The current recession has been accompanied by dramatic changes in trade. Figure 1 presents the pattern of OECD trade as the crisis unfolded.

There is a time lag in these data and real-time analysis that followed it. The trends in trade in late 2008, first spotted in early 2009, invited a mix of consternation and hyperbole in the business and economics press and blogosphere alike. Through the summer of 2009, discussion ranged from worries about export credit shortfalls to resurgent import protection. The focus has been on finding the cause, and the assumption has been that the collapse in trade is unprecedented, inconsistent with the general level of economic downturn, and indicative of a trade-related set of problems calling for trade-specific solutions.

There may actually be two puzzles:

- The dramatic fall in trade as the recession deepened, and

- The apparent rebound in trade in the most recent data.

What we may be witnessing is an exaggerated collapse and bounce, greater than the corresponding drop and recovery in OECD GDP levels. Applying ‘Occam’s Razor’, the simple explanation fits the data nicely – trade has followed the sectoral composition of the recession.

Figure 1 OECD import growth (month on month, 3-month moving averages).

The composition effect

In the emerging academic literature on trade and the crisis, the papers closest to the points we highlight here focus on the sectoral composition of the downturn and trade.

One set of explanations for the increased sensitivity of trade to GDP swings includes increased complexity in production. Freund (2009), for example, highlights fragmentation in production. She also notes that durable goods are most affected, historically, by financial downturns. This includes iron and steel. McKibbin and Stoeckel (2009) work with a CGE model modified to include elements of the financial crisis. They find that the drop in durables is much higher than for non-durables. In addition, the bursting of the housing bubble was identified as being most responsible for the drop in consumption and imports, while the change in the assessment of risk was largely responsible for the drop in investment.

Also working with a CGE model, Bénassy-Quéré, Decreux, Fontagné, and Khoudour-Castéras (2009) emphasize that a large part of the recent drop in the level of trade is linked to price rather than volume effects. They also stress the importance of using appropriate price deflators. GDP price deflators can lead to substantial overestimating of trade volume changes in economic downturns. Willenbockel and Robinson (2009) also use a CGE model, focusing on developing countries and the collapse in global commodity prices as the downturn unfolded. Borchert and Mattoo (2009) focus instead on the relative stability of trade in the crisis. Indeed, in the case of India, the relative service intensity of India’s trade profile served to dampen swings in total trade during the crisis.

Figure 2 Quarterly changes in US GDP and exports, annual rate.

Figure 2 presents a quarterly breakdown for the US of GDP and export trends as the recession unfolded in 2008 and early 2009. In the first quarter of 2009, GDP was down at an annual rate of 6.5%, while exports fell 29.9% at an annual rate. The key point is the composition of the fall in US GDP. The production of goods was down at an annualized 16.4% in the fourth quarter of 2008 and another 8.7% in the first quarter of 2009. Services production, on the other hand, only fell at an annualized 0.9% in the first quarter of 2009. Correspondingly, the exports of goods were down a striking 25.5% in the fourth quarter of 2008 and 36.9% in the first quarter of 2009, while services exports fell at a rate of 13.6%, roughly one-third of the fall in goods trade in the same period.

This pattern is similar to the observations made by Borchert and Mattoo (2009) regarding India. Even at this level of aggregation, it is clear that the goods side of the US economy has been hit harder than the services side, both in terms of production, and also trade volumes.

Figure 3 Quarterly changes in US goods exports by major use category, millions 2007 dollars

A more detailed decomposition of production and trade

Figure 3 presents the change in real US goods exports by quarter, in 2007 dollars, by major end-use category. The key points are:

- Almost all of the drop has been in investment and durable goods, and industrial supplies.

- Motor vehicles alone account for roughly one-third of the total decline.

Basically, the recession has been hardest on heavy manufacturing – machinery, vehicles, and related raw materials. This has translated into a deep manufacturing recession, and a correspondingly deep drop in trade.

- On the import side, roughly half of the drop in US import values at the depth of the trade collapse was actually due to a drop in raw materials like oil (Francois and Woerz 2009).

- The drop in motor vehicle trade actually maps almost exactly to the drop in US production (more on this below).

The compositional effect

An important point to keep in mind is that manufacturing has a much greater weight in total trade values than it does in value added. While this is obviously true for the OECD countries (where services are typically 70% of value added but only 20% of trade values), it also holds for major developing economies as well.

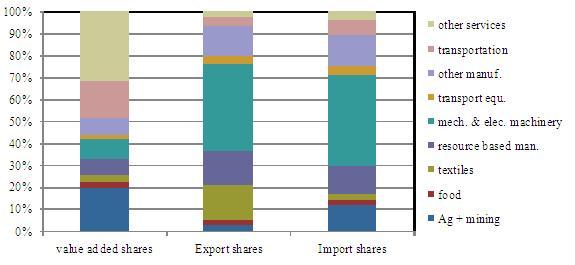

This is illustrated in Figure 4, which presents a breakdown of China’s patterns of production and trade by major sector.

