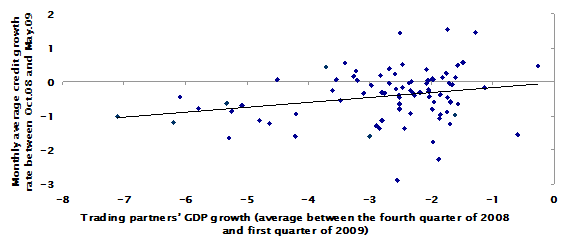

Growth among trading partners propped up bank credit

Another determinant of credit growth after the crisis was the size of the external shock affecting demand across countries. We measure this with the real GDP growth of trading partners due to its high coverage of countries and the fact that is exogenous compared to other measures such as real GDP growth. We find that the coefficient is statistically significant, has the expected positive sign, and is quantitatively important (Figure 3). A one percentage point increase in main trading partners’ GDP raises real bank credit growth after the crisis by a monthly 0.1 percentage point above trend.

Figure 3. Real bank credit growth and trading partner's GDP growth (deviation from trend; percentage points)

Source: Authors’ calculations based on IFS, DOTS and CEIC data.

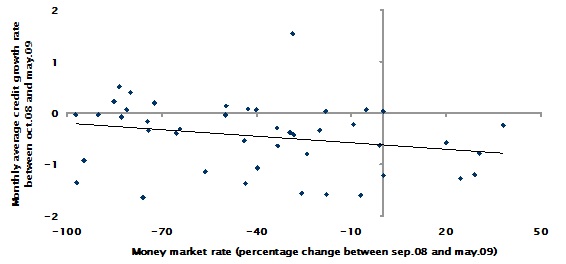

Lower interest rates boosted bank credit

The change in the money market rate has a highly statistically significant coefficient and has the expected negative sign (Figure 4). Countries where the money market rate dropped the most after the crisis, partly due to counter-cyclical monetary policies in those countries, presented higher growth rates of bank credit. A 10 percentage point reduction in the rate of growth of money market rate post-crisis increased the average monthly growth rate of bank credit by 0.04 percentage points.

Figure 4. Real bank credit growth and money market rate (deviation from trend; percentage points)

Source: Authors’ calculations based on IFS and EBRD data.

The upside of financial isolation

Our results also suggest that bank credit in countries with low financial integration performed better than in highly integrated countries – although this relationship is not linear. This suggests that in a financial crisis episode of global proportions, being less financially integrated insulates the banking system in particular, and the economy as a whole, from external financing disruptions. This by no means implies that countries should not pursue financial integration with the rest of the world, but only that this entail costs in a volatile macro-financial environment.

Conclusions

We show that credit booms prior to the crisis are an important determinant of credit contraction observed in the aftermath of the crisis, and that the external shock affected countries differently depending on the growth performance of their main trading partners. Among other relevant variables to explain bank credit growth are the international financial integration and the role of countercyclical monetary policy and liquidity played in each country. The latter variable was crucial in alleviating the credit crunch in the period after the crisis.

Disclaimer: The views expressed herein are those of the authors and not necessarily represent those of the Central Bank of Chile and the IMF.

References

Aisen, Ari and Michael Franken (2010), “Bank Credit during the 2008 Financial Crisis: A Cross-Country Comparison”, IMF Working Paper 1047.

Berkman, S. Pelin; Gaston Gelos; Robert Rennhack and James P. Walsh (2010), “The global financial crisis; Why were some countries hit harder?”, VoxEU.org, 28 March.

Levine, Ross and Sara Zervos (1998), “Stock Markets and Economic Growth”, The American Economic Review, vol.88, No.3, pp.537-558.

Loser, Claudio (2009), “Global financial turmoil and Emerging Market Economies: Major contagion and a shocking loss of wealth?” Centennial Group Latin America, prepared for the Asian Development Bank (ADB).

Moghadam, Reza (2010), “Emerging market countries and the crisis: How have they coped?”, VoxEU.org, 30 April.

Rajan, Raghuram G. and Luigi Zingales (1998). “Financial Dependence and Growth”, The American Economic Review, vol.88, No.3, pp.559-586.

Tornell, Aaron and Frank Westermann (2002). “Boom-Bust Cycles in Middle Income Countries: Facts and Explanation”, IMF Staff Papers, Vol. 49, IMF Annual Research Conference (2002), pp. 111-155.