Jean-Claude Juncker, Prime Minister of Luxembourg, President of the Eurogroup, and one of Europe’s leading policy makers, once famously complained that "We all know what to do, but we don’t know how to get re-elected once we have done it" (The Economist, 2007). Politicians in Europe are deeply aware of the need for structural reform – in particular in the euro area where the pace of structural reform has been disappointing since the inception of the single currency (European Commission 2008;Duval and Elmeskov 2005) – and yet reluctant to bite the bullet out of fear of losing the next general election.

Of course, this fear is rooted in experience: structural reforms – ranging from the abolition of state monopolies to making labour markets more flexible – invariably meet strong opposition from vocal interest groups while the benefits of reforms are more diffused and are believed to arise only in the future – hence beyond the term in office of the current ruler. But does this also mean that the electorate punishes incumbent governments if they push through bold structural reforms? In a recent paper (Buti et al. 2008) we argue that this fear is largely unfounded; in particular if a number of conditions are met.

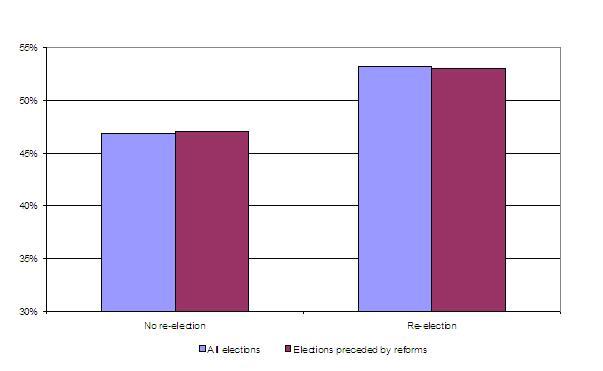

A prima facie examination of the electoral and structural reform records for 21 OECD countries over the 1985-2004 period shows that a small majority of incumbent governments (50 – 55%) are re-elected for a next term in office no matter what, i.e. whether they are reformist or non-reformist. See Figure 1 which shows the fraction of governments that where not re-elected (first pair of columns) and those that were (second pair) for all elections and elections that were preceded by reforms.

This confirms findings from a recent series of case studies that reformist governments, even if they have to overcome initial resistance and misconception, do tend to be re-elected (Munkhammar 2007). More sophisticated testing with a probit model indicates that whether the incumbent government pursues structural reform or not does not matter for its re-election probability: it is statistically insignificant. The only statistically significant economic factor appears to be the business cycle: if the economy happens to be in an upswing, the incumbent's re-election probability clearly increases.

Figure 1. Probability of re-election and the occurrence of reforms

We could simply stop here, taking the view that structural reforms are apparently irrelevant for the re-election probabilities of incumbent governments. But we want to go one step further by asking: under which conditions structural reform can actually raise the incumbent’s probability of re-election? Our prior belief, and the hypothesis we extensively test in our paper, is that the stage of development of financial markets matters a lot for the re-election probabilities of reformist governments.

Finance, reform, and elections

Here is the story. Well-developed financial markets permit households to borrow against future income and smooth consumption over time. Moreover, the availability of a wider range of investment opportunities and income sources improves risk-sharing and permits consumption-smoothing across states of nature. In practice, well-functioning financial markets allow households to seize the opportunities created by structural reforms early and hence help bring forward their benefits.

This has implications for the political feasibility of structural reforms. Even in the presence of short-run costs, reforms would be perceived as bringing overall gains while making agents more resilient to reform-related temporary income loss. We therefore expect structural reforms to meet a more positive electoral reception if financial markets function well. In countries with poorly functioning financial markets, the electoral constituency in favour of reforms is bound to be smaller and hence the government carrying out reforms more likely to be punished at the next elections. Additionally, by reducing the share of liquidity-constrained households, well-functioning financial markets make the economy more "Ricardian" (Seater, 1993).This means that fiscal policy is less effective, and hence the government will be less tempted to prop up demand by opening the public purse and more inclined to take the hard route of structural reforms.

