As numerous studies over the last two decades have shown, interest rate policies of a large number of central banks can be explained by the so-called Taylor Rule. According to this rule, which is consistent with inflation targeting, the policy rate is determined by a neutral real rate, the target inflation rate, the output gap, and the deviation of inflation from the target (or expected) rate. In this formula, the output gap can be interpreted as a leading indicator for inflation, as suggested by an augmented Phillips-curve inflation model, where the deviation of actual inflation from the target has the character of an error-correction term.

There is no room for financial variables, such as money, credit, or asset prices, in this policy rule.

- Leading economists and central bankers have indeed suggested that monetary policy should abstain from trying to prick asset price bubbles, but stand ready to support banks and financial markets when the bubbles burst (Bernanke and Gertler 2001).

- Only a minority have seen this differently and argued that monetary policy should lean against asset price inflation and monitor credit developments closely to this effect (ECB 2005).

As technical progress and global trade integration depressed prices in the 1990s and 2000s the Taylor Rule suggested that policy rates be kept low over an extended period of time despite strong credit growth and asset price increases. In this column we show how the policy of inflation targeting, which essentially implies that the central bank minimise the output gap, has led to excessive credit growth that eventually bred financial instability.

Credit and the output gap

We have argued at some length in the past that because credit growth is a stock variable and domestic demand is a flow variable, the conventional approach of comparing credit growth with demand growth is flawed (see for example Biggs et al. 2010a, 2010b).

To see this, assume that all spending is credit financed. Then total spending in a year would be equal to total new borrowing. Debt in any year changes by the amount of new borrowing, which means that spending is equal to the change in debt. And if spending is equal to the change in debt, then the change in spending is equal to the change in the change in debt (i.e. the second derivative of the development of debt). Spending growth, in other words, should be related not to credit growth, but rather the change in credit growth.

We have called the change in debt (or the change in credit growth) the 'credit impulse'. The credit impulse is effectively the private sector equivalent of the fiscal impulse, and the analogy might make the reasoning clearer. The measure of fiscal policy used to estimate the impact on spending growth is not new borrowing (the budget deficit), but rather the change in new borrowing (the fiscal impulse). We argue that this is equally true for private sector credit.

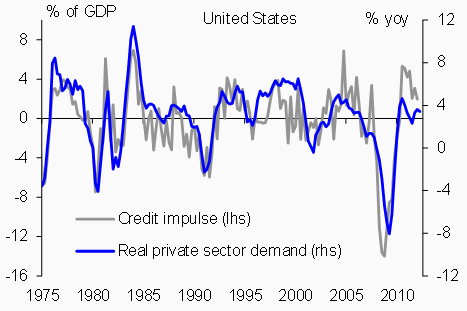

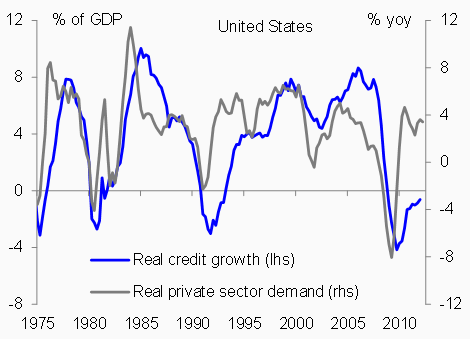

Our credit impulse approach has proved useful for the analysis and forecasting of economic activity in both the US and the Eurozone over the past three years. Domestic demand growth in the US rebounded in line with the credit impulse in 2010 (Figure 1), even though credit growth was still negative (Figure 2). The same was true in the Eurozone and many other countries around the world. With the concept of the credit impulse we could also debunk the myth of creditless recoveries (or so-called 'Phoenix Miracles') (Biggs et al. 2010a).

Figure 1. US credit impulse and demand

Source: Deutsche Bank Research

Figure 2. US credit growth and demand

Source: Deutsche Bank Global Market Research

Monetary policy and financial instability

We argued in the previous section that GDP growth should be related to the credit impulse, or the change in new borrowing. Figure 1 above for the US provides a sense of the nature of the relationship. When the credit impulse is zero, growth tends to be close to potential. Fluctuations in the credit impulse around zero cause fluctuations in GDP around trend.

If fluctuations in the credit impulse around zero are correlated with fluctuations in GDP growth around trend, then it follows that the output gap must be correlated with new borrowing as a % of GDP (Biggs and Mayer 2012). This logical implication of the credit impulse argument is supported by the empirical evidence. Figure 3 shows the correlations between the output gap (as estimated by the OECD) and private sector new borrowing as a % of GDP in the US. The correlation is excellent.

Figure 3. US output gap and new borrowing

Source: OECD, US Federal Reserve, Deutsche Bank Research

The implications of this view is that if we know what new borrowing as a % of GDP is, we have a reasonable estimate of the output gap. If new borrowing is high as a % of GDP then the economy is operating above potential. For given periods of time, credit growth can be used as proxy to new borrowing in % of GDP1 and hence provides a readily available, excellent indicator for a possible overheating of an economy, which is much easier to measure than the unobservable output gap. Figure 4 shows the two variables for the US. Nominal credit growth is well correlated with the output gap.

Figure 4. US output gap and credit growth

Source: OECD,US Federal Reserve, Deutsche Bank Global Market Research

Figure 4 has interesting implications for the sustainability of economic growth. In the US, over the past 20 years an output gap of 0% has been consistent with nominal credit growth of 7.0%. Potential nominal GDP growth averaged 4.8% in the US over the observed period and less than 4.0% in the Eurozone. In other words, when the output gap was 0%, credit was rising faster than nominal GDP and the debt ratio was rising. Exactly the same was true in the Eurozone.

An output gap of 0% would have suggested that the economy was performing at its potential and on a growth path that is generally perceived as being sustainable. Unless there were worrisome signals from actual inflation, the Taylor Rule would have suggested that policy interest rates were appropriate at existing levels. However, the right hand scale of the Figure suggests that growth at potential went along with credit growth that was faster than nominal GDP growth. In other words, growth in line with potential was associated with an ever increasing debt-to-GDP ratio. What might have appeared to have been a sustainable growth path from an output gap perspective was a growth path that gave rise to unsustainable debt dynamics. In short, the application of the Taylor Rule by the US Federal Reserve would have paved the way towards excessive debt accumulation, financial instability, and the subsequent financial crisis.

References

Bernanke, Ben and Mark Gertler (2001), “Should Central Banks Respond to Movements in Asset Prices?”, The American Economic Review, 91(2), Papers and Proceedings of the Hundred Thirteenth Annual Meeting of the American Economic Association, 253-257.

ECB Monthly Bulletin, April, 2005 (Box 4).

Biggs, M, T Mayer, and A Pick (2010a), "The myth of the "Phoenix Miracle"", VoxEU.org, 14 May.

Biggs, M, T Mayer, and A Pick (2010b), "Credit and Economic Recovery: Demystifying Phoenix Miracles", 15 March.

Biggs, M and Mayer, T (2012), "Towards macro-prudential policy framework", Global Economic Perspectives, Deutsche Bank, 6 June.

1 The difference is that in new borrowing relative to GDP the denominator is GDP, whereas in credit growth it is the stock of credit.