Few issues are as important or as controversial as the lender of last resort (Bank for International Settlements 2014). Indeed, this function is arguably what makes central banking central to the financial system, and to the economy at large.

As is well known, the lender of last resort (LOLR) function played a key role at various stages of the Global Crisis (Domanski et al. 2014). Whether central banks did (for AIG) or did not (for Lehman Brothers) act as LOLR mattered greatly, as did how they implemented and communicated LOLR when they did provide it (e.g. Northern Rock).

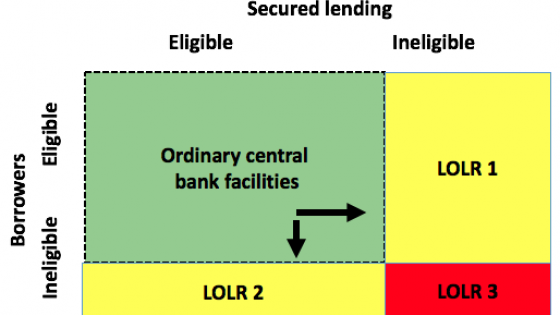

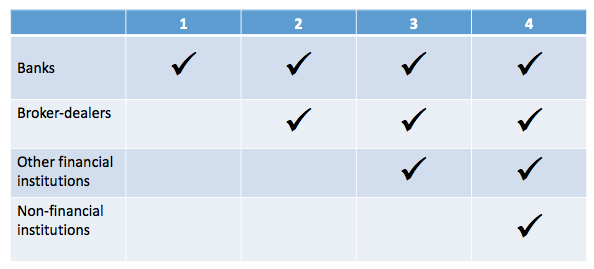

Figure 1 Lender of last resort begins where eligibility stops

In contrast, eligibility requirements have received less attention. Yet, these determine whether or not a facility is a LOLR and provider of emergency liquidity assistance. LOLR/emergency liquidity assistance starts where ordinary central bank facilities stop, that is where eligibility for such facilities ends.

Hence, LOLR/emergency liquidity assistance can take the following forms:

- LOLR1: To eligible borrowers on the basis of ineligible collateral

- LOLR2: To ineligible borrowers on the basis of eligible collateral

- LOLR3: To ineligible borrowers on the basis of ineligible collateral

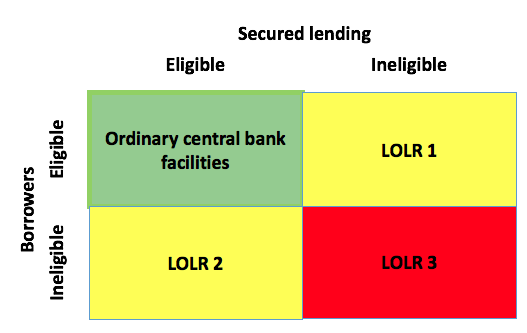

During the crisis, central banks initiated a policy that might be called 'eligibility easing'. This reduced the need for central banks to act as LOLR/provide emergency liquidity assistance by:

- Expanding the collateral eligible to support normal central bank liquidity facilities (Breeden and Whisker 2010)

- Extending the range of counterparties eligible to access normal central bank liquidity facilities (Bank of England 2014)

Figure 2 Eligibility easing reduces need for LOLR

In addition, central banks extended the term of normal liquidity facilities. Separately, in the context of quantitative easing (QE), central banks expanded the range of assets acquired directly via open market operations. In the US, the Federal Reserve Board bought massive amounts of mortgage-backed securities (Federal Reserve Board 2017). In the Eurozone, the ECB has stated to purchase both government and corporate bonds as part of its supplemental asset purchase programme (ECB 2017). These central bank purchases have supported the price of such assets, enhanced their market liquidity and improved the creditworthiness of institutions holding them. In effect, central banks have acted as buyers of last resort.

Taken together, eligibility easing and QE proved remarkably effective in stabilising the world economy. Indeed, in my view it is one of the principal reasons that economists describe 2008 to 2010 as the Great Recession, and not the start of the Greater Depression.

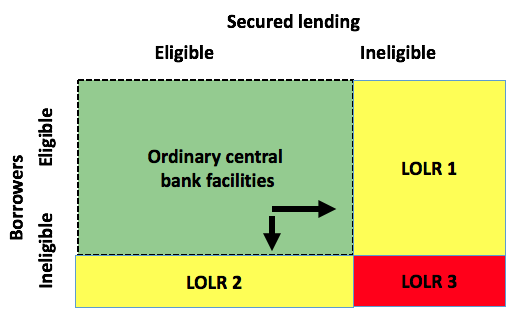

Figure 3 The future of eligibility easing: Should central banks adopt the accordion approach?

Ending eligibility easing

Now that the recovery is finally taking hold, central banks are struggling with the question of when and how to end QE. A similar debate needs to take place with respect to eligibility easing.

With respect to the range of assets eligible to serve as collateral for ordinary central bank facilities, central banks have three options. They could retain the current broad range. They could return to a narrower range (as the US did under Dodd Frank). Or, they could regard revisions to the range as a macro-prudential tool (Huertas 2011: 106-110). When using this approach, the central bank would narrow the range of assets that were eligible as collateral as an upturn progressed, and broaden the range as a downturn took hold. In effect, this would create a countercyclical accordion. Note that the central bank could supplement these measures by varying the haircut on assets that do remain eligible, as well as varying the term of its ordinary facilities.

Figure 4 The future of eligibility easing: Should non-banks be eligible for ordinary central bank facilities?

With respect to the counterparties eligible to access ordinary central bank facilities, authorities have to decide the basis on which this will occur. Should access be restricted to banks only, restricted to banks and broker dealers, open to all financial institutions, or open to all (that is, available to both financial and non-financial institutions)? Note that any solution that goes beyond banks alone would undermine the notion that banks are special, and therefore would weaken the rationale for bank regulation.

