Economic crises trigger advances in economic analysis. The Great Recession, to take a recent example, put banking and financial frictions in the spotlight of macroeconomic analysis and modelling. Lindé et al. (2016) show that an estimated macro model with financial frictions and constrained monetary policy goes some way in accounting for the depth of the Great Recession and the slow recovery. Kollmann et al. (2014) illustrate the transmission of asset price shocks through borrowing constraints, and Kollmann et al. (2012, 2013) discuss the effectiveness of financial rescue policies in a DSGE model with a banking sector.

COVID-19 has been a crisis of very different anatomy. This dissimilarity applies to causes (virus spread and containment measures) and consequences (manifestation in economic data). An entire new literature has emerged that marries epidemiological and macroeconomic models to assess the dynamic impact of health, and health policy, on economic outcomes and of economic activity on the spread of the virus. Early examples include Bodenstein et al. (2020) and Eichenbaum et al. (2020a, 2020b).

Closer to their standard business, economists have also thought about how to describe the economic essence of the pandemic in established macro models. Guerrieri et al. (2020) portray shutdowns as sector-specific supply shocks in a multi-sector economy and show the possibility of negative demand externalities for the rest of the economy. Clemens and Roeger (2021) use a two-sector model (more- and less-affected sector) to analyse the impact of a temporary VAT cut as implemented in Germany. Kollmann (2021) considers a stylised 1-sector New Keynesian (NK) framework and concludes that a combination of (persistent) aggregate demand (AD) and supply (AS) shocks is required to reconcile the COVID-19 recession with its subdued inflation response. Kühl (2021) uses the standard version of the ECB’s New Area-Wide Model (NAWM II) and finds a significant role for demand and supply shocks to explain euro-area (EA) output and inflation in 2020. Chen et al. (2020) adapt the New York Fed DSGE model by adding transitory demand (discount factor) and supply (labour and TFP) shocks, including some anticipation of pandemic waves, to account for the fact that the disruptions caused by the pandemic differ from standard business cycles.

In the same spirit, we augment the European Commission’s Global Multi-country (GM) model (Albonico et al. 2019) with shocks that are specific to COVID-19 and the short-term policy responses at the national level (Cardani et al. 2021). First, we add a non-persistent ‘forced savings’ shock that constrains private consumption starting in 2020q1 and is not subject to standard (habit) persistence.1 Second, we include a transitory ‘labour hoarding’ shock, which is a frictionless labour demand shock (changing the labour intensity of production at the intensive margin without hiring or firing costs for the firms). This shock accounts for the wedge between effective hours worked (production function) and hours paid (wage income) and, hence, captures income stabilisation through short-time work (STW) schemes in the euro area. The profiles of the two ‘lockdown shocks’ co-move closely with empirical indicators of mobility and the stringency of restrictions and with data on subsidies to firms, respectively, which supports our interpretation.2 Following Pfeiffer et al. (2020), we furthermore embed liquidity-constrained firms into the model to account for the limited access to finance of notably small firms in the service sector. The mechanism also generates positive co-movement of consumption and investment demand.

