Since the outbreak of the financial crisis, the relationship between debt and growth has been an issue of heated debate among both academics and policymakers. Reinhart and Rogoff (2010a) showed a negative correlation between sovereign debt and economic growth, and argued that countries could be confronted with a considerable decline in their growth potential after the debt-to-GDP ratio exceeds 90%.

While the research by Reinhart and Rogoff had a substantial influence in policy circles, their results are controversial. Last year, researchers from the University of Massachusets Amherst revealed a number of computational errors in the calculations by Reinhart and Rogoff (Herndon et al. 2013). After correcting the errors, Herndon et al. disputed the existence of a 90% threshold in the relationship between debt and growth. They did, however, still find a negative (albeit weaker) negative correlation between debt and growth.

Even if a negative correlation between debt and growth seems undisputed, this does not imply that debt is harmful for growth, since correlation does not always imply causation. In fact, Reinhart and Rogoff (2010b) have emphasised the possible bi-directional causality between debt and growth. They argue that high debt may lead to higher taxes and/or lower government expenditure, which is harmful for economic growth, while on the other hand periods of low growth may lead to high deficits and accumulation of debt. Nevertheless, these hypotheses are not backed by a quantitative analysis to establish the relative size and significance of each direction. To decompose the correlation into cause and effect, we apply Vector Autoregressive (VAR) models. Our main result is that debt does not seem to have any significant impact on growth.

Methods and results

We estimate a VAR for sovereign debt and GDP growth on panel data for 20 OECD countries over a period of 55 years, which we obtain from the dataset of Reinhart and Rogoff (2009). Detailed descriptions of the data and model can be found in our recent article (Lof and Malinen 2014). The application of VAR models has several advantages.

- First, a VAR treats both debt and GDP as endogenous. Both are allowed to have an impact on each other, and these impacts can be separated.

- Second, a VAR is a dynamic model, such that we can analyse and quantify intertemporal impacts. By computing so-called impulse response functions, we can visualise the long-run impact on both variables after a shock hits one of the variables.

- Finally, a VAR is a fairly simple model, which is estimated by regressing both debt and GDP growth on both their own and each other’s past observations.

Eberhardt and Presbitero (2013b) emphasise the role of nonlinearities and cross-country heterogeneities, to show that there is no robust evidence for a significant effect of debt on growth. Our analysis shows that this holds even in this simple linear framework.

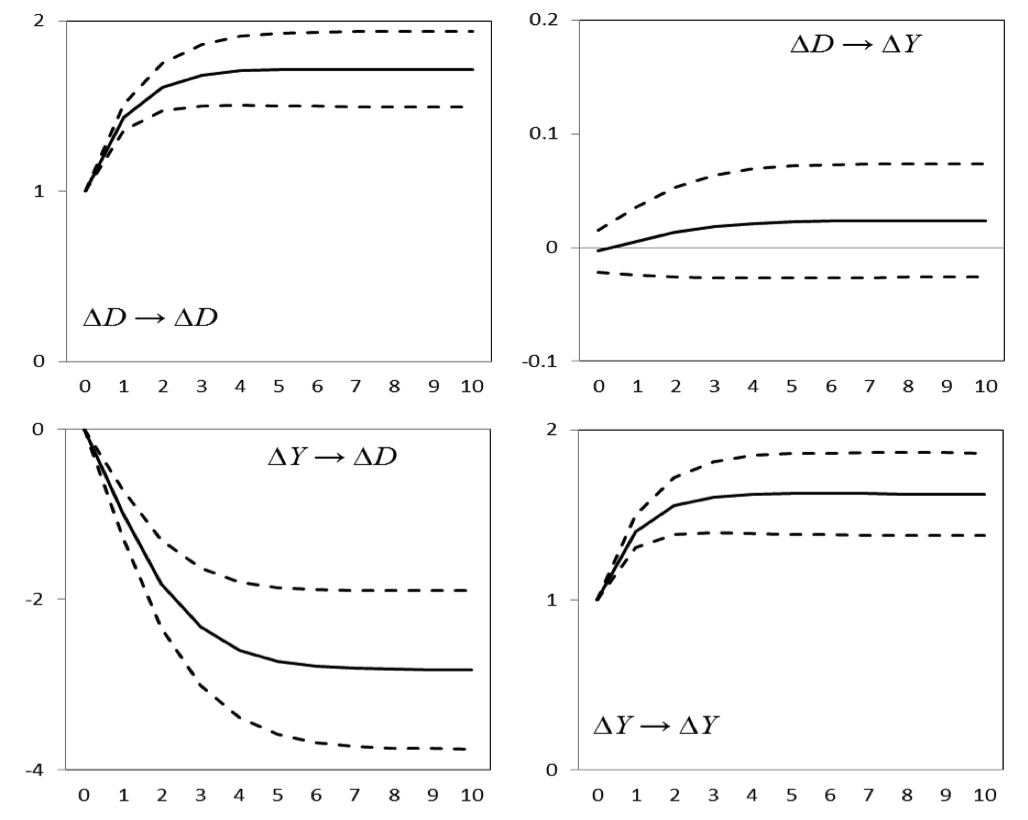

Figure 1 shows the cumulative impulse response functions (CIRF) from the estimated panel VAR. The solid line shows the estimated cumulative impact over a period of 10 years on debt (left column) and GDP (right column), after a positive shock to either debt (top row) or GDP (bottom row). The dashed lines show the 95% confidence interval.