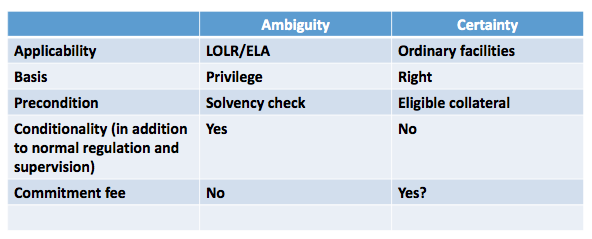

Figure 5 Terms and conditions

What’s constructive: Ambiguity or certainty?

Finally, there is the question of the terms and conditions on which LOLR/emergency liquidity assistance is granted (Calomaris et al. 2017). Although there is a consensus that the terms for LOLR/emergency liquidity assistance should be harsher than those for ordinary facilities, greater clarity is needed on the terms and conditions for ordinary facilities. Which regime is more constructive: ambiguity or certainty?

All liquidity is not equal

I believe central banks should draw a distinction between LOLR/emergency liquidity assistance and ordinary liquidity facilities. In the former, ambiguity is essential: no one should have the right to receive LOLR/emergency liquidity assistance (the review of eligibility easing will determine which counterparties have the right to request LOLR/emergency liquidity assistance). In contrast, certainty is constructive with respect to ordinary central bank facilities: eligible counterparties should be able to expect that the central bank will provide liquidity when they pledge eligible collateral.

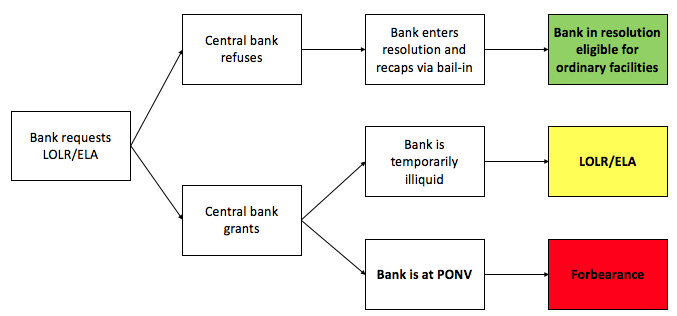

Figure 6 Central bank responses to requests for LOLR/emergency liquidity assistance

This distinction is particularly important in connection with resolution. If a bank asks for LOLR/emergency liquidity assistance, this may be a sign that it has reached the point of non-viability. Correspondingly, the central bank must rapidly decide whether to grant or decline the request for LOLR/emergency liquidity assistance. In making this decision, the central bank should first consider whether the bank requesting LOLR/ emergency liquidity assistance is solvent. If it is not, LOLR/emergency liquidity assistance could be judged, under normal bankruptcy procedures, a fraudulent conveyance. However, the central bank should also take into account that the decision itself (whether or not to grant LOLR/emergency liquidity assistance) may have an influence on asset prices, and hence on the solvency calculation.

The central bank’s decision also affects the bank’s continuity. Granting the bank’s request for LOLR/emergency liquidity assistance permits the bank to continue to function, but it also creates the possibility that the authorities exercise forbearance. Indeed, without liquidity support from the central bank, the supervisor alone cannot (except where the bank finances itself exclusively with insured deposits) exercise forbearance.

Declining the request will almost certainly lead to the immediate failure of the bank and force the supervisor or resolution authority to put the bank into resolution, regardless of the views that these authorities may have about the bank’s condition.

Financial stability will be enhanced if markets know what will happen next. To this end, the central bank and resolution authority should make clear that they will pursue the following presumptive path:

- They will put the bank into resolution.

- They will immediately bail-in instruments qualifying as TLAC so that bank is not only solvent but meets minimum requirements for CET1 capital.

- They will ensure that the bank-in-resolution retains access to financial market infrastructures.

- Finally, they will make ordinary central banking facilities available to the recapitalised bank on the basis of the bank’s unencumbered assets. In particular, the central bank should stand ready to take over both the financing and the collateral from repo providers. It makes no sense for the central bank to create the impression that it will refuse to grant the recapitalised bank access to ordinary central bank facilities. This position would undermine practically any resolution plan that the resolution authority might devise.

In sum, eligibility easing deserves as much attention as QE. It too played a significant role in containing the crisis. The time has now come to determine its future role, both as a macro-prudential tool and as a determinant of what really constitutes the ‘last’ resort when it comes to LOLR/emergency liquidity assistance.

Author’s note: The author is a partner in EY’s Financial Services Risk practice and chairs EY’s Global Regulatory Network as well as the CEPS Resolution Task Force. The opinions expressed here are personal.

References

Bank for International Settlements (2014), Re-thinking the lender of last resort.

Breeden, S and R Whisker (2010), "Collateral risk management at the Bank of England", Bank of England Quarterly Bulletin Q2: 94-103.

Bank of England (2014), "Widening access to the Sterling Monetary Framework: broker-dealers and central counterparties", News Release.

Calomaris, C W, D Holtz-Eakin, R G Hubbard, A H Meltzer and H Scott (forthcoming) "Establishing Credible Rules for Fed Emergency Lending", Journal of Financial Economic Policy.

European Central Bank (2017), "Asset purchase programmes".

Domanski, D, R Moessner and W Nelson (2014), "Central banks as lender of last resort: experiences during the 2007-2010 crisis and lessons for the future", Federal Reserve Board Finance and Economics Discussion Series.

Federal Reserve Board (2017), "Credit and Liquidity Programs and the Balance Sheet", Board of Governors of the Federal Reserve System.

Huertas, T F (2011), Crisis: Cause, Containment and Cure (2nd edition), London: Palgrave Macmillan.