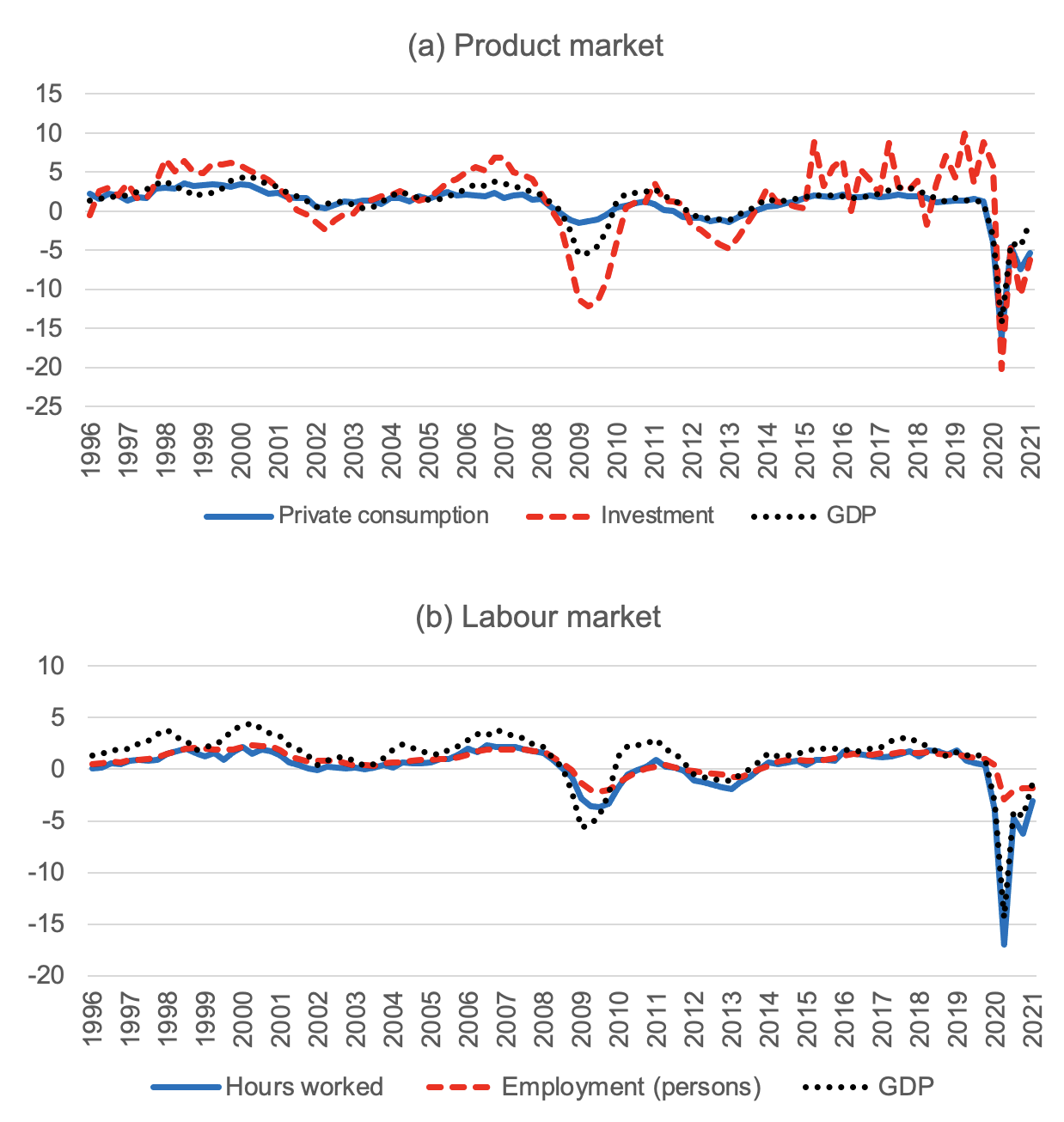

Our model extensions relate to main characteristics of the COVID recession. Private consumption and investment in the euro area have fallen in tandem and to a similar extent (%) in 2020 (Figure 1, Panel a). Investment tends to be more volatile than consumption growth in ‘normal’ times, and consumption fell less than investment during the Great Recession. Compared to the dramatic contraction of hours worked in the pandemic (in line with real GDP), the number of persons employed has remained rather stable (Figure 1, panel b), contrasting with the close co-movement between hours and persons during the preceding 25 years.

Figure 1 Euro area GDP, consumption, investment and employment growth (%, year-on-year)

Note: Data are quarterly. Private final consumption, gross fixed capital formation and GDP are in constant prices. The growth rates refer to growth relative to the same quarter of the previous year.

