Question: Does it matter where your bank is headquartered?

Answer: Yes.

The global financial crisis has revealed a new fragility in bank funding – uncertainty around access to dollar funding for non-US banks. This fragility arises from structural differences between US and non-US banks’ dollar funding access, and has real implications in terms of higher prices and possibly reduced access to credit for even the largest US corporate borrowers.

In 2007, the Federal Reserve instituted the Term Auction Facility, the first of a series of extraordinary measures to alleviate tight funding conditions. When the Federal Reserve disclosed the names of banks that had borrowed from that facility, a large number were headquartered outside of the US (Benmelech 2012). More recently, researchers have documented a slow run by US money-market funds from European banks (Acharya and Steffen 2012, Chernenko and Sundarem 2012).

In frictionless markets, shocks in the dollar funding market would be alleviated by currency markets, and dollar lending would not be disproportionally unaffected. However, the assumption of frictionless markets in dollar funding seems violated in practice during recent episodes of dollar funding shocks to non-US banks. Federal Reserve Governor, Jeremy Stein, highlighted the issue of banks’ global funding risk (and evidence of financial market frictions) in a speech at the Global Research Forum sponsored by the European Central Bank.

This column presents evidence, based on our recent work (Acharyaet al. 2011), on how global banks responded to shortages of dollar funding in 2007, how this affected bank lending to corporates, and argues for a home field advantage in funding liquidity for banks.

The 2007 ABCP funding shock disproportionally affected foreign banks

In August of 2007, a large amount of dollar maturity transformation undertaken by the global financial sector came to a screeching halt (see Figure 1). The market dislocation began by affecting banks that had borrowed short-term in the asset-backed commercial paper (ABCP) market – and invested in subprime mortgage-backed and other asset-backed securities. Acharya and Schnabl (2010) document that while much of the ABCP exposure was dollar denominated; a substantial portion of this ABCP exposure was concentrated amongst foreign banks. Of more than $1 trillion ABCP outstanding, less than $500 billion was sponsored by banks headquartered in the US. This shock to funding markets came substantially in advance of the decline in US macroeconomic conditions that started in 2008.

Figure 1. A screeching halt

Source: Acharya, Schnabl and Suarez (2013).

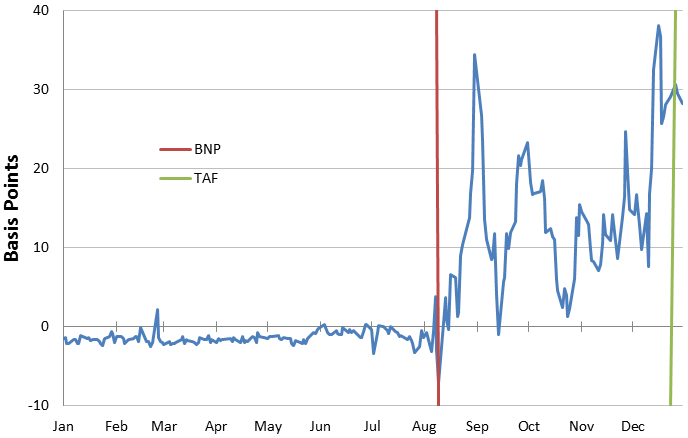

Evidence of market dislocations is found in violations of USD/EUR covered interest parity (see Figure 2), which began after August 2007 and continued until the Federal Reserve began to take action in December of 2007 via auctions for banks and dollar-swap lines with other central banks.

Figure 2. Violations of USD-EUR covered interest parity, 2007

Source: Hrung and Sarkar (2012).

In the immediate aftermath of the ABCP freeze, banks headquartered in the US tapped into alternative funding sources, in the deposit market and advances from the Federal Home Loan Banks (as documented by Ashcraft et al. 2010 and He et al. 2010). Foreign banks encountered difficulties in accessing the US deposit market and advances from the Federal Home Loan Banks in the same amounts as their US counterparts. This asymmetry highlights an important funding risk in global banking, manifesting as currency shortages for banks engaged in significant maturity transformation in foreign countries.

Real effects of funding shortage to corporate borrowers

Does this shock to foreign banks’ dollar funding matter? Relative to before the ABCP freeze and relative to non-dollar loans, we find evidence that foreign banks with ABCP exposure charged higher spreads on syndicated loans denominated in dollars. This is illustrated by a simple comparison of a couple of banks based on publicly available data, – the average US bank with ABCP exposure and two foreign banks, i.e. BNP Paribas and West LB. As shown in Figure 3, banks suffered a funding shock through their ABCP exposure (see Acharya et al. 2013 for details on these data), and lowered spreads on their non-dollar loans at the end of 2007 (based on our calculations from LPC’s Dealscan data). However, on average, US-headquartered banks also lowered prices in the US, while BNP Paribas and West LB charged higher loan spreads, on average.

