Investment in knowledge-based (intangible) assets – such as software, R&D, skills, organisational change, managerial practices, branding, etc. – has risen globally in recent decades. However, there are still significant differences in the level of intangible investment undertaken across developed economies. As the essence of innovation-based growth, intangible assets have been considered particularly important to boost growth in countries closer to the technological frontier, but the importance of investing in intangible assets is broadening.

A key issue in the current European policy debate is the extent to which policies and institutions are able to facilitate the reallocation of resources to promote new sources of growth based on knowledge-based capital (Andrews and Criscuolo 2013). Prior evidence has found that low levels of competition and strict employment laws prevent optimal adjustments to factor allocation and hamper the successful diffusion of new technologies (Arnold et al. 2011). Well-functioning product, labour, and capital markets are expected to improve the efficiency of resource allocation leading to an increase in the returns to knowledge-based capital.

This column draws on empirical research carried out for the European Competitiveness Report 2013 (European Commission 2013) and the underlying background study (Foster et al. 2013). The research focuses on two main channels through which it is possible to raise the potential for productivity growth in the EU and close the gap with technology leaders.

- The first is through investing in intangible assets and absorptive capacity.

- The second is through increasing production efficiency.

These are crucial for countries further away from the technological frontier. The study provides a comprehensive cross-country analysis of such determinants of productivity growth, focusing on the influence of ICTs, R&D, skills and the regulatory environment.

Closing the EU-US productivity gap

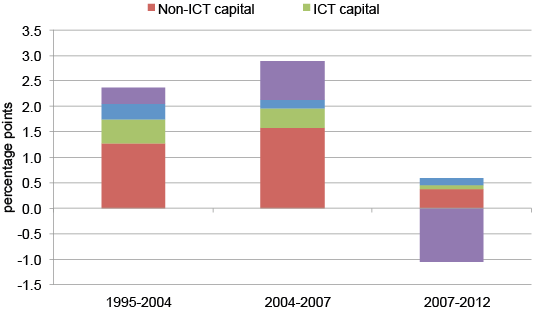

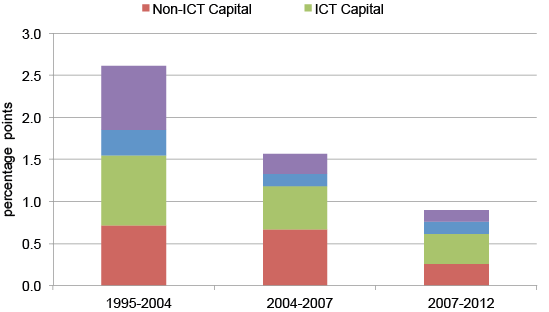

Prior to the start of the financial and economic crisis, the slowdown in labour productivity growth in the EU was linked to a delay in the adoption of ICT technologies. It was thought that productivity in the EU would eventually catch up with the US. Several years after the ‘ICT revolution’, the EU not only continues to lag behind the US, but the productivity gap has recently widened. The EU has not been able to materialise the benefits of the ICT revolution to the same extent as the US. Moreover, differences in total factor productivity (TFP) growth, which aims to capture the efficiency with which inputs are used, have recently widened (see Figures 1 and 2).1

Figure 1. Decomposition of the EU labour productivity growth, 1995-2012

Source: EUKLEMS, The Conference Board and own calculations.

Figure 2. Decomposition of the US labour productivity growth, 1995-2012

Source: EUKLEMS, The Conference Board and own calculations.

Two key factors that have been put forward to explain the poor productivity performance of EU countries are:

- the lack of investments in knowledge based (intangible) assets; and

- a rigid regulatory framework.

Empirical research has shown that in the EU there have been insufficient investment in skills and organisational changes which are necessary to reap the benefits of ICT technologies (Brynjolfsson and Hitt 2000, O’Mahony and Vecchi 2005). The rigidity of the regulatory framework in the EU compared to the US has recently been identified as a cause of lower TFP growth (Bourlés et al. 2012). It has become apparent that high levels of investment alone do not necessarily lead to better productivity performance and faster economic growth.

Despite the fact that most of the leading technologies available worldwide are developed by a few frontier countries, technological laggards can still benefit from these through international trade. In this context, investing in intangible assets, such as R&D and human capital, can increase countries' absorptive capacity and the effectiveness of international technology transfers (Griffith et al. 2004).

- Our study finds evidence of a positive role for intangible assets – i.e. R&D and human capital – and absorptive capacity in facilitating international technology transfers.