Source: Eurostat

Main drivers of the pandemic recession

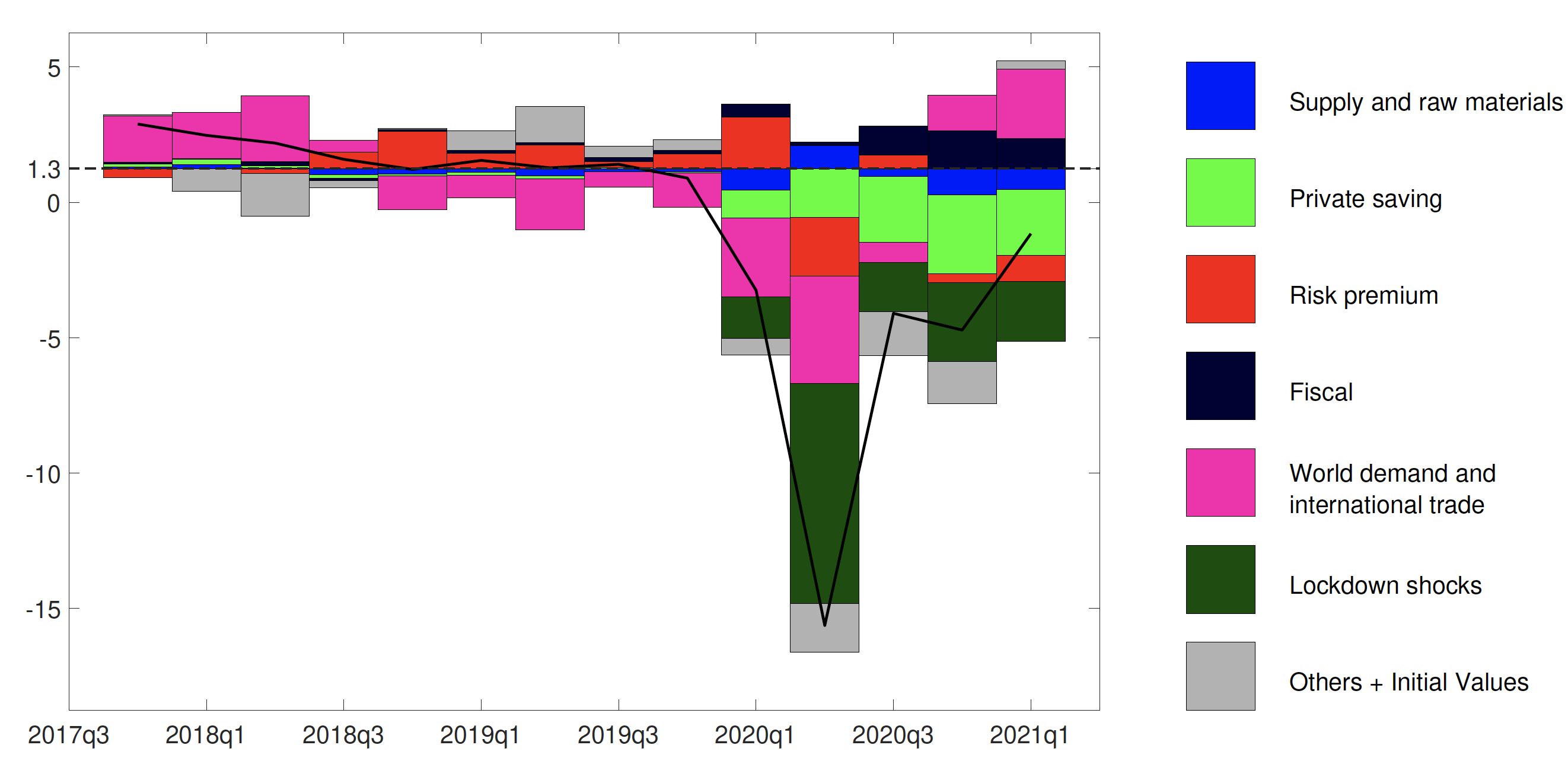

In European Commission (2020, 2021, we decompose year-on-year euro area real GDP growth into its main drivers.3 Figure 2 updates the analysis with the latest available data. The ‘lockdown shocks’, particularly ‘forced savings’, have been the dominant drivers of the 2020 recession, with a strong downside weight in 2020q2, an easing in 2020q3, and a renewed deterioration in 2020q4. A persistent increase in saving (‘private savings’ in Figure 2) also contributed to making the massive decline in private consumption the single most important driver of the 2020 recession.4 The pandemic’s impact on global demand and trade has been a third important driver of 2020 GDP growth, with falling export demand and some offsetting from stronger home bias on the import side. Falling investment demand (‘risk premium’) added to the contraction of economic activity mainly in 2020q2. Standard supply factors, in comparison, have played a minor role, with a positive contribution in 2020q2 that is associated with falling commodity prices. The results point to a supportive role of discretionary fiscal policy since mid-2020, complementing the automatic stabilisers.5