Figure 3. The aftermath of the ABCP freeze

In multivariate analysis, we use a difference-in-differences approach to control for variation in characteristics across banks, differences in banks between before and after the shock, and between dollar and euro-denominated syndicated loan, for a given bank (allowing us to hold constant the bank solvency shock, if any). At the same time, we exploit variation among banks due to funding shock (ABCP exposed versus not) and due to differential access to funding in the dollar markets (foreign versus US banks). The differences are statistically significant, and economically within the relevant range for cost of credit lines and their substitutes such as cash holdings.

Dollar funding remains a problem for European banks

While the US Federal Reserve and ECB have pursued a series of extraordinary measures to alleviate dollar funding pressures, the issue of dollar funding has again arisen as US MMFs reduce funding for European banks. While in 2011, it is harder to distinguish which effects are funding and solvency related and which are related to changes in the prospects of the macroeconomy, Ivashina et al. (2012) and Correaet al. (2012) find that foreign banks contracted dollar lending more than they contracted euro lending even in the recent period of 2009-2011.

Policy implications

While we can present evidence about changes in loan pricing, it is hard to determine whether spreads on syndicated loans made by foreign banks were too low pre-funding shock or rose excessively post-August 2007 (or both). Acharya and Richardson (2009) argue that bank risk-taking in the pre-Crisis period was driven by regulatory arbitrage motive. Shin (2012) calls the resulting provision of intermediation a “global banking glut”, arguing that it led to the underpricing of dollar-denominated maturity mismatch and in particular to compressed loan premiums. While these results suggest that access to deposits, Discount Window and advances from Federal Home Loan Banks – stable liabilities – can help stabilise the banking sector and the transmission channel in a crisis, their ex-post efficacy must be weighed against any ex-ante moral hazard they induce. Investigating this issue, whether home-field advantage in US funding liquidity for US banks relative to non-US banks is desirable or not, presents a significant but worthy challenge.

Disclaimer: The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.

References

Acharya, Viral, Gara Afonso and Anna Kovner (2011), “How Do Global Banks Scramble for Liquidity? Evidence from the Asset-Backed Commercial Paper Freeze of 2007”, Working Paper, NYU Stern School of Business.

Acharya, Viral and Matthew Richardson (2009) “Causes of the Financial Crisis,” Critical Review, Volume 21(2–3), Pages 195–210.

Acharya, Viral and Philipp Schnabl (2010), “Do Global Banks Spread Global Imbalances? Asset-Backed Commercial Paper during the Financial Crisis of 2007-09,” IMF Economic Review, Volume 58, Pages 37-73.

Acharya, Viral, Philipp Schnabl, and Gustavo Suarez (2013), “Securitization without Risk Transfer,” Journal of Financial Economics, Volume 107, Issue 3, March 2013, Pages 515–536.

Acharya, Viral and Sascha Steffen (2012), “The Greatest Carry Trade Ever? Understanding Eurozone Bank Risks”, Working Paper, NYU Stern School of Business.

Ashcraft, Adam, Morten Bech, and Scott Frame (2010), “The Federal Home Loan Bank System: the Lender of Next-to-Last Resort?” Journal of Money, Credit and Banking, June, 42(4), 551-83.

Benmelech, Efraim (2012), “An Empirical Analysis of the Fed's Term Auction Facility,” NBER Working Paper No. 18304.

Chernenko, Sergey, and Adi Sunderam (2012), “Frictions in Shadow Banking: Evidence from the Lending Behavior of Money Market Funds,” mimeo.

Correa, Ricardo , Horacio Sapriza, and Andrei Zlate (2012), “Liquidity Shocks, Dollar Funding Costs, and the Bank Lending Channel During the European Sovereign Crisis,” International Finance Discussion Papers , Pages 2012-1059 (November 2012) .

He, Zhiguo, In Gu Khang and Arvind Krishnamurthy (2010), “Balance Sheet Adjustment in the 2008 Crisis,” IMF Economic Review 1, pp. 118-156.

Hrung, Warren, and Asani Sarkar. 2012. “The US Dollar Funding Premium of Global Banks,” Working Paper, the Federal Reserve Bank of New York.

Ivashina, Victoria, David Scharfstein and Jeremy Stein (2012), “Dollar Funding and the Lending Behavior of Global Banks,” NBER Working Paper No. 18528.

Shin, Hyun (2012), “Global Banking Glut and Loan Risk Premium,” Mundell-Fleming Lecture, IMF Economic Review, 60: 155-192, July 2012.