On 17 September last year, the US requested consultations with China concerning a wide range of export-contingent measures – grants, tax preferences and interest-rate subsidies, totalling at least $1 billion – in apparent violation of the WTO’s Agreement on Subsidies and Countervailing Measures, China’s accession protocol and article XVI of the GATT. The EU joined the consultations shortly after on 28 September.

Although the nature of China’s subsidies has always been murky, an issue that the US, the EU, Canada and other countries have repeatedly raised at the WTO over the last decade, it is not widely appreciated that several of these subsidies are conditional on firms exporting all or the majority of their output. These are what we would call ‘pure-exporter subsidies’.

Figure 1. Kernel density of export intensity in France and in China

Pure-exporter subsidies

As a result of these policies, a large number of manufacturing firms in China export all or almost all of their production. Between 2000 and 2006, more than a third of Chinese manufacturing exporters sold 90% or more of their output abroad. In contrast, as can be seen in Figure 1, less than 2% of French exporters display such high export intensity; similarly, Bernard et al (2003) report a corresponding figure of 0.7% for US exporters.

What do pure-exporter subsidies mean for China and the world?

In our latest research article (Defever and Riaño 2012) we provide the first in-depth analysis of the economic implications of pure exporter subsidies for China and the rest of the world. We show that pure-exporter subsidies not only boost exports but, unlike regular export subsidies, also protect China's domestic firms from foreign competition.

A strong reliance on encouraging exports while at the same time protecting the domestic market has been a cornerstone of China's transition in to a market economy (see e.g. Naughton 2007). Since the late 1970s, China has been characterised by a dualistic trade regime in which a system of export-oriented enclaves coexist with a highly protected domestic economy; a situation that Feenstra (1998) described as 'one country, two systems'.

Ultimately, Chinese consumers are faced with higher prices while foreign consumers reap the benefits of cheaper subsidised goods. We show that eliminating these subsidies would improve welfare in China by 3% while reducing welfare in the rest of the world by 1%.

Which firms benefit from these subsidies?

The large number of widely spread pure exporter subsidies (some of them quite short-lived) makes them extremely difficult to keep track off in a systematic manner. However, we are able to identify three types of firms which were more likely to receive preferential treatment under the laws and regulations effective in China between 2000 and 2006, conditionally on them exporting most of their production. These include Foreign-invested Enterprises, establishments devoted to export processing activities, i.e. Processing Trade Enterprises, and privately owned firms located within free trade zones (FTZs).

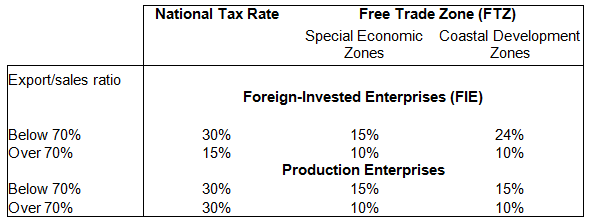

Table 1 presents the statutory corporate income tax rates that applied for different types of firms between 1991 and 2008, perhaps one of the clearest examples of a policy instrument favouring pure exporters. China's corporate income tax law, in place between 1991 and 2008, stated that the standard corporate income tax rate for Chinese-owned firms operating in China was 30%. However, foreign-invested enterprises (FIEs) exporting more than 70% of their production faced a lower income tax rate of just 15%. Additionally, if these firms happened to be located in an FTZ, they would see their income tax rate further reduced to 10%. Moreover, in all FTZs, Chinese-owned enterprises exporting more than 70% of their production faced a 10% corporate income tax rate, regardless of their ownership structure or trade regime under which they operated.

Table 1. China’s corporate income tax rate, 1991-2008

Another example is the processing trade enterprises (PTEs), which face a strict control over their domestic sales. These enterprises are allowed to import inputs duty free as long as they are not used for domestic consumption. If any output is sold in the domestic market, firms must promptly pay the tariffs and value-added taxes on the imported materials. More importantly, they must obtain approval from both the provincial commerce authorities and customs for an import licence. Failing to do so translates into a penalty ranging from 30% to 100% of the declared value of the imported materials and parts.

