The classical case for flexible exchange rates rests on the argument that without the constraint of a currency target, policymakers are free to adjust the domestic monetary stance efficiently in response to business cycle disturbances, and choose their own inflation target. In a world of high capital mobility, a country foregoes these options if it, instead, commits to an exchange-rate peg or joins a monetary union.

The presumption that, under flexible exchange rates, monetary policy is able to freely adjust the domestic monetary stance and control inflation has been put into sharp relief by the Great Recession, during which numerous central banks have found themselves constrained by the zero lower bound (ZLB) on interest rates. This has led the literature to start re-reconsidering the case for flexible exchange rates (e.g. Galí and Monacelli 2016, Cook and Devereux 2016, Schmitt-Grohé and Uribe 2016). Cook and Devereux (2016) in particular, put forward the argument that, with a currency target, domestic inflation cannot deviate too much from foreign inflation. Even in response to large adverse shocks (that would cause interest rates to fall to the ZLB under a floating exchange rate), inflation expectations then remain anchored, preventing damaging deflationary dynamics. The ‘straightjacket’ of fixed-exchange rate regimes may not be detrimental after all, given that our (advanced) economies seem to be vulnerable to the ZLB problem.

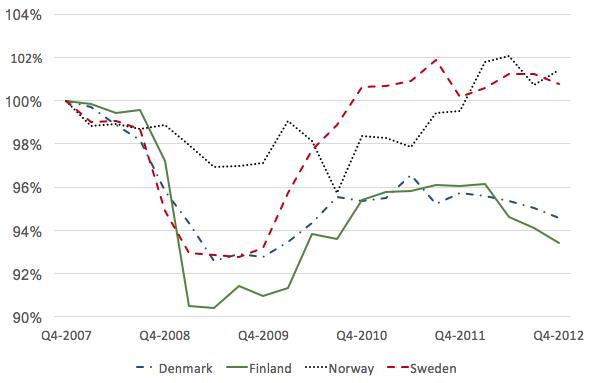

Figure 1 Real GDP (top panel) and change of exchange rate (bottom panel) in four Scandinavian countries

a. Output

b. Exchange rate

Notes: Sample period = 2007Q4-2012Q4. GDP is normalised to 100% in 2007Q4, the exchange rate is expressed in percentage terms relative to 2007Q4.

Sources: OECD Economic Outlook and Bundesbank.

The debate is far from theoretical, and this view is far from uncontroversial. To illustrate the issues at the heart of the debate, Figure 1 shows the evolution of output and exchange rates in four Scandinavian countries during the Great Recession. While there may be relevant country-specific factors that weigh on the divergent response to the global shock, these are countries with comparable income and cultural and institutional commonalities. They do, however, differ in their exchange rate arrangements. Two of these countries have given up exchange rate flexibility: Finland is a member of the Eurozone; Denmark operates an independent currency, but maintains a narrow peg to the euro. The other two, Sweden and Norway, pursue inflation targeting, but only in Sweden did policy rates fall to the ZLB in 2009–10. The left panel of the figure shows a sizeable output contraction for Finland and Denmark, but not for Norway. The contraction in Sweden, in turn, is larger than in Norway and, in fact, as strong as in Denmark and Finland on impact. Yet Sweden recovers quickly afterwards. Most important for our purposes, the right panel shows that not only did the Norwegian Krone depreciate sharply during the first year of the crisis—something you may expect in a country that does not face a constraint on its monetary policy and enjoys room of manoeuvring policy rates. But also, the Swedish Krona depreciated, although initially by less than the Norwegian currency. This evidence suggests that there may remain a case for flexible exchange rates.1

Which exchange rate regime is best for a small open economy in a global Great Recession?

In a recent paper, we reconsider this question, showing that theoretical results and policy lessons are more nuanced than the literature has so far suggested (Corsetti et al. 2017). Flexible exchange rates still retain important welfare properties, even in economies at risk of entering the ZLB.

To be as clear as possible, we encompass existing results in the literature, and present some new ones. We use a New-Open-Macroeconomics model as a unifying framework – working out tractable analytical expressions for a small open economy. We consider three monetary regimes: an unconstrained float, where monetary policy can always pursue a conventional Taylor-type rule targeting the natural rate of interest; a float where monetary policy pursues a Taylor rule but is unable to adjust interest rates for an extended period; and a credible and permanent exchange-rate peg. Thus we contrast an unconstrained monetary regime to two constrained regimes; one because of a currency peg, the other because interest rates are stuck at their ZLB.

We then ask which exchange rate regimes can ensure better macroeconomic and welfare performance when faced with a Great Recession. If the economy is at the ZLB, under what conditions would flexible exchange rates still provide ‘insulation’? Under which regime would fiscal policy be a better substitute for monetary policy?

Our point of departure is the observation that the ZLB can be a country-specific or a global issue (i.e. a large recessionary demand shock can originate either only at home or abroad). It turns out that the idiosyncratic versus international (systemic) nature of the ensuing recession makes a large difference.

We find that if the source of the shock is abroad and foreign interest rates become constrained at their ZLB, so that foreign monetary policy cannot cushion the adverse demand shock, flexible exchange rates do provide a great deal of insulation to the domestic economy. This is the case not only if domestic monetary stimulus can be deployed with the right intensity without running in turn into the ZLB, but also (albeit to a lesser extent) when domestic monetary policy also becomes constrained by the ZLB. The reason is – and this is the most novel result of our analysis – that the home currency depreciates upfront even in the absence of efficient monetary stimulus2 (recall the Swedish case in Figure 1). Upfront depreciation stabilises demand, both external and domestic, for domestically produced goods, and decouples domestic prices somewhat from any deflationary crawl that haunts the rest of the world in our scenario.

