Trade in goods across borders is conducted by firms, from an exporting firm in a source country to an importing firm in a destination country. Firms trade, not countries.

While this may seem obvious, the importance of firms in determining responses to policy and shocks has only recently been the subject of systematic study (Melitiz 2003; Antras 2003; Bernard, Jenson, and Schott 2006). That research has emphasised the enormous heterogeneity across exporting firms. Some firms trade, most do not, and a very few handle the large majority of any country’s international transactions – both exports and imports. Only now are we beginning to ask how exporters and importers interact, and what the consequences are for trade when heterogeneous exporters meet heterogeneous importers (see, for example, Carballo et al. 2013b).

Using a new data set that links all Norwegian export transactions with every importer in every country, we set out to answer some of these questions (see Bernard et al. 2013). In our data, the identities of both the exporter and the importer are available. We can link a firm’s export transactions to specific buyers in all destination countries, and – at the same time – examine all of an importer’s transactions with Norwegian firms.

Other recent studies have also used exporter-importer linked data. In a series of papers using data on pairs of exporting and importing countries, Blum et al. (2010, 2012) study the role of intermediaries in trade, and examine the persistence of seller-buyer relations. With data from a trio of Latin American countries, Carballo et al. (2013a) have also drawn attention to the role of buyers in international trade. They point to systematic relationships between a firm’s number of buyers, the distribution of sales across them, and the characteristics of its destination markets. The Norwegian data confirms the role of buyers in explaining cross-country differences in exports, both at the firm level and at the aggregate level.

The effect of importer heterogeneity on trade flows

Our focus is less on the number of importers than on how the heterogeneity of importers across destinations matters for firm-level and aggregate trade flows. While importer heterogeneity exists in every destination, there is substantial variation across markets. Norwegian exports to the US and other developed countries are very concentrated in a few buyers, while Norwegian exports to China and other lower-income countries are less concentrated. We examine how this variation in importer dispersion affects the responsiveness of Norwegian exports to shocks to income.

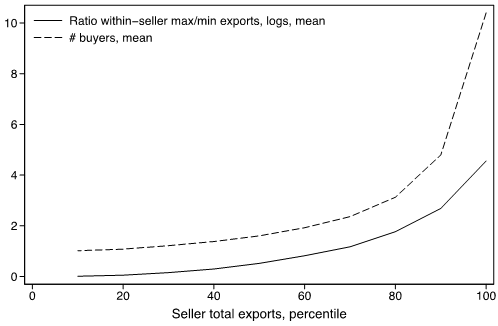

Unsurprisingly, large exporters reach more customers. Less intuitive is the fact that larger sellers have greater dispersion in their sales across import partners. This is shown in Figure 1, where the horizontal axis denotes the size percentile of the exporter (in terms of total exports). The dotted line shows the average number of customers for each percentile of exporters. The solid line shows exports to the largest buyer relative to the smallest buyer within a firm, averaged across all firms for a given exporter percentile (in logs). Larger exporters therefore reach more customers, but they also reach a wider range of customers (small and large).

Figure 1. Exporter size, customer numbers, and sales dispersion

There is negative assortative matching between sellers and buyers – the better-connected an exporter in terms of number of buyers, the less well-connected is its average customer in terms of seller contacts. This is shown in Figure 2. The horizontal axis denotes the number of connections per Norwegian exporter, while the vertical axis denotes the number of connections for the average customer (demeaned and in logs). The slope is negative, meaning that more-connected sellers on average meet with less-connected buyers.

Figure 2. Negative assortative matching between sellers and buyers

Economic logic

How do we explain these facts about the relationship between sellers and buyers in trade? In order to export their goods, firms need to find a buyer. But it is well-understood that finding a buyer is costly. Taking this into account, we develop a theoretical model with buyer and seller heterogeneity where meeting a buyer requires the exporter to incur some relation-specific costs, due to e.g. bureaucratic procedures, contract agreements, or the customisation of output to the requirements of particular buyers.

Our model is able to match many of the stylised facts, and it also allows us to generate a set of testable implications about the role of buyer heterogeneity in international trade which are confirmed as we take the model to the data.

- A key theoretical finding is that buyer-side heterogeneity plays an important role in generating the variation of exports across sellers, and in explaining the response of exports to aggregate shocks.

Hence, the response of firm-level exports to comparable shocks to demand and trade barriers across destinations varies systematically with the dispersion of expenditures.

- Specifically, the export response is amplified in destinations with less buyer dispersion.

We test this theoretical prediction by estimating the trade elasticities of Norwegian exports to a large set of destination countries. We then compare these elasticities with various measures of buyer heterogeneity. As predicted by the model, we find a strong and significant relationship between the two.

An implication of our work is therefore that the growth in trade following trade liberalisation will depend on these demand-side characteristics. Furthermore, our work points to the importance of relation-specific costs, and suggests that trade promotion and other policy instruments may help firms’ exports by reducing these types of costs.

References

Antras, Pol (2003), “Firms, Contracts, and Trade Structure”, Quarterly Journal of Economics 118(4): 1375–1418.

Bernard, A, A Moxnes, and K H Ulltveit-Moe (2013), “Two-sided heterogeneity and Trade”, CEPR Discussion Paper 9681.

Blum, B S, S Claro, and I J Horstmann (2010), “Facts and figures on intermediated trade”, The American Economic Review 100: 419–423.

Blum, B S, S Claro, and I J Horstmann (2012): “Import intermediaries and trade costs: Theory and evidence”, mimeo, University of Toronto.

Carballo, J, G I P Ottaviano, and C V Martincus (2013a), “The buyer margins of firms’ exports”, CEPR Discussion Paper 9584.

Carballo, J, G I P Ottaviano, and C V Martincus (2013b), “When Harry meets Sally: The buyer margins of firms’ exports”, VoxEU.org, 11 September.

Melitz, M J (2003), “The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity”, Econometrica 71: 1695–1725.

Bernard, Andrew B, J Bradford Jensen, and Peter K Schott (2006), “Survival of the best fit: Exposure to low-wage countries and the (uneven) growth of U.S. manufacturing plants”, Journal of International Economics 68(1): 219–237.