Some observers have called for more aggressive fiscal policies, arguing that fiscal space is increased by historically low interest rates (Furman 2016). There are also calls for 'living with the debt' (Ostry et al. 2015) as long as debt is 'safe'. Debt should be stabilised, not reduced.

This column asks how far these arguments can be taken, in particular in the specific setting of the Eurozone. The European Commission has just called for a fiscal stance more supportive of the recovery and of monetary policy in the Eurozone (European Commission 2016a). However, the Commission has also signalled the tensions between the desirable fiscal stance when considering the Eurozone as a single entity, as if there were a Eurozone finance minister, and the limitations of the current EU fiscal framework, including fiscal sustainability concerns that are particularly relevant for certain member states. The implications of the low interest rates environment should thus be tailored to the peculiarities of the Eurozone.

The basic arithmetic of debt, growth and interest rates

Over the past decades, interest rates have steadily fallen and they have now reached historic lows. Super-low nominal interest rates reflect the fall in (expected) inflation and a decline of the natural interest rate. While there is great uncertainty on future evolutions and a moderate rebound from current lows is likely at some point, the mainstream view is that generally low interest rates are to stay for a while (e.g. Fisher 2016).

Low interest rates push back the boundaries of government debt sustainability. Debt stabilisation requires generating a primary surplus for servicing the debt burden. If there is a maximum feasible primary surplus pmax, there is a corresponding debt limit bmax = pmax/(r*-g*) where r*-g* is the interest rate growth rate differential (Blanchard 1984). In this stylised framework, a durably lower interest rate implies a higher debt limit.

Stronger growth is also conducive to additional fiscal space. However, when lower rates are accompanied by equally lower growth, the inter-temporal budget constraint is basically unchanged. Put differently, it is the difference (r*-g*) that plays out in the debt limit equation. Therefore, one needs to examine the evidence on r*-g*, now and going forward, when assessing fiscal space.

What is the empirical evidence and prospects?

The average r-g on Eurozone government bonds fell to -0.3% in 2015 and is on course to fall further in 2016 (Figure 1a). This contrasts with an average r-g of 1.4% since the start of EMU. Negative values of r-g allowing Ponzi-type schemes may not last forever. However, even assuming a medium-term uptick, an r*-g* lowered to say 0.5% together with moderate primary surpluses would be consistent with relatively high debt limits, e.g. 200% of GDP for just a 1% of GDP primary surplus.

The ability of Eurozone countries to generate primary surpluses is backed by past evidence (Figure 1b). Looking forward, ageing-related pressures and expanding needs in public services will constrain that ability. This makes it all the more necessary to pursue structural improvements in the quality of public finances for raising the efficiency of tax and spending.

At the global level, the critical question is how long the current exceptional financing conditions will continue. The full effect of exceptionally low issuing rates still has to materialise on average borrowing costs, and governments can 'lock in' the currently favourable terms by increasing the maturity of emissions, as several sovereigns are doing. Rates will go up at some point however. Besides, forces that have weighed down on the natural rate such as demography may start working in reverse (Bean 2015).

The bottom line is that r-g is currently low, is likely to go up at an indeterminate horizon, but could nevertheless remain a little lower than past averages indicate. Policy-wise, the optimal response is to spend now on growth-boosting but non-permanent programmes. This advice should be followed. The challenge is to find initiatives that are efficient and add up to a significant macroeconomic total (Blinder 2016). On the fast track lane can feature maintenance investment and spending on active labour market policies, as well as targeted investment tax credits and cuts in labour costs. Big ticket infrastructures that carry long lags would support growth in a longer-term perspective. A sound institutional framework is however necessary to ensure the quality of projects. Similarly, a credible fiscal framework helps raising the commitment to needed medium-term adjustments.

Figure 1a Distribution of growth-adjusted implicit rate

Figure 1b Distribution of primary surplus

Source: AMECO, authors' calculations. Data for EMU countries, 1999-2015, with countries included as they enter EMU. Total number of observations is 242. The left chart plots the distribution of the difference between the average interest rate on government bonds and nominal GDP growth. The right chart plots the distribution of the primary balance in percent of GDP.

The empirical evidence also points to a large heterogeneity of country situations including within the EU. Debt levels, growth prospects and borrowing rates all differ. At the national level, there is something that looks like a vicious circle and a virtuous cycle. Broadly speaking, one group of countries tend to combine high debt, low growth and higher borrowing rates. These factors are mutually reinforcing. Another group has the opposite characteristics. This is a loose categorisation. But it is suggestive – a basic Blanchard criterion uses the same r-g for all. In reality, there is multi-dimensional endogeneity.

