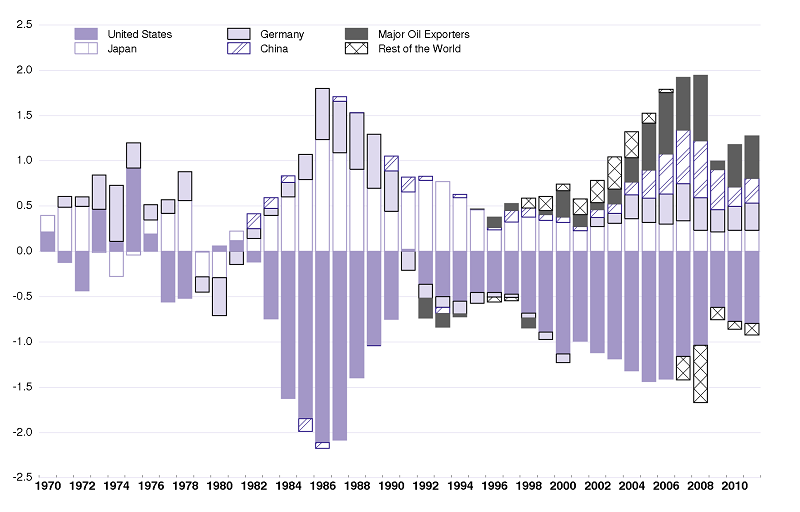

Global imbalances, measured as the sum in absolute terms of the current-account positions of the world’s major regions, nearly halved in the aftermath of the global crisis after reaching a post-war high of over 5% of world GDP in 2008. Figure 1 shows the evolution from 1970 to latest data. But much of this was a mechanical result of the collapse in trade (Baldwin 2009; Claessens et al. 2010) and they are now widening again. The question of global imbalances is firmly back on the policy agenda.

Figure 1. Current-account balances (in % of world GDP), 1970-2010

Source: de Mello and Padoan (2010).

Large global imbalances are not necessarily undesirable, so long as they reflect increased financial integration and a more efficient allocation of global savings across countries. But past experience shows that current-account reversals following rising global imbalances can be sizeable. The associated disruptive movements in capital flows could pose risks for the global recovery, which remains hesitant and uneven across countries and regions.

We can draw lessons from past episodes of current-account reversals for the present situation both in terms of policies and patterns of capital flows.

A chronology of current-account reversals

The first step to learning the lessons of historical reversals is to identify particular episodes. But this is no simple task, and there are many different methodologies for defining current-account reversals. Most of the empirical literature uses ad hoc definitions based on the size of adjustments in external positions (Milesi-Ferretti and Razin 1997 and 2000, Eichengreen and Adalet 2005, Edwards 2005, Liesenfeld et al. 2007).

In recent work we take a different approach (de Mello and Padoan 2010 and de Mello et al. 2010). We think of current-account reversals as structural breaks in a country’s current-account balance that ensure sustainability in external positions. External imbalances build up while remaining sustainable for a period of time until a structural break takes place.

Our focus is therefore not on the size of the reversal per se but on whether or not the presence of a reversal ensures sustainability of the ratio of current-account balances to GDP. A chronology of such sustainability-consistent reversals can be identified using unit root tests that allow for structural breaks in the level and/or trend of the ratio of current account balance to GDP.1

We find it important to also consider reversals in trends, because external sustainability can be maintained without a large shift in the level of the current-account balance in relation to GDP. Indeed, our chronology shows that, except for Japan in the second quarter of 1979, all the reversals that have been associated with external sustainability in the major deficit and surplus regions have occurred in the trends, not the levels, of the current-account balance-to-GDP ratios.

Specifically our tests show that current-account reversals (in trends) took place in:

- the US 1983 Q4 and 1991 Q3

- Japan 1979 Q2 and 1987 Q3

- China 1997 Q1 and 2003 Q1

- Germany 2005 Q4

- oil exporters 1983 Q3 and 1994 Q1

See the appendix table for more details.

