Debate on the “What should we have expected in terms of economic recovery?” question is raging on the internet (Reinhart and Rogoff 2012, Taylor 2012). Since publishing our widely-read column a few weeks ago, we have received several enquiries asking if we can apply the same benchmarks to evaluate the current performance of the UK economy. We now can.

Awfully sorry, UK recovery might perhaps be rather different

Since publishing our widely-read column a few weeks ago, which ended with an out-of-sample analysis of the current US recovery, we have received several enquiries asking if we can apply the same benchmarks to evaluate the current performance of the UK economy. We now can.

After collecting and checking data on the UK shadow banking system, we now publish these as an update to our original column. We again estimate out-of-sample real GDP per capita forecasts from the 2007 cyclical peak, using our preferred model with “normal” and “financial” recession treatments (two discrete bins), plus a variable measuring the “excess credit” treatment, the rate of change of the loan-to-GDP ratio in the prior expansion relative to the mean in each bin.

The chief difficulty with an out-of-sample forecast for the US or the UK is deciding how to account for the growth of the shadow system, which was for these countries a significant vehicle of credit creation in the last decade or two, but which was otherwise virtually (post-1980) or entirely (pre-1980) absent from other periods and other countries in the historical sample at our disposal. We elected to provide a “forecast range” with upper and lower bounds for what an expected financial crisis recession and recovery could look like this time around: the optimistic upper path was the forecast using “excess credit” based only on actual loans on bank balance sheets; the pessimistic lower path was based on adding in an estimate of credit growth in the shadow system.

For the US expansion phase prior to 2007, we estimated that total bank loans to GDP grew at a rate of 1.75 percentage points per year (+0.50 ppy above the financial-bin mean), but adding the shadow system raised this figure to 5.0 ppy (+3.75 ppy above the mean) using Fed data.

Our estimates for the UK say that the shadow system had a smaller impact, but that the total rate of credit expansion was similar to that of the US case. In the pre-2007 expansion, UK lending to the private sector increased from about 75% of GDP to slightly less than 125% percent of GDP in 2007. Total bank loans to GDP grew at a rate of about 3 percentage points per year over the 1991–2007 expansion (+1.75 ppy above the financial-bin mean). Yet by 2007 we estimate an additional £450 billion of UK lending had been financed by the shadow banking system which raises the rate to 5.0 ppy (+3.75 ppy above the mean) based on Bank of England data.

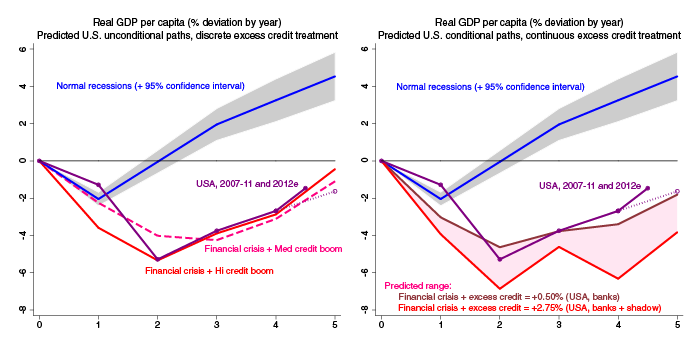

The out-of-sample forecasts for both countries can now be computed, and are shown in Figure A1 below, with all other controls set at their historical mean, as before. We now update the actual paths and use the latest IMF WEO October data and forecast of 2012 y-o-y growth rates (just released) as an identical and impartial source for comparability across the two countries.

Figure A1. The US and UK, 2007–12: actual versus predicted paths

The pink range indicates the expected recovery path. As we noted in our original column, the US exceeds expectations here. The US growth path manages to emerge from and stay above the predicted range by years 3-4-5 (i.e. 2010–12). In contrast, the UK path is disappointing, and can’t really be called a recovery yet.

Even using the maximal measure of excess credit based on bank and shadow bank data to bias the forecast path down as far possible, it is still not possible to account for the UK’s dismal performance. The UK was on a similar path to the US in years 1-2 (2008–09), but falls well behind the US in years 3-4 (2010–2011), only to drop below the forecast range in year 5 (2012).

