Twenty years ago, in September 1992, the Swedish central bank raised its policy rate to 500% in an attempt to defend the fixed exchange rate during the European currency crisis. The Swedish economy was then already in the midst of a severe economic crisis.

The buildup and early phases of the crisis resemble the developments preceding the current European crisis, and particularly the developments in Ireland and Spain. In the late 1980s there was rapid credit expansion, quickly rising property prices combined with high construction activity and current-account deficits. Public debt was low and falling, but ex post assessments show that fiscal policy was still too expansionary. Kindleberger and Aliber (2011) include both the Swedish episode and the recent episodes in Ireland and Spain among the big ten financial bubbles in history.

A banking crisis followed when Swedish property prices started falling around 1990, and this was one of several factors contributing to the Swedish economic crisis. GDP fell for three consecutive years, the unemployment rate increased from 2% in 1990 to 11% in 1993, banks were nationalised, budget deficits hovered around 10%, and public debt increased by more than 30 percentage points to its peak in 1996.

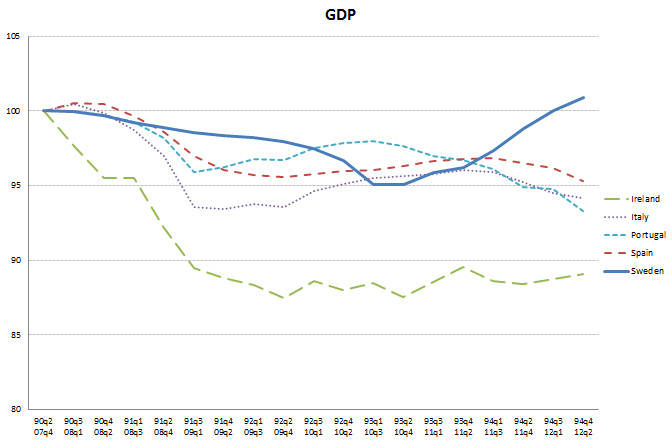

In contrast to the current crisis, the Swedish recovery was quick (Figure 1). GDP growth was rapid and the banking system appeared recapitalised already in 1994. Budget deficits were quickly eliminated in the subsequent years. Growth has remained high in the last 15 years, and the net public debt ratio has fallen by more than 50 percentage points.

Figure 1. Real GDP, index, base year 1990q2 (Sweden) and 2007q4 (other countries).

Source: OECD Economic Outlook 91

Managing the Swedish crisis

In a recent paper (Flodén 2012), I describe the Swedish crisis and the policy measures implemented in response to the crisis. I focus in particular on aspects of the crisis management that may be relevant to the current crisis. Unfortunately, my main message is a negative one, but before getting there, let me summarise the Swedish policies under two headings: short-run crisis management and long-run structural reforms.

Short-run crisis management

- Banking crisis: Several measures were taken quickly, to address the banking crisis and to avoid a credit crunch. A general guarantee was issued to the depositors and creditors of the banks and mortgage institutions in late 1992. Two banks were nationalised, reconstructed, and recapitalised in 1992 and 1993. Three of the remaining four large private banks applied for support from a newly set up bank support authority but by mid-1993 the banks had already raised sufficient new private capital.

- Exchange rate: The fixed exchange rate was vigorously defended until November 1992. After giving up the fixed exchange rate, the krona depreciated by 20%. In combination with rapid productivity growth (possibly as a result of layoffs) relative unit labour costs fell by more than 30% in the year after the krona started floating.

- Monetary policy: To establish credibility for a newly announced inflation target, the monetary policy stance was tight in 1993-1995.

- Fiscal policy: Attempts to consolidate in 1991-1994 failed to bring deficits down to acceptable levels. This included two consolidation programs negotiated with broad political consensus in 1992 prior to abandoning the fixed exchange rate. Further, and more substantial, austerity measures for 1995-1997 were announced in late 1994.

Long-run structural reforms

- A new tax system was implemented, broadening tax bases and reducing marginal rates.

- Sweden joined the EU, partly to boost confidence for the Swedish economy.

- Election periods were prolonged from three to four years to increase the planning horizon in the political process.

- The monetary framework was modernised. The central bank announced an inflation target and obtained independence, first de facto and, eventually, also de jure.

- The fiscal framework was modernised. A new top-down budget process was introduced, supported by expenditure ceilings. A surplus target for general government net lending and a balanced-budget requirement for municipalities were introduced. More recently a council was established to monitor fiscal policy.

- A new pension system was introduced. This system is, at least on paper, robust to population aging and strengthens incentives to postpone retirement.

- A number of reforms were implemented to enhance market competition and efficiency. Several markets were deregulated and there have been widespread initiatives to stimulate private, but publicly financed, production of welfare services.

Insights for the current crisis

There is little doubt that the overall effects of the Swedish policy initiatives have been positive. In particular, the new fiscal framework has worked well and generated a widespread focus on sound public finances but also allowed for flexibility over the business cycle. The framework may serve as a role model for countries that need to create institutions that result in better fiscal outcomes. Still, the policies that brought Sweden out of its crisis quickly would not be so successful in today’s crisis countries. There are several reasons for this.