Current account reversals: A few stylised facts

Based on our chronology of current-account reversals, an event analysis can be carried out for a number of variables that are known to affect a country’s external sustainability.

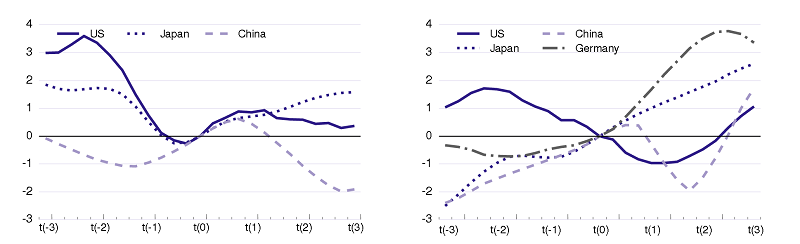

Take for instance fiscal policy (Figure 2). The event analysis shows that the budget balance differs considerably in deficit and surplus countries prior to and after current-account reversals.

- In the US, the world’s largest deficit country, the budget balance deteriorates prior to current-account reversals and improves thereafter (a pattern also observed in Japan in the late 1970s break).

This suggests that fiscal consolidation may contribute to reducing global imbalances, although the responses of private saving to changes in government savings also need to be taken into account.

- In the surplus countries (Germany, Japan in the late 1980s break, and China, albeit for a short period of time), by contrast, budget balances continue to improve after current-account reversals.

This suggests that concern about the sustainability of public finances is not a major driver of current-account adjustment in these countries.

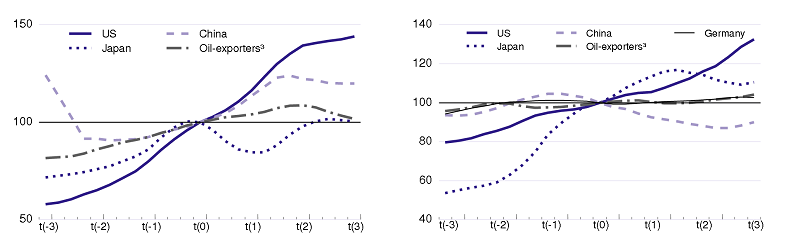

We also find that inspection of exchange rate patterns in the vicinity of current-account reversals is instructive.

- In the US, structural breaks in that country’s current-account balance are associated with a continued trade-adjusted nominal appreciation of the US dollar, albeit by a smaller magnitude in the early 1990s episode than in the early 1980s break.

- In the surplus countries, there is some heterogeneity in exchange rate behaviour around current-account reversals, which tend to be followed by a depreciation of the trade-adjusted exchange rate, albeit with some lag in the case of the late 1980s episode in Japan.

- There nevertheless appears to be little change in the exchange rate after reversals in the case of the oil-exporting countries and Germany. As for China, exchange rate patterns changed radically between the two episodes of current-account reversals.

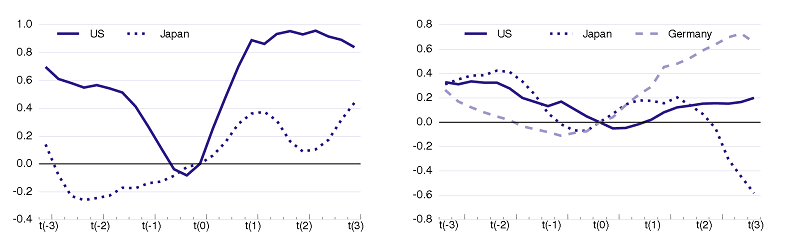

The longer-term repercussions of current-account reversals can be gauged by looking at patterns in potential output growth around structural breaks. Potential output accelerates in the aftermath of corrections in external positions in deficit and surplus countries alike, a development that is nevertheless short-lived, as the post-reversal growth impetus appears to ebb after a year. This suggests that structural reform is needed to entrench the short-term impact of regained external sustainability on potential growth.

