Not long ago it seemed that the number and depth of regional agreements liberalising trade was an ever-expanding process. Recent years, and 2016 in particular, have been marked by a backlash against trade in public opinion and from politicians. In some cases, the phenomenon even resembles a complete U-turn. The vote for Brexit in the UK and the campaign promises of President-elect Donald Trump to raise tariffs on imports from Mexico to 35% (which we call ‘Trumpit’) are striking proof that, unlike technical progress in transport or communication technologies, regional trade agreements (RTAs) are political decisions that can be reversed.

In this column we analyse the consequences of those two examples of the dismantling of RTAs. Past work on the effects of NAFTA (e.g. Romalis, 2007, Caliendo and Parro 2015) and the potential impact of Brexit (e.g. Dhingra et al. 2016) frames these deals as pure trade agreements. We argue that a complete understanding of the impact of reconstructing trade barriers between two countries needs to take into account much more than the simple direct effects of changes in the trade costs imposed on imports. Because of the complex structure of multinational production characterising many modern industries, indirect effects will in many cases be of first order. In recent models analysing multinational production (Arkolakis et al. 2013, Tintelnot 2016), firms make a rich set of decisions, allocating production of different varieties to different plants in order to serve in the most efficient way the different markets they have decided to target. Central in those choices is a triangle of frictions, comprising the traditional trade costs between the plant and the consumer, and also the costs affecting the ease of coordinating the production process in each plant from the firm’s headquarters. A third source of friction has been overlooked in this literature: the costs affecting the performance of firms from a given headquarter country selling in a specific market. For instance, Renault might be especially strong in Belgium even for cars produced in Slovenia or Turkey because of the ease of establishing and maintaining distribution networks close to France.

Changes in the configuration of RTAs will affect firm’s decisions in both complex and subtle ways. For instance, raising tariffs between Mexico and the US will generate different reactions depending on whether the firms producing in Mexico also have plants in the US and Canada, or whether they serve the US market from German plants, for instance. The location of headquarters also matters – US firms will find it relatively more difficult to operate Mexican plants (for instance because of additional costs on inputs sourced from the US), diminishing the efficiency of those plants, and therefore their sales even outside the US. Toyota-owned plants in Mexico importing inputs from their Japanese headquarters will not be directly affected.

In a new paper, we apply this framework to one of the industries where those complex impacts of trade liberalisation are especially pronounced, namely, the car industry (Head and Mayer 2016). The availability of exceptionally rich data collected by the consultancy firm IHS makes it possible to estimate relevant frictions and all the other parameters of our quantitative model of the industry. We can then investigate scenarios of regional disintegration in Europe and North America. Our regressions estimate the impacts of two important variables: tariffs (which remain large in many countries), and the ‘deep integration’ provisions of RTAs. The impact of ad valorem tariffs is very easy to interpret since those are direct price shifters. Estimating the impact of those tariffs on sourcing decisions and on market share on the destination countries results in two different central elasticities in that model. The first elasticity drives the substitutability between alternative assembly locations facing different tariffs for a given destination. For instance, a GM plant in the US faces a 10% tariff when selling in the EU, but this tariff is zero if this plant is located in Mexico (the consequence of the free trade agreement signed in 2000) or in Turkey (EU and Turkey have shared a customs union since 1996). The response of the decision of where to source a model with respect to the relevant tariff is very large, with an elasticity estimated around -8. The second critical elasticity is the one driving consumer’s choices of which car to buy – we find that a 1% increase in tariff rates reduces car demand by around 3.5%.

Modern regional agreements, and in particular the two we consider here, incorporate topics that go well beyond tariff reductions. Ease of travel or migration for professionals, FDI protection and largely liberalised free trade in services should all reduce frictions in operating multinational production activities in all three facets of the friction triangle mentioned above. Between the countries of production and demand, deep RTAs are estimated to reduce trade costs by an ad valorem equivalent of 3%. The reduction of coordination costs between headquarters and production sites when the two countries have a deep RTA is 5.2%. Marketing costs reductions (between headquarters and destination) due to deep RTA integration are markedly larger at 18% (mostly due to a fall of fixed costs of adding a new car model in a given market).

With these estimates in hand, it is possible to produce a counterfactual quantification of what the dismantling of NAFTA and the exit of the UK from EU will mean for the reshuffling of worldwide car production and the expected price and variety of cars available to consumers in each of the affected countries.

