International economic integration is supposed to improve efficiency, and it certainly would if barriers to international mobility of goods, capital, and people were the only things standing between the real world and the economists’ perfect world of competitive equilibrium. By extending the reach of markets across countries’ borders, however, integration also makes it more difficult for each country to implement policies meant to address other market imperfections; integration offers firms new freedoms not only to exploit trade opportunities, but also to escape nations’ regulation and taxation.

This may be a really good thing if policy is shaped by rent-seeking political interactions. Economic integration may then improve efficiency not only directly, but also by fostering competition among jurisdictions – competition that may force bad governments to get better. Still, any tendency for economic integration to deprive governments of policymaking power is something that will worry governments. Thus the jurisdictional competition may itself be an important obstacle to tighter integration – especially since political interactions still occur mostly within nations. And many government policies do not simply implement wasteful redistribution; they serve the useful purpose of addressing market imperfections. Welfare would not be improved by economic integration if it makes such policies unfeasible.

This point is well understood and the European and global international integration processes address the most evident of these “race to the bottom” problems. Trade agreements stipulate product quality standards and workplace safety rules because individual consumers and workers are often unable to assess the dangers entailed by performing a given job or using a given product and, since individual employers and producers need not have incentives to provide truthful information in decentralised markets. Fear can easily hamper market interactions in the absence of government inspection, certification, and enforcement activities.

Much less is done and can be done about the implications of economic integration for something else the market finds it difficult to provide, namely insurance against job-market and other life-shaping risks. Markets are poorly equipped to deal with such risks, because an individual’s wage and employment depend importantly on luck (so that insurance would be welcome) but also on effort (which is unobserved and bothersome, and unavoidably wanes if lack of effort simply increases the chance of receiving insurance payoffs, rather than that of having to reduce consumption).

To address this market failure, governments implement redistribution and social insurance schemes within each country. It is sensible for them to try and do so. But their information-gathering and enforcement powers, while superior to those of individual market participants, are not such as to eliminate the negative effects of insurance on effort, employment, and productivity. Thus, social insurance is less affordable when a country is poor, and also when economic integration makes it important to prevent any productivity shortfall, which can have disastrous consequences for a country’s position in the market, and grants self-interested individuals new ways to escape taxation and seek subsidies across countries’ borders.

The increasing importance of “competitiveness” concerns can in theory trigger a race to the bottom in social insurance, just at the same time as economic integration introduces new sources of risk in each country’s labour market. This is an important concern in reality, and an important obstacle to full liberalisation of international markets. In practice, it is hard to tell if integration does have dismal consequences for inequality and for social policy, because both are influenced by many other technological and political factors. But useful data can be gathered from Europe’s Economic and Monetary Union’s experiment.

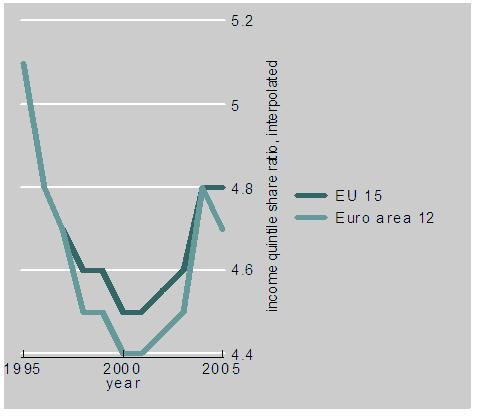

Eurostat publishes, for individual countries and interesting aggregates, a set of “quintile ratio” inequality statistics (the share of disposable income adjusted for household size accruing to the richest 20% of the population, divided by that accruing to the poorest 20%). These data paint an interesting picture of inequality’s evolution around the turn of the millennium. Just as the Eurozone countries began to enjoy full and irreversible economic integration, inequality increased very sharply in the EU15 and more sharply in the 12 Eurozone countries, bringing its previous decline to an end and reverting to the 1996 level by 2004.

Evolution of inequality, as measured by the income quintile ratio, in the EU15 and Euroarea12 aggregates. Source: Eurostat.

Of course, much is going on behind this scary picture. In particular (since a rising tide does lift all boats) business-cycle dynamics tended to reduce inequality until 2000, and to increase it afterwards. But these and other data can be used to account for income and other factors, and isolate the implications of removing international barriers to trade and mobility not only for output, unemployment, and integration, but also for inequality and social policy.

It is easy to assess the impact of EMU statistically if one is willing to believe that EU15 countries are sufficiently similar and similarly influenced by other events to warrant attributing to EMU the differences between EMU “ins” and “outs” before and after EMU. The assumption may be difficult to swallow, but some such assumption is necessary in all empirical work (and it is reassuring to find that the results are robust to excluding Denmark, Sweden, or the UK from the comparison group, or to including Norway, the only other country for which sufficient comparable data are available).

Doing so (see for details a paper I have written for DG ECFIN Annual Research Conference), one finds that EMU does appear to improve economic performance (both in terms of per capita income and in terms of unemployment) and the intensity of international transactions (especially as regards foreign direct investment flows). But it also appears to be associated with higher inequality, and with lower social spending. Interestingly, the inequality variation associated with EMU is fully accounted for by changes in social policy expenditure (excluding pensions) as a share of GDP, and in GDP and unemployment (both of which are of course likely to be influenced by integration policies, as well as by global cyclical and technological development). A rising economic tide lifts all boats, but the weaker boats are lifted more effectively when generous social policy accompanies higher income levels.

It is also interesting to find that while the share of labour income in GDP has declined very sharply with EMU, possibly reflecting the greater ability of mobile capital to exploit international opportunities, that variable is not per se relevant to personal income inequality. Higher unemployment is associated with more inequality along time-series fluctuations, but countries with higher average unemployment are less unequal in terms of household-adjusted income, perhaps because employed breadwinners earn higher wages and live in the same households as unemployed youth.

After all this is said and done, the resulting picture may not be as scary as that shown here. But it remains worrisome. EMU appears to be associated with better aggregate economic performance, but also with higher inequality and lower social spending within countries joining the Eurozone. This may indicate that economic integration’s inequality effects are mediated by (comparatively, in comparison to pre-EMU and non-EMU) less generous social policy, and that some of the apparent increase in country output may reflect smaller inefficiency losses from redistribution’s effects on effort incentives.

Whether such developments should be viewed as good news depends of course on the side of redistribution budgets one finds himself on, and on whether one views redistribution as a suitable or a misguided tool for pursuing goals that markets should in principle but might in practice fail to achieve. Financial market development can indeed fulfil some of the needs addressed by social policy in theory, and is associated with lower social spending in cross-country data, along the lines of another recent paper I wrote. In the data, however, indicators such as the ratio to GDP of bonds, credit, and stock market valuation do not appear to be any higher in EMU countries, after adoption of the euro, than in the comparison group.

The quantity and quality of available data are not and will never be such as to yield conclusive evidence. Piecing together the various pieces of circumstantial evidence, however, forms a view of post-EMU inequality and policy evolution that is intriguingly consistent with theoretical “race to the bottom” problems, and casts doubt on the economic efficiency and political sustainability of full economic integration in the absence of the area-wide social policies and levels of financial market development observed, for example, in the US. When forecasting the future of EMU and shaping its policies, it would be wrong and dangerous to disregard the implications of economic integration not only for efficiency and growth, but also for the sources and remedies of income inequality.