Does banking structure matter when it comes to fund innovation? Should states simply deregulate their banking markets or on the contrary, try to promote local banks?

Considering that bank lending is the main source of funding to new firms (Robb and Robinson 2011), it is crucial to understand how the structure of banking markets affects the allocation of funding between innovative projects and young startups. In a recent research (Hombert and Matray 2012), we show that when the banking market is very competitive and dominated by large banks, lenders are less able to fund innovation. Using the staggered deregulation of US state banking markets from the 1970s to the beginning of the 1990s, we demonstrate a causal effect of banking deregulation on the drop in the number of innovators, measured by firms which filed at least one patent with the American Patent Office (UPSTO).

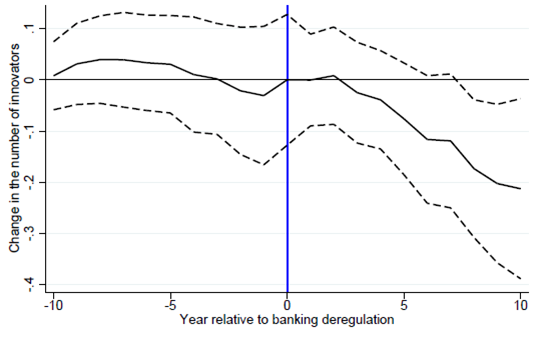

Figure 1 shows one of our main results. It plots the number of innovators around banking deregulation relative to a control group of states which do not deregulate. It is evident that the number of innovators starts to decline three years after deregulation begins and ends up 20% below its initial level after ten years.

Figure 1. Effect of banking deregulation on innovation

In addition to the effect on the number of innovators, we found two other important trends. First, we observe a reallocation of projects within firms. Firms who continue to innovate focus on more incremental, less risky innovations. The average number of citations received by patents (a standard measure of patent quality) declines, as well as the standard deviation of these citations. We also found that public firms reallocate their investment projects away from R&D and more towards physical assets.

Second, we demonstrate that deregulation reshapes comparative advantages between states. The states which deregulate their local banking market experience a decrease in the share of technologically innovative industries in their total GDP. A complete deregulation leads to a relative decline of 15%.

Funding issues facing innovative small firms

Innovative projects require investments in intangible assets and human capital which are difficult to evaluate by external lenders. Innovation also tends to occur in new areas of economic activity in which the potential of a project can hardly be assessed by comparison with similar projects. In addition, a number of innovative projects are often undertaken by young startups without an easily verifiable track record. These characteristics imply that innovative projects suffer from potentially severe information availability problems. In addition, R&D investments generally have little collateral value, which therefore cannot be used to mitigate borrowing constraints caused by the lack of information.

Effect of deregulations on innovation

Two elements of the banking market structure determine the degree of soft information that lenders and debtors can exchange:

- The degree of competition: As the literature on lending relationships has shown, lender-borrower relationships alleviate borrowing constraints for debtors unable to provide much information by allowing banks to acquire soft information about projects such as the competence and trustworthiness of the management, as well as the types of investment opportunities that could arise (Berger et al. 2005). The problem is that such relationships cannot be sustained in a highly competitive market (Petersen and Rajan 1994).

- The size of banks: Large banks have difficulties dealing with non-verifiable soft information that cannot be easily passed along within the hierarchy (Stein 2002).

The deregulation which we analyse creates a more competitive environment by allowing banks to enter new markets and threaten other incumbent banks. In addition, the relaxation surrounding bank expansion led to an increase in average bank size through internally generated growth (for example, de novo branching) and branch and bank purchases.

Therefore such a reform would lead to a deterioration of lender-borrower relationships and would produce a system no longer able to deal with soft information, resulting in restrictions in access to bank lending. Consistent with our hypothesis, we find that firms which have a limited track record are more affected by deregulation, namely younger firms and firms in younger industries. More directly, using various proxies for the degree of soft information in a given industry, we also find that industries that rely more on soft information are more affected.

The shock that the reform creates on lending relationships tightens the access to bank funding for firms which have to communicate through soft information and therefore, reduces their ability to innovate.

Conclusion

Our paper provides insight into the drivers of innovation and the capacity for a state to finance its technologically innovative sectors. In particular, it shows that the ability of banks to deal with soft information is crucial and that simply increasing the size of funding might not be sufficient if the funds are allocated at arm’s length. It also suggests that while reducing financial constraints for more established firms, the increase in competition for lending between banks might lead to further tightening of financial constraints for innovative firms.

Our research also indicates that if states decided to support their innovative activities by allocating public funds, they should not be allocated by a centralised and hierarchical structure, but on the contrary by local agencies, more able to deal with soft information.

Finally, our results shed some light on the drivers of comparative advantages for states or countries. For example, French economists and policymakers often question why Germany is more innovative than France. The specificity of the German banking market, characterised by multiple regional banks with close relationships with their debtors would partially explain why that is the case.

References

Berger, A, N Miller, M Petersen, R Rajan, and J Stein (2005), “Does function follow organizational form? Evidence from the lending practices of large and small banks", Journal of Financial Economics, 76:237-269.

Hombert J and A Matray (2012), “The Real Effects of Hurting Lending Relationships: Evidence from Banking Deregulation and Innovation”, Working Paper, HEC Paris

Petersen, M and R Rajan (1994), “The Benefits of Lender Relationships: Evidence from Small Business Data", Journal of Finance, 49:3-37.

Robb, A and D Robinson (2011), “The Capital Structure Decisions of Startup Firms", forthcoming, Review of Financial Studies.

Stein, J (2002), “Information Production and Capital Allocation: Decentralized vs. Hierarchical Firms", Journal of Finance, 57:1891-1921.