Following the classic exposition by Corden and Neary (1982), the economy can be divided into three sectors: the natural resource sector, the non-resource tradable sector (usually understood as agriculture and manufacturing), and the non-tradables sector (including non-tradable services and construction). The real exchange rate is defined as the price of non-tradables (set in the domestic economy) relative to the price of tradables (set in the world market). There are two types of effects leading to Dutch Disease and real exchange rate appreciation:

- The spending effect. This comes into play when increased income from the booming natural resource sector stimulates demand and spending by the private and public sectors, leading to higher prices and output in the non-tradables sector. In the non-natural resource tradables sector (“manufacturing”), however, prices are fixed at international levels, profits are squeezed by rising economy-wide wages and increased demand is increasingly met out of rising imports.

- The resource movement effect. Takes place when the boom in the natural resource sector attracts capital and labour away from other parts of the economy. Output declines in the non-resource economy, but by more in tradables, where prices are fixed at world market levels.

Both effects result in a fall in the output share of non-natural resource tradables relative to non-tradables, and a real exchange rate appreciation.

But is there any empirical evidence of Dutch Disease?

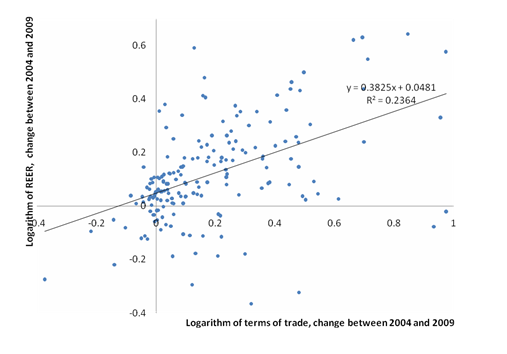

There is relatively robust evidence that terms of trade increases cause real exchange rate appreciation in natural-resource-rich countries (for example Spatafora and Warner 1995). Figure 1 illustrates the correlation between real effective exchange rates and terms of trade changes.

Figure 1. Terms of trade shocks and real appreciation, 2004–2009

Source: Authors’ calculations

The evidence on the shrinking of the manufacturing sector in response to terms of trade shocks has been somewhat mixed (Sala-i-Martin and Subramanian 2003). Most recently, however, Ismail (2010) finds much stronger evidence for Dutch Disease effects, with a 10% increase in an oil windfall associated with a 3.4% fall in value added across manufacturing sectors. Such effects are larger in economies that are more open to capital flows and with relatively less capital-intensive manufacturing sectors.

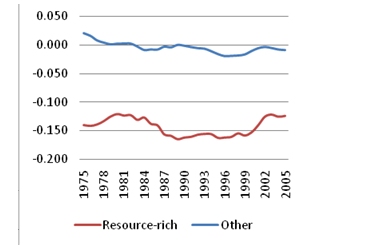

Determining how large the tradables sector would have been in the absence of the natural resources is difficult. Using the Chenery and Syrquin (1975) approach, we estimate a norm for the size of the tradables (manufacturing and agriculture) sector for all countries over time, controlling for per capita income, population, and time trend. Figure 2 shows the difference between the actual size of the tradables sector and the norm, for both resource-rich and non–resource-rich countries. On average in resource rich countries the tradables sector (as defined) is around 15% of GDP lower than the norm.

Figure 2. Dutch Disease measure for resource-rich and other countries, 1975-2005

Source: Authors’ calculations based on Chenery and Syrquin (1975).

Is there evidence that Dutch Disease is bad for growth?

In general, an increase in wealth due to a natural resource discovery or a permanent rise in the terms of trade is a positive development, generating higher incomes and allowing more consumption of both non-tradables and tradables, the latter supplied to a greater extent through imports. Rents from mineral resources can provide government with increased resources for investment in public goods and other development expenditures.

These gains may however come at the expense of growth in the long term, based on the idea that manufacturing and other non-resource tradables possess specific long-term, growth-enhancing qualities, such as the presence of positive technological spillovers, learning by doing effects, or increasing returns to scale in production. Manufacturing is also more labour intensive than natural resource industries, with implications for employment. Given increasing returns and costly and time-consuming learning in manufacturing, the economy would struggle to rebuild sources of growth upon depletion of its natural resource.

The results of cross-country analysis of a direct link between natural resource riches and growth have been inconclusive. Sachs and Warner (2001) argued that natural resource abundance has a strong negative impact on growth, but Lederman and Maloney (2008), using a different specification, on the contrary found a positive effect. Trying to reconcile this disparate evidence in a panel cointegration framework, Collier and Goderis (2007) concluded that commodity price booms have positive short-term impacts on growth, but that in countries with bad governance and ”point source” natural resources (oil and minerals) the impact on growth is significantly negative in the long term. Quality of institutions conditions the quality of policies and therefore how natural resource abundance affects growth.

