According to the World Bank more than 1.5 billion people live in countries affected by violent conflict. Countries affected by conflict are marked by poverty and stagnant or even deteriorating economic wellbeing (World Bank 2011). In light of this relationship it is no wonder that state fragility and civil war have become central topics in the development debate. The connection between conflict and poverty has also served as an additional argument for both diplomatic and military interventions in developing countries.

However, correlation is not causation. It is possible and in fact likely that poverty leads to conflict as much as conflict leads to economic deterioration. It is therefore important to identify the specific channels through which conflict affects the economy.

A relatively new literature is trying to understand the economic effects of violent conflict through micro studies. This literature is able to identify the effect of violent conflict on society in a detail that was up until now impossible. However, micro studies stem from very specific and vastly different regions and intensities of violence. Acemoglu, Hassan and Robinson (2011), for example, study the effect of the Holocaust on development in Russian cities; Akresh, Bhalotra, Leone and Osili (2012) study the Nigerian civil war in the 1960s; and Besley and Mueller (2012) study contemporary Northern Ireland.

The obvious disadvantage of this literature is therefore that its findings are difficult to translate to other circumstances. Here is where cooperation between the more standard cross-country literature and micro studies is needed. The former can serve as a framework to translate micro studies and make it possible to extrapolate their findings into new cases. This exercise is needed if micro studies are to inform policymakers in the formulation of a hypothetical "what-if" scenario in which an intervention (military or diplomatic) prevents the outbreak or escalation of a violent conflict. Only then can the economic costs of conflict be compared to the costs of intervention.

The economic costs of conflict

In the evaluation of the economic cost of conflict it is crucial to first understand the role of persistence. Even one year of civil war has the potential to cripple the economy of a country if its effects are persistent. As a rule of thumb, if the effects of violence are persistent, the discounted economic loss from this violence is about 10-20 times higher than the loss caused during the conflict.1

Previous research suggests relatively low degrees of persistence (see Mueller 2012). In their review, Blattman and Miguel (2010) cite several studies that suggest that regions that suffer a loss of capital stock through bombing campaigns can and do recover economically. This contrasts with series of recent academic work which has found disastrous permanent health effects of violence on children. A translation of this literature suggests that a person that was affected by violence as a child suffers a permanent loss of income between 1.2% and 3.4% for each year affected. Other estimates that directly measure the impact on education suggest that affected children lose 0.2 to 0.24 years of education permanently for each year that they are affected by civil war. This implies a permanent income loss of between 2.6% to 6.1%.2 Even relatively short episodes of violence can therefore have a long-term impact on labour productivity. It is important to note that this, in turn, will affect capital accumulation. Through this channel the humanitarian disaster during conflict becomes an economic liability for the future.

Conflicts displace masses of people internally and disrupt transport. On average, more than 22 persons become refugees for each person killed in battle-related violence. The fear of violence and worker absence leads to an increase of labour costs by 93%. Affected firms are not able to export any more due to problems in production and transport. Exports drop by about 50% in affected firms.3 Overall external trade decreases by 30% permanently, i.e. the disrupted trade does not recover completely after violence recedes. Both refugee streams and the collapse in trade imply that the costs of conflict spread to other countries.

The economy of a country in conflict suffers from lack of investments.4 The value of fixed assets like housing falls by between 20 to 40 percent when a civil war starts. Non-residential construction declines by 10.8% and investment in machinery and equipment by 26% with the start of violence. Farm investments decrease by between 12% and 56%. These effects are only reversible if peace after conflict changes expectations about the future significantly. If peace is seen as fragile, investments do not recover. This fact is particularly important for the design of reconstruction and peace-building efforts – a peace that is not regarded as stable will inhibit economic recovery.

Conflict also has a long-term impact through its effect on political attitudes and preferences.5 Recent survey work and experimental studies find that political engagement in the affected population increases, risk-taking increases and the affected population is less willing to save. While some of these changes may be positive, the overall preference change does not favour capital accumulation. What is particularly worrying is that growing identification and political activism within communities could go hand-in-hand with a decrease in generalised trust and a strengthening of ethnic divisions. Conflict lowers the economic interaction between ethnic groups and increases the likelihood of renewed conflict in this way.

The cross-country data suggests that the “benchmark” civil war reduces GDP per capita growth by between 3.3 and 8.1 percentage points for every year in civil war. These numbers are relatively plausible given the magnitudes found in the micro studies. However, magnitudes will vary depending on the channels discussed above. The extent of the humanitarian crisis caused by conflict, for example, should be a good predictor of long-term human capital accumulation.