Of course, our reference data include many past episodes where individual policy choices or even entire macroeconomic regimes were inimical to stable outcomes (e.g. certain actions in the 1930s in particular, or the operation of the gold standard in general). Thus the overall poor track record embedded in macroeconomic history might be seen by some readers as a pretty low bar. But the idea that we can now easily surmount that bar clearly isn’t a foregone conclusion.

Future economic historians will debate whether US policy in recent years can take some credit for supporting the economy at a level above a range of plausible alternative paths. But the UK’s policy choices will not find refuge so easily, since there the output path has now diverged below what a wide range of plausible historical projections might excuse.

References

Reinhart, C and K Rogoff (2012), "This time is different, again? The US five years after the onset of subprime", VoxEu.org.

Taylor, J (2012), "Weak recovery denial", Economics One blog.

Start of original column (published 5 October 2012)

The record of finance capitalism over two centuries appears replete with financial crises far more costly than normal recessions (Bordo et al. 2001, Reinhart and Rogoff 2009ab, Schularick and Taylor 2012). Economic historians knew this. But in the current malaise, the study of crises is understood to be no longer of solely antiquarian interest. As the Bank of England’s Andrew Haldane wrote on Vox recently, “the lessons of financial history have been painfully re-taught since 2008 ” (Haldane 2012).

Fact-checking financial recessions is a salient issue, especially in a US election year. On the one hand, the incumbent faces criticism that the recovery is slow. In August the Mitt Romney campaign invoked US history to argue that performance has been poor:

“The 2007-2009 financial crisis produced a severe recession ... But GDP growth has been anaemic since then, averaging just 2.2% per year since the trough. This pattern is unusual. The past ten recessions have been followed by faster recoveries, and GDP has fairly swiftly recovered to the previous trendline.”

On the other hand, none of the last ten US downturns coincided with a financial crisis. In his convention speech nominating Barack Obama a month later, Bill Clinton intimated that the usual pattern in normal recessions was not relevant in this instance:

“The difference this time is purely in the circumstances… no president, not me, not any of my predecessors, no one could have fully repaired all the damage that he found in just four years.”

Outside the political rough-and-tumble, there remain important matters of ongoing concern to the academic and policy community, where some uncertainty still seems to endure. At the recent 2012 Jackson Hole symposium, the need for a clearer consensus was highlighted. “Empirically, the profession has not settled the question of how fast recovery occurs after financial recessions” (Brunnermeier and Sannikov 2012).1

Documenting life in the age of credit

Can economic history cast light here? We share concerns that short-broad datasets for postwar emerging markets may not be a suitable benchmark for most advanced countries. And long-narrow samples using a single country (e.g., the US) may provide too few recession observations for robust inference. Such doubts provide an argument for a different type of analysis, i.e. an approach focusing only on the experience of advanced countries, so as to better focus the lens of history for current observers.

We reach back into the historical record over 140 years, examining the experiences of 14 advanced countries, to document the pervasive cyclical influence of credit in the economic fortunes of nations (Jordà et al. 2011). This dataset is not a sample; it is close to the entire population, so better evidence may be hard to find.

With that in mind, we set out to address two key questions:

- Are financial-crisis recessions and recoveries significantly different – that is, more painful – than normal recessions?

- Is the intensity of credit creation, or leveraging, in the preceding expansion phase systematically related to the severity of the subsequent recession phase?

The answer to both questions appears to be yes, and therein lie the lessons that can inform our current economic outlook.

All recessions are not created equal

Based on 200 business cycles since 1870, we find that financial recessions are costlier than normal recessions. We also document, for the first time to our knowledge, that, regardless of the type of the recession, a close correlation exists between the buildup of credit in an expansion and the severity of the subsequent recession.2

Drawing on our earlier work, the analysis uses a measure of 'excess credit' in the expansion phase preceding a recession, i.e. the rate of change of credit over GDP, relative to its mean, from previous trough to peak. We correlate this measure with output in the recession and recovery phases for up to five years.

We start with simple treatment bins and unconditional forecasts (Cerra and Saxena 2008). Our results in Table 1 show that the size of the credit boom in the expansion has significant predictive power for the subsequent slump.

In a normal recession, per capita output falls 2% in year 1, bounces back in year 2, and by year 5 is 4.5% above the previous peak. The path in financial recessions when excess credit is in the low tercile is not so different from normal recessions. The trough is lower. A doubly-large drop of 4% in year 1, and still below zero in years 2 and 3. The difference between the paths in years 1 to 3 is statistically significant. But in years 4 and 5 that is not true, and by year 5 the level is within 1% of the normal path.

