It is the closest thing to a physical law in international finance (e.g. Obstfeld and Rogoff 1996, Krugman et al. 2015), except that it has been consistently violated for almost a decade now. Textbooks, it seems, will have to be rewritten.

Covered interest parity (CIP) states that the interest rate differential between any two currencies in the money markets should equal the differential between the forward and spot exchange rates. Otherwise, arbitrageurs could make a seemingly riskless profit. For example, anyone able to borrow dollars cheaply in the cash market could profit by lending them via the FX market for yen through a swap – effectively selling dollars for yen today and repurchasing them at the forward rate. The intuition is that both cash and swap transactions amount to borrowing dollars for a given period, so that their cost should be the same.

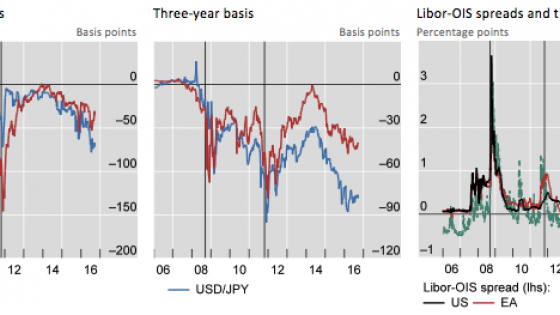

The initial violations – i.e. the opening up of a ‘basis’ or ‘cross-currency basis’ – started with the Global Crisis and continued with the Eurozone Crisis (Figure 1). It became more expensive to borrow dollars against most currencies, notably the yen and the euro, through FX swaps than in the money market. Initially, the explanation seemed quite straightforward: at times of stress, counterparty risk inhibits arbitrage (e.g. Baba et al. 2008, Mancini-Griffoli and Ranaldol 2012). But, after narrowing, the basis opened up with a vengeance around 2014, despite tranquil market and funding conditions, as indicated by the evolution of the VIX and the Libor-OIS spread (Figure 1). In fact, the basis has been so wide that borrowing dollars in the cash market, swapping them for yen or euros and investing the proceeds at negative rates could still yield a profit.

Figure 1 Cross-currency basis against the US dollar, interbank credit risk and market risk1

Notes: 1 The vertical lines indicate 15 September 2008 (Lehman Brothers file for Chapter 11 bankruptcy protection) and 26 October 2011 (Eurozone authorities agree on debt relief for Greece, leveraging of the European Financial Stability Facility and recapitalisation of banks). 2 Chicago Board Options Exchange S&P 500 implied volatility index; standard deviation, in percentage points per annum. OIS = overnight indexed swap; EA = Eurozone.

Sources: Bloomberg; authors’ calculations.

What explains these consistent violations of CIP? This question has recently attracted considerable attention among central bankers and market practitioners (e.g. Arai et al. 2016, Barclays 2015, Du et al. 2016, Iida et al. 2016, JPMorgan 2015, Shin 2016). In a recent paper, we argue that the best explanation is the interaction of large FX hedging demand with tighter limits to arbitrage (Borio et al. 2016). In particular, we find that quantitative proxies for hedging demand can explain the dispersion of the basis across countries and its evolution over time.

Hedging demand meets limits to arbitrage…

How do these two factors interact?

The demand for hedging FX risk, as long as it is insensitive to the size of the basis, explains why the basis opens up: FX swaps and forwards are the main instruments of choice. This demand arises mainly from three sources.

- First, banks’ business models.

For a long time, banks have been the main players managing the currency mismatches on their balance sheets mainly via swaps. Banking systems may be structurally short or long in specific currencies, given their core deposit base, with FX swaps playing a key role in filling any gap.

- Second, institutional investors’ strategic hedging decisions.

These decisions tend to be quite insensitive to hedging costs (the basis). As a result, increases in foreign currency investments translate into higher hedging needs.

- Third, non-financial firms’ opportunistic bond issuance.

Non-financial firms without a top-notch rating seek to issue in those currencies where credit spreads are narrower, swapping the proceeds back into the currency they need for business reasons. This factor becomes relevant when credit spreads in different currencies differ systematically for a given borrower, for example when they are compressed by central bank large-scale asset purchases. Such issuance, for instance, has recently surged in the euro and moved in sync with the size of the basis.