When to intervene?

An important part of the debate in policy circles concerns the timing of intervention. Is it, for example, more cost-effective to help states prevent a civil war through capacity building or to intervene after conflict broke out?

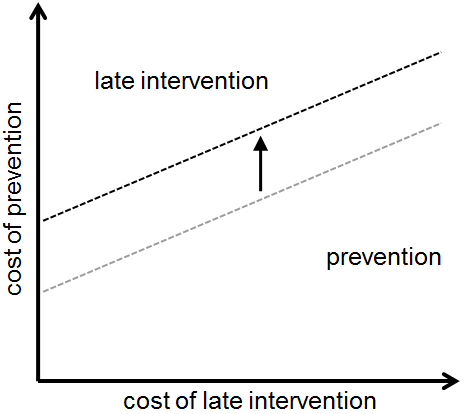

One way to approach this trade-off is to build a simple model of the choice between prevention and waiting. Imagine a model that takes only four factors into account: the cost of conflict, the cost of preventing the conflict, the cost of intervention once the conflict has started and the probability that conflict starts without prevention. Figure 1a shows a graphic representation of the main trade-off. It displays the expected cost of a late intervention (once and only if a conflict breaks out) on the x-axis and the cost of prevention on the y-axis. The dashed line represents the line of indifference between intervention and waiting for a given cost and probability of conflict. For costs of prevention below the line it is optimal to intervene immediately, i.e. before conflict can break out. For all cost combinations above the dashed line the optimal policy is to wait for the situation to evolve.

Figure 1a. Intervention vs. waiting

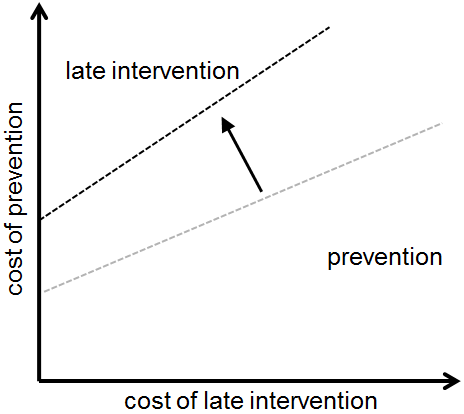

It is straightforward to illustrate the importance of persistence in this model. If persistence is high then this implies high economic costs of conflict. In Figure 1b this is illustrated by an upwards shift of the line of indifference. In more situations it is now better to prevent conflict immediately.

Figure 1b. Increase in the costs of conflict

In addition, the model reveals the essential role played by the (estimated) probability that conflict will break out without prevention. An increase of this probability is illustrated in Figure 1c. The line of indifference now shifts upwards and pivots counter-clockwise. Prevention now saves larger expected costs both in terms of conflict costs and costs of later intervention.

Figure 1c. Increase in the probability of conflict

The model suggests that prevention is most cost-effective right before conflict breaks out - when the probability of conflict is high but damage not yet visible. The problem with this view in practice is, however, that there can be close links between the probability of conflict and the costs of preventing conflict. Once a situation spirals out of control it becomes more difficult to establish peace. An understanding of conflict risk and the costs of different interventions is an essential part of the decision.

Caveats

Building capacity from outside implies that more resources for repression are laid into the hands of those who control political power. Thus, foreign help in building capacity is in danger of preventing armed conflict at the cost of aiding repression. A key indicator of this danger is the extent to which political power of the government is constrained institutionally.6 High institutional restrictions of executive power mean that the incentives of the group in power to abuse the build-up in capacity are muted.

A second significant caveat is that we therefore have little hard evidence on the effectiveness of different types of interventions. While counter-insurgency has received some attention recently (see, for example, Berman, Felter and Shapiro 2011) preventive measures like capacity building are much harder to evaluate.

The analysis of preventive measures could be aided considerably by reliable measures of conflict risk. A good measure of conflict risk would not only be useful for academic research but could, as illustrated above, assist the policy process as well. Open-source Initiatives like Conflict and Mediation Event Observation (CAMEO) or the Global Database of Events, Language, and Tone (GDELT) might help but it requires both theory and data to predict conflict.

References

Acemoglu D, T Hassan and J Robinson (2011), "Social Structure and Development: A Legacy of the Holocaust in Russia", Quarterly Journal of Economics, 126(2): 895-946.