Figure 2 Decomposition of year-on-year euro area real GDP growth (%)

Note: Growth rates are year-on-year, i.e. they measure growth relative to the same period of the previous year. Units on the y-axis are % (1=1%). The solid black line represents the data. Bars below (above) the dashed line (trend growth) indicate negative (positive) contributions to real GDP growth.

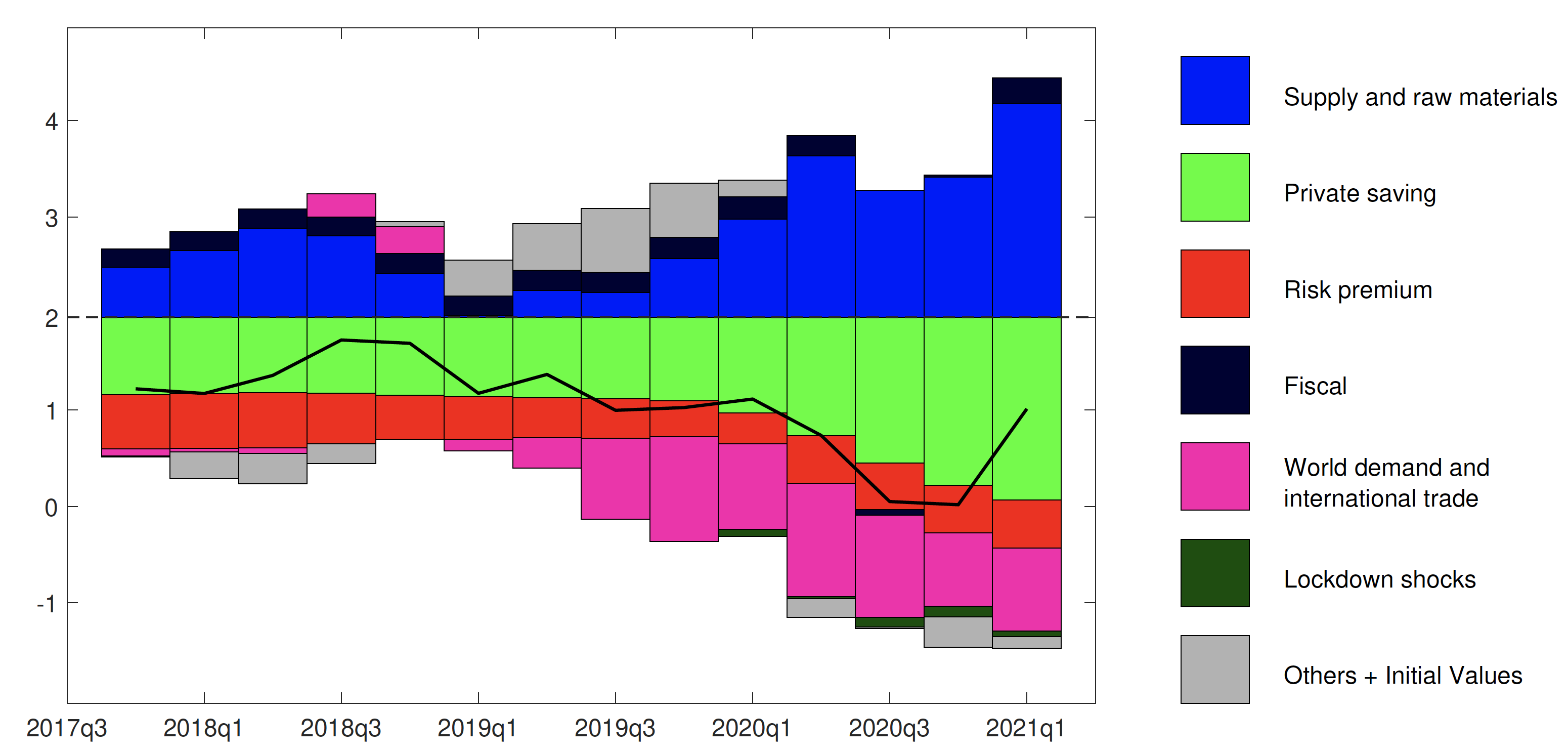

The shock decomposition for euro area consumer price inflation (Figure 3) emphasises different factors.6 Transitory ‘lockdown shocks’ have little impact on current inflation despite strong negative output effects, because they do not alter inflation expectations. Persistent negative savings shocks (‘private saving’), in contrast, lower inflation expectations, which leads to lower current inflation. Persistent negative shocks to world demand and international trade have a similar effect.

These downside factors are partly offset by positive contributions from ‘supply and raw materials’, notably labour cost and price mark-up shocks. The former mirror an increasing wedge between wages and labour productivity, the latter fill the gap between inflation and its fundamental drivers.7 The decline of commodity prices, to the contrary, has contributed to lower inflation in 2020, while it has increased consumer prices in the first quarter of 2021.8

Figure 3 Decomposition of year-on-year euro area HICP inflation (%)

Note: Inflation rates are year-on-year, i.e. they measure HICP level growth relative to the same period of the previous year. Units on the y-axis are % (1=1%). The solid black line represents the data. Bars below (above) the dashed line (trend inflation) indicate negative (positive) contributions to HICP inflation.

Decomposing growth revisions

Another way of looking at the pandemic’s macroeconomic ramifications is the analysis of forecast errors, as suggested by Kollmann (2021). COVID-19 has been a very large exogenous shock and arguably the main driver of revision to the euro area forecast for 2020-21.

Figure 4 provides a shock decomposition of the forecast error for real GDP growth. More precisely, it decomposes the difference between euro area real GDP growth (up to 2021q1) as reported in July 2021 and the corresponding series from the Autumn 2019 forecast (European Commission 2019b).9