Figure 2. An event analysis of current account reversals

A. Government balance (rescaled to 0 at t0)

B. Nominal effective exchange rate (rescaled to 100 at t0)

C. Potential output growth (annualised quarterly rates, rescaled to 0 at t0)

Source: de Mello and Padoan (2010). Note: First break: t0 = 1983 Q4 for the US, 1979 Q2 for Japan, 1997 Q1 for China, and 1983 Q3 for the oil-exporting countries. Second break: t0 = 1991 Q3 for the US, 1987 Q3 for Japan, 2003 Q1 for China, 2005 Q4 for Germany and 1994 Q1 for the oil-exporting countries. First break (left panel ), Second break (right panel).

A first lesson we draw from previous current-account reversals is that a combination of fiscal, exchange rate, and structural policies could bring about a sustained reduction in global imbalances in the present situation. This point is also made in the latest OECD Economic Outlook (OECD 2010), where a number of simulations are presented to compare and contrast the impact of different policy scenarios on the evolution of global imbalances over the longer term.

Implications for capital flows

A second lesson concerns capital flows. While imbalances can be reduced through appropriate policies, such policies will have implications for the direction and composition of flows of capital between surplus and deficit countries. Of course, a fully-fledged analysis is beyond the scope of this note, but a few stylised facts can be highlighted. For example:

- Fiscal consolidation tends to follow current-account reversals on the basis of previous experience and will be much needed in some countries as a result of a massive build-up of government debt related to the global crisis. A gradual reduction in the supply of government bonds in (mostly advanced) countries that currently have high debt and/or budget deficits could lead to a rebalancing of capital flows from surplus to deficit countries towards corporate bonds, equity, and/or foreign direct investment, which could be growth-enhancing. Of course, for such a rebalancing to take place, the effects of changes in the rates of return of riskless assets (government bonds) and private sector securities on demand for those assets would need to be taken into account (see Caballero and Krishnamurthy 2009).

- Greater exchange-rate flexibility in those emerging-market economies that currently have large current-account surpluses could also lead to a change in international capital flows. In the event of a revaluation of their exchange-rate parities, surplus countries whose currencies are currently pegged or tightly linked to the dollar, such as China and the oil-exporting countries, would no longer need to accumulate large amounts of international reserves in the form of US government bonds. To the extent that lower demand for US bonds is matched at least in part by rising investment in corporate bonds, equity, and foreign direct investment in deficit countries, a combination of fiscal consolidation in deficit countries with greater exchange-rate flexibility in surplus countries could be growth-enhancing.

- Structural reform to lift global potential output after the crisis could have potentially strong effects on the composition of capital flows, especially if combined with fiscal consolidation in deficit countries and greater exchange rate flexibility in emerging market economies with large current-account surpluses (see the simulations of policy scenarios in OECD 2010). For example, initiatives that could lead to higher household savings in the US (such as through the elimination of tax deductibility of mortgage payments and greater reliance on consumption taxes) would affect the size and composition of insurance and pension fund portfolios. A liberalisation of entry restrictions in sheltered sectors in surplus countries, such as Germany and Japan, could create opportunities for foreign investment in those countries. Reforms in emerging-market economies with large current-account surpluses aimed at reducing household savings (by strengthening social safety) nets and/or corporate savings (through financial market reform) would increase the attractiveness of investing in such countries, thus limiting capital outflows towards advanced economies.

References

Bagnai, A and S Manzocchi (1999), “Current-Account Reversals in Developing Countries: The Role of Fundamentals”, Open Economies Review, 10:143-63.

Baldwin, Richard (ed.) (2010), The Great Trade Collapse: Causes, Consequences and Prospects, A VoxEU.org Publication, 27 November.

Caballero, RJ and A Krishnamurthy (2009), “Global Imbalances and Financial Fragility”, American Economic Review: Papers & Proceedings, 99:584-588.