The foreign R&D content of intermediate goods is found to be positively associated with productivity growth, with the magnitude of these spillover effects depending on the level of absorptive capacity, which is measured by variables such as average years of secondary schooling of workers and R&D spending of domestic firms. Stricter labour market regulation and greater union density are also linked to smaller spillovers from foreign R&D.

- We do not find convincing evidence that restrictive regulation in product and financial markets hampers the capacity of a country to reap the benefits of knowledge developed elsewhere.

- However, using a stochastic frontier analysis framework, we do find evidence that the regulatory environment determines the efficiency with which inputs are used in production (technical efficiency).

- Concerning the role of the set of rules governing the functioning of the labour market, we find that production efficiency is higher in countries with less restrictive employment protection laws for regular contracts, while the ease with which firms can use temporary contracts is likely to hamper their production efficiency.

- Interestingly, investment in ICT assets is found to increase productivity growth by raising efficiency levels in production.

Overall, these results put emphasis on the ability of mature economies to exploit existing resources as one of the most important sources of productivity gains (van Ark et al. 2012).

Policy recommendations

From a policymaking perspective, policies that reduce R&D costs, for example via the provision of tax incentives, can support R&D investment. Policy initiatives promoting firms’ hiring of highly qualified workers and workforce training should also be encouraged. Other complementary policies should be directed towards raising investments in ICTs and the reorganisation of production. These measures should be accessible for SMEs, which do not always have appropriate resources to embark on formal R&D activities and rely on alternative ways of increasing their competitiveness. Reducing the strictness of product market regulations, in particular in key service-providing industries, is likely to be conducive to higher levels of technical efficiency, by allowing input re-allocation, outsourcing of marginal tasks, and the adoption of the best production and managerial practices. Changes in the regulatory settings affecting the labour market should be tailored to restore an optimal mix of regular and temporary workers, bearing in mind that an excessive liberalisation of temporary workers’ contracts may hinder productivity and efficiency performance.

Authors' note: This publication does not necessarily reflect the view or position of the European Commission.

References

Andrews, D. and Criscuolo, C. (2013), “Knowledge-Based Capital, Innovation and Resource Allocation”, OECD Economics Department Working Papers, No. 1046, OECD Publishing.

Arnold, J., Nicoletti, G. and Scarpetta, S. (2011), “Does Anti-Competitive Regulation Matter for Productivity? Evidence from European Firms,” IZA Discussion Papers 5511, Institute for the Study of Labor (IZA).

Bourlés, R., Cette G., Lopez J., Mairesse, J. and Nicoletti, G. (2012), “Do product market regulations in upstream sectors curb productivity growth? Panel data evidence for OECD countries”, Review of Economics and Statistics, MIT Press, vol. 95(5), pages 1750-1768, December.

Brynjolfsson, E. and Hitt, L. (2000), “Beyond computation: information technology, organizational transformation and business performance”, Journal of Economic Perspectives, 14, pp.23–48.

Brynjolfsson, E. and Saunders, A., (2009), Wired for Innovation: how information technology is reshaping the economy, MIT Press.

European Commission (2013), Towards Knowledge-Driven Reindustrialisation, Chapter 3: "Reducing productivity and efficiency gaps: the role of knowledge assets, absorptive capacity and institutions”, SWD (2013)347 final, DG Enterprise and Industry, European Commission.

Foster, N., Poschl, J., Rincon-Aznar, A., Stehrer, R., Vecchi, M. and Venturini, F. (2013), “Reducing productivity and efficiency gaps: The role of knowledge assets, absorptive capacity and institutions”, Background study of chapter 3 in European Competitiveness Report, DG Enterprise and Industry, European Commission.

Griffith R., Redding S. and van Reenen J., (2004), “Mapping the Two Faces of R&D: Productivity Growth in a Panel of OECD Industries”, Review of Economics and Statistics, 86, 883–895.

O'Mahony, M., and Vecchi, M. (2009), “R&D, knowledge spillovers and company productivity performance”, Research Policy, 38(1), pp. 35-44.

Van Ark, B., Levanon, G, Chen, V. and Cheng, B. (2012), “Performance 2011: Productivity, employment and growth in the world’s economies”, Research Report R_-1475-11-RR, The Conference Board.

1 Our analysis of the firm-level EFIGE dataset also shows evidence of diverging productivity patterns within the EU showing that the most productive firms prior to the crisis are the ones that managed to show a higher resilience to the effects of the global downturn.