After the near-collapse of large parts of the financial system and unprecedented support measures from the public sector and central banks, the leaders of the G20 agreed on the need for a radical overhaul of the financial system. In parallel, several countries embarked on ambitious reforms at the national level, which have produced a set of structural measures, ranging from the prohibitions of activities and a ringfencing of retail banking to special resolution or capital regimes for systemically important institutions. This high level of regulatory activity contrasts quite starkly with a widespread public perception that nothing major has happened in the financial sector and that reforms have not had any impact. Therefore, it seems only natural to ask whether reforms have had any measurable effects. It also seems natural to address this question to the market rather than the involved and interested parties.

In our study (Schäfer, Schnabel and di Mauro 2013), we investigate the following questions:

- How have financial markets reacted to different types of regulatory reforms?

- In particular, have bank equity valuations and the prices of banks' credit risk been affected by regulatory measures?

- Have some reforms had a larger impact than others?

- Have different regulatory interventions had differing effects on different types of banks, such as investment and commercial banks, or systemic and non-systemic banks?

An event study of regulatory reform streams

To answer these questions we analyse the reaction of equity returns and credit default swap spreads following major regulatory events of the banking industry during the period from June 2009 till October 2011 within the framework of an event study.1 We focus on four important national reform streams, namely the Dodd-Frank Act in the US, the reforms proposed by the Vickers report in the UK, the restructuring law and bank levy in Germany, and the too-big-to fail regulation in Switzerland. These four reforms typify fundamentally differing approaches to dealing with the weaknesses of the financial system revealed by the financial crisis: a prohibition of risky activities (Volcker rule in the US), a ringfencing of systemic activities (UK), the establishment of resolution procedures (Germany), and special capital regimes for systemically important banks (Switzerland).

As in any event study, the timing of events is of the essence. Regulatory reforms are usually discussed over an extended period of time; there are consultations with experts and affected parties, negotiations between political parties and governments, which make a certain outcome more or less likely. One crucial question is how to filter out the important sub-events, the ‘real’ news. Ideally, we would like to identify those events where truly new information (about content or probabilities) became available to markets. We use the editorial process of major financial newspapers as a filtering device: a reform measure is classified as an event if it was published as a lead article on the front page of a major newspaper as is common in the literature (see, e.g., O’Hara and Shaw 1990).

Snapshot of results

The results of our study reveal that the public perception that nothing has happened after the crisis does not do justice to the various national efforts to stabilise financial systems and contain systemic risk. We show that financial markets indeed reacted to the structural reforms enacted at the national level.

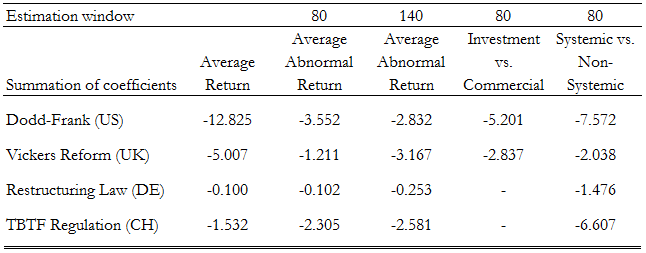

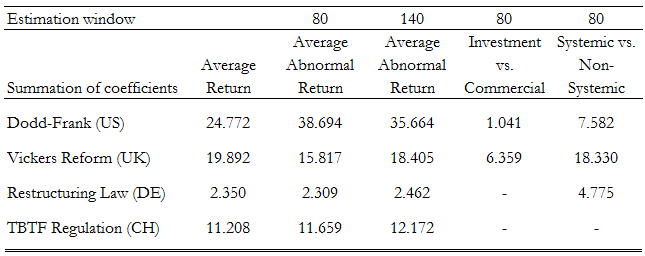

Tables 1 and 2 list the overall changes in average abnormal returns in equity prices and credit default swap spreads, summed up over all significant sub-events, as well as the differences between different bank types.2 The table shows that the largest overall effects in stocks and credit default swaps are found for the reforms enacted in the US. The response of market prices to the Vickers reform was a marked increase in credit default swap spreads, but less so in equity prices. In both instances, there were reversals when the reforms were watered down or postponed. In Germany, the introduction of a special resolution regime for systemic banks led to an increase in credit default swap spreads of such banks. Finally, in Switzerland, the too-big-to-fail regulation, which requires systemic banks to hold significantly higher levels of capital, led to a strong increase in credit default swap spreads of systemic banks.