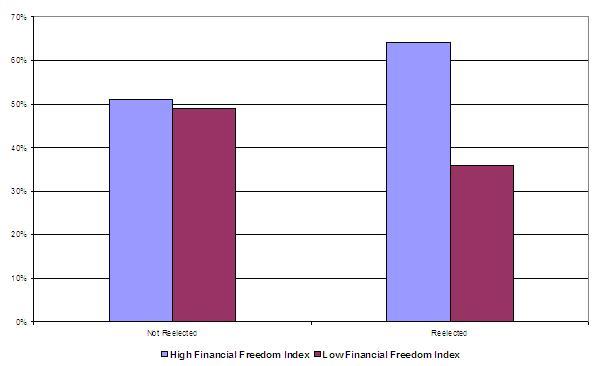

The data show prima facie evidence that, of all reformist governments that have been re-elected, 65% were governing a country with relatively pro-competitive financial market regulations (according to the financial freedom indicator compiled by the Fraser Institute), whereas the corresponding share among non-reformist governments was only 50% (see Figure 2). More sophisticated testing in our paper strongly confirms this prima facie evidence. We find a highly significant positive effect of the interaction of the financial freedom index and structural reform on the re-election probability of incumbents. An interaction between the cyclical position of the economy and structural reform is also highly significant, suggesting that an incumbent who pursues ambitious structural reform in an environment of financial market freedom while the economy is in an upswing is very likely to be re-elected.

Figure 2. Probability of re-election and the occurrence of reforms by financial freedom

Of course the consumption-smoothing and risk-sharing roles are not unique to financial markets. Social security can in principle also provide this. In fact, recent evidence shows that financial markets and automatic stabilisers can be alternative means to smooth output volatility (Debrun, Pisani-Ferry and Sapir, 2008) or to promote the acceptance of globalisation (Bertola, 2007). Thus, if well-designed, social security may be expected to strengthen and complement the role of financial markets in softening the resistance against structural reform. While there is little prima facie evidence that fiscal automatic stabilisers would play any role in making reformist governments more popular, the more sophisticated testing procedures reported in our paper do support this.

Conclusions

We think these findings are novel. To our knowledge - and surprisingly given the well-known quote by J-C Juncker – no attempt so far has been made to test empirically the impact of structural reforms on governments’ re-election. The few existing cross-country analyses on the determinants of re-election, such as Powell and Whitten (1993) and Brender and Drazen (2008) do not include structural reform among their explanatory variables. Our work tries to fill this gap.

To sum up, our paper suggests that – in addition to the well-known implications of well-functioning financial markets for the growth potential and the resilience of economies to shocks – there is also an indirect political economy benefit. Financial development, neglected so far, strengthens the constituency in favour of reforms, thereby boosting the electoral incentives for governments to make progress with structural reforms in product and labour markets. As such, reforms improving the functioning of financial markets play an important role in defying, and defeating, the "Juncker curse". This has important implications for any advice regarding the optimal packaging of reforms: as indicated by the Commission in its recent communication on EMU@10 (European Commission, 2008), upfront financial market reforms facilitate reforms in product and labour markets.

Note: The authors are affiliated with the European Commission. They write here in a personal capacity.

References

Bertola, G. (2007) "Finance and Welfare States in Globalizing Markets", in C. Kent and J. Lawson (eds.) The Structure and Resilience of the Financial System, Reserve Bank of Australia.

Brender, A and A. Drazen (2008) "How do Budget Deficits and Economic Growth Affect Re-election Prospects? Evidence from a Large Cross-section of Countries", mimeo, previously appeared as NBER Working Paper No. 11862.

Buti, M., A. Turrini, P. van den Noord and P. Biroli (2008), ‘Defying the 'Juncker Curse': Can Reformist Governments be Re-elected?’, European Economy – Economic Papers No. 324, European Commission.

Debrun, X., J. Pisani-Ferry, and A. Sapir (2008), "Government Size and Output Volatility: Should We Forsake Automatic Stabilization?", European Economy –Economic Papers No. 316, European Commission.

Duval, R. and J. Elmeskov (2005), "The Effects of EMU on Structural Reforms in Labour and Product Markets", OECD Economics Department Working Papers No. 438.

European Commission (2008), EMU@10: Successes and Challenges after 10 Years of Economic and Monetary Union, European Economy No. 6, Brussels.

Munkhammar, J. (2007), The Guide to Reform; How Policymakers Can Pursue Real Change, Achieve Great Results and Win Re-Election, Timbro/IEA, Stockholm.

Powell, G. and G. Whitten (1993), " A Cross-national Analysis of Economic Voting: Taking Account of the Political Context", American Journal of Political Science, 37, 391-414.

Seater, J. J. (1993), “Ricardian Equivalence,” Journal of Economic Literature, 31(1), 142-190.

The Economist (2007), "The Quest for Prosperity", March 15th.