Several mega-regional trade agreements (mega-RTAs) involving a large number of countries have been under negotiation. The Trans-Pacific Partnership (TPP) Agreement, involving 12 Asia-Pacific countries including the US and Japan, concluded negotiations in October 2015 with the parties signing it in February 2016. Although this mega-RTA was axed by new US President Donald Trump afterwards, it may still exist among the remaining 11 countries. Two other mega-RTAs – the Regional Comprehensive Economic Partnership (RCEP) involving 16 East Asian countries, and the Trans-Atlantic Trade and Investment Partnership (TTIP) between the US and EU – have also been under negotiation. Most RTAs are bilateral and involve two countries. However, the number of multilateral RTAs, including mega-RTAs, is increasing.

The emergence of mega-RTAs is likely to complicate the trading environment, as some countries may be covered by overlapping RTAs. For example, the TPP overlaps with the North American Free Trade Agreement (NAFTA), which involves the US, Mexico, and Canada. It also overlaps with the Japan-Mexico RTA. Among the RCEP member countries, there already exist several RTAs, in particular the so-called ASEAN plus-one RTAs (i.e. between each member of the Association of Southeast Asian Nations and China, Japan, South Korea, India, and Australia-New Zealand). Once overlapping RTAs enter into force, firms are faced with multiple RTA schemes when trading with the member countries. For example, if the TPP enters into force (even among 11 countries), exporters in Japan will be able to choose tariff schemes from among the TPP, the Japan-Mexico RTA, and most favoured nation (MFN) schemes (i.e. non-use of a preferential scheme) when trading with Mexico.

How do exporters choose their tariff schemes when multiple RTA schemes are available? Many researchers, including Cadot et al. (2006), Francois et al. (2006), Manchin (2006), Bureau et al. (2007), and Hakobyan (2015), have considered the situation where exporters face MFN and RTA tariff schemes, and empirically investigated factors that affect firms’ choice between these two tariff schemes. They found that the larger the preference margin (defined as the difference between MFN and RTA tariff rates) and the less restrictive the rules of origin (RoOs), the more likely the use of the RTA scheme. While useful, these studies did not consider the case of multiple and overlapping RTAs. Our explores the choice of tariff schemes when multiple RTA schemes in addition to an MFN scheme are available for exporters study (Hayakawa et al. 2017).

Specifically, we examine the case where one bilateral RTA and one multilateral RTA (i.e. an RTA among more than two countries) are present. One key difference between these two RTAs is that, in the case of multilateral RTAs, cumulation among multiple countries is allowed when satisfying the RoO requirement. The cumulation provision of RoOs enables RTA users to accumulate the value of intermediates from member countries in determining the originating status of the products to be exported. Therefore, exporters are less likely to be required to adjust procurement sources for the purpose of RoO compliance. However, cumulation among multiple countries requires exporters to collect a larger number of documents (i.e. higher documentation costs) since they need to prove that inputs from other member countries are produced in and are imported from those countries. Thus, multilateral RTAs are less costly in terms of procurement requirements, but more costly in terms of documentation preparation when compared to bilateral RTAs.

Given this trade-off, it can be demonstrated theoretically that exporters with high, medium, and low ranges of productivity choose multilateral RTA, bilateral RTA, and MFN schemes, respectively. One line of evidence to support this sorting is available from the imports of Thailand from Japan in 2014. According to the Customs Office of the Kingdom of Thailand, the mean and median of transaction-level trade values are 391,000 Thai baht (THB) and 33,000 THB, respectively, under the ASEAN-Japan Comprehensive Economic Partnership (AJCEP), 210,000 THB and 16,000 THB under the Japan-Thailand Economic Partnership Agreement (JTEPA), and 61,000 THB and 3,000 THB under MFN. Since the transaction-level trade values are likely to be positively correlated with exporter productivity, the order of trade values for different tariff schemes is consistent with the order of exporter productivity, as indicated earlier.

