In many advanced and most emerging countries, a fair share of firms avoid paying some or all taxes (Schneider et al. 2011).1 All the major international organisations periodically put strong pressure on governments to take decisive steps to fight the phenomenon (e.g. IMF 2015, World Bank Group et al. 2015). Their main concern, beyond equity, is that tax evasion erodes the tax base, limiting public investment and the provision of public services. One often neglected issue is that combating tax evasion could also help directly boost productivity and growth by reducing distortions.

Evasion is not an equally viable option for all economic actors in a country, and it thus has the potential to alter the allocation of resources and harm productivity. While well-known cases usually involve large corporations, tax evaders are more often small firms, which are more difficult to monitor and tend to display little propensity to innovate (possibly because innovating entails growing and becoming more visible).2 Moreover, tax evasion allows many firms to survive despite having low productivity, and to compete unfairly with ‘regular’ firms, thus squeezing their profit margins and reducing their incentives to innovate. The strength of the direct and indirect effects of tax evasion on economic growth is largely unknown, though potentially considerable.

Analytical framework

In recent work, I try to assess those effects using a Schumpeterian model with heterogeneous firms (see Klette and Kortum 2004, Lentz and Mortensen 2008), in which the possibility of evading taxes interacts with businesses’ propensity to innovate (Bobbio 2016). In the model, the probability of being caught increases with the amount of taxes the firm chooses not to pay and, most importantly, with its size; thus, tax evasion represents a correlated distortion. The distortion reduces the effort of tax-evading firms to innovate (because growth will increase the probability of their being caught) as well as that of regular firms (through unfair competition). By lowering the innovation intensity in the economy, tax evasion also hampers selection, shifting the composition of business towards firms with less innovative capacity and reducing the aggregate growth rate over the extensive margin as well.

The model is calibrated on the Italian economy, which has a high level of tax evasion, weak firm dynamics, small average firm size, low R&D intensity, and weak aggregate productivity performance compared with other advanced countries.3 Even before the crisis, between 1995 and 2006, the annual growth rate of labour productivity in Italy was 0.9%, compared with 2.4% in France and 2.5% in Germany.

Quantitative results

The main finding is that, every year, tax evasion knocks 20 basis points off Italian productivity growth. This is probably a conservative figure,4 but it implies that tax evasion explains up to 15% of the cumulative growth differential with France and Germany. The calibrated model also shows that enforcing taxes would improve the efficiency of resource allocation, raising the market share of more productive and more innovative businesses by almost eight percentage points.

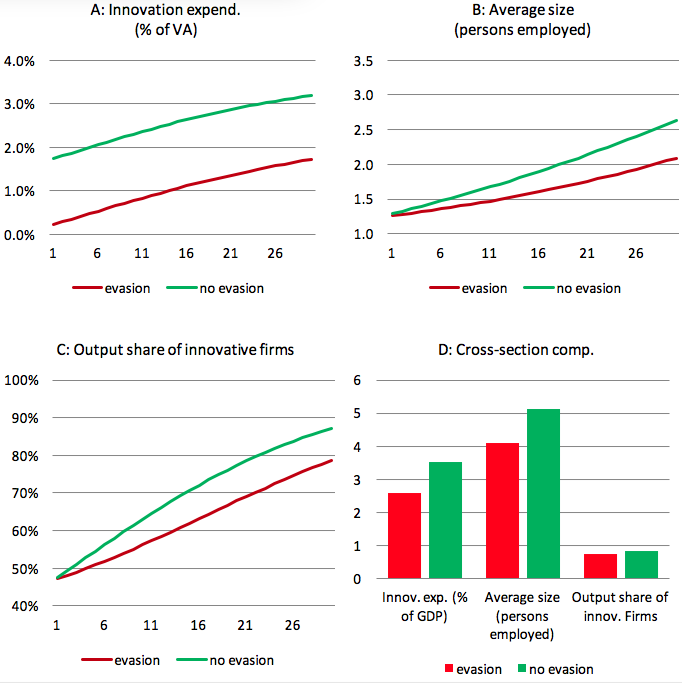

The inducement is that lowering the scope for evading taxes reduces the (shadow) cost of growing and becoming a regular business, and raises the benefits. When taxes are fully enforced, small businesses innovate and grow at double the rate (+120%; see panels A and B of Figure 1); large businesses also innovate and grow more (by nearly 20%) because of fairer competition. Selection becomes stricter, and creative destruction clears the market of small businesses with poorer performance (Figure 1, panel C).5 As a result, in a compliant Italy, firms would be on average 25% larger, and innovation expenditure would be 36% higher (Figure 1, panel D).

Figure 1. The impact of tax evasion on innovation, firms’ growth and selection

Note: Simulation results for the calibrated model (targeting a 12% share of shadow labour in total —employment – see endnote 4) and for the counterfactual with no tax evasion; panel A: innovation expenditure by age divided by value added by age; panel B: employment by age divided by number of firms by age; panel C: share of value added produced by innovative firms by age; panel D: comparison of the same three quantities along the two balanced growth paths. In the case with evasion, actual quantities are displayed, including both the observed and the unobserved components.