Figure 4 Decomposition of the forecast error for euro area real GDP growth (year-on-year)

Note: The chart shows the forecast error as the difference between year-on-year EA real GDP growth reported in July 2021 and the forecast for year-on-year EA real GDP growth from Autumn 2019. Units on the y-axis are percentage points (1=1pp forecast error). The solid black line shows the forecast error. Bars below (above) the zero line indicate negative (positive) contributions to the forecast error.

Figure 4 paints a picture that is very similar to Figure 2. The ‘lockdown shocks’ are the main drivers of the COVID-related forecast error, together with an upward revision of persistent savings (downward revision of private consumption growth), and negative surprises on world demand and trade as well as investment demand (‘risk premium’) notably in 2020q2. Discretionary fiscal policy has been more expansionary than expected before the pandemic shock, which explains the positive contribution of fiscal shocks to growth revisions for the second half of 2020 and early 2021.

Conclusions

In light of the short-term trade-off between health and economic activity, the COVID-19 recession in the euro area has been exceptionally deep. Instead of fostering aggregate demand by government spending, stabilisation policy has focused on income support and maintaining the productive infrastructure of the economy to contain negative spillover to non-confined sectors, limit scars and facilitate the subsequent rebound. In particular, short-term work schemes have stabilised employment despite the dramatic decline in actual hours worked.

Our estimated model suggests a rapid recovery as far as transitory ‘lockdown shocks’ are concerned. The prerequisite is an end of the health emergency, which allows lifting restrictions on economic activity. Where precautionary motives are important, more clarity on medium- and longer-term perspectives may be necessary for consumer and investor confidence to strengthen.

Acknowledgements: The views expressed in this column are those of the authors and should not be attributed to the European Commission. We thank Bjoern Doehring, Martin Eichenbaum, Robert Kollmann, João Leal, Sergio Rebelo, Werner Roeger, Mathias Trabandt and Milan Vyskrabka for comments and discussion and Susanne Hoffmann for help with the data.