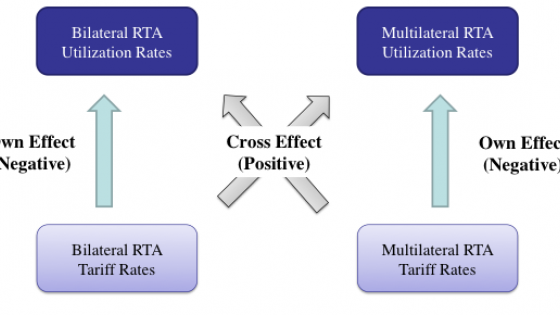

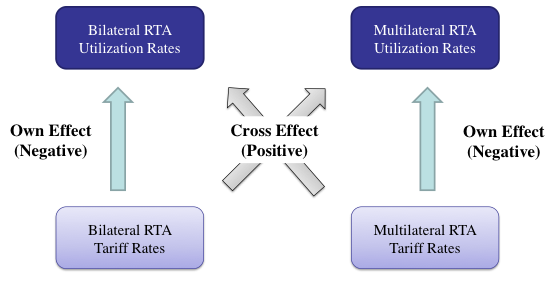

Furthermore, the product-level utilisation rate of an RTA scheme increases when its own RTA preferential rate decreases, or the preferential rates of other RTAs increase. The utilisation rate of an RTA is defined as the share of trade utilising the RTA scheme out of trade eligible for the preferential tariff rate under the RTA. We refer to these effects, those associated with own preferential rates and with other RTAs’ preferential rates, as ‘own effect’ and ‘cross effect,’ respectively. These effects are summarised in Figure 1. The existence of these effects can be confirmed in Japan’s imports from Malaysia, the Philippines, Singapore, Thailand, and Vietnam during the 2012-2015 period. Japan concluded not only a bilateral RTA with each of these countries but also a multilateral RTA with ASEAN as a whole. These RTAs involving Japan present a good case to examine the tariff scheme choice when multiple RTAs are present. Our empirical analysis using Japan’s import data by different tariff schemes found statistically significant evidence concerning own (negative) and cross (positive) effects of tariff rates on RTA utilisation rates.

Figure 1 Own and cross effects

These results imply that when multiple RTA schemes are available, the utilisation of one RTA scheme is affected not only by its own tariff rates, but also by the rates of other RTAs. Therefore, policymakers should take into account the schedule of tariff reduction/elimination in other overlapped RTAs when they aim to promote the use of an RTA under consideration. For instance, the utilisation rate of existing RTAs is likely to be affected by a new mega-RTA.

Our findings provide an important policy implication for policymakers formulating mega-RTAs. We found that the utilisation rate of RTA schemes depends on the quality of the RTA in terms of the coverage of products for tariff reduction, the extent of tariff reduction, and the extent of ease of complying with RoOs. These findings indicate that the mega-RTAs should be designed to be of the best quality so that the exporters choose to utilise them without consideration of other overlapping RTAs, resulting in the avoidance of the ‘spaghetti bowl’ (or ‘noodle bowl’) effect.

Editors' note: The main research on which this column is based appeared in a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Bureau, J C, R Chakir and J Gallezot (2007), “The utilisation of trade preferences for developing countries in the agri-food sector.” Journal of Agricultural Economics 58, 175–198.

Cadot, O, C Carrere, J De Melo and B Tumurchudur (2006), “Product-specific rules of origin in EU and US preferential trading arrangements: An assessment.” Word Trade Review 5, 199–224.

Francois, J, B Hoekman and M Manchin (2006), “Preference erosion and multilateral trade liberalization.” World Bank Economic Review 20, 197–216.

Hakobyan, S (2015), “Accounting for underutilization of trade preference programs: U.S. generalized system of preferences.” Canadian Journal of Economics 48, 408–436.

Hayakawa, K, S Urata and T Yoshimi (2017), “Choosing between multiple preferential tariff schemes: Evidence from Japan’s imports.” Discussion Paper 17-E-002, Research Institute of Economy, Trade and Industry (RIETI).

Manchin, M (2006), “Preference utilisation and tariff reduction in EU imports from ACP countries.” The World Economy 29, 1243–1266.