Figure 1. Normal versus financial bins with 'excess credit' treatment split into discrete terciles

However, things are not so pleasant on the other two financial recession paths when excess credit is in the middle or high tercile. The recession is longer and the troughs are lower, with a leveling off only in years 2 or 3 at the -4% or -5% level. After that growth is sluggish and per-capita output is still typically below the zero reference level in year 5.

Figure 2 displays the paths from Table 1 in the left panel, and for comparison paths derived from regressions in Table 2 in the appendix where discrete excess credit bins are replaced by the variable itself to allow for a continuous measure of credit 'treatment' in each bin.

Figure 2. Unconditional paths for real GDP per capita with 'Excess Credit' treatments

Credit overhang and the macroeconomic recovery path

The more excess credit in the preceding expansion, the worse the recession and subsequent recovery appear to be. The findings so far are based on a basic event-study approach à la Romer and Romer (1989) that treats every occurrence identically.

Clearly, this may not provide sufficient texture. By enriching the analysis with more variables and more complex dynamics, we make it far less likely that excess credit survives as an independent driver of business-cycle fluctuations. And yet this is precisely what we find.

The statistical toolkit we use is the local-projection approach in Jordà (2005), a semi-parametric way to compute impulse-response dynamics. We apply this to a seven-variable system and ask how the recession paths of key macroeconomic variables differ in normal and financial recessions – and how the preceding credit boom comes into play.

These 'treatments' still make a big difference even in a richer dynamic model, as we see from the conditional paths in Figure 3. In the top-left chart we see that financial recessions are more painful, with recovery to the previous peak taking five years, versus three years for normal recessions. Paths are worse when excess credit is raised by one standard deviation; the normal path is dragged down by about 1%, and the financial path by about 2%.

Figure 3. Conditional paths for seven-variable system with 0 and +1 standard deviation 'Excess Credit' treatments

Our conditional local-projection analysis easily extends to other macroeconomic variables, as shown by the other paths in Figure 3. Here we can see how financial recessions have an impact on investment, prices, lending, and interest rates and the current account (solid paths). Allowing for a standard-deviation perturbation to our 'excess credit' measure (dotted and dashed paths) pushes all of these paths dramatically away from normal. The first six paths lower, and the current account toward surplus. Highly-leveraged financial crises appear very different from normal recessions on many dimensions.

Grading US economic performance in the current downturn

Looking at the credit build-up in the last US expansion, we can now compute how much the legacy of the financial crisis might weigh down recovery relative to the norm.

The treatment effect can be calibrated to actual US data for the 2001–07 expansion. The US excess credit variable based on bank loans was +1.74 percentage points of GDP over these six years (60th percentile, or at the top of the mid tercile bin).

However, one concern is that the recent US credit boom is not fully captured by banks’ loan books; bank assets ignore the shadow system, and could understate the true “credit treatment” needed for our out-of-sample prediction. To attempt to measure the shadow system loans we go to the Fed Flow of Funds and compute the change in total loan instruments in the US economy for the expansion. This variable, on the liability side of nonfinancial sectors, rose by +5.0 percentage points of GDP per year, well above the +1.75 percentage points per year for just bank loans, and an excess of +2.75 percentage points relative to the historical mean (well into the hi tercile bin).

In Figure 4, we use these two measures of US excess credit before the last crisis to compare observed outcomes (actual real GDP to mid-2012 plus Fed forecast to end-2012; all deflated by population growth, actual or last value) with the path that would have been predicted based on our universe of historical experience.

In the left panel using our unconditional forecast, the US performed about as well as could have been expected for financial recessions following typical mid- or high-tercile credit booms, the relevant comparators. A similar interpretation applies to the right panel using conditional forecasts, albeit here the predicted paths are yet more grim.

Figure 4. The US, 2007–12: actual versus predicted paths

By this reckoning the US has done quite well, steering out of the to-be-expected financial recession range based on the inherited level of excess credit, especially if the shadow system is considered. Most importantly a deep financial recession was avoided at the outset, and this level effect remained intact.

