Trade in the last quarter of 2008 and the first quarter of 2009 contracted in an exceptionally sudden, severe, and globally synchronised fashion. According to Eichengreen and O’Rourke (2009) the drop has been even fiercer than that during the Great Depression. Beyond a limited resurgence of protectionism (Baldwin and Evenett 2009; Evenett 2009 and Bussiere et al. 2009), two broad explanations for the collapse of world trade have been put forward.

First, the slump in trade has been associated with a sharp deterioration of demand and activity worldwide, deterioration which has been particularly severe in the rich club of OECD countries (Araujo and Oliveira-Martins 2009) and for investment goods and the automobile industry (Francois and Woerz 2009).

The increasing dominance of manufacturing models relying on internationally fragmented supply chains (Tanaka 2009; Yi 2009) may have magnified this impact. However, simulations aimed at identifying the contribution of the demand channel that take into account international input-output relationships have hardly reproduced the magnitude of the drop in world exports, suggesting that additional factors may have played a role (Benassy-Quéré et al. 2009; Willenbockel and Robinson 2009).

Second, the intensification of the financial crisis may have led to liquidity shortages, greater risk aversion, and lower confidence amongst both financial institutions and producers. As a result, reduced availability of credit and financing may have increased firms’ exit rates from export markets; credit constraints have been found to sharpen the firm selection effect, i.e. the churning through which market shares are reallocated from the least productive to the most productive exporters (Manova 2008). Indeed, Iacovone and Zavacka (2009) confirm the importance of financing constraints in explaining the drop in sectoral exports during past banking crisis, by disentangling the supply-side determinants (including the lack of external finance) from the demand-side determinants.

Looking at the firm-level trade data

Given this background, it appears important to address the micro-economic dimension of the recent trade collapse. We do so in a new paper (Bricongne et al. 2009), where we use monthly French firm-level data through April 2009. We quantify the severe burden of adjustment that the crisis has imposed on many individual firms, examine the channels through which the credit crisis affects firms (particularly exporters), and investigate how financial constraints interact with various types of trade costs. We ask whether exporters, which are heterogeneous in their performance and key characteristics, were heterogeneously affected by such a crisis.

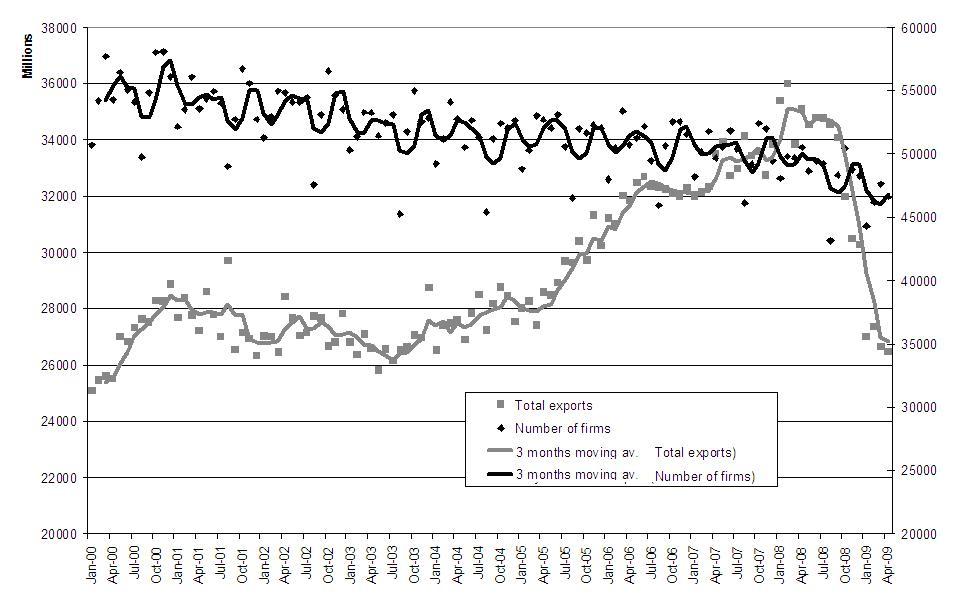

A first glance at the monthly French customs data (Figure 1) points to a steep decline in the value of total exports from September 2008 onwards. The number of French exporters, which has been declining since 2000, also appears to have further contracted in the peak period of the crisis: from 50,458 in October 2008 to 46,616 in April 2009. While seasonality and the number of working days may bias the results somewhat, all in all about 3,800 firms stopped exporting, corresponding to 7% of the average number of monthly exporters over the whole ten-year period considered.