The first column presents value-added shares, while the second and third present export and import shares. The salient features are:

- Transportation and other services account for almost half (48%) of value added in China, but only 11% of imports and 7% of exports.

- Mechanical and electrical machinery dominates both imports (41%) and exports (40%) yet is only 9% of value added.

- Textiles and clothing, and resource-based manufacturing, account for another 31% of exports, yet only 11% of value added.

Indeed, a great deal of China’s value added is in sectors that, on a gross value basis, contribute relatively little to the external accounts.

Like the OECD, such patterns mean that for China, a global recession that hits industrial goods sectors the hardest will also have a disproportionate impact on trade relative to GDP. In contrast, for countries where, for historical reasons, value added is concentrated in industrial supply and machinery sectors (like much of Eastern Europe), the impact of the recession on GDP has been much greater.

Figure 4 China: structure of value added and trade in 2004.

Detailed finding from the US auto sector

Finally, Figure 5 presents the evolution of US production, imports, and exports in the motor vehicles sector. These are all indices of production, and so reflect “real” trends from 2007 to 2009. Production is based on the number of vehicles, while the trade data are deflated using BEA real and nominal price data for Census-based trade categories.

What is clear from the figure is that, at the sectoral level, we have an almost exact mapping between trade and production trends. The collapse of US trade in motor vehicles corresponds to the global crisis in the vehicles sector. Because the motor vehicle sector is a large share of US trade, this has also helped drive the collapse in total US trade (again, see also Figure 4). Indeed, the recovery of US vehicle trade in the third quarter of 2009 – as restructuring has progressed and credit lines have been re-established – has also contributed to almost half of the annualized 21.4% increase in US goods exports in the third quarter of 2009.

Figure 5 US production and trade in motor vehicles, March 2007=100.

Public policy questions

There are potentially important public policy questions lurking behind the trade-recession linkages.

- Has the recession been compounded by a set of trade-specific problems and issues? If so, how big are these, and should we be worried?

In confronting these questions, we need to be careful when comparing real and nominal changes in trade.

We have clearly witnessed a dramatic drop in world trade, and may also see an equally dramatic surge. For policy purposes though, an important question arises:

- Is the decline out of line with the global shock to GDP and the underlying credit crisis?

At the moment, trade seems to be a victim, but one that reflects non-trade weaknesses in credit and demand. The countries with the greatest trade shocks were also more exposed to sectors hit hard by the recession. They are victims, so far, of the general pattern of recession rather than of systemic protection.

Remaining risks of protectionist pressures

This does not mean we should let down our guard against protection. There may be risks for protection on the upside of the trade cycle that did not materialize on the downside. Antidumping regimes are backward looking, using recent trends in data to establish causal links between injury and trade.

If trade surges on the upside as rapidly as it fell on the downside, it may be relatively easily to establish spurious links between recovering import volumes and recession-related ill health at the firm level. Indeed, there is evidence that findings of injury in past business cycles have been a function of general macroeconomic conditions in both OECD and developing country regimes. (Feinberg 1989, Knetter and Prusa 2003, Francois and Niels 2006). So, while the cure for the symptoms lies in curing the underlying illness – recession linked to a deep credit crisis – it is important to maintain a rearguard action on the import protection front.

References

Bénassy-Quéré, A., Y. Decreux , L. Fontagné, D. Khoudour-Castéras (2009), “Explaining the steep drop in international trade with mirage,” CEPII working paper.

Borchert, Ingo; Mattoo, Aaditya (2009), “The Crisis-Resilience of Services Trade,” World Bank Working Papers 4917, April.

Robert M. Feinberg (1989), “Exchange Rates and "Unfair Trade," The Review of Economics and Statistics, Vol. 71, No. 4 (Nov., 1989), pp. 704-707.

Francois, J. and J. Woerz (2009), “The Big Drop: Trade and the Great Recession,” VoxEU, March.

Francois, J. and G. Niels (2006), “Business Cycles, the Exchange Rate, and Demand for Antidumping Protection in Mexico,” Review of Development Economics, (3):388-399.

Freund, Caroline (2009), “The Trade Response to Global Downturns. Historical Evidence,” World Bank Working Papers 5015, August 2009.

McKibbin, W.J., and A. Stoeckel, (2009), “Modelling the Global Financial Crisis. Centre for Applied Macroeconomic Analysis,” The Australian National University, Working Paper 25/2009.

Knetter, M. and T. Prusa (2003), “Macroeconomic factors and antidumping filings: evidence from four countries,” Journal of International Economics, 61(1): 1-17.

Willenbockel, Dirk; Robinson, Sherman (2009), “The Global Financial Crisis, LDC Exports and Welfare: Analysis with a World Trade Model,” Munich Personal RePEc Archive Working Paper No. 15377, April.