NAFTA counterfactuals: Trumpit and the collapse of the RTA

Our NAFTA counterfactuals consider two potential ways that trade preferences between the US, Mexico, and Canada might be altered. Our first scenario takes seriously the proposal by Trump to impose 35% tariffs on imports from Mexico. Anticipating an equal retaliation, this counterfactual also resets the Mexican tariff on US cars and parts to 35%. Paralleling the ‘Brexit’ abbreviation, we term this the ‘Trumpit’ counterfactual. The second scenario envisions the dissolution of NAFTA, where all three members end deep integration and revert to imposing MFN tariffs on each other.

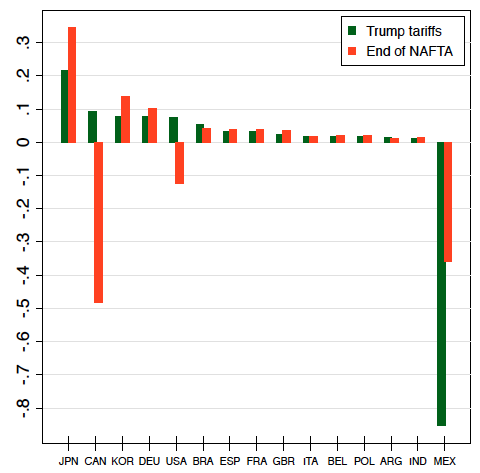

Figure 1a Change in percentage share of world output

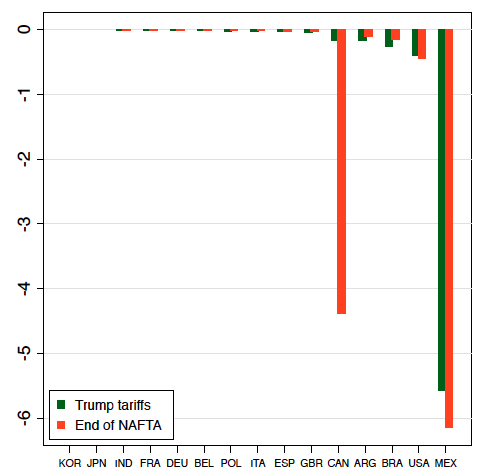

Figure 1b Percentage change in consumer surplus

Figure 1 lists the most affected nations in terms of production and consumer surplus.

Mexican production (and, presumably, employment) declines by 41%, which would have to be regarded as a disaster from a local industry that has been thriving in recent years. The Mexican plants not only lose sales in the US market due to the application of the Trump tariff to cars, the Chevrolet and Ford plants also lose thousands in sales to Canada and other markets. One major reason is that the 35% retaliatory duties significantly raise these plants’ parts costs. The loss of a deep integration further increases assembly costs by about 5%. The combined cost shock to US-owned plants in Mexico is so large that they actually lose small amounts of sales in the Mexican market. The main beneficiaries from the collapse of Mexican exports to the US are the US-based producers, followed by plants located in Japan and Canada (which keep their preferential access to the US market). It is notable that most EU-based producers also gain because their relative access has been made better by the spike in the US-Mexico tariff. Not surprisingly, Trumpit is very bad for Mexican car buyers, who experience consumer surplus losses of almost 6%.

In the end-of-NAFTA scenario, depicted in orange in Figure 1, all three members reduce production. The gain in US production for its home market is now dominated by the lost sales to Canada and Mexico, resulting in an overall fall of about 1%. This is much smaller than the drops in the two partners' production, with Canada losing 24% and Mexico 17% due to the loss of their favoured status in the US market. An example of the richness of the multinational production effects comes from comparing how Korean and Japanese production benefit from NAFTA dissolution. As the costs of serving the Canadian market from the US rise, Toyota's probability of sourcing from the US falls by 5.3 percentage points (from 10.9% to 5.6%). Toyota's Japanese plants are the biggest beneficiaries, gaining 2.6 points, but its Canadian plants grab 1.6%. Hyundai's US plant also sees a sharp fall in its sourcing probability (8 points). However, as Hyundai lacks a plant in Canada, it reallocates nearly the entire probability (6.8 points) to its Korean plants.