Figure 1. French exports and exporters, 2001 to 2009

Note: Chapters 98 and 99 of the HS2 are dropped. 3-month moving averages. Left scale: euros. Source: Bricongne et al. (2009)

One important question with policy implications is whether small and less productive firms are more adversely hit by the economic crisis than large and more productive firms. One could expect that larger, more productive, and more globalised firms are better able to overcome the contraction of foreign demand and increased credit constraints, for instance by relying on intra-group financing or securities issuing. Indirect support for this thesis is provided by Muûls (2008).

Contrary to expectations, we find that large and small exporters have been similarly affected by the crisis. After controlling for export orientation in terms of sectoral specialisation and destination markets served, large and small exporters have been similarly hit by the crisis, with one notable exception, the month of February 2009, when the largest firms were the most severely hit (Table 1, columns 1-4). Similarly we find limited evidence of a differential impact of the crisis on firms with different degrees of export differentiation, i.e. between firms that focus on a few products and markets and firms that export many products to many destinations (Table 1, columns 5-8).

Table 1. Mid-point growth rate of exports (year-on-year) across exporter types, corrected for sectoral and geographical orientation of exports

Note: Mid-point growth rates are calculated as weighted year-on-year differences of each firm's exports per destination and HS2 sector following methodology in Buono et al. (2008). Correction for sectoral and geographical variance using weighted analysis of variance. Source: Bricongne et al. (2009)

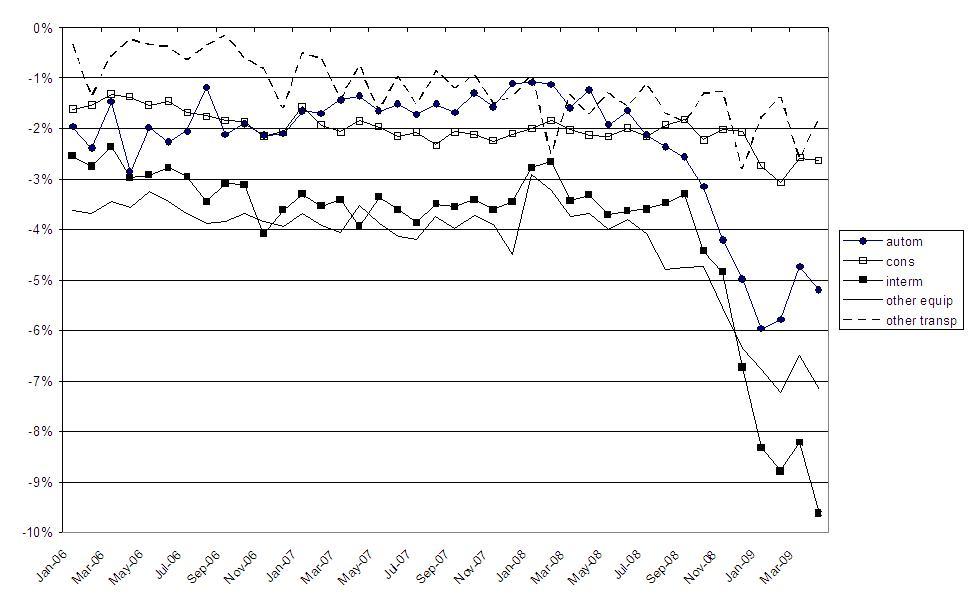

The trade impact of the crisis has discriminated more along sectoral lines. Most of the contraction was absorbed by exports in intermediate and other equipment goods and in the automotive industry. By contrast, losses for consumer goods remained rather contained (See Figure 2, relative to losses in volumes of exports by largest 1% exporters).

Figure 2. Contribution of negative growth to the top 1% exporters sales’ mid-point growth rates, January 2008 to April 2009 by broad sector of economic activity

Note: Chapters 98 and 99 of the HS2 are dropped. Exporters are ranked according to the value of their exports within a sector. Source: French customs data, own calculations

Moreover the great bulk of the deterioration of exports appears to have originated from the intensive margin, i.e. by means of a reduction of exported volumes, rather than via the extensive margin. For example, in February 2009, the intensive margin accounted for more than 80% of the total 27.5% year-on-year contraction of French exports. The top 1% exporters, owing to their more global and continued presence on export markets, have been the most hard-hit. With a recorded loss of 16.4%, they absorbed more than 70% of the total loss in the intensive margin.

