The debate on the merits and drawbacks of democracy dates back to Plato and Aristotle and is among the most controversial issues in political economy. On one side, Hobbes, Alexis de Tocqueville and more recently Samuel Huntington expressed scepticism regarding the economic efficiency of representative rule, fearing populist demands for redistribution and expropriation. On the other, most philosophers of the Enlightenment, while acknowledging these concerns, believed that a democratic polity would best safeguard political and economic freedom and thus promote development.

The performance of the global economy after the Second World War re-enforced this debate. While most industrial countries were democratic, democracy did not bring prosperity in many developing and Third World countries. In contrast, it was the East Asian countries under oligarchic regimes that experienced the fastest growth over this period. Yet the tragedy of Africa was to a large extent the outcome of brutal autocratic regimes.

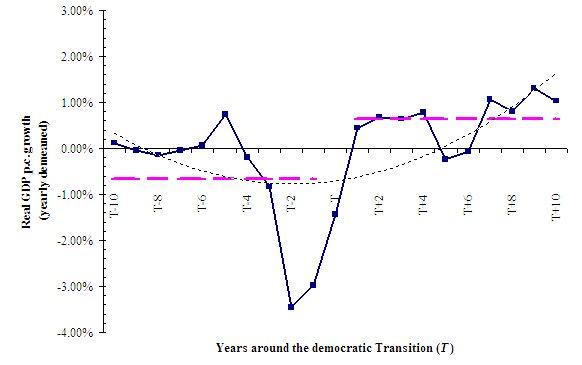

Given these diverse growth experiences, it is hardly surprising that cross-country studies failed to detect a significant effect of democracy on growth. Yet studying the cross-sectional correlation, while naturally the first step, does not address the relevant policy question: Do countries that abandon oligarchy and establish representative rule experience growth gains? In a recent paper (Papaioannou and Siourounis 2008), we tackle this question quantifying the effect of successful democratic transition on growth during the so-called "Third Wave of Democratisation". Instead of comparing cross-country economic performance and relating it to political institutions, we study growth in transition countries that switched from autocratic to representative rule. Our within-country approach allows us to identify the dynamic effects of regime changes. Figure 1 plots the evolution of real per capita GDP growth in the years surrounding a successful democratisation (market with T) compared to the global growth rate in each year. Two noteworthy observations emerge. First, compared to the pre-transition period, average growth (indicated with the purple dashed line) seems to be higher in the democratic years. Second, compared to the world average, annual per capita GDP growth in democratisation countries drops significantly during the transition; yet after the consolidation of representative rule growth fluctuates at a higher rate. It seems that as democracy consolidates, growth rates stabilise at a higher rate (compared to the non-democratic years). The graph suggests that in the short run there may be non-negligible transition costs, but in the long run growth stabilises at higher rates.

Figure 1: Real p.c. GDP growth around permanent democratizations

In our paper we use various econometric panel techniques to analyse the dynamic effects of successful democratic reforms in transition countries over the past four decades. Besides directly answering the relevant policy question on whether democratisations foster or slow down growth, our “within” country approach allows us to account for some (though not all) of the limitations of previous work.

The shortcomings of cross-country comparisons

Identifying and quantifying precisely the effect of the polity on economic performance is much harder than simply regressing cross-country average growth on a proxy measure of democracy (as most of the cross-country work has done).

First, there are non-negligible conceptual, aggregate, and measurement issues regarding how to define democratic rule and identify political transitions.1 As Robert Dahl puts it “democracy has meant different things to different people at different times and places”.

Second, political freedom is correlated and to a great extent jointly determined with other institutional features, such as legal efficiency, bureaucracy independence, regularly barriers, etc. It is thus quite challenging to isolate the effect of democracy from these associated factors. This becomes harder when working with cross-sectional data from a hundred or so countries.

Third, the potentially positive effects of democracy on the economy will almost certainly not occur overnight. It needs time for the society to build the necessary supportive to democracy structures (e.g. independent electoral committees; parliamentary accountability rules; judiciary supervision of the executive). The consolidation of democratic rule may also be delayed, as quite often the previous regime tries to regain power through coups or maintain the de facto political status quo (e.g. Argentina in the early 1970s; Bolivia in the early 1980s).

An event study approach

In our paper, we quantify the effect of successful democratic transition on growth during the period 1960-2005, trying to account for these shortcomings.