References

Albonico, A, L Calés, R Cardani, O Croitorov, F Ferroni, M Giovannini, S Hohberger, B Pataracchia, F Pericoli, R Raciborski, M Ratto, W Roeger, L Vogel (2019), "Comparing post-crisis dynamics across Euro Area countries with the Global Multi-country model," Economic Modelling 81(C): 242-273.

Altig, D S Baker, J Barrero, N Bloom, P Bunn, S Chen, S Davis, J Leather, B Meyer, E Mihaylov, P Mizen, N Parker, T Renault, P Smietanka, G Thwaites (2020), “Economic Uncertainty in the wake of the COVID-19 Pandemic,” VoxEU.org, 24 July.

Balleer, A, S Link, M Menkhoff, P Zorn (2020), “Demand or Supply? Price Adjustment during the Covid-19 Pandemic,” CESifo Working Paper 8394.

Blanchard, O, J Pisani-Ferry (2021), “Persistent COVID-19: Exploring potential economic implications,” Peterson Institute for International Economics, 12 March.

Bodenstein, M, G Corsetti, L Guerrieri (2020), “Social distancing and supply disruptions in a pandemic,” CEPR Discussion Paper 14629.

Burgert, M, W Roeger, J Varga, J in 't Veld, L Vogel (2020), "A global economy version of QUEST: Simulation properties," European Economy Discussion Paper 126, DG ECFIN.

Cardani, R, O Croitorov, M Giovannini, Ph Pfeiffer, M Ratto, L Vogel (2021), “The Euro Area’s pandemic recession: A DSGE-based interpretation,” JRC Working Papers in Economics and Finance 2021/10.

Chen, W, M Del Negro, S Goyal, A Johnson, A Tambalotti (2021), “The New York Fed DSGE model forecast - March 2021”, Liberty Street Economics, 31 March.

Claeys, G, L Guetta-Jeanrenaud (2021), “How has COVID-19 affected inflation measurement in the euro area?” Bruegel Blog, 24 March,

Clemens, M, W Roeger (2021), “Temporary VAT reduction during the lockdown,” DIW Discussion Paper 1944.

Coibion, O, D Georgarakos, Y Gorodnichenko, G Kenny, M Weber (2021), “The effect of macroeconomic uncertainty on household spending,” VoxEU.org, 31 July.

Deutsche Bundesbank (2020), “Monthly report – November 2020”, 72(11).

Eichenbaum, M, S Rebelo, M Trabandt (2020a), "The macroeconomics of epidemics," NBER Working Paper 26882.

Eichenbaum, M, S Rebelo, M Trabandt (2020b), "The macroeconomics of testing and quarantining," NBER Working Paper 27104.

Eichenbaum, M, S Rebelo, M Trabandt, (2020c), “Epidemics in the Neoclassical and New Keynesian models,” NBER Working Paper 27430.

European Commission (2017), “Report on Public Finances in EMU 2017,” European Economy Institutional Paper 069, DG ECFIN.

European Commission (2019a), “Report on Public Finances in EMU 2019,” European Economy Institutional Paper 133, DG ECFIN.

European Commission (2019b), “European Economy Forecast – Autumn 2019,” European Economy Institutional Paper 115, DG ECFIN.

European Commission (2020), “European Economy Forecast – Autumn 2020,” European Economy Institutional Paper 136, DG ECFIN.

European Commission (2021), “European Economy Forecast - Spring 2021,” European Economy Institutional Paper 149, DG ECFIN.

Guerrieri, V, G Lorenzoni, L Straub, I Werning (2020), "Macroeconomic implications of COVID-19: Can negative supply shocks cause demand shortages?," NBER Working Paper 26918.

In ‘t Veld, J, M Larch, M Vandeweyer (2013), “Automatic fiscal stabilisers: What they are and what they do,” Open Economies Review 24: 147-163.

Kollmann, R, W Roeger, J in 't Veld (2012), "Fiscal policy in a financial crisis: Standard policy versus bank rescue measures," American Economic Review: Papers & Proceedings 102(3): 77-81.

Kollmann, R, M Ratto, W Roeger (2013), "Fiscal policy, banks and the financial crisis," Journal of Economic Dynamics and Control 37: 387-403.