Akresh R, S Bhalotra, M Leone, and U Okonkwo Osili (2012), "War and Stature: Growing Up during the Nigerian Civil War", The American Economic Review, 102(3): 273-77.

Akresh R, L Lucchetti, H Thirumurthy (2012), "Wars and Child Health: Evidence from the Eritrean-Ethiopian Conflict", Journal of Development Economics, 99(2): 330-340.

Bellows, J and E Miguel (2006), "War and institutions: New Evidence from Sierra Leone", The American Economic Review, 96: 394-399.

Besley; Timothy and Hannes Mueller (2012), "Estimating the Peace Dividend: The Impact of Violence on House Prices in Northern Ireland", The American Economic Review, 102(2): 810-833.

Besley; Tim and Torsten Persson (2011), "The Logic of Political Violence", Quarterly Journal of Economics, 126(3): 1411-1445.

Berman; Eli, Joseph Felter and Jacob Shapiro (2001), "Can Hearts and Minds Be Bought? The Economics of Counterinsurgency in Iraq", Journal of Political Economy, 119: 766-819.

Blattman; Christopher (2009), "From Violence to Voting: War and Political Participation in Uganda", American Political Science Review, 103(02): 231-247.

Blattman; Christopher and Edward Miguel (2010), "Civil War", Journal of Economic Literature, 48(1): 3-57.

Bundervoet, Tom; Philip Verwimp, and Richard Akresh (2009), "Health and Civil War in Rural Burundi", Journal of Human Resources, 44 (2): 536-563.

Case; Anne, and Christina Paxson (2008), "Stature and Status: Height, Ability, and Labor Market Outcomes", Journal of Political Economy, 116 (3): 499-532.

Fielding; David (2003), "Modelling Political Instability and Economic Performance: Israeli Investment During the Intifada", Economica, 117: 159-186.

Ichino, Andrea and Rudolf Winter-Ebmer (2004), "The Long-Run Educational Cost of World War II", Journal of Labor Economics, 22(1): 57-86.

Ksoll; Christopher, Rocco Macchiavello and Ameet Morjaria (2010), "The Effect of Ethnic Violence on an Export- Oriented Industry", CEPR Discussion Paper 8074.

León; Gianmarco (2012), "Civil Conflict and Human Capital Accumulation The Long-term Effects of Political Violence in Peru", Journal of Human Resources, 47, 4.

Martin; Philippe; Thierry Mayer and Mathias Thoenig (2008), "Civil Wars and International Trade", Journal of the European Economic Association, 6(2-3): 541-550.

Mueller; Hannes (2012) "Growth Dynamics: The Myth of Economic Recovery: Comment", The American Economic Review, 102(7): 3774-77.

Mueller; Hannes (2013), "The Economic Costs of Conflict", IGC Working Paper April 2013.

Singh; Prakarsh (2013) "Impact of Terrorism on Investment Decisions of Farmers Evidence from the Punjab Insurgency", Journal of Conflict Resolution, forthcoming.

Rohner D, M Thoenig, and F Zilibotti (2012), "Seeds of Distrust: Conflict in Uganda", CEPR Discussion Paper 8741.

Voors; Maarten, Eleonora E. M. Nillesen, Philip Verwimp, Erwin H. Bulte, Robert Lensink, and Daan P. Van Soest (2012), "Violent Conflict and Behavior: A Field Experiment in Burundi", The American Economic Review, 102(2): 941-964.

World Bank (2011) World Bank Report: Conflict, Security, and Development.

1 This calculation assumes a discount rate of about 5% and a horizon of 30 years.

2 Numbers are based on Akresh, Bhalotra, Leone and Osili (2012); Akresh, Lucchetti and Thirumurthy (2012); Bundervoet, Verwimp and Akresh (2009); Case and Paxson (2008); Ichino and Winter-Ebmer (2004) and Léon (2012). Calculations are in Mueller (2013).

3 Numbers are based on Ksoll, Macchiavello and Morjaria (2010) and Martin, Mayer and Thoenig (2008).

4 Numbers are based on Besley and Mueller (2012), Fielding (2003) and Singh (2013).

5 See Bellows and Miguel (2006); Blattman (2009); Rohner, Thoenig and Zilibotti (2012) and Voors et al (2012).

6 In Besley and Persson (2011) executive constraints are measured using data from the Polity project. This project indexes political institutions on a scale between 1 and 7 in a large set of countries.