Another line of argument notes that although real exchange rate appreciation in a resource boom is in principle an equilibrium phenomenon that reflects improved fundamentals, agents could mistakenly overestimate the permanence of the fundamental improvement, resulting in real exchange rate overvaluation. And there is now a good deal of evidence on the strong negative impact of overvaluation on growth (Aguirre and Calderon 2006, among others).

Dutch Disease may also result in high export concentration in commodities with high price volatility. If government spending is closely related to natural resource revenues then it will also become more volatile and in turn drive volatility in the real exchange rate through the spending effect described above. A large body of empirical work documents the adverse impact of real exchange rate and other economic volatility on investment and growth.

As shown by earlier booms, high commodity prices can lead to over borrowing, when countries use their resources as collateral to borrow abroad, and then finance large investment projects and high public consumption. But when prices fall they are left with balance-of-payments crises and unsustainable external debt levels. A recent paper by Reinhart and Rogoff (2010) suggests that when external debt reaches above 60% of GDP annual growth declines on average by 2 percentage points, and for very high levels of debt, growth is cut in half.

Impacts of natural resources on an economy will depend to a large extent on policies

Excessive spending appears to be at the heart of economic mismanagement in the wake of natural resource booms (Gelb and Associates 1988). Fiscal policy is thus a main instrument for dealing with the negative impacts of Dutch Disease. Sound fiscal rules for the disposition of natural resource revenues can help constrain the spending effect – the main transmission channel in low-income countries and also to smooth expenditures and reduce volatility.

An adequate fiscal policy should however also balance the need to implement development objectives with the need to constrain the spending effect. The so-called “permanent income” fiscal rule recommends spending no more than a constant annuity that, received forever, would yield the same net present value as the stream of expected revenues from the natural resources. Collier and others (2009) however suggest that a better fiscal rule for a low income developing country would require less saving of revenues in the form of external assets earlier on, allowing for more domestic investment and consumption than in the permanent income strategy. This approach would allow addressing some urgent development needs in low income countries, but it also would require strict fiscal discipline, clear spending rules and strong institutions for public financial management.

More on curbing the disease

Policies covering the composition of spending can also help curb Dutch Disease. Directing spending toward tradables (including imports) rather than non-tradables would help slow the impact through the spending effect. Improving the quality of spending to ensure that productivity in non-tradable sectors increases more rapidly would also help alleviate real exchange rate appreciation and other Dutch Disease effects. Spending on investment projects, rather than on increasing recurrent permanent expenditures, such as wages, helps countries to more easily adjust to volatility of revenues. However, special care needs to be taken to ensure that capacity to prioritise and implement public projects is adequate, especially in low- income countries.

Monetary policy in commodity-exporting countries would need to coordinate with fiscal policy; the choice of an appropriate anchor for monetary policy is especially important for macroeconomic management. For example, inflation targeting has been an extremely successful instrument elsewhere, but it may result in a monetary policy that puts appreciation pressure on the exchange rate when commodity prices increase.

This column reflects the views of the authors writing in their personal capacity

References

Aguirre, A, and C Calderon (2005), Real Exchange Rate Misalignments and Economic Performance. Central Bank of Chile Economic Research Division, April.

Auty, R (2001), Resource Abundance and Economic Development, Oxford University Press.

Chenery, H, and M Syrquin (1975), Patterns of Development, 1950–1970, Oxford University Press.

Collier, P, and B Goderis (2007), Commodity Prices, Growth and the Natural Resources Curse: Reconciling a Conundrum, The Centre for the Study of African Economies Working Paper Series, Working Paper 276. Oxford.

Collier, P, F Van Der Ploeg, Michael M Spence, and Anthony AJ Venables (2009), Managing Resource Revenues in Developing Economies. IMF Staff Papers (2010) 57 :84–118. Washington, DC.

Corden, WM, and PJ Neary (1982), “Booming Sector and Deindustrialization in a Small Open Economy”, Economic Journal 92 :825–848, December.

Gelb, A and Associates (1988), Oil Windfalls: Blessing or Curse?, World Bank and Oxford University Press, Washington, DC.

Lederman, D, and WF Maloney (2008), “In Search of the Missing Resource Curse.” World Bank Policy Research Working Paper, WPS 4766. Washington, DC.

Reinhart, CM, and KS Rogoff (2010), “Growth in a Time of Debt”, NBER Working Paper 15639, January.

Sachs, JD, and AM Warner (2001), “The Curse of Natural Resources”, European Economic Review, 45(4–6):827–38, May.

Sala-i-Martin, X, and A Subramanian (2003), “Addressing the Natural Resource Curse: An Illustration from Nigeria”, IMF Working Paper 03/139, International Monetary Fund, Washington, DC, July.