Vis-à-vis such a worldwide recession, a currency peg would instead perform quite poorly. Here, a country gives up the benefits of stabilising current demand in such a regime so that the domestic economy is fully exposed to the drop in international demand. But also, more importantly, a credible peg anchors home prices to the foreign price level – if the rest of the world suffers a deflationary drift (as a consequence of being in a liquidity-trap Great Recession), the domestic economy is bound to import it. Worse, it does so to such an extent that the exchange rate actually appreciates in real terms. This means that rising real interest rates depress home consumption demand, compounding the negative effects of a falling external demand and the loss in competitiveness. Indeed, these effects linger – a country that pegs its currency gives up the benefits of stabilising future demand as well.

The importance of these results cannot be overemphasised. A decade after the outburst of the Global Crisis, the world economy remains vulnerable to the risk that large global shocks once again cause a great recession. This is a challenge to policymaking in small open economies, which by their very openness are particularly vulnerable to external developments. In light of our findings, in such a world, the case for flexible exchange rates remains alive and well: intrinsically, the risk of temporary liquidity traps, ruling out efficient monetary stabilisation, is not a good enough reason to overturn the received wisdom.3

Drawing a balanced policy lesson

As stressed by the literature, results are very different when the recessionary demand shock does not affect the rest of the world. The main difference is the response of world prices. If the shock is not global, but originates in the small open economy, inflation-averse foreign monetary authorities can keep world prices stable. The peg now provides a commitment to reflate the domestic economy toward a stable world price level. And, a credible and stable nominal anchor is beneficial in a small open economy. If, instead, absent the currency constraint, domestic interest rates would be at the ZLB, economic activity would decline and domestic prices would start to fall.

However, precisely in situations in which the ZLB problem would emerge amid flexible exchange rates (say, because of large domestic demand shocks), there is also a ‘benign coincidence’ – fiscal policy can be expected to become a much more effective tool of stabilisation. A strong inflationary impact of fiscal policy magnifies the size of the multiplier at the ZLB (e.g. Woodford 2011, Fahri and Werning 2017). Importantly, this is true independent of the (domestic or external) origin of the shock. Conversely, as established in earlier work of ours (Corsetti et al. 2013), fiscal policy is rather ineffective under a peg because, by anchoring long-run expectations of the price level to constant world prices, an exchange rate target limits the inflationary impact of public spending. This result can be seen as one more reason to hold that the ZLB problem does not necessarily weaken the case for flexible exchange rates in small open economies.

Of course, the recourse to fiscal policy may be limited by economic or institutional constraints.4 In this sense, our conclusions could be framed according to the logic of the classic work of Poole (1970) – the choice between a float or a peg vis-à-vis the risk of a ZLB problem is ultimately informed by the type of shocks an economy is mostly vulnerable to, but also by the set of instruments that policymakers can effectively rely upon.

References

Caballero R, E Farhi and P O Gourinchas (2015), “On the global ZLB economy”, VoxEU.org, 5 November.

Cook, D and M Devereux (2016), “Exchange rate flexibility under the zero lower bound", Journal of International Economics 101: 52-69.

Corsetti, G, K Kuester and G J Müller (2013), “Floats, pegs and the transmission of fiscal policy”, L F Cespedes and J Gali (eds), Fiscal Policy and Macroeconomic Performance, vol 17, Central banking, analysis, and economic policies book series, Central Bank of Chile, Chapter 7: 235-281.

Corsetti, G, K Kuester and G J Müller (2016), “The case for flexible exchange rates in a Great Recession”, CEPR, Discussion Paper 11432.

Corsetti, G, K Kuester and G J Müller (2017), “Fixed on flexible: Rethinking exchange rate regimes after the Great Recession”, CEPR, Discussion Paper 12197.

Corsetti, G, E Mavroeidi, G Thwaites and M Wolf (2017a), “Step away from the zero lower bound: Small open economies in a world of secular stagnation”, CEPR, Discussion Paper 12187.

Farhi, E and I Werning (2017), “Fiscal multipliers: Liquidity traps and currency unions”, Handbook of Macroeconomics 2: 2417-2492.

Galí, J and T Monacelli (2016), “Understanding the gains from wage flexibility: The exchange rate connection”, American Economic Review 106(12): 3829-68.

Krugman, P (2014), “Currency regimes, capital flows, and crises", IMF Economic Review 62(4): 470-493.

Obstfeld, M, J D Ostry and M S Qureshi (2017), “Trilemma redux: New evidence from emerging market economies”, VoxEU.org, 11 August.

Poole, W (1970), “Optimal choice of monetary policy instruments in a simple stochastic macro model", Quarterly Journal of Economics 84(2): 197-216.

Schmitt-Grohé, S and M Uribe (2016), “Downward nominal wage rigidity, currency pegs, and involuntary unemployment”, Journal of Political Economy 124(5):

1466-1514.

Woodford, M (2011), “Simple analytics of the government expenditure multiplier", American Economic Journal: Macroeconomics 3(1): 1-35.

Endnotes

[1] In addition to the issues discussed in this column, recent literature has reassessed exchange rate regimes in relation to the potentially destabilising effects of large capital flows (e.g. Obstfeld et al. 2017) and/or currency wars (e.g. Caballero et al. 2015).

[2] This is not the case if monetary policy abroad is not at the ZLB – i.e. if the global recessionary shock can be effectively stabilised, so that there is no ‘Great Recession.’ In this case, if the home economy happens to hit the ZLB, the home exchange rate appreciates.

[3] For a related discussion in the context of secular stagnation, see Corsetti et al. (2017a).

[4] The model could be enriched by including country-risk considerations. This creates an additional constraint on stabilisation policy although, as stressed both by Krugman (2014) and in our previous work (Corsetti et al. 2016) does not necessarily diminish the relative benefits of flexible rates.