The residents of the US pay relatively low interest on their liabilities to foreigners, while earning relatively high returns on their foreign assets. This positive “excess return” on net foreign assets – known as the “exorbitant privilege” of issuing an international currency – facilitates the sustainability of large negative external positions.

In general, this privilege may be viewed as compensation for the US’ role as the world’s main financial centre, issuing safe low-yield liabilities to finance risky investment abroad (Gourinchas, and Rey 2005). Recently, however, several economists pointed to the inaccuracy of international statistics to justify excess returns on net US foreign assets. Some argue that these statistics in fact underestimate the true value of US investment abroad (the popular “dark matter” theory); others maintain that the inconsistency between the measurement of stocks and flows artificially raises the excess returns of the US (Hausmann and Sturzenegger 2006, Curcuru et al. 2008, Lane and Milesi-Ferretti 2008).

While the debate on the US exorbitant privilege remains lively, cross-country studies of excess returns have so far been extremely rare (Lane and Milesi-Ferretti 2002 and Meissner and Taylor 2006 are the exceptions.). My recent research (Habib 2010) extends the analysis of differential returns between gross foreign assets and liabilities since the 1980s to include a sample of almost 50 countries. This allows me to delve deeper into two key questions:

- Is the privilege of the US really exorbitant when compared to other countries and, in particular, other issuers of international currencies?

- Does the peculiar structure of (risky) foreign assets and (safe) liabilities of the US help to explain excess returns?

My findings point to the following answers, respectively:

- Yes, the US privilege is exorbitant. While a few international currencies have strong performance in their yields from the investment income balance (dividends, interest payments and so on), their total returns, including capital gains, perform less well.

- In general, no, the US asset-liability structure does not explain excess returns (even though country risk partly matters).

Excess returns on net foreign assets across countries

I calculated differential returns in real domestic currency terms between foreign assets and liabilities for a sample of 49 developed and emerging economies over the period 1981-2007. These returns include two main components:

- yields from the investment income balance (i.e. dividends, interest payments, branch profits and reinvested earnings); and

- rates of capital gain, mainly due to the valuation effects of exchange rate and asset price changes.

Returns are derived from balance of payments flows and international investment positions, using IMF data and the Mark-II database of Lane and Milesi-Ferretti (2007). They represent what countries earn from their foreign assets and pay out from their foreign liabilities.

The results in more detail

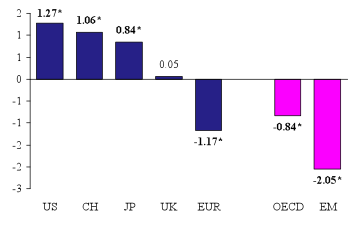

Turning first to average excess real “yields” from net foreign assets (Figure 1) – income balance flows excluding capital gains – the US is one of the few countries showing a positive and statistically significant excess yield, on average 127 basis points per annum between 1981 and 2008. Indeed, across the whole sample, excess yields are negative, in particular for emerging markets.

Interestingly, other issuers of international currencies, such as Japan and Switzerland, also enjoy positive differential yields of a magnitude similar to the US. Remarkably, the Eurozone posts an average negative yield differential of almost 120 basis points per year. This average figure, however, conceals an important structural break. Back in the 1980s, the countries that now make up the Eurozone had a negative yield differential between foreign assets and liabilities of around two percentage points. This negative differential starts shrinking after the 1992 ERM crises and virtually disappears after 1999. This suggests significant macroeconomic benefits stemming from the compression of risk premia in the Eurozone during the convergence process leading to the adoption of the euro.

Figure 1. Differential real yields (income balance) on foreign assets and liabilities, 1981–2008 average

Note: Author’s calculations based on IMF BPS and Mark-II database. OECD and Emerging Markets (EM) data until 2007. For the Eurozone (EUR) yields until 1999 are calculated as the average of the founding member states, including Greece and excluding Belgium and Luxembourg. * Asterisk indicates statistical significance at the 5% level.

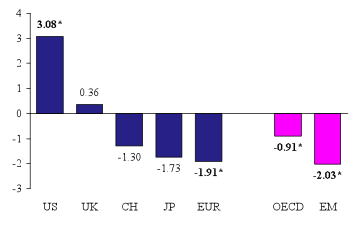

If we now examine excess “total returns”, including capital gains (Figure 2), the picture is different. Excess total returns on US net foreign assets do indeed appear “exorbitant” from a global perspective. They are more than 300 basis points per year between 1981 and 2008, larger than in other countries, consistently through time, and statistically significant. The cross–country analysis shows that only a dozen countries generate average positive excess total returns on their net foreign assets, and they are generally much smaller than the returns of the US, and often not statistically different from zero.

