Governments around the world try to level the information playing field among investors by regulating the disclosure of corporate information. But what is the cost of unequal access to information? In this column, we review evidence from the three most recent papers in this area.

Theoretical arguments for and against leveling the information playing field

On the one hand, uninformed investors may demand a return premium to invest in companies where they have an information disadvantage. This return premium compensates them for their expected losses from trading against informed investors in these companies’ stocks (Easley and O’Hara 2004). By raising companies’ cost of capital, information asymmetry could inhibit investment and hence long-run economic growth.

On the other hand, Hughes, Liu, and Liu (2007) argue that in a large market, uninformed investors can diversify away such information risk, rendering information asymmetry irrelevant for the cost of capital. Manne (1966) and Carlton and Fischel (1983) argue that allowing informed insiders to trade on their private information causes stock prices to more accurately reflect fundamental value, increasing welfare. Perhaps motivated by this latter view, insider trading was legal in most European countries in the early 1990s (Posen 1991).

Evidence from China

A key challenge in empirically identifying the effect of information asymmetry is that informed trading in a stock is usually hard to observe. In Choi, Jin, and Yan (2013), we overcome this challenge by using a unique dataset that contains the daily portfolio positions of a representative sample of all Shanghai Stock Exchange investors from 1996 to 2007. Due to the less developed state of Chinese legal institutions and regulations, there is likely to be greater variation in selective information leakage across Shanghai Stock Exchange companies than there is within developed markets, making information asymmetry effects on the cost of capital easier to detect.

Institutions have a large information advantage on average across stocks in the Shanghai Stock Exchange. In our data, we find that institutional buys subsequently outperform institutional sells by a large margin. Ranking stocks by aggregate net institutional purchases during the prior week, the top 20% return 15.5% more than the bottom 20% on a risk-adjusted annualised basis over the next week.

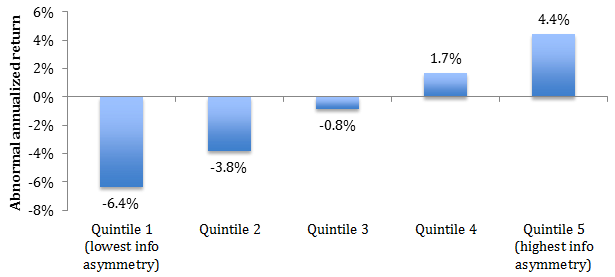

Figure 1. Average annualised abnormal returns by information asymmetry quintile

We then show that the aggressiveness with which institutions have traded in a given stock over the past year – measured by the average weekly absolute change in the percentage of the stock owned by institutions – positively predicts the strength of institutions’ future information advantage in that stock. Therefore, we sort stocks into quintiles at the end of each month by past-year institutional trading aggressiveness and measure the average returns of the quintile portfolios during the next month.

We find that average returns rise with information asymmetry. Figure 1 shows that after controlling for other known determinants of stock returns, the average return of stocks in the top quintile of predicted information asymmetry is 10.8% per year higher than that of stocks in the lowest quintile of predicted information asymmetry. In other words, investors charge a higher cost of capital to companies whose stock contains more information asymmetry.

Evidence from Finland

Berkman, Koch, and Westerholm (2013) use comprehensive daily stockholding from Finland and shows that trades made in the accounts of ten-year-old children or younger are unusually profitable. For example, on the day before major earnings announcements, children trade in the correct direction 57% of the time and outperform older investors by 1.1% over the next two days. On the day before takeover announcements, children trade in the correct direction 72% of the time and outperform by 12% over the next two days. The authors argue that these children’s guardians are unusually well informed and trade on their information within their children’s accounts.

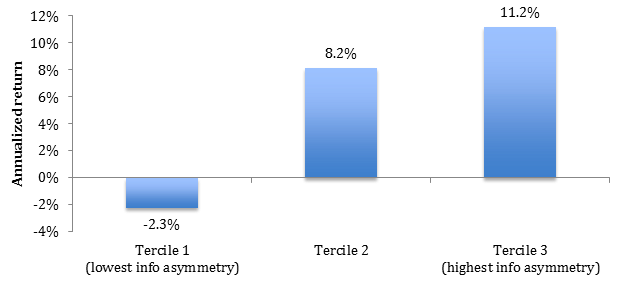

The authors then sort Finnish stocks by the percentage of trades in the previous three months that occurred through children’s accounts. Stocks with a higher percentage are stocks in which there is more information asymmetry. Figure 2 shows that from 1995 to 2010, the average return of stocks in the top tercile (i.e. third) of information asymmetry is 13.7% higher per year than the average return of stocks in the bottom tercile.

Figure 2. Average annualised returns by information asymmetry tercile

Evidence from the US

Unlike in China and Finland, comprehensive daily stock holdings data are not available for the US. Kelly and Ljunqvist (2012) overcome this inability to directly observe informed trading by using sell-side analyst coverage changes that are unrelated to the economic fundamentals of the covered companies.

The first set of unrelated changes they examine occurs when brokerage houses that cover an overlapping set of stocks merge and retain only one analyst per overlapping stock. A stock in the overlapping set therefore loses the publicly released reports of one analyst. The second set of unrelated changes occurs because two brokerage firms suffered heavy casualties in the 11 September 2001 terrorist attacks, forcing them to reduce coverage. The third set of coverage changes occurs when one brokerage firm that served retail clients acquired a brokerage firm that exclusively served institutions, which caused company research previously released only to institutional clients to become available to retail investors as well.

Kelly and Ljunqvist argue that analyst coverage of a company decreases information asymmetry; they show that bid-ask spreads, illiquidity, and return volatility around earnings announcements – which should be positively correlated with information asymmetry – increase following unrelated coverage terminations. They also show that earnings in the quarter following an unrelated termination are no different between companies that did and did not suffer an unrelated termination, suggesting that the coverage terminations they study are in fact unrelated to economic fundamentals.

Because there is no evidence that future company cash flows are affected by unrelated coverage changes, stock price decreases around unrelated coverage changes are equivalent to increases in the cost of capital. Kelly and Ljunqvist report that merger-induced coverage terminations cause a stock’s price to drop by about 2% and terminations induced by 9/11 cause a stock’s price to drop by about 0.6%. In contrast, merger-induced coverage initiations cause a stock’s price to increase by about 1%.

Conclusion

Across different countries and stages of economic development, evidence has accumulated that greater information asymmetry among active traders of a particular stock increases the company’s cost of capital. These findings suggest that there are societal benefits to levelling the information playing field across investors.

References

Berkman, Henk, Paul D Koch, and P Joakim Westerholm, 2013. “Informed trading through the accounts of children”, Journal of Finance, forthcoming .

Carlton, D, and D Fischel (1983), “The regulation of insider trading”, Stanford Law Review, 35, 857-95.

Choi, James J, Li Jin, and Hongjun Yan (2013), “Informed trading and expected returns”, NBER Working Paper.

Easley, David, and Maureen O’Hara (2004), “Information and the cost of capital.” Journal of Finance 59, 1553-1583.

Hughes, John S, Jing Liu, and Jun Liu (2007), “Information asymmetry, diversification, and cost of capital”, Accounting Review 82, 702-729.

Kelly, Bryan, and Alexander Ljungqvist (2012), “Testing asymmetric-information asset pricing models”, Review of Financial Studies 25, 1366-1413.

Manne, Henry (1966), Insider Trading and the Stock Market, New York, Free Press.

Posen, Norman (1991), International Securities Regulation, Boston, Little, Brown, and Company.