Brexit: The exit of the UK from the EU

Since the June 23, 2016 vote for the UK to leave the EU, the final trade arrangement between the two parties has been the subject of much speculation. Here we consider two potential post-Brexit relationships between the UK and EU (Dinghra and Sampson 2016 consider two other variants). The shallow RTA case captures the scenario in which Britain retains tariff-free access to the EU but loses the deep integration aspects of the RTA, such as free mobility of professionals and the ability to influence EU regulations on car standards. We then simulate the scenario where UK exports face the EU's MFN tariffs while the EU reciprocates at the same rates. Both cases hold constant all the RTA relationships the UK currently enjoys through its EU membership (including, in particular, the customs union with Turkey and the EU-Mexico FTA).

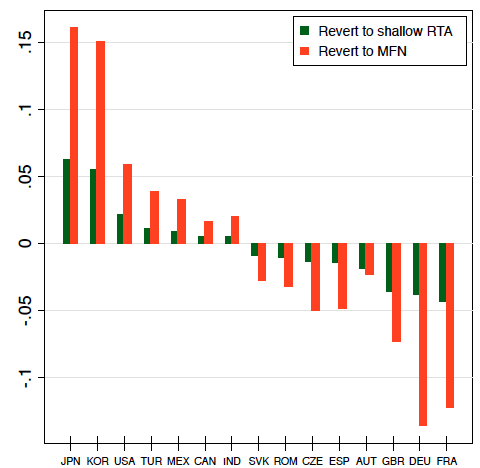

As seen in Figure 2, the post-Brexit shallow RTA scenario involves a reduction in car production in the UK of 24,000 units, 1.8% of UK production, and 0.36% of world output. Since the average plant in the UK has about one worker per 50 cars, this corresponds to a loss of about 500 assembly jobs. Although production for the home market rises, it does not come close to offsetting losses in exports to the EU and to the rest of the world (ROW). The latter comes from a rise in operating the British plant for Opel, the only EU-headquartered brand still assembling cars in the UK in 2013 (Peugeot closed its Ryton factory in 2007). The idea is that absent deep integration, supplying inputs from Opel's headquarters in Germany becomes more costly.

Figure 2a Change in percentage share of world output

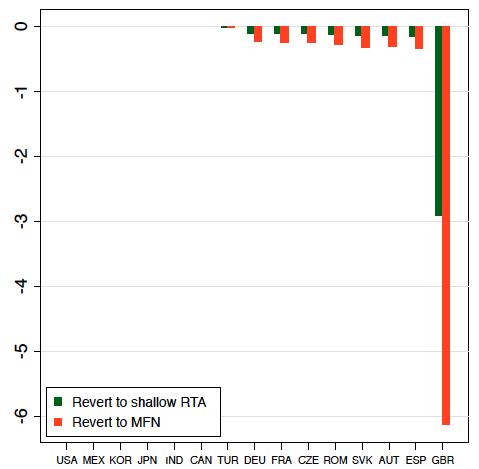

Figure 2b Percentage change in consumer surplus

Consumer surplus in the UK falls by about 3% due mainly to higher import prices. The number of models sold in the UK only falls slightly for most brands, with the largest impact on the entry margin being the predicted cut of two Volkswagen models. The and UK and France incur the greatest production losses. Consumer surpluses in Europe are only slightly affected, as we see in panel (b) of Figure 2. The scenario in which the UK fails to maintain tariff-free access to the EU market dramatically increases the losses for UK production and consumer surplus. Imposing the current 10% MFN duty on EU imports doubles consumer losses to 6%, while UK car production shrinks by 48,000 cars – or about 1,000 workers –compared to what the model predicts under full integration with the EU.

References

Caliendo, L and F Parro (2015), “Estimates of the Trade and Welfare Effects of NAFTA” The Review of Economic Studies 82(1): 1-44.

Dhingra, S and T Sampson (2016), “UK-EU Relations After Brexit: What is Best for the UK Economy?” in R Baldwin (ed), Brexit Beckons: Thinking Ahead by Leading Economists, CEPR Press.

Dhingra, S, H Huang, G Ottaviano, J P Pessoa and J Van Reenen (2016), “The Costs and Benefits of Leaving the EU: Trade Effects” Technical paper to accompany CEP Brexit Analysis 02, March 2016.

Head, K and T Mayer (2016), “Brands in Motion: How frictions shape multinational production”, updated version of CEPR Discussion Paper No. 10797 (available at https://dl.dropboxusercontent.com/u/398204/brands_in_motion.pdf).

Romalis, J (2007), “NAFTA's and CUSFTA's Impact on International Trade” The Review of Economics and Statistics, 89(3), 416-435.