The main result is in the top-right panel:

- A positive shock to debt (i.e. an increase in debt) seems to have no negative impact on GDP. The point estimate of the impact is in fact even positive, but the confidence interval is so wide that the effect is not significant.

- On the other hand, the bottom-left panel shows that a positive shock to GDP does have a significant negative impact on debt, which explains the negative correlation between debt and GDP.

Figure 1 Cumulative Impulse-response functions computed from estimated PVAR, for 20 countries over the period 1954–2008

In our article (Lof and Malinen 2014), we elaborate on the robustness of these results. We verify that the results hold for a smaller group of countries for which longer time-series are available, and for different measures of debt. Since we consider a recursive VAR, the order of the variables potentially affects the results. In our benchmark model, we place debt before GDP, such that debt can react to GDP only after a lag, while the reverse effect may occur immediately. The justification behind this assumption is that shocks to debt occur after political decision-making, which takes time. In the article, we also estimate the model with the order reversed. As it turns out, the assumption does not drive our results, as we find similar outcomes with the reverse order.

Threshold effects

Finally, we investigate the idea of a threshold effect, or ‘tipping point’, in the relation between debt and growth. Reinhart and Rogoff argue that the negative correlation increases after the level of debt exceeds 90% of GDP. Herndon et al. (2013), as well as Eberhardt and Presbitero (2013a) attempt to refute the existence of such a threshold effect.

To analyse this issue in the VAR framework, we divide the sample into high-debt and low-debt countries. First, we label countries as high-debt country when the average debt-to-GDP ratio over the period 1954-2008 exceeds 50%. Next, we look at those countries for which the maximum debt-to-GDP ratio over this period exceeds 90%. Figure 2 reproduces the off-diagonal panels of Figure 1, for these two samples of high-debt countries and for the corresponding samples of low-debt countries. The results are clear:

- The relation between debt and GDP is remarkably stable across high-debt and low-debt countries.

Consistent with the results in Figure 1, the impact of debt on GDP is insignificant or mildly positive (top row), while the reverse impact of GDP on debt is negative and significant (bottom row). There is no evidence for a negative effect of debt on growth, not even for elevated levels of debt.

Figure 2 Cumulative impulse response functions for different subsamples.

Notes: Left panels: Average Debt-to-GDP ratio>50%. Second from left panels: Average Debt-to-GDP ratio<50%. Second from right panels: Maximum Debt-to-GDP ratio>90%. Right panels: Maximum Debt-to-GDP ratio<90%.

Conclusion

Based on a simple VAR analysis with panel data, we can conclude that there is little evidence for a negative long-run effect of sovereign debt on economic growth. Our findings are consistent with recent studies applying different methods, such as Panizza and Presbitero (2013), as well as Kimball and Wang (2013) who “could not find even a shred of evidence in the Reinhart and Rogoff data for a negative effect of government debt on growth”.

Using the negative correlation between debt and growth as a justification for austerity policies could be another example of confusing correlation with causation. While high levels of sovereign debt may surely be a burden for a country, the claim that debt is harmful for growth is not supported by our results.

References

Eberhardt, M and A F Presbitero (2013a), “Public debt and economic growth: There is no ‘tipping point’”, VoxEU.org, 17 November.

Eberhardt, M and A F Presbitero (2013b), “This Time They are Different: heterogeneity and Nonlinearity in the Relationship between Debt and Growth”, IMF Working Paper 13/248.

Herndon T, M Ash and R Pollin (2013), “Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff”, PERI working paper n° 322, April.

Kimball, M and Y Wang (2013). “After crunching the Reinhart and Rogo’s data, we’ve concluded that high debt does not slow growth”, Quartz blog, May 29, 2013.

Lof, M and T Malinen (2014), “Does sovereign debt weaken economic growth? A Panel VAR analysis”, Economics Letters 122/3, 403-407.

Panizza, U and A F Presbitero (2013), “Public debt and economic growth in advanced economies: A survey”, Swiss Journal of Economics and Statistics, vol. 149(II): 175-204.

Reinhart, Carmen M and Kenneth S Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly. Princeton University Press.

Reinhart, C M and K S Rogoff (2010a), “Growth in a Time of Debt”, American Economic Review: Papers and Proceedings 100(2): 573–578.

Reinhart, C M and K S Rogoff (2010b), “Debt and Growth Revisited”, VoxEU.org, 11 August.