From purchasing safe automobiles to taking vitamins and exercising at the gym, every day individuals make decisions that reveal their willingness to pay to reduce mortality risk. Government agencies implement a variety of measures – from regulating air pollution, to improving food safety, to vaccination programmes -- that reduce mortality risk. Increasing longevity yields large economic benefits. For example, Murphy and Topel (2006) estimated nearly $100 trillion in benefits from improving US life expectancy over 1970-2000. The US Environmental Protection Agency (1997) estimated that reducing premature mortality by cleaning up the air yielded nearly $20 trillion in benefits over 1970-1990. Reducing mortality risk represents the largest category of monetised benefits in Federal regulations over the past decade (US OMB 2014).

These estimates build on an extensive scholarly literature that has investigated how individuals trade off mortality risk and income in markets, such as accepting higher occupational mortality risk in exchange for a higher wage (see Viscusi and Aldy 2003 for a survey), as well as how life expectancy and wealth affect the value individuals place on reducing mortality risk (Viscusi 1979, Shepard and Zeckhauser 1984, Rosen 1988). While the typical application in public policy analyses employs a single measure of benefits for risk reduction for the entire population, various papers in the literature highlight the potential heterogeneity in the benefits associated with reducing mortality risk. This heterogeneity across the population can have important implications for government policies and regulations on health, safety, and environmental protection. Do benefits vary with age? With income? By gender and ethnicity?

Estimating the value of life

To address these questions, we run a series of ‘simulated laboratory experiments’ (Aldy and Smyth 2014). To do so, we develop a model that determines how ‘simulated participants’ in our experiments behave when confronted with the probability of dying in the current year. Participants decide how much to work and how to allocate income to current consumption and to savings. Each experiment begins with an identical set of 10,000 age-20 simulated participants who make annual consumption/savings and labour/leisure decisions in response to participant-specific persistent and temporary wage shocks, and participants advance to the next year if they do not face a stochastic mortality, until age 100 when all surviving simulated participants die. Simulated participants who advance to the next year are asked how much income they would forego for a small reduction in the probability that they would die in the coming year.

We calibrate the model to labour market, wealth, and longevity data for the US. As a result, the lifetime patterns of labour participation, income, and savings in our simulated experiment over thousands of simulated participants closely resembles the real-world US distributions. We also calibrate the income-risk trade-off to what Aldy and Viscusi (2008) estimate as the US labour force’s maximum willingness to pay to reduce mortality risk over the life cycle. We also run experiments in which we differentiate labour income and longevity by gender and ethnicity. To facilitate comparisons with the existing literature and to government policy analysis practice, we translate each simulated participant’s willingness to pay for a reduction in mortality risk to a value of statistical life (VSL) – effectively what a population would be willing to pay to avoid one statistical fatality.

Through our experiments, we find dramatic heterogeneity by income, age, gender, and ethnicity. We find that the mean value of statistical life is about one-third larger than the median one, and the 95th percentile is twelve times larger than the 5th percentile for age-45 simulated participants. These results reflect the dispersion in incomes that evolves in each experiment and enables us to investigate the income elasticity for the willingness to pay to reduce mortality risk. We find that a 10% increase in the wage increases the value of statistical life by 17% (an elasticity of 1.7), while the same increase in realised labour income (the product of the wage and hours worked) is a much smaller 6% (an elasticity of 0.6). These two measures – differing by a factor of three – help explain a puzzle in the existing literature. Three prominent meta-analyses of the value of statistical life literature produced an elasticity of 0.5–0.6 (Liu et al. 1997, Mrozek and Taylor 2002, Aldy and Viscusi 2003), while several other papers produced an elasticity of 1.5–1.7 (Bowland and Beghin 2001, Costa and Kahn 2004). Our experiments can replicate both sets of results based on the choice of income measure used to calculate the value of life-income elasticity.

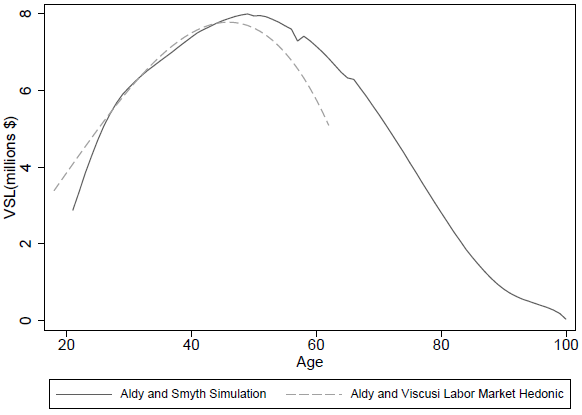

The value of statistical life changes significantly over the life cycle for almost all simulated participants. Across most of the income distribution, it follows an inverted-U shape over the life cycle and tracks quite closely, on average, the life-cycle value of life estimated through statistical analyses of wages and occupational mortality in Aldy and Viscusi (2008) (see Figure 1). These results suggest that a middle-aged individual values a given reduction in mortality risk more than that individual would in the later years of her life.

Figure 1. The value of life over the lifecycle

Evaluating the heterogeneity in the value of statistical life

To evaluate heterogeneity by ethnicity, we run three experiments.

- In the first, we find that simulated white participants’ willingness to pay to reduce mortality risk is significantly higher than simulated black participants’, and nearly double at their life-cycle peaks, consistent with Viscusi’s (2003) labour market analysis.