Kollmann, R, B Pataracchia, M Ratto, W Roeger, J in ’t Veld (2014), “International capital flows and the boom-bust cycle in Spain," Journal of International Money and Finance 48: 314-335.

Kollmann, R (2021), "Effects of Covid-19 on Euro Area GDP and inflation: Demand vs. supply disturbances," ECARES Working Paper 2021-12, Université Libre de Bruxelles

Kühl, M (2021), “Decomposing inflation dynamics during the pandemic: An aggregate perspective,” ECB Economic Bulletin 1/2021, European Central Bank.

Lindé, J, F Smets, R Wouters (2016), "Challenges for central banks’ macro models," in: J Taylor, H Uhlig (eds), Handbook of Macroeconomics, Volume 2, first edition, pp. 2185-2262.

Pfeiffer, Ph, W Roeger, J in ’t Veld (2020), "The COVID19-pandemic in the EU: Macroeconomic transmission and economic policy response," European Economy Discussion Paper 127, DG ECFIN.

Endnotes

1 We are agnostic as to whether the ‘forced savings’ are fundamentally demand-side (‘hesitant consumers’) or supply-side (mandated closures) disturbances to the economy. Due to its temporary nature, which implies a small impact on expected future inflation, the shock has only a moderate impact on current inflation. Based on firm-level price-setting data from Germany, Balleer et al. (2020) suggest a predominance of the demand component insofar as output contraction has been associated with an increased probability of price cuts rather than price increases.

2 The ‘forced savings’ and ‘labour hoarding’ shocks have been constrained to the period since 2020q1 in the version presented here. Releasing this constraint generates very similar shock profiles, however. In particular, the non-persistent savings and labour hoarding shocks play practically no role in the shock decomposition of GDP growth prior to 2020.

3 More precisely, the decomposition relates to deviations of actual real GDP growth from the steady-state growth rate of 1.3% per year. The analysis incorporates an occasionally binding zero lower bound (ZLB) constraint on monetary policy. There is no separate accounting for unconventional monetary policy. The latter affects the estimated investment risk (financing cost), private savings and exchange rate shocks instead. In particular, investment risk premia and private savings would be higher and the euro stronger without unconventional easing, lowering domestic and external demand. See, e.g., Burgert et al. (2020).

4 The persistent shock may reflect precautionary savings. In particular, it is plausible that elevated uncertainty about the course of the pandemic and its economic impact over different horizons has strengthened precautionary motives (e.g. Altig et al. 2020, Blanchard and Pisani-Ferry 2021, Coibion et al. 2021). A stronger role for persistent savings shocks is also an expression of the fact that lockdowns have become more entrenched in the second half of 2020.

5 The automatic stabilisers are elements of fiscal policy (notably tax and benefit systems) that imply an automatic countercyclical response of the primary government balance to economic activity. Automatic stabilisers are part of the model structure (tax and spending rules) and do, hence, not appear in the shock decompositions. See in ‘t Veld et al. (2013) as well as European Commission (2017) and European Commission (2019a) for a review of estimates of automatic stabilisation and related results with the European Commission’s QUEST model.

6 The decomposition relates to deviations of inflation from its steady-state rate of 2.0% per year.

7 Reweighting of the consumption basket for inflation measurement is likely to affect the output-inflation nexus in our one-sector model. The GDP contraction in the pandemic has been concentrated in certain sectors from which the weights in the consumption baskets have been lowered at the same time (Claeys and Guetta-Jeanrenaud 2021). The partly offsetting effects on inflation of negative demand and negative supply shocks during the pandemics is also emphasised in Eichenbaum et al. (2020c).

8 The positive effect of expansionary fiscal policy on HICP inflation is offset in 2020q3-4 by the temporary VAT reduction in Germany, which we include in the model together with the Deutsche Bundesbank (2020) evidence on the pass-through to consumer prices.

9 In principle, differences between the two series may reflect not only forecast error but also revised historical data. Revisions of historical data between autumn 2019 and mid-2021 have been minor (practically negligible) compared to the forecast error, however. The model-based decomposition takes account of forecast errors for the large set of variables included in the Commission forecasts, i.e. not only GDP growth.