Table 1. Stock returns

Table 2. CDS spreads

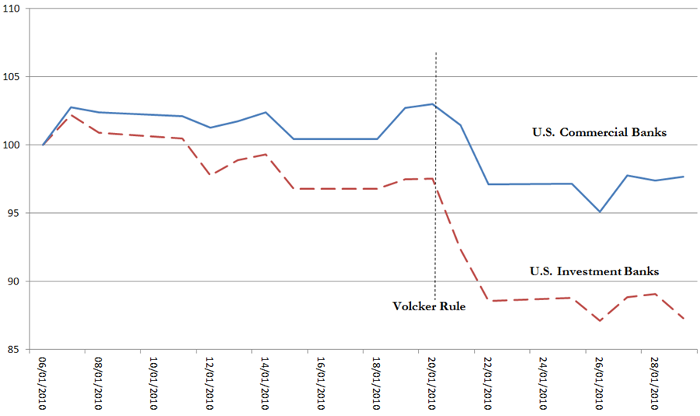

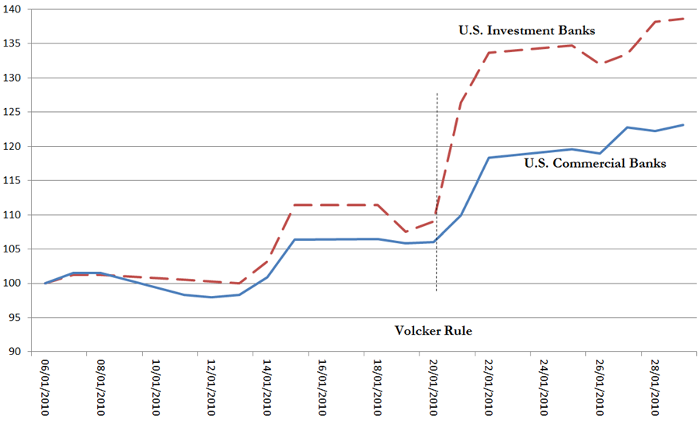

We find the strongest individual results for the Volcker rule, which led to a significant decrease in equity prices and an increase in credit default swap spreads, especially for investment banks and systemic banks, as shown in Figures 1 and 2. This reform also produced significant spillover effects to banks in the UK and to Switzerland.

Figure 1. The Volcker rule: US stocks of investment and commercial banks

Figure 2. The Volcker rule: US CDS spreads of investment and commercial banks

Has enough happened?

In our study, we asked the following questions:

- Has anything happened in financial regulation after the crisis?

- Have the various structural reforms enacted in countries hosting major financial centres been registered in equity valuations and credit default spreads of their banks?

The good news is that the answer is ‘yes’. In all cases, the reforms seem to have reduced bailout expectations, especially for systemic banks, and lowered equity returns in many cases.

These results give rise to obvious follow-up questions, such as ‘has enough happened’? The bad news is that we cannot really tell. There are several reasons why this is a much harder question to answer. The most important one is that we are ultimately interested in the safety of the financial system. While evidence suggests that lower bailout expectations lead to lower risk-taking (Boyd and Gertler 1994), our methodology is silent on this issue. In fact, with the data currently available, this question cannot be answered reliably. Only the future will tell.