First, and most importantly, the sharp depreciation of the Swedish exchange rate in combination with strong growth on export markets was a crucial aspect of the Swedish recovery. This resulted in an export-led recovery, which facilitated crisis management. If rapid economic growth had not resumed quickly:

- ... the general guarantee extended to the banking system could have turned out much more costly, as a similar guarantee did in Ireland more recently.

- ... the recapitalisation of the banking system in 1992 and 1993 would most likely have been insufficient.

- ... fiscal consolidation, in particular in 1995 and 1996, might not have been economically or politically feasible (there are clear indications, by the way, that the consolidation was contractionary).

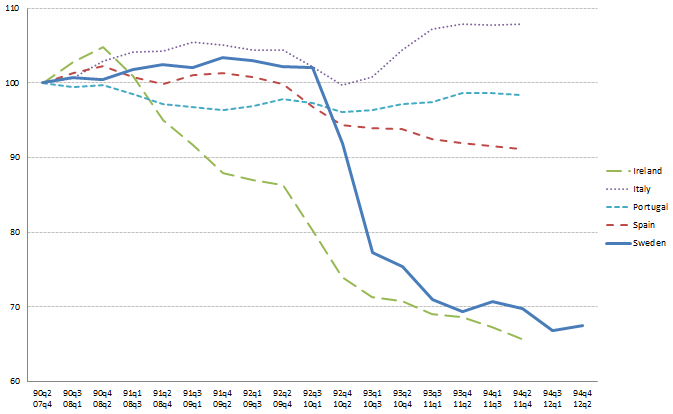

Today’s crisis countries have problems restoring competitiveness, partly because of fixed exchange rates and partly because competitiveness is relative to other countries that now face similar challenges (see Figure 2, and note that Krugman 2011 and others argue that the Irish data are misleading). And in this global recession, they cannot benefit from benign world market developments as Sweden did. The successful Swedish austerity program in the mid-1990s does not, therefore, provide many insights to the ongoing debate on austerity versus stimulus (see for example Alesina and Giavazzi 2012, Corsetti 2012, and DeLong 2012).

Figure 2. Relative unit labor cost in manufacturing, index, base year 1990q2 (Sweden) and 2007q4 (other countries)

Source: OECD Economic Outlook 90.

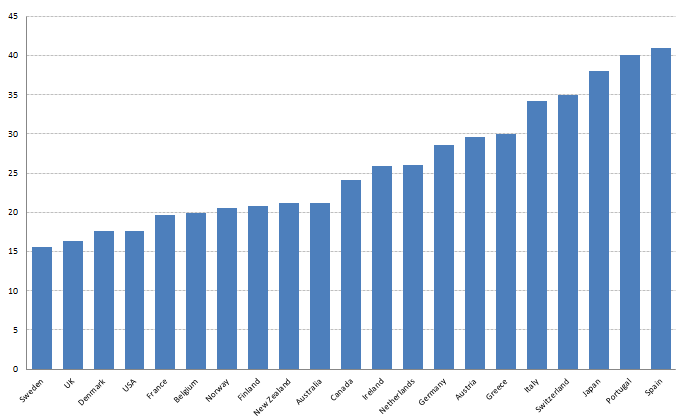

Second, the underlying problems were never as demanding in Sweden as they are in southern Europe today. The Swedish net public debt peaked at 27% of GDP while many countries now have accumulated net debts exceeding 100%. Adding to explicit debt burdens are the demographic challenges, which are now both severe and imminent in southern Europe. For example, the number of persons aged 65 and above per working-age person will increase much more in southern Europe than in western and northern Europe in the coming decades according to projections by the United Nations (Figure 3). Low or negative population growth rates will also reduce the capacity to service debt in these countries.

Figure 3. Population aged 65+ per 100 persons aged 20-64 years, increase from 2010 to 2050

Source: United Nations Populations Forecasts, medium scenario.

Concluding remarks

Fiscal austerity was effective during the Swedish economic crisis, but that insight is not particularly helpful today. Austerity would have been more complicated both economically and politically if it had not been supported by currency depreciation and strong external demand, and crisis countries today do not benefit from such developments. Attempts to consolidate before growth had resumed failed in Sweden. One possible interpretation of these observations is that prospects to consolidate are bleak until competitiveness has been restored in crisis economies.

References

Alesina, Alberto and Francesco Giavazzi (2012), “The Austerity Question: ‘How’ is as Important as ‘How Much’”, VoxEU.org, 3 April.

Corsetti, Giancarlo (2012), “Has Austerity Gone too Far?”, VoxEU.org, 2 April.

DeLong, Bradford (2012), “Spending Cuts to Improve Confidence? No, the Arithmetic Goes the Wrong Way”, VoxEU.org, 6 April.

Flodén, Martin (2012), “A Role Model for the Conduct of Fiscal Policy? Experiences for Sweden”, CEPR Discussion Paper 9095.

Kindleberger, Charles and Robert Aliber (2011), Manias, Panics, and Crashes, sixth edition, Palgrave MacMillan

Krugman, Paul (2011), “Irish Competitiveness”, The New York Times, 19 December.