On the measurement issue, we construct a detailed dataset of permanent political transitions during the Third Wave of Democratisation. To do so we went over various electoral databases, political archives, and historical resources. We also studied the evolution of various democracy indicators that by construction do not aim to identify transitions, but rather measure the level of civil liberties protection. Since not all transitions brought the same level of political freedom, we separate reforming countries to “full” and “partial” democratisation.2 This also allows us to examine whether moderate democratic reforms can have growth gains.

Second in contrast to cross-sectional approaches, we employ a before-and-after event study approach that allows us to examine the effect of democratisation on growth in countries that made the transition. Not only does this approach allows us to account for (to a first-approximation) time-invariant factors that may affect both economic and political development (related for example to geography, social factors, or colonial heritage), but it directly addresses the relevant policy question, on whether growth falls, accelerates, or remains constant following transitions.

Third, to investigate dynamics, we use annual data as this enables us to identify the potentially different short-, medium-, and long-run effects of democratisation and also account for potential anticipation effects.

Gains from democratisation

Our work yields three main findings:

Our within-country estimates imply that on average democratisations are associated with a 0.5% to 1% increase in annual per capita growth. This result suggests that, besides any moral superiority, democracy can produce significant economic gains (which most likely will enhance its popularity and legitimacy). This finding stands in contrast with previous cross-sectional studies, which did not account for unobserved heterogeneity, time-invariant country characteristics, and dynamics (e.g. Barro, 1996). Our results accord with other recent studies using similar methods finding that democratic transitions are associated with positive growth gains (e.g. Persson and Tabellini, 2006a). Most importantly, this pro-democracy finding is strengthened by the evidence in Persson and Tabellini (2007), who, using elaborate econometric techniques, show that exits from democracy are followed by significant drops in growth on the order of 2%.

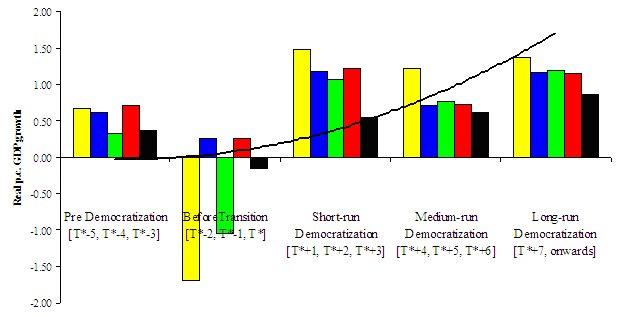

We then explore the dynamic effects of transitions allowing the effect to differ in the short, medium and long run. Our model also allows us to account for potential anticipation effects and for the volatile transition period. Figure 2 gives a graphical illustration of our estimates. The bars correspond to different econometric specifications and samples (for example the models in the black, the green, and the red bars exclude socialist economies; in the specification in the black bar we control for other growth covariates).

Figure 2: Dynamic Effects of Democracy in Transition Countries

During the transition, growth is volatile and usually negative. This conforms to the documented pattern that crises give an “opportunity window” for democratic transitions. For example, most transitions in South America took place after the debt crisis of the early 1980s. Similarly it took a severe financial meltdown for the family-run regime of President Suharto to collapse in Indonesia.3 Growth tends to be higher immediately after the transition, but this effect is (to some extent) driven by the business-cycle recovery of the economy. Most importantly, growth stabilises at a higher rate in the medium and especially the long run. Our preferred estimate implies that growth in transition countries is around 0.9% higher after the consolidation of democracy compared to evolution of growth in non-reforming countries. This finding parallels Ian Bremmer's influential theory that "closed" societies that "open" up experience an initial period of instability, but then liberalism is associated with better economic outcomes. This result is also in line with recent work that stresses the importance of democratic capital in the development process (Persson and Tabellini, 2006b).