Moreover, it is not quite clear what is ‘enough’. For sure, the goal of reforms cannot be to generate the largest possible drop in equity prices and increase in credit default swaps (by that measure, a reform that shuts down the system would be considered a successful reform). Rather the measure of a successful reform should be that it eliminates the distortions stemming from systemic risk. One possible approach is to compare our results quantitatively with the funding cost differentials created by government support. According to Ueda and di Mauro (2013), the value of the subsidy as of 2009 was as much as 60 to 80 basis points funding cost differential. Measured against this benchmark, we would conclude that none of the national reforms has been enough to fully eliminate the distortion.

The next question is whether some forms of structural reforms are better than others. After all there are different underlying and competing philosophies behind the various reforms. The US and UK reform, in particular the Volcker Rule and the ringfencing approach by Vickers, have the experience with separate banking systems as intellectual backdrops. By contrast, the Swiss and German reforms aim at increasing capital buffers and improving resolvability. It would be tempting to conclude by looking at the size of credit default swap spread changes that the US-type structural reform is the most effective. However, this would not necessarily be the right conclusion. Without doubt, the Volcker rule came as a bombshell. But apart from signalling the type of future reforms, this announcement made clear that national governments unilaterally would go beyond the fine-tuning of Basel regulations, which surprised investors all over the world. On the other side of the spectrum, it would be incorrect to conclude from the comparatively small effect that the German reform had on credit default swap spreads that resolutions regimes are generally ineffective. The problem of the German restructuring regime is not that it is ineffective in principle but that it turns out to be irrelevant in practice since it is implemented at the national level.

National restructuring regimes cannot solve the cross-border coordination issues, which proved to be crucial in the financial crisis. In the Eurozone, this problem has been recognised and a supranational resolution regime is planned as part of the future banking union. But at the global level, the chances of solving the cross-border coordination issues are slim. The Basel process has delivered a framework of capital regulation but there is no robust framework for cross-border resolution. Unfortunately, the fact that different large countries are following different strategies in reforming their banking systems may actually make this cross-border coordination problem larger rather than smaller. This would be really bad news.

Editor’s note: This column is based on a recent CEPR Discussion Paper entitled “Financial Sector Reform After the Crisis – Has Anything Happened?”, which you can download for free here.

References

Boyd, J H and M Gertler (1994), “The Role of Large Banks in the Recent U. S. Banking Crisis”, Federal Reserve Bank of Minneapolis Quarterly Review, 18(1), 2–21.

Fratianni, M U and F Marchionne (2009), “Rescuing Banks from the Effects of the Financial Crisis”, MoFir Working Paper Series, No. 30.

O’Hara, M and W Shaw (1990), “Deposit Insurance and Wealth Effects: The Value of Being ‘Too Big To Fail’”, Journal of Finance, 45(5), 1587–1600.

Schäfer, A, I Schnabel, and B Weder di Mauro (2013), “Financial Sector Reform After the Crisis: Has Anything Happened?“, CEPR Discussion Paper 9502.

Schwert, GW (1981), “Measuring the Effects of Regulation: Evidence from the Capital Markets”, Journal of Law and Economics 24, 121–145.

Ueda, K and B Weder di Mauro (2013), “Quantifying Structural Subsidy Values for Systemically Important Financial Institutions”, International Monetary Fund Working Paper No. 12/128, Washington, DC, forthcoming in Journal of Banking and Finance.

Veronesi, P and L Zingales (2010), “Paulson’s Gift”, Journal of Financial Economies 97(3), 339–368.

1 There is a long tradition of evaluating the effects of regulatory events using event studies, going back to Schwert (1981). A number of recent studies deal with the support measures in the recent financial crisis. Veronesi and Zingales (2010) study the effect of the Paulson Plan on the valuation of banks relative to non-financial firms while Fratianni and Marchionne (2009) consider fiscal support measures in the banking sector during the financial crisis.

2 Detailed results on various subevents and subgroups can be found in the working paper.