One implication is that there is no one size fits all. Policy prescriptions must be differentiated. Interestingly, while r and g may be strongly connected worldwide, there is room for national differences in r-g. Free moving capital implies common trends in r (Gros 2016), but national factors affect national r, including on liquidity and perceived sustainability.1 Differentiation of g is even more evident. In particular investments and reforms sustaining growth remain largely national.

Eurozone specificities

In advanced economies, sovereign debt is typically regarded as risk free in nominal terms. This is because the central bank can always ensure the cash payment of debt obligations, while keeping the option to raise interest rates to preserve a low inflation regime.

The Eurozone has a more complicated setting with a single central bank, 19 national budget authorities and legally enshrined clauses of no bail out and no monetary financing. This makes it impossible for the central bank to backstop governments unconditionally. The instruments that have been introduced by the ECB within its price stability mandate recognise this reality. For example, the Outright Monetary Transactions programme is conditional on a sustainability-restoring programme with the European Stability Mechanism. Similarly, quantitative easing by the ECB incorporates only limited cross-border risk sharing.

The current institutional setting in the Eurozone implies that government debts cannot be consolidated in a single 'federal' balance sheet (Coeuré 2016). Fiscal space has to be evaluated on a national basis. Moreover, like for example US states, there is a case for a more conservative debt strategy at the country level than in an environment where direct monetary control would fully eliminate the rollover risk on sovereign debt (Fall et al. 2015). At the same time, if the Eurozone were to deepen its fiscal integration in the future, it may be able to sustain a higher level of public borrowing overall than is presently the case as the sum of individual Eurozone countries.

Which 'debt anchors' in the EU?

One way to devise a credible debt strategy is to keep a long-run debt objective serving as an anchor to the fiscal framework. Stabilising debt around its current level is a viable strategy when far away from debt limits. When closer to those limits, some gradual reduction may be necessary. That implies a long-run debt anchor that is below the current level.

One rationale for aiming at reducing debt when starting from high levels is uncertainty. Medium to long-run projections of debt are sensitive to many risks. One is uncertainty on the future values of r-g. Other risks tend to be positively (debt enhancing) biased. In particular, debt shocks are largely asymmetric, including because of contingent liabilities (Escolano and Gaspar, 2016). In addition, implemented fiscal policy tends to be looser than planned.

In a risk-based approach, aiming at debt stabilisation ex ante may not be enough to be reasonably confident that debt will not increase ex post. For this reason, highly indebted countries may need to shoot ex ante for some pace of debt reduction, just in order to have sufficient assurances that debt will at least stabilise ex post. As an illustration, one can calculate the targeted debt reduction in a median scenario so that one has a 90% chance that the debt ratio at least does not increase ex post, given the historical variance of shocks on r and g.2

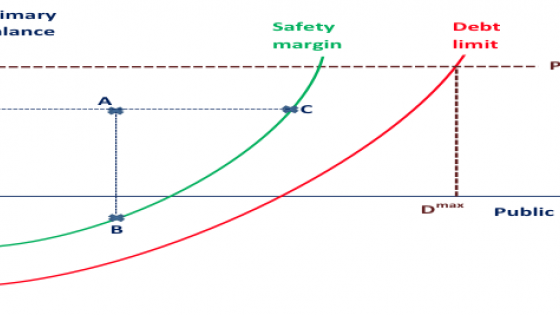

To give a more operational characterisation of fiscal space, one must consider the information on both 'stock' (debt) and 'flow' (balance). In a stylised 'Blanchard framework' (Figure 2), the debt limit curve (red curve) depicts the frontier between initial combinations of debt and primary balances that are sustainable and those that are not. In the real world, nearing the debt limit may not be prudent enough for the above reasons. Thus, for debt to be regarded as safe, one needs to incorporate a security margin (green curve) vis à vis the debt limit.

Figure 2. Operationalising fiscal space: A Blanchard (1984)-inspired framework

Note: Points A, B, C describe stylised positions of hypothetic countries. Point A corresponds to moderate debt and moderate primary surplus: there is ample fiscal space. Point B: debt remains moderate but the current primary position is low. In a prudent approach taking into account a safety margin there is little fiscal space. Point C: debt is relatively high. The country has adjusted somewhat in terms of 'flows', i.e. a moderate primary surplus. It is therefore still in the safety space (note it would not be if had the same primary balance as country B). However, in a prudent approach taking into account a safety margin there is little fiscal space.