- In the second experiment, we construct a new population – simulated participants with ‘white’ wage dynamics and ‘black’ longevity; and

- In the third, we construct another new population – simulated participants with ‘black’ wage dynamics and ‘white’ longevity.

Comparing the results of these three experiments shows that the vast majority of the ‘black-white value of statistical life gap’ results from differences in wages. Improving the survival rates of black participants to the levels of white participants closes less than 10% of the gap.

In a similar fashion, we investigate heterogeneity by gender. Women should expect to live more than 5 years longer than men, which should increase their value of statistical life relative to men. Countering this effect, however, is the higher labour market compensation men experience. We assess the life-cycle value of statistical life for men and women to discern which of these two effects dominate. We find that female’s value of statistical life peaks in their late 40s, about five years later than the male’s peak. Averaged over the working years, the ratio of female-to-male value of life is about 0.87, slightly larger than the 0.75 ratio in the labour market analysis by Viscusi and Hersch (2008). As with the black-white gap, the ‘female-male value of statistical gap’ is driven primarily by differences in labour income, as evidenced by the supplementary experiments with populations that have ‘male’ wage dynamics and ‘female’ longevity and vice versa.

Implications for mortality risk reduction policies

The substantial heterogeneity in the value of statistical life over the life cycle and across the population could have several implications for the application of the estimates to mortality risk reduction policy proposals.

- First, the greater than one-for-one increase in value of statistical life with respect to wages implies that as an economy becomes richer, people may want to devote more resources to health care and other measures to reduce mortality risk.

- Second, the life-cycle variation in the value of statistical life evident in our simulated experiments does not support current US EPA practice of a constant value of life irrespective of age. The inverted-U life-cycle pattern we find implies that EPA practice overestimates the benefits of mortality risk reduction for the elderly and underestimates the benefits of risk reduction for prime-aged adults.

- Third, the results on the growth of the value of statistical life with income can inform assessments of long-term mortality risk reduction policies, such as reducing UV-B exposure through the phase-out of chlorofluorocarbons. Such policies would reduce mortality risk for future generations that would be expected to have higher lifetime incomes and would be willing to pay more for risk reduction.

- Fourth, the heterogeneity across the population suggests that a one-size-fits-all would not appropriately reflect how much individuals would be willing to pay for risk reduction if they had such an opportunity to do so in a competitive market.

For proposed policies that may affect the mortality risk profile for a specific demographic group, population-specific values of life may be appropriate (see Sunstein 2004 for further discussion of this idea). Given the negative response to the so-called ‘senior discount’ used by the US EPA in its 2002 evaluation of the Clear Skies Initiative, this may raise political and ethical concerns (Aldy and Viscusi 2007). Such concerns may be entirely legitimate for those contexts in which at least some of the differences in lifetime incomes and wage profiles, and hence estimated values of statistical life, reflect gender- or ethnic-specific discrimination in labour markets (see discussion in Viscusi 2010).

References

Aldy, J E and S J Smyth (2014), “Heterogeneity in the Value of Life”, National Bureau of Economic Research Working Paper 20206, June.

Aldy, J E and W K Viscusi (2008), “Adjusting the Value of Statistical Life for Age and Cohort Effects”, Review of Economics and Statistics 90(3): 573-581.

Aldy, J E and W K Viscusi (2007), “Age Differences in the Value of Statistical Life: Revealed Preference Evidence”, Review of Environmental Economics and Policy 1(2): 241-260.

Bowland, B J and J C Beghin (2001), “Robust Estimates of Value of a Statistical Life for Developing Economies”, Journal of Policy Modeling 23: 385-396.

Liu, J T, J Hammitt, and J L Liu (1997), “Estimating Hedonic Wage Function and Value of Life in a Developing Country”, Economic Letters 57: 353-358.

Mrozek, J R and L O Taylor (2002), “What Determines the Value of Life? A Meta-Analysis”, Journal of Policy Analysis and Management 21(2): 253-270.

Murphy, K M and R H Topel (2006), “The Value of Health and Longevity”, Journal of Political Economy 114(5): 871-904.

Rosen, S (1988.), “The Value of Changes in Life Expectancy”, Journal of Risk and Uncertainty 1: 285-304.

Shepard, D S and R J Zeckhauser (1984), “Survival versus Consumption”, Management Science 30(4): 423-439.

Sunstein, C R (2004), “Valuing Life: A Plea for Disaggregation”, Duke Law Journal 54: 385-444.

US Environmental Protection Agency (1997), “The Benefits and Costs of the Clean Air Act, 1970 to 1990”, Report to Congress, October.

US Office of Management and Budget (2014), “2014 Draft Report to Congress on the Benefits and Costs of Federal Regulations and Unfunded Mandates on State, Local, and Tribal Entities”, Washington, DC: Executive Office of the President.

Viscusi, W K (1979), Employment Hazards: An Investigation of Market Performance, Cambridge: Harvard University Press.

Viscusi, W K (2003), “Racial Differences in the Value of Statistical Life”, Journal of Risk and Uncertainty 27(3): 239-256.

Viscusi, W K (2010), “Policy Challenges of the Heterogeneity of the Value of Statistical Life”, Foundations and Trends in Microeconomics 6(2): 99-172.

Viscusi, W K and J E Aldy (2003), “The Value of a Statistical Life: A Critical Review of Market Estimates throughout the World”, Journal of Risk and Uncertainty 27(1): 5-76.

Viscusi, W K and J Hersch (2008), “The Mortality Cost to Smokers” Journal of Health Economics 27: 943-958.