Is there room to achieve a similar growth target by lowering taxes, without stepping up tax enforcement? In the presence of tax evasion, the model predicts that lowering the corporate tax rate would boost the growth rate permanently by four basis points for each percentage point reduction in government revenues. When the scope for tax evasion varies across firms, the competitive edge obtained by taxes avoidance increases with the level of statutory tax rates; hence, lowering tax rates boosts growth.6

Concluding remarks

One recurrent suggestion in the debate on fiscal policy is to use the additional revenues from tax enforcement to lower tax rates. The discussion above suggests that combining these two policies could prove particularly effective as they both promote growth. Based on the model simulations, reducing tax evasion by one quarter and using the extra proceeds to cut the corporate tax rate would increase growth by 10 basis points (a third of this coming from lower statutory rates).

These counterfactuals provide support for a commonly held opinion – that if a society chooses a high level of taxes in order to provide for a wide range of goods and services from public funds, then it needs to make sure that everybody bears a fair share of the tax burden – not only for reasons of equity, but for efficiency too.

Author's note: The views expressed herein are those of the author and not necessarily those of the Bank of Italy.

References

Acemoglu, D, U Akcigit, N Bloom and W Kerr (2013) “Innovation, reallocation and growth”, NBER, Working Paper 18993.

Bobbio, E (2016), "Tax evasion, firm dynamics and growth", Bank of Italy Occassional Paper No 357.

Calvino, F, C Criscuolo and C Menon (2016) “No country for young firms? Start-up dynamics and national policies”, OECD Science, Technology and Industry Policy Papers, 29, Paris.

Internal Revenue Service (2006) “IRS Updates Tax Gap Estimates”.

IMF (2015) Current challenges in revenue mobilization: Improving tax compliance.

Klette, T and S Kortum (2004) “Innovating firms and aggregate innovation”, Journal of Political Economy, 112(5): 986–1018.

Lentz, R and D Mortensen (2008) “An empirical model of growth through product innovation”, Econometrica, 76(6): 1317–1373.

Ministero dell'Economia e delle Finanze (2014) "Nota di aggiornamento del documento di economia e finanza 2015, rapporto sui risultati conseguiti in materia di misure di contrasto dell'evasione fiscale".

Schneider F, A Buehn and C Montenegro (2011) “Shadow economies all over the world: New estimates”, in F Schneider (ed), Handbook of the Shadow Economy, Edward Elgar: Cheltenham, UK.

Slemrod, J (2007) “Cheating ourselves: The economics of tax evasion”, The Journal of Economic Perspectives, 21(1): 25–48.

World Bank Group et al. (2015) From billions to trillions: Transforming development finance.

Endnotes

[1] The size of the shadow economy across high-income OECD countries is estimated at 13.5% of GDP in 2005, and varies from 8.5% in the US, around 15% in France and Germany, to as much as 27.1% in Italy. The (unweighted) average figure for developing countries is 35.5%, ranging from 12.2% in China to 64.7% in Bolivia (Schneider et al. 2011).

[2] According to the US Internal Revenue Service (2006), the net misreporting percentage for non-farm sole proprietor income in 2001 was 57%. Based on those data, Slemrod (2007) puts the net misreporting percentage for firms with fewer than $10 million in assets at 29%, as opposed to 14% for larger businesses. The Italian Revenue Agency estimates that sole-proprietorships concealed approximately one third of their tax base between 2007 and 2008 (Ministero dell’Economia e delle Finanze 2014). For a more general discussion, see IMF (2015). According to Eurostat data, in 2007, firms with 250 or more employees accounted for 77% of R&D expenditure in Italy and 91% in Germany.

[3] See endnote 1 for comparative estimates of the size of the shadow economy. Based on Eurostat Structural Business Statistics, Italian firms employed an average of 4.1 persons in 2008 compared with 12.3 in Germany. In the same year business expenditure on R&D was 0.6% of GDP in Italy and 1.8% in Germany. For cross-country evidence on firm dynamics, see Calvino et al. (2016).

[4] First, I assume that the elasticity of the probability of innovation to the amount of resources invested is one third, which is at the lower end of the interval of available microeconometric estimates (ranging from 0.3 to 0.6; see Acemoglu et al. 2016). An elasticity of 0.4 implies that tax evasion lowers growth by nearly 30 basis points. Second, I target a relatively low level of tax evasion, calibrating the model to generate a share of undeclared labour equal to 12%, the lowest of all the official estimates. Third, I assume that innovation requires only labour—instead, if it requires investing in physical equipment, the effect on growth of eliminating tax evasion and lowering taxes will be 24 basis points.

[5] Clearly, getting rid of tax evasion would also entail a large windfall in public revenues, estimated at around 5.4% of GDP in the model, which is in line with the Italian Revenue Agency’s official estimates of the tax gap – 91.4 billion euros or approximately 5.6% of GDP on average from 2007 to 2013 (Ministero dell’Economia e delle Finanze 2014).

[6] On the other hand, in a compliant economy, lowering statutory rates has little impact on growth—labour and value added taxes have no effect because they are levied uniformly on all businesses and do not alter competition and expected profits from innovation; corporate taxes have a negligible effect because of the model parameters resulting from the calibration exercise.