Figure. 2. Differential real total returns (including capital gains) on foreign assets and liabilities, 1981–2008 average

Note: Author’s calculations based on IMF BPS and Mark-II database. OECD and Emerging Markets (EM) data until 2007. For the Eurozone (EUR), returns until 1999 are calculated as the average of the founding member states, including Greece and excluding Belgium and Luxembourg. * Asterisk indicates statistical significance at the 5% level.

Whereas in the study of excess yields, other international currencies could match the privilege of the US, this is not any more the case once capital gains are included in the calculations. The Eurozone, Switzerland and Japan do not enjoy any privilege and, actually, pay more overall on their foreign liabilities compared with what they receive on their foreign assets. For the latter two countries, however, this negative differential is not statistically significant.

Leverage, country risk, exchange rates and excess returns

For many economists, the asymmetry between the low risk of US foreign liabilities and the relatively higher risk of their foreign assets is the most logical explanation for the US exorbitant privilege. In the US, the argument goes, gross foreign liabilities are dominated by low-yield debt and other investments (trade credits, loans, currency and deposits), whereas the composition of gross foreign assets is more balanced between low-yield instruments and risky assets such as FDI and equity, with the latter supposed to generate superior returns. In addition, some economists consider that the relatively lower country risk attached to investment in the US, compared with US investment abroad, justifies a positive return differential. A closer scrutiny of data, however, sheds serious doubts on these two popular arguments.

First, as regards the potential “leverage” effect, which is generated by an asymmetry in the composition of foreign assets and liabilities, I show that the impact of a higher share of riskier investment in the foreign assets relative to liabilities is actually negative in the case of the US. The exorbitant privilege of the US is instead the result of an extraordinary “return” effect, i.e. the better performance of US investment abroad compared to foreign investment in each of the main categories of the international investment position. In other words, the position of the US as a “levered investor” did not contribute to its exorbitant privilege, at least over the past two decades.

The country-panel econometric analysis of excess returns also confirms this verdict, failing to find a robust positive relationship between leverage and excess returns. There seem to be other more important determinants of excess returns. Notably, countries experiencing large real exchange rate depreciations may boost their excess returns on net foreign assets, with an impact that is proportional to the relative foreign currency exposure. This effect is channelled through capital gains, not through investment income.

Second, as regards country risk, a higher (i.e. better) country rating is associated with higher excess yields from investment income, but – rather unexpectedly – the impact on excess total returns, including capital gains, is in fact negative.

Conclusion

Over the past decades the US has managed to produce positive return differentials on net foreign assets. It is not simply the average level of this differential that is extraordinary, but also the ability of the US to achieve it in a consistent manner through time, from both investment income and capital gains.

Other major issuers of international currencies, such as Japan, Switzerland and the Eurozone, have failed to produce a similar performance, due to capital losses. Only when focusing on the yield differential from investment income do Japan and Switzerland come close to matching the US. The Eurozone, on the other hand, does not enjoy any yield privilege similar to other issuers of international currencies – although the negative yield differential between foreign assets and liabilities of Eurozone countries was significantly eroded in the run-up to EMU accession.

Contrary to popular belief, my analysis shows that the asymmetry in risk between foreign assets and liabilities does not explain the exorbitant privilege of the US. The transformation of risk may not be called upon to justify excess returns. Country risk may also help to explain excess yields from the income balance, but this is only one part of the story.

Disclaimer: The views expressed in this column are those of the author and do not necessarily reflect those of the European Central Bank.

References

Curcuru, Stephanie E, Thomas Dvorak and Francis E Warnock (2008), “Cross-Border Returns Differentials”, Quarterly Journal of Economics 123:1495-1530, November.

Gourinchas, Pierre-Olivier and Hélène Rey (2005), “From World Banker to World Venture Capitalist: US External Adjustment and the Exorbitant Privilege”, NBER Working Paper 11563.

Habib, Maurizio M (2010), “Excess Returns on Net Foreign Assets: The Exorbitant Privilege from a Global Perspective”, ECB Working Paper 1158, European Central Bank, February.

Hausmann, Ricardo and Federico Sturzenegger (2006), “Global Imbalances or Bad Accounting? The Missing Dark Matter in the Wealth of Nations”, Centre for International Development Working Paper 124, Harvard University, September.

Lane, Philip R and Gian Maria Milesi-Ferretti (2002), “External Wealth, the Trade Balance and the Real Exchange Rate”, European Economic Review 46:1049-1071.

Lane, Philip R and Gian Maria Milesi-Ferretti (2007), “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970-2004”, Journal of International Economics 73:223-250.

Lane, Philip R and Gian Maria Milesi-Ferretti (2008), “Where Did All the Borrowing Go? A Forensic Analysis of the US External Position”, IMF Working Paper 08/28.

Meissner, Christopher M and Alan Taylor (2006), “Losing our Marbles in the New Century? The Great Rebalancing in Historical Perspective”, NBER Working Paper 12580.