With the US economy officially in recession and other major economies set to follow suit, the spectre of rising unemployment once again occupies the minds of policymakers and media pundits alike.

At any point in time, many workers flow into and out of the unemployment pool. It is well-understood among economists that changes in the rate of unemployment among developed economies are underpinned by substantial changes in these unemployment flows (Marston 1976; Blanchard and Diamond 1990). Recent research has identified a clear pattern in times of recession. Increases in unemployment are preceded by a rise in unemployment inflows as jobs are destroyed, followed by a rise in the duration of unemployment spells as workers fail to quickly find new jobs.

A natural question, then, is whether the recent ramp-up in US unemployment has evolved any differently. Despite many similarities with previous recessions, the rapid inflow of workers into unemployment during the current downturn confirms that this is one of the most severe recessions in recent US history.

Reflections on the current US recession

A useful rule of thumb exploited in recent research is that the percentage increase in unemployment is well-approximated by the percentage increase in inflows plus the percentage increase in duration of unemployment (Elsby, Michaels, and Solon 2009). Figure 1 plots these for each US recession since 1969, including the current crisis (shaded). In some ways, the current recession looks much like previous downturns. Inflows as well as duration have contributed to increased unemployment in much the same way as in the recessions of 1969 and 1974. But other dimensions of the current crisis are more alarming. Unemployment inflows have already grown by more than 30% since the beginning of the unemployment ramp up – faster rates of job loss have played a particularly dominant role relative to previous downturns.

If the current crisis evolves similarly to earlier episodes, these elevated rates of job loss do not bode well for unemployment prospects in 2009. A pattern observed in prior recessions has been that increased inflows are often a precursor to increased duration and further increases in unemployment (see Figure 1). This pattern suggests that further weakening of the labour market looms on the horizon, an outcome that would amount to a recession more severe than any seen in the US in the last forty years. This highlights the important need for a successful US stimulus package to stem the tide of a worsening macroeconomic situation in 2009.

Figure 1. Percent changes in US unemployment inflow rate and duration by recession

Figure 1 also highlights a curious fact absent in popular discussions of the crisis. Unemployment in the US had already begun to ramp up in early 2007, long before the official recession start date in December 2007 and the vagaries of the financial crisis that came to a head in the latter half of 2008. Figure 1 suggests that the initial impulse to the current recession may not have been the credit crunch, but rather that the credit crunch aggravated already worsening economic conditions.

Reverberations in Europe?

How have the big European economies fared in the wake of the recent turmoil? Figure 2 plots the most recent data on unemployment rates in Great Britain, Spain, France, and Germany.1 Germany and France both continue to enjoy declining unemployment rates. In contrast, Spain is experiencing a substantial rise in unemployment. Britain has experienced a moderate rise.

Figure 2. Unemployment rates in Britain, Spain, France and Germany

Note: Dashed lines are future unemployment rates under the assumption that inflow rates and duration increase no further.

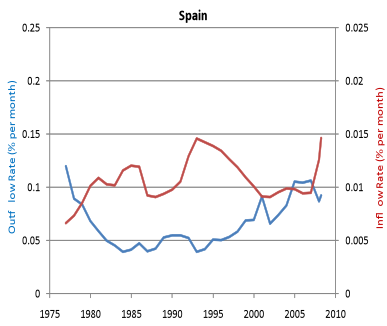

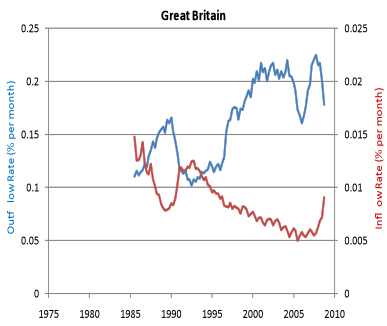

Closer inspection of unemployment flows in recent data for Britain and Spain, however, reveals marked increases in the rate at which workers have flowed into unemployment, as well as declines in the rate at which the unemployed leave the jobless pool (Figure 3). Since 2007, inflows have risen by 50% in Britain and 43% in Spain, while outflow rates have fallen (and hence unemployment duration has increased) by 23% in Britain and 14% in Spain.

Figure 3. Rates of inflow to and outflow from unemployment in Spain and Britain

Thus, as in the US, increases in unemployment have been driven by both increases in inflows and duration. And, like in the US, both inflows and duration began to rise in Great Britain and Spain in 2007, again suggesting that the origins of the current slowdown were apparent some time before the recent financial crisis struck. But the role of job losses has been more dominant in Europe. Inflow rates have reached levels last seen in the mid-1990s, when Spanish unemployment soared above 20% and Britain was still recovering from the early 1990s recession.

So, why has the increase in British unemployment been so modest to date? The answer is that European labour markets are much less dynamic than their American counterparts. European workers take far longer to leave unemployment: American workers exit unemployment on average six times faster than European workers. In these sluggish European labour markets, it takes time for unemployment to respond to changes in the rate at which workers flow in and out of the unemployment pool.

Prospects for European unemployment in 2009

Although longer unemployment durations are a source of misery for multitudes of Europeans in want of work, they have one redeeming feature for an economist. Changes in unemployment flows today provide advance warning of unemployment increases in the future. So what is in the cards for unemployment in Spain and Great Britain? The dashed lines in Figure 2 present a conservative scenario. They depict the future course of unemployment assuming that labour market conditions get no worse in either country. Even in this conservative outcome, unemployment will rise to 5% in Britain, and 13.5% in Spain by the end of 2009.

So the bad news is that the persistent declines in unemployment enjoyed in Spain and Britain since the 1990s are now a thing of the past. Mounting rates of joblessness in 2009 seem very likely. Time will tell if the credit crunch has precipitated an acceleration of these trends.

References

Blanchard, Olivier J. and Peter Diamond (1990). The Cyclical Behavior of the Gross Flows of US Workers, Brookings Papers on Economic Activity, 1990-2, 85-155.

Elsby, Michael W. L., Ryan Michaels, and Gary Solon (2009). The Ins and Outs of Cyclical Unemployment, American Economic Journal: Macroeconomics, 1(1): 84–110.

Elsby, Michael W.L., Bart Hobijn, and Aysegul Sahin (2008). Unemployment Dynamics in the OECD, NBER Working Paper 14617.

Marston, Stephen T. (1976). Employment Instability and High Unemployment Rates, Brookings Papers on Economic Activity, 1976-1, 169-210.

Footnotes

1 Data up to December 2008 for Great Britain are taken from unemployment claims. For Spain, France and Germany, data are available up to the third quarter of 2008 from Eurostat. Annual calculations for these and other OECD countries are presented in Elsby, Hobijn and Șahin (2008).