Geography and offshoring to China

Why do firms offshore manufacturing to China? This column uses data from China’s processing trade regime to argue that a hidden driver is the country’s geographic proximity to its East Asian neighbours.

Search the site

Why do firms offshore manufacturing to China? This column uses data from China’s processing trade regime to argue that a hidden driver is the country’s geographic proximity to its East Asian neighbours.

Anecdotal evidence is rife with tales of multinational firms that have offshored their production to China, stoking fears that it is leading to a hollowing-out of manufacturing around the world. Many private sector analysts and policymakers attribute this offshoring wave to Chinese home-grown factors such as its low labour costs, stable political system, aggressive export promotion policies, and undervalued exchange rate.

But the usual explanations may not tell the whole story. China depends heavily on imported intermediate inputs (see Koopman et al. 2008 on this site). In recent research we consider the possibility that some of China’s attractiveness stems from its proximity to East Asian suppliers of industrial inputs (Ma and Van Assche 2010). In short, another factor behind China’s success may simply be the bliss of its proximity to its East Asian neighbours.

China’s processing trade regimeData from China’s processing trade regime provide a useful tool to evaluate why firms offshore production to China. The Chinese government installed this customs regime in the mid-eighties to promote its exports by providing firms duty exemptions on imported inputs as long as they are used solely for export purposes. The tariff exemption solely benefits firms that want to use China as an assembly & export platform of foreign inputs. As a result, processing exports heavily rely on foreign inputs. Indeed, Koopman et al. (2008) have shown on Vox that only 18% of China’s processing exports value is produced in China, while the remaining 82% consists of the value of imported processing inputs. The database thus provides us with a rich source of information on trade flows that are related to offshoring to China.

This unique dataset allow us to identify two interesting spatial patterns in China’s processing trade. First, if we look at the aggregate data, China’s processing trade clearly depicts a triangular trade pattern (see table 1). Foreign processing inputs are predominantly imported from China’s wealthier East Asian neighbours, while processed final goods are largely exported to Western markets.

Table 1. The origin and destination of China’s processing import and export, 2008

|

|

Share of processing imports originating from

|

Share of processing exports destined to

|

|

East Asia

|

72.8

|

28.2

|

|

Japan

|

20.4

|

11.6

|

|

South Korea

|

17.3

|

6.0

|

|

Singapore

|

4.6

|

3.3

|

|

Taiwan

|

15.8

|

2.2

|

|

Malaysia

|

6.0

|

1.9

|

|

Thailand

|

4.5

|

1.0

|

|

Philippines

|

2.8

|

0.7

|

|

Vietnam

|

0.2

|

0.5

|

|

Indonesia

|

0.9

|

0.8

|

|

Macau

|

0.4

|

0.3

|

|

|

|

|

|

Non-Asian OECD

|

19.4

|

59.6

|

|

EU-19

|

9.1

|

27.5

|

|

US

|

7.4

|

25.7

|

|

Canada

|

0.7

|

1.8

|

|

Australia

|

0.7

|

1.7

|

|

Other

|

1.6

|

2.8

|

|

|

|

|

|

ROW

|

7.8

|

12.2

|

Authors’ calculations using China’s Customs Statistics Data. The data are adjusted to correct for Hong Kong re-exports.

If we disaggregate the processing trade data to the provincial level, however, this triangular trade pattern is inconsistent across processing locations. In a cross-section of 29 Chinese provinces, the average distance travelled by processing imports is negatively correlated to the average distance travelled by processing exports for most years in the period 1988-2008. In other words, whereas many provinces in China do exhibit the triangular trade pattern observed in Table 1, there are also other provinces that exhibit the opposite pattern. They import their processing inputs from far away and export their processed final goods to neighbouring destinations.

In our recent research we attribute these spatial trends to the role of distance-related trade costs (such as transport costs and time-related costs) in global production networks. In a world where such trade costs matter, proximity to upstream and downstream nodes of the global value chain are important factors in firms’ offshoring decisions (see also Yi 2003, Evans and Harrigan 2005, Baldwin and Venables 2011). The closer a location is from its upstream suppliers and/or downstream markets, the more attractive it becomes as an offshoring location.

