Even though the number of violent conflicts has decreased since a peak in 1992, civil war remains an endemic form of violence in poor countries. With the end of the Cold War, democratisation and increased integration in the world economy have often been advocated in order to promote prosperity and peace in poor countries. However, little is known on the impact of trade openness on the risk of civil conflicts.

Is international trade insurance or deterrence?

One line of thinking on this topic by Collier and Hoeffler (2007) views trade itself as a motivation for civil wars, or as a means of financing rebellion.1 In a recent paper2, we take a different approach, identifying two possible mechanisms relating international trade and civil wars: deterrence and insurance.

The first effect is such that trade openness lowers the risk of civil wars, the second works in the opposite direction. Our hypothesis is the following: because civil wars destroy international trade, some of the economic gains generated by trade are put at risk for all groups (rebels and government), so that the opportunity cost of conflict increases with observed trade flows and all involved actors should have more incentive to make concessions and avoid a violent escalation. From this point of view, greater openness to international trade should act as a deterrent to escalation towards civil conflicts. However, international trade also provides a substitute to internal trade as it provides alternative sources of income and consumption. From this point of view, it can act as insurance and can reduce the opportunity cost of civil war. Another way to state the second argument is that international trade can weaken economic ties and dependencies between groups and regions inside a country. This reduced internal dependency decreases the opportunity cost of conflicts. This line of reasoning echoes the one made in our previous paper3 showing that multilateral trade (contrary to bilateral trade) openness increases the probability of a bilateral conflict between countries.

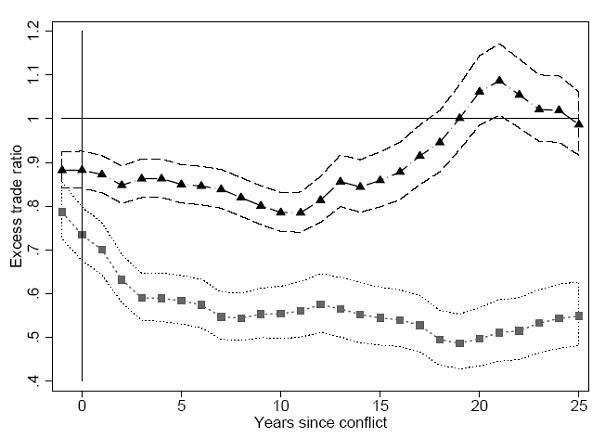

In our empirical analysis we first quantify how much civil war destroys international trade. Indeed, the tension between the insurance motive and the deterrence effect ultimately depends on the degree of trade disruption induced by conflicts. Insurance should dominate deterrence when trade is relatively unaffected by wars. Using the Correlates of War (COW) data source on the 1945-2001 period, we analyse how the time-series pattern of trade disruption depends on the severity of the conflict. To that purpose, a standard gravity equation including the usual controls for trade costs (geographical distance, contiguity, colonial linkages…) is extended so as to include the marginal effect of civil wars on trade costs (related to infrastructure, rule of law, information, trust...). Results are depicted in the figure below where we report the war-induced fall in effective trade openness relative to its ``natural'' (i.e. gravity predicted) level, with 10% confidence intervals in bands. The squares represent the impact of the most intense civil wars - those involving more than 50,000 casualties - the triangles represent the impact of less severe crises. All those effects come in addition to the impact civil wars have on trade through their negative impact on income. Interestingly, the fall in trade anticipates the onset of the civil war. Many explanations can be given to this finding but it points clearly to an endogeneity issue in previous empirical studies of political scientists that have found a negative impact of trade on the risk of civil wars.

It is worth stressing that the effect of a severe civil war is both very large on contemporaneous trade and very persistent: a 25% drop in trade is observed in the first year of the conflict; then trade disruption worsens with time. For less severe conflicts, the effect is smaller and it disappears after around 20 years. That civil wars destroy international trade is not surprising; but the extent of the destruction in the case of severe conflicts is truly dramatic. This is in stark contrast with our earlier research where we find that inter-state wars do not affect multilateral trade between the two belligerents and the rest of the world.

The second stage of our empirical analysis focuses on the impact of trade openness on the probability of civil war. Our strategy consists in disentangling the deterrence effect and the insurance motive by estimating the differential impact of trade openness on low versus high intensity civil wars. Because deterrence depends positively on the expected destruction of trade, we can infer safely from the previous graphic that deterrence dominates insurance in the case of the most severe civil wars (and inversely for less severe wars). In terms of statistical inference, this means that we should observe a negative conditional correlation between trade openness and the probability of high intensity civil wars and a positive conditional correlation between trade and low intensity wars. Our estimates are consistent with those two statements.

A possible competing explanation for the positive correlation between trade openness and low-intensity conflicts is that trade itself is a motivation for civil wars or helps to finance the rebellion. It is therefore important to take into account the share of primary exports in GDP as an additional determinant of civil conflicts, which leaves the results on the interaction between trade openness and civil wars unaffected.

Conclusion

Our conclusion is that trade openness has contrasting effects on the probability of civil wars. It deters severe conflicts but fosters less severe ones. Our work should be interpreted as a word of caution on the expectations that several commentators have put on globalisation as a means of reducing internal violence in poor countries. However, our results do point to the positive effect that trade openness has in deterring the most violent conflicts. This is no small achievement.

Footnotes

1 See for example Paul Collier, and Anke Hoeffler, 2007, ``Civil War'', Handbook of Defense Economics, for this argument.

2 “Civil wars and International Trade", forthcoming, Journal of the European Economic Association Papers and Proceedings.

3 “Make Trade not war?”, forthcoming, Review of Economic Studies. See our Vox column of 4 July 2007.