Tighter limits to arbitrage explain why the basis does not close. These limits reflect the higher price tag banks and other potential arbitrageurs attach to expanding their balance sheets. Balance sheet space is rented, not free. And, in contrast to what the textbooks say, basis arbitrage involves market, credit, counterparty, and liquidity risks. While these risks have been there all along, pre-crisis arbitrageurs did not fully price them in, and leveraged up for little return.1 Post-crisis, stricter management of risks and pressure from shareholders, creditors and prudential authorities have resulted in banks, and the leveraged players to which they lend, curbing balance sheet-intensive activities such as basis arbitrage.

… as evident in the cross section…

The relevance of FX hedging demand can be traced in the cross section of currencies. In our paper, we construct rough estimates for the three types of player identified above for four jurisdictions (Australia, Eurozone, Japan and Sweden) and find that the sign of the basis matches the net demand for hedging across the sectors.

The role of banks’ hedging demands, for which better data are available, is especially important, as they can be the swing factor. Naturally, both hedged foreign-currency investments of domestic institutional investors and foreign non-financial firms’ opportunistic issuance in the local currency tend to widen the basis against that currency: the high demand to borrow foreign currency via the FX swap market makes funding relatively expensive there. By contrast, there is no reason why the structural position of banks in the FX swap market – the position driven by their business models – will have the same sign. Where banks need swaps to fund their foreign currency business (Japan and Eurozone), they will add to the hedging demand of the other sectors; where FX swaps have been used to fund the domestic currency loan book (Australia and Sweden), they will offset it.

Indeed, a measure of banks’ FX swap demand helps explain quite well both the sign and size of the basis across a larger sample of countries (Figure 2). Here, our indicator of hedging demand and FX swap use is the ‘funding gap’ in key currencies, mainly US dollars.2 The funding gap, derived from the BIS international banking statistics, is the difference between the banks’ consolidated global on-balance sheet assets and liabilities in a given foreign currency. Assuming that banks hedge their currency risk, the resulting gap indicates the size of their off-balance sheet position in that currency, which will largely be managed by FX swaps.

Figure 2 Currency hedging demand and three-year basis

Notes: For Sweden (SE), net euro liabilities (x-axis) and the SEK/EUR basis (y-axis). The yellow dot adds a measure of US non-financial firms’ bond issuance in euros (reverse yankee bonds). AU = Australia; CA = Canada; CH = Switzerland; EA = Eurozone; GB = Great Britain; JP = Japan; NO = Norway; SE = Sweden.

Sources: Bloomberg; BIS international banking and debt securities statistics; authors’ calculations.

… and the time series…

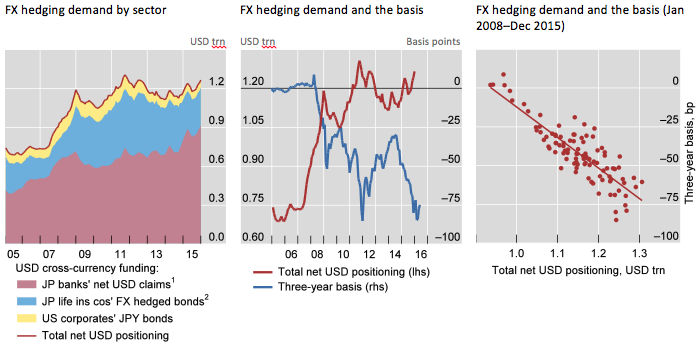

The footprints of FX hedging demand emerge just as clearly in the evolution of the US dollar-yen basis. This has been the most extreme and persistent non-zero basis and it is the only one for which we could obtain a reliable long time series for institutional investors’ hedging demand. The aggregate measure of US dollar hedging needs for the three sectors – banks, institutional investors and non-financial firms (samurai bonds) – has risen by around one third post-crisis, from $0.9 trillion in 2009 to over $1.2 trillion in 2015 (Figure 3, left-hand panel). The banking sector has been the main driver, as banks have been funding their major expansion abroad.

Confirming our hypothesis, after a clear break during the Global Crisis, a close relationship emerged between variations in our measure of hedging demand and the basis (Figure 3, centre and right-hand panels). Pre-crisis, the basis was very small and stable, regardless of hedging volumes; post-crisis, it tracked them remarkably closely. In particular, an increase in hedging demand has coincided with a widening of the basis further into negative territory. Regression analysis that controls for other factors confirms the impression the figure conveys.3

Figure 3 Sources of currency hedging demand and the yen/US dollar basis

Notes: 1 Difference between gross USD assets and liabilities of Japanese banks; quarterly data linear interpolated to monthly frequency. 2 Japan life insurance companies’ currency-hedged US dollar bond holdings estimated by multiplying the stock of the insurance companies’ FX bond holdings by their time-varying currency hedge ratios; monthly frequency.