Evidence from firm-level data

By matching firm-level data from the Annual Survey of Manufacturing Firms with custom-based export transactions for the period 2000-2006, we are able to identify FIE and PTE as well as private firms located in FTZs. Altogether, these three types of firms account for 90% of the exporters in our data. These three types of exporters may benefit from a wide array of subsidies that are conditioned on them exporting all or most of their production. Conversely, firms located outside an FTZ and which are neither FIEs nor PTEs constitute only 10% of all exporting firms.

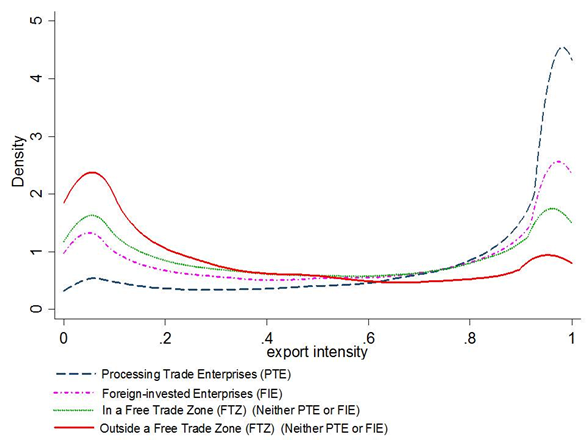

Figure 2 shows the distribution of export intensity across the three groups of firms described above and of firms located outside an FTZ and which are neither FIEs nor PTEs. Pure exporters are more prevalent among PTEs, while FIEs and firms located in an FTZ exhibit a greater degree of bimodality. The export intensity for the residual group of firms displays a majority of firms selling a small share of their output abroad, the more common pattern documented for manufacturing firms in other countries (closer to France’s export intensity distribution shown in Figure 1).

Figure 2. Export intensity distribution by firm type and location

A new form of protectionism

By attracting multinational affiliates and compelling them to export all of their production, China has protected its low-productivity domestic companies from competition whilst simultaneously boosting exports. The promotion of processing trade enterprises and the establishment of FTZs are geared towards the same objective.

In contrast, a standard export subsidy allows exporters to expand at the expense of the domestic firms inducing exit of the least productive firms serving only the domestic market.

Our work shows how pure-exporter subsidies contribute to this strategy by boosting exports while simultaneously protecting the least efficient, domestically oriented firms. Furthermore, our analysis shows that Chinese consumers are adversely affected by the use of pure-exporter subsidies; their aggregate expenditure falls because they need to finance the subsidy, while facing lower consumption variety and higher prices due to the protection that the subsidy provides to low-productivity firms. For consumers in the rest of the world, on the other hand, these pure exporter subsidies have resulted in a greater variety of cheaper imported products. Eliminating these subsidies will improve the welfare of Chinese consumers while increasing the price of consumer goods elsewhere.

One of the main goals of the twelfth Five-Year Plan, unveiled in October 2010, is to redirect China’s focus towards its domestic economy, emphasising growth based on domestic consumption. Abandoning pure exporter subsidies will be an important first step in this direction.

References

Bernard, Andrew B, Jonathan Eaton, J Bradford Jensen and Samuel Kortum (2003), “Plans and Productivity in International Trade”, American Economic Review, 93, 1268-1290.

Defever, Fabrice and Alejandro Riaño (2012), “China’s Pure Exporter Subsidies”, CEP Discussion Paper.

Feenstra, Robert C (1998), “One Country, Two Systems: Implications of WTO Entry for China”, Manuscript, University of California, Davis.

Naugton, Barry (2007), The Chinese Economy: Transitions and Growth, Cambridge, MA, MIT Press.