Turning to the extensive margin, exit rates from products and/or export markets (in particular among the largest firms) have noticeably increased, signalling a retrenchment in export strategies. Nevertheless, firms highly diversified in terms of exported products and destinations, such as champions in their own niches, were more likely to survive. By contrast, market entry rates have remained remarkably stable in the period up to April 2009. Since sunk costs are usually paid by a firm well before its entry into a new market, it is possible that the effects of a credit shortage in the period 2008Q4–2009Q1 are likely to have affected only marginally firms’ entry strategies over the period of data availability. Again, champions in their own niche were least affected. Accordingly, they hardly changed market entry strategies.

Given the financial nature of the crisis and its strong sectoral bias, we further attempted to quantify the impact of credit constraints. Not all sectors are affected in the same way by financial constraints; the production technology, which tends to be sector specific, determines firms’ financial needs. Our investigation of the effect of financial constraints on the dynamics of French firms’ exports uses differences across sectors in their dependence on external finance, applying the methodology of Rajan and Zingales (1998) to the firms in our sample.

Considering the period from January 2007 to April 2009, we regressed the mid-point growth rates of exports on the sectoral foreign demand in each market, firms’ size (and alternatively, as robustness check, on firms’ degree of export diversification), and our sectoral measure of financial dependence. Finally, a step-dummy for the crisis interacted with firms’ size and financial dependence controls for effects idiosyncratic to the period of the crisis.

While our estimation results confirm that size ultimately did not matter in the recent trade crisis, the degree of sectoral external financial dependence appears to have been important in determining firms’ export performance, both in pre-crisis times and during the crisis. Firms in sectors extensively relying on external finance appear to have had a competitive advantage and export more than the average firm before the crisis. By contrast, during the crisis this advantage appears to have reversed. Belonging to a sector ranked in the top decile of financial dependence negatively impacts a firm’s export performance in the period of the crisis, whatever its size. This result contrasts with a negligible mean effect for exporters belonging to the least financially dependent sectors. Qualitatively similar results hold when firms are categorised by degree of export diversification rather than size of exports and are robust to alternative specifications of financial dependence.

In conclusion the micro-analysis suggests that the trade crisis has had a distinctively sectoral focus, with the impact concentrated on durable goods, including equipment, investment goods and the automotive industry. More generally, the crisis has severely hit firms in sectors heavily dependent on external finance, irrelevant of the size or the degree of export diversification of firms, confirming the financial origin of the crisis. Finally the collapse of trade came mainly through the intensive margin although market exit rates also increased, in particular for firms with less diversified exports.

References

Araujo, S. and J. Oliveira-Martins (2009). “The Great Synchronisation: What do high-frequency statistics tell us about the trade collapse?” VoxEU.org, 8 July.

Auboin, M. (2009). “Trade finance: G20 and follow-up”. VoxEU.org, 5 June.

Baldwin R., and S. Evenett (2009), The collapse of global trade, murky protectionism, and the crisis: Recommendations for the G20, CEPR, London.

Benassy-Quéré A., Y. Decreux, L. Fontagné, and D. Khoudour-Casteras (2009), “Economic Crisis and Global Supply Chains”, CEPII Working Paper 2009-15.

Buono I., H. Fadinger, and S. Berger (2008), “The Micro-Dynamics of Exporting. Evidence from French Firms”, Working Paper 0901, University of Vienna.

Bussière M., E. Perez, R. Straub, and D. Taglioni (2009), “Protectionist responses to the crisis: Global Trends and Implications”, mimeo ECB.

Eichengreen B. and K. H. O’Rourke (2009). “A Tale of Two Depressions”. VoxEU.org, 6 April.

Evenett, Simon (2009), Broken Promises: a G20 Summit Report by Global Trade Alert, VoxEU.org, CEPR, London

Francois J. and J. Woerz (2009) “The Big Drop: Trade and the Great Recession”. VoxEU.org, 2 May.

Iacovone L. and V. Zavacka (2009). “Banking Crises and Exports. Lessons from the Past”. World Bank Policy Research Working Paper. 5016, August.

Manova K. (2008). “Credit Constraints, Heterogeneous Firms and International Trade”, NBER Working Paper, 14531.

Muûls M. (2008). “Exporters and credit Constraints. A Firm-Level Approach”. Research series 2008-09-22, National Bank of Belgium.

Rajan, R. and L. Zingales (1998). “Financial Dependence and Growth”. American Economic Review, 88(3): 559-586.

Tanaka, Kiyoyasu (2009). “Trade collapse and vertical foreign direct investment”, VoxEU.org, 7 May.

Yi, Kei-Mu (2009). “The collapse of global trade: The role of vertical specialization”, in Baldwin and Evenett (eds.)

Willenbockel, D., and S. Robinson (2009) “The Global Financial Crisis, LDC Exports and Welfare: Analysis with a World Trade Model”. Paper presented at the GTAP conference, Santiago de Chile, June.