We can use this insight to explain the spatial pattern in China’s processing trade. Even before China entered the international scene, its wealthier East Asian neighbours such as Japan, Korea, and Taiwan were already key manufacturers of products consumed in the West. In the 1980s, however, rising labour costs were threatening to undermine East Asian firms’ competitive edge and many chose to offshore their labour-intensive final assembly to China. China’s low labour costs and export promotion policies undoubtedly played a role in their decision, but China’s proximity to East Asian suppliers created the additional benefit that offshoring to the country added little distance-related trade costs. These offshoring decisions can explain the emergence of the triangular trade pattern observed in Table 1. Instead of directly exporting their final goods to Western markets, East Asian firms now send their inputs to processing plants in China and then export it on to the large Western market after assembly.

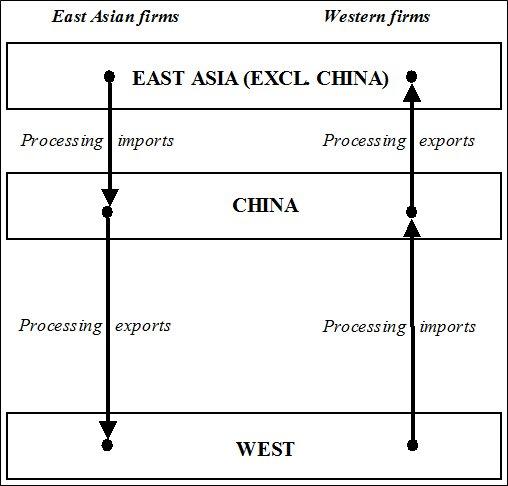

Offshoring labour-intensive final assembly activities to China could also be sensible for Western firms that sell their goods in Eastern markets. For these firms, offshoring to China only leads to limited extra distance-related trade costs due to China’s proximity to East Asian markets. As is shown in Figure 1, these Western firms would exhibit a triangular trade pattern that is opposite from Table 1. They would import their inputs from the far West and export their processed goods to the close East Asian markets. Then again, offshoring to China would be significantly less attractive for Western firms selling to Western markets. In that case, the plant in China would be far from both its upstream suppliers and its downstream markets.

Figure 1.

Interestingly, the existence of such a two-way triangular trade pattern provides a plausible explanation for the negative correlation between import distance and export distance that we observe in China’s processing trade data. In Ma and Van Assche (2010), we show that this is more than a coincidence. If our theory holds, we should find that East Asian firms are primarily attracted by China’s proximity to East Asian suppliers, which can be proxied with import distance (i.e. the average distance from where processing inputs are imported). Conversely, Western firms should be primarily attracted by its vicinity to East Asian markets, which can be measured with export distance. In a panel regression across 29 Chinese provinces during 1988-2008, we find evidence of this. Processing exports to non-Asian OECD countries are more sensitive to import distance and less sensitive to export distance than those destined for East Asian countries. This result is consistent across a battery of robustness checks.

Policy implicationsOur study suggests that China’s attractiveness as an offshoring location for labour-intensive assembly activities is not only driven by low labour costs, political stability and aggressive export promotion policies. Its geographic proximity to its East Asian neighbours also provides it with privileged access to the region’s upstream suppliers and downstream markets.

These results should be no surprise if we look at other famous offshoring locations around the world. They virtually all are located next to large and wealthier economies. Mexico neighbours the US. Turkey and Poland are located next to the EU-15. China, Thailand and Vietnam are in the vicinity of Japan, Korea, and Taiwan.

Policymakers in these countries can help further enhance their attractiveness as an offshoring location by improving port efficiency and reducing the administrative hurdles of international trade. At the same time, their resilience as offshoring destinations will also depend on the world economy’s ability to keep transportation costs in check. With oil prices once again rising to record highs, this may become the single most important threat to the offshoring model.

ReferencesBaldwin, R, A Venables (2011), “Relocating the value chain: offshoring and agglomeration in the global economy”, NBER Working Paper 16611.

Evans, C and J Harrigan (2005), “Distance, time, and specialization: Lean retailing in general equilibrium”, American Economic Review, 95(1):292-313.

Koopman, R, Z Wang, and S-J Wei (2008), “How much of Chinese exports is really made in China?”, VoxEU.org, 8 August.

Ma, A and A Van Assche (2010), “The role of trade costs in global production networks. Evidence from China’s processing trade regime”, World Bank Working Paper 5490.

Yi, K-M (2003), “Can vertical specialization explain the growth of world trade?”, Journal of Political Economy, 111:52-102.

2,730 Reads