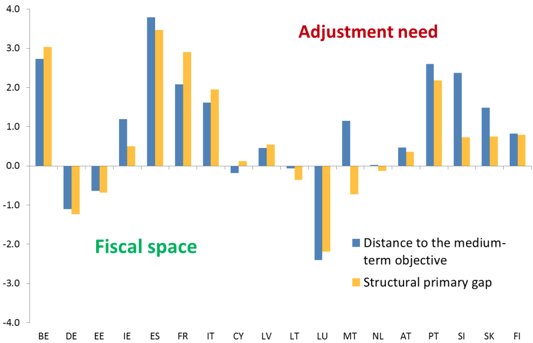

In practice, a basic measure of available space can be derived by comparing the current level of the primary balance with a primary balance norm consistent with a long-run debt anchor. The difference between the two is suggestive of fiscal space, or remaining adjustment needs. Figure 3 illustrates on the basis of a conservative choice of debt criterion in line with EU fiscal rules. The results are cross-checked with another criterion directly drawn from the Stability and Growth Pact, i.e. the distance between current positions of the structural balance and medium-term objectives.

Using this simple criterion, one sees that there is fiscal space in some EU countries, but there remains an adjustment gap in others. Some member states currently have significant fiscal space (e.g. Germany). Other countries including France, Italy and Spain still show a need for further adjustment from the perspective of debt stabilisation cum gradual reduction.

Figure 3. Fiscal space and adjustment needs at country level

Source: Commission autumn forecast 2016, authors' calculations. The distance to the medium-term objective is the difference between the level of the structural balance in 2016 and the medium-term objectives of the country within the Stability and Growth Pact. The structural primary gap is the difference between the level of the structural primary balance in 2016 and a primary balance norm. The latter is the primary balance that generates an annual reduction of 5% of the excess of debt over 60% of GDP. For countries with debt levels below 60%, the primary balance norm stabilises debt at its current level. The calculations of the primary balance norms assume a positive but low growth adjusted interest rate of 0.5%.

Conclusions

Current conditions are extraordinary and call for a supportive fiscal policy. However, the consequences for the inter-temporal budget constraint may be less than meets the eye. They depend on uncertain future evolutions (in particular of r*-g*) as well as on policies. In any event, the case is strong for spending now on investment and other targeted programmes supporting growth and employment.

However, fiscal space is heterogeneously distributed. In the Eurozone some countries have a clear margin and should use it. Others that may be pushed closer to the debt limits should pursue a more prudent approach of gradual debt unwinding. The sustainability risks attached to Eurozone individual countries may in fact prevent the Eurozone from pursuing an adequately supportive fiscal policy in unusual circumstances. A common stabilisation capacity would help for managing shocks that cannot be absorbed by national stabilisers alone, as advocated in the Five Presidents' Report (Juncker et al. 2015).

References

Bean, C (2015), "Causes and consequences of persistently low interest rates", VoxEU, 23 October.

Blanchard, O J (1984), "Current and anticipated deficits, interest rates and economic activity", European Economic Review 25(1), 7-27.

Blinder, A (2016), "Fiscal policy reconsidered", The Hamilton Project, Policy Proposal 2016-05, May.

Coeuré, B (2016), "Sovereign debt in the euro area: too safe or too risky?", Keynote address at Harvard University's Minda de Gunzburg Center for European Studies in Cambridge, MA, 3 November.

Escolano, J and V Gaspar (2016), "Optimal debt policy under asymmetric risk", IMF Working Paper, WP/16/178.

European Commission (2016a), "Towards a positive fiscal stance for the euro area", Communication from the Commission, COM(2016) 727, 16 November.

European Commission (2016b), "Fiscal sustainability report", European Economy, Institutional Paper 018, January.

Fall, F, D Bloch, J M Fournier and P Hoeller (2015), "Prudent debt targets and fiscal frameworks", OECD Economic Policy Papers, N°15, OECD Publishing, Paris.

Fisher, S (2016), "Low interest rates", Remarks at the 40th Annual Central Banking Seminar sponsored by the Federal Reserve Bank of New York, 5 October.

Furman, J (2016), "The new view of fiscal policy and its application", VoxEU, 2 November.

Gros, D (2016), "Ultra-low or negative yields on euro area long-term bonds: Causes and implications for monetary policy", CEPS Working Documents, N°426, September.

Juncker, J C, D Tusk, J Dijsselbloem, M Draghi and M Schulz (2015), Completing Europe's Economic and Monetary Union, European Commission, Brussels, June.

Ostry J, A Ghosh and R Espinoza (2015), "When should public debt be reduced?", IMF Staff Discussion Notes, N 15/10, June.

Endnotes

[1] In practice liquidity and risk premia are also strongly influenced by overall market conditions.

[2] The Fiscal Sustainability Report explores such an approach over a five-year horizon by introducing the notion of 'non increasing debt caps' (European Commission, 2016b, see section 2.3).