Sources: Bank of Japan; Japanese Ministry of Finance; The Life Insurance Association of Japan; Barclays FICC Research; Bloomberg; BIS international banking statistics and debt securities statistics; authors’ calculations.

What about evidence of tighter limits to arbitrage? By its very nature, this is harder to quantify, but the footprints are clearly there. For one, since 2014 the basis has started to exhibit quarter-end spikes, along with repo rates, indicating that arbitrage becomes harder then. This has coincided with the greater importance of quarter-end reporting and regulatory ratios following regulatory reforms. In addition, the arbitrage has meant growing exposures to the Japanese official sector for US, French and UK banks, so that their country limits may have become more binding. Indeed, the basis widened following Japan’s downgrade in 2015.

The imprint of monetary policy

So much for the proximate factors explaining the basis – what about the ultimate causes? Clearly, very low interest rates coupled with divergent monetary policies across key currencies have played a role. Ultra-low rates have been weighing on Japanese banks’ profitability and inducing their expansion abroad and have been encouraging Japanese insurance companies to buy hedged foreign bonds. In addition, central banks’ large-scale asset purchases have withdrawn long-term assets from the market and compressed risk premia, encouraging further hedging demand from both institutional investors and foreign non-financial firms.

All this has strengthened spillovers across markets and resulted in some paradoxical outcomes. For instance, by easing aggressively to improve domestic financial conditions, a central bank may find that it raises the cost of funding in foreign currency for its banks, if they rely extensively on this market.

Welcome to the topsy-turvy world of unconventional monetary policies.

Authors’ note: The views expressed are the authors’ and not necessarily those of the Bank for International Settlements.

References

Arai, F, Y Makabe, Y Okawara and T Nagano (2016), “Recent trends in cross-currency basis”, Bank of Japan Review, 2016-E-7, September.

Baba, N, F Packer and T Nagano (2008), “The spillover of money market turbulence to FX swap and cross-currency swap markets”, BIS Quarterly Review, March, pp 73–86.

Barclays (2015), “Cross-currency basis: The shadow price of USD dominance”, Barclays FX Research, 1 December.

Borio, C, R McCauley, P McGuire and V Sushko (2016), “Covered interest parity lost: understanding the cross-currency basis”, BIS Quarterly Review, September, pp 45–64.

Du, W, A Tepper and A Verdelhan (2016), “Deviations from covered interest rate parity”, available at SSRN 2768207, August.

Iida, T, T Kimura and N Sudo (2016), “An upsurge in a CIP deviation during the noncrisis period and the role of divergence in monetary policy”, Bank of Japan Working Paper Series, no 16-E-14, August.

JPMorgan (2015), “USDJPY basis update: a perfect storm”, Japan Fixed Income Strategy, 9 November.

Krugman, P, M Obstfeld and M Melitz (2015), International Economics, 10th edition, Harlow, Essex: Pearson.

Mancini Griffoli, T and A Ranaldo (2012), “Limits to arbitrage during the crisis: finding liquidity constraints and covered interest parity”, Working Papers on Finance, no 1212, University of St Gallen, School of Finance.

McGuire, P and G von Peter (2009), “The US dollar shortage in global banking”, BIS Quarterly Review, March, pp 47–63.

Obstfeld, M and K Rogoff (1996), Foundations of international macroeconomics, MIT Press.

Shin, H S (2016), “Global liquidity and procyclicality”, speech at the World Bank conference “The state of economics, the state of the world”, Washington DC, 8 June.

Sushko, V, C Borio, R McCauley and P McGuire (2016), “Failure of covered interest parity: FX hedging demand and costly balance sheets”, BIS Working Papers, forthcoming.

Endnotes

[1] For example, in Sushko et al. (2016), we derive the currency basis taking into account balance sheet exposure to counterparty and market risks inherent in FX derivatives.

[2] See McGuire and von Peter (2009) for a detailed explanation of this indicator.

[3] In addition, in Sushko et al. (2016) we perform a series of panel regressions and other econometric tests that confirm the result.