Claessens, Stijn, Simon J Evenett, and Bernard Hoekman (eds.), Rebalancing the Global economy: A Primer for Policymaking, A VoxEU.org Publication, 23 June.

de Mello, L and PC Padoan (2010), “Are global Imbalances Sustainable? Post-Crisis Scenarios”, OECD Economics Department Working Paper, No. 795, OECD, Paris.

de Mello, L, PC Padoan and L Rousova (2010), “Are global Imbalances Sustainable? Shedding Further Light of the Causes of Current Account Reversals”, OECD Economics Department Working Paper, forthcoming, OECD, Paris.

Edwards, S (2005), “Capital Controls, Sudden Stops and Current Account Reversals”, NBER Working Papers, No.11170, National Bureau of Economic research, Cambridge, MA.

Eichengreen, B and M Adalet (2005), “Current Account Reversals: Always a Problem?”, NBER Working Paper, No. 11634, NBER, Cambridge, MA.

Lee, J and MC Strazicich (1999), “Minimum LM Unit Root Test”, Faculty Research Paper, No. 9932, Department of Economics, University of Central Florida, Orlando, FL.

Lee, J and MC Strazicich (2003), “Minimum Lagrange Multiplier Unity Root Test with Two Structural Breaks”, Review of Economics and Statistics, 85:1082-89.

Liesenfeld, R, GV Moura and J-F Richard (2007), “Dynamic Panel Probit Models for Current Account Reversals and their Efficient Estimation”, Economics Working Paper, No. 2007-11, Department of Economics, Christian-Albrechts University, Kiel.

Milesi-Ferretti, GM and A Razin (1997), “Sharp Reductions in Current Account Deficits: An Empirical Investigation,” NBER Working Paper, No.6310, NBER, Cambridge, MA.

Milesi-Ferretti, GM and A Razin (2000), “Current Account Reversals and Currency Crises, Empirical Regularities”, in P. Krugman (ed.), Currency Crises, University of Chicago Press, Chicago, Il.

OECD (2010), OECD Economic Outlook, No. 87, Chapter 4, OECD, Paris.

Appendix

Table 1. A chronology of current account reversals: Unit root tests

Current account balance accumulated over four quarters (in % of GDP)

|

|

Period

|

Two breaks

|

One break

|

|

|

|

Lag

|

Test

|

Break date

(level, trend)2

|

Lag

|

Test

|

Break date

(level, trend)2

|

|

|

|

|

|

|

|

|

|

|

|

US

|

1971-2007

|

6

|

-5.57*

|

1983q4(n,s)

|

1991q3(n,s)

|

|

|

|

|

Japan

|

1971-2007

|

1

|

-6.25**

|

1979q2(s,s)

|

1987q3(n,s)

|

|

|

|

|

China

|

1992-2007

|

1

|

-7.94***

|

1997q1(n,s)

|

2003q1(n,s)

|

|

|

|

|

Germany

|

1991-2007

|

3

|

-6.37***

|

2000q1(n,s)

|

2004q4(n,n)

|

8

|

-7.22***

|

2005q4(s,s)

|

|

Oil-exporters

|

1971-2007

|

5

|

-9.00***

|

1983q3(n,s)

|

1994q1(n,s)

|

|

|

|

Note: The optimal number of lagged first-differenced terms included in the unit root test to correct for serial correlation is selected according to the general-to-specific procedure of Lee and Strazicich (1999 and 2003) with a maximum number of lags set to 8. Statistical significance at the 1, 5 and 10% levels is indicated by ***, ** and *, respectively. The statistical significance/insignificance of the estimated breaks in levels and trends is denoted at the 10% level by “s” and “n”, respectively. Oil exporters includes Canada and Saudi Arabia. Source: de Mello and Padoan (2010).

1 See de Mello and Padoan (2010) and de Mello et al. (2010) for more information on the methodology. To our knowledge the only other study that defines structural breaks on the basis of the data generating process is Bagnai and Manzocchi (1999), although they use a different methodology to test for the presence of unit roots in the data.