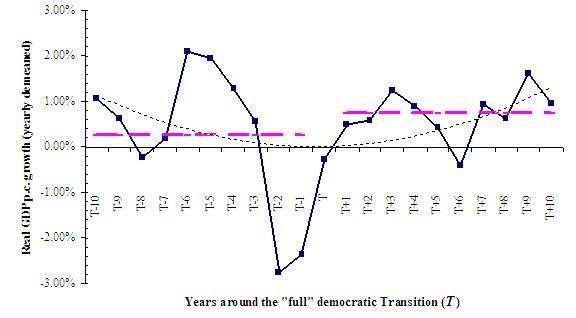

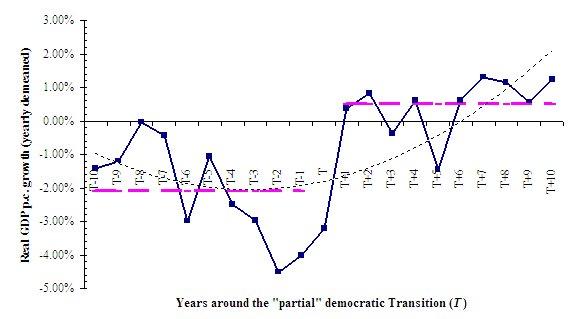

Nowadays, many countries are implementing incremental steps towards democracy. To assess the potential consequences of such policies, we repeat our analysis distinguishing between “full” and “partial” democratisations. Figures 3 and 4 plot the evolution of growth (accounting for global factors) around the democratic transition separately for the group of "full" and "partial" democratisation countries. Countries that implemented partial reforms were experiencing below global mean annual growth rates before the transition. However, after switching to democracy, these countries experienced, on average, higher growth rates than the rest of the world. Our econometric analysis matches the descriptive evidence in Figure 4, offering optimism for countries that implement moderate democratic reforms.

Figure 3: Real p.c. GDP growth around "full" democratizations

Figure 4: Real p.c. GDP growth around "partial" democratizations

Conclusion

While there is significant heterogeneity across countries (Persson and Tabellini, 2007), our results suggest that, if anything, the average effect of successful democratic transitions on growth is positive. Our “within” evidence shows that the experience of the past four decades suggests that even moderate political reforms can also bring sizable economic gains. Most importantly, our dynamic analysis suggests that growth is usually volatile and negative during the transition period. Yet after the consolidation of democracy, growth stabilises at a higher rate. This J-shaped pattern accords with F.A. Hayek’s (1960) idea that the “as is true of liberty, the benefits of democracy will show themselves only in the long-run, while its more immediate achievements may well be inferior to those of other forms of government.”

References

Barro, Robert J. 1996. "Democracy and Growth", Journal of Economic Growth, 1(1): 1-27.

Bremmer, Ian. 2006. The J Curve: A New Way to Understand Why Nations Rise and Fall. Simon and Schuster, New York, NY.

Dahl, Robert Alan. 2000. On Democracy. New Heaven, MA: Yale University Press.

Hayek, Friederich A. 1960. The Constitution of Liberty. Chicago/ILL: University of Chicago Press.

Munck, Gerardo L., and Jay Verkuilen. 2002. "Conceptualizing And Measuring Democracy: Evaluating Alternative Indices", Comparative Political Studies, 35(1): 5-34.

Papaioannou, Elias and Gregorios Siourounis. 2008a. "Democratization and Growth", Economic Journal, 118(10): 1520-15551. Also CEPR DP 6987

Papaioannou, Elias and Gregorios Siourounis. 2008b. "Economic and Social Factors Driving the Third Wave of Democratization", Journal of Comparative Economics, 36( 3): 365-387. Also CEPR DP 6986

Persson, Torsten, and Guido Tabellini. 2006a. "Democracy and Development: The Devil in the Details", American Economic Review Papers and Proceedings, 99(2): 319-314.

Persson, Torsten, and Guido Tabellini. 2006b. "Democratic Capital: The Nexus of Economic and Political Change." National Bureau of Economic Research (Cambridge, MA), Working Paper 12175.

Persson, Torsten, and Guido Tabellini. 2007."The Growth Effect of Democracy: Is It Heterogeneous and How Can It Be Estimated?" in Institutions and Economic Performance, (ed.) Elhanan Helpman, Harvard University Press, Cambridge, MA.

Footnotes

1 For a discussion of the conceptual challenges in defining democracy see: Munck, Gerardo L., and Jay Verkuilen. 2002. "Conceptualizing And Measuring Democracy: Evaluating Alternative Indices." Comparative Political Studies, 35(1): 5-34.

2 In Papaioannou and Siourounis (2008b) we give details on the data construction. Descriptions of the political transition for each country and country-specific figures on growth dynamics around the transition are available at www.dartmouth.edu/~elias.

3 For works on the effect of crises on democratic transitions, see Antonio Ciccone’s Vox column on “democratising recessions.”