Seeing this US outperformance it may be tempting for readers to map the paths into policy shifts. The extraordinary, coordinated central bank and fiscal actions of 2008–09, both globally and in the US (Fed liquidity and QE1 programs and the ARRA stimulus); and then the arguably premature tapering of such policy supports (Fed dithering over QE/twist programs, and the phase out of ARRA with no further stimulus). We think such conjectures represent fertile ground for future research.

Credit bites back

To assume that this US recovery would resemble previous “normal recession” is to use the wrong benchmark. Such forecasts risk overstating growth, lending, interest rates, investment, and inflation. Our work shows that the leverage run-up was unusually high going in, so as in the past it is unsurprising that a painful deleveraging dynamic is taking its toll on the way out.

This time actually is different – and worse – in one very clear and measurable dimension. Now, as in past debt overhangs for more than a century, credit has exerted a crucial influence on the course of the business cycle.

References

Bordo, Michael D, Barry Eichengreen, Daniela Klingebiel, and María Soledad Martínez Pería (2001), "Is the crisis problem growing more severe?" Economic Policy 16(32): 53–83.

Bordo, Michael D, and Joseph G Haubrich (2010), "Credit Crises, Money and Contractions: An Historical View", Journal of Monetary Economics 57: 1–18.

Brunnermeier, Markus K, and Yuliy Sannikov (2012), "Redistributive Monetary Policy", Paper presented at the Jackson Hole Economic Policy Symposium, The Changing Policy Landscape, Federal Reserve Bank of Kansas City, August 31–September 1, 2012.

Bry, Gerhard, and Charlotte Boschan (1971), "Cyclical Analysis of Time Series: Selected Procedures and Computer Programs", New York, NBER.

Cerra, Valerie, and Sweta C Saxena (2008), "Growth Dynamics: The Myth of Economic Recovery", American Economic Review 98(1): 439–457.

Haldane, Andrew (2012), “What have the economists ever done for us?”, VoxEU.org, 1 October.

Howard, Greg, Robert Martin, and Beth Anne Wilson (2011), "Are Recoveries from Banking and Financial Crises Really So Different?" Board of Governors of the Federal Reserve System, International Finance Discussion Papers 1037, November.

IMF (2012), "Dealing with Household Debt", In World Economic Outlook, April, Chapter 3.

Jordà, Òscar (2005), "Estimation and Inference of Impulse Responses by Local Projections", American Economic Review 95(1): 161–182.

Jordà, Òscar, Moritz Schularick, and Alan M Taylor (2011), "When Credit Bites Back: Leverage, Business Cycles, and Crises", CEPR Working Paper 8678, revised October 2012.

Mian, Atif, and Amir Sufi (2010), "Household Leverage and the Recession of 2007 to 2009", IMF Economic Review 58, 74–117.

OMB (2012), Budget Of The U.S. Government, Fiscal Year 2012, Analytical Perspectives, Washington DC, Office Of Management and Budget.

Reinhart, Carmen M, and Kenneth S Rogoff (2009a), "The Aftermath of Financial Crises", American Economic Review 99(2): 466–72.

Reinhart, Carmen M, and Kenneth S Rogoff. (2009b), This Time is Different: Eight Centuries of Financial Folly, Princeton, NJ, Princeton University Press.

Romer, Christina D, and David Romer (1989), "Does Monetary Policy Matter? A Test in the Spirit of Friedman and Schwartz", in NBER Macroeconomics Annual 1989 edited by Olivier Jean Blanchard and Stanley Fischer, Cambridge, Mass., MIT Press, 121–184.

Schularick, Moritz, and Alan M Taylor (2012), "Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008", American Economic Review 102(2): 1029–61.

Tobin, James (1989), "Review of Stabilizing an Unstable Economy by Hyman P. Minsky", Journal of Economic Literature 27(1): 105–108.

Appendix

Figure 5. Normal versus financial bins with 'excess credit' as a continuous treatment in each bin

1 For example, studies such as Howard et al. (2011) and Bordo and Haubrich (2010), which focus only on US recessions, face a challenge of small sample size. Elsewhere, doubts arise from the tendency to pool advanced and emerging or developing countries in a common sample. As the US Administration noted, “Some international economic organizations have argued that a financial recession permanently scars an economy... The statistical evidence... comes mostly from the experiences of developing countries and its relevance to the current situation in the United States is debatable” (OMB 2012).

2 Our work is consistent with intra-US data on credit booms and busts (Mian and Sufi 2010).