With the election of Donald Trump and the recent accusations of exchange rate manipulations, tariffs and exchange rates are back at the centre stage of policy debates. Three main implicit assumptions underlie these debates. First, tariff and exchange rate movements have a large impact on exports and therefore on growth. Second, these movements may counterbalance each other, and imposing a tariff of 10% would compensate for a supposed currency undervaluation of 10%. Finally, tariffs and exchange rates will affect exporters’ competitiveness and export performance in the same way as a change in production costs or production taxes and export prices would. For example, the border adjustment tax in the US is mostly discussed based on these types of assumptions, which imply that international trade elasticities are the same for exchange rates, tariffs, and export prices. Indeed, in standard trade models (such as Krugman 1979 or Eaton and Kortum 2002, see also Melitz 2003) these three elasticities have all the same value.

The value of international trade elasticities also matters for the calculation of gains from trade. Arkolakis et al. (2012) show that for a large class of trade models, the welfare effect from trade (the change in real income) depends on the change in the share of domestic expenditure and on the trade elasticity to variable trade costs. While measuring the share of domestic expenditures is an easy task (this is equal to one minus the import penetration ratio), there is no consensus on the value of the trade elasticity to trade costs. Moreover, the implicit assumption that trade elasticities to tariff and exchange rate are similar is empirically not validated. While the elasticity of export volumes to a change in tariffs is quite large (typically above 2), the aggregate elasticity to changes in the exchange rate is typically below 1. This is what Ruhl (2008) has dubbed the international elasticity puzzle. Empirical estimates of trade elasticities are therefore of crucial interest for both academics and policymakers.

There is also a missing elasticity in this debate, namely the elasticity of firm level exports to firm level export prices, which the literature has largely ignored. In a recent paper, we shed new light on this debate by putting firm-level export prices explicitly at the centre of the analysis of the international elasticity puzzle (Fontagné et al. 2017). Our results, based on French firm-level data, confirm that, when estimated at the firm level, the tariff elasticity is higher (around 2) than the exchange rate elasticity (less than 1). This is the standard international elasticity puzzle. We go further by showing that the export price elasticity is even larger (around 5) than both the tariff and the exchange rate elasticities. From this point of view, our results make the international elasticity puzzle even more puzzling. We also report a number of stylised facts on international trade elasticities which we believe should be of interest to both policymakers and academics.

The electricity price shocks and the export price elasticity

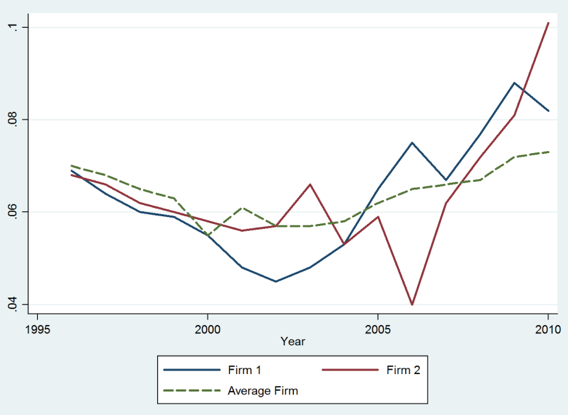

To estimate the elasticity of exports to export prices, we need an exogenous firm cost shock (affecting the export performance of the firm only through the export price). For this purpose, we use changes in the firm’s electricity prices as instruments for changes in export prices. A useful feature of electricity prices in France is its variance across firms and within a firm over time. In Figure 1, the dashed line is the average price of electricity paid by French firms between 1996 and 2010, while the continuous blue and red lines represent the price paid by two anonymous firms chosen to have a mean price and a standard deviation similar to the mean and the standard deviation of the overall sample. Although the overall trend is similar, annual variations in electricity prices are not synchronised across firms. Indeed, we show that this suggestive graph is representative of the French electricity market in the period 1996-2010. This market experienced deregulation pushed by the European Commission, but also transitory re-regulation by the French government that both affected French firms differently due in particular to the exogenous starting date of each firm-specific contract. Our identification strategy is based on electricity prices that vary at the firm level for reasons that are both endogenous to the firm’s activity (in particular, its average electricity use, which is then captured by firm fixed effects in our empirical strategy) and also exogenous to the firm’s export activity (regulation changes, year and length of beginning of contract, tax changes both at the national and local levels, location, changes in both market and regulated tariffs and local weather).

Figure 1. Electricity price (€/Kwh)

Note: The dashed line refers to the average firm, obtained by collapsing the dataset by year. Firms 1 and 2 are specific (anonymous) firms with means and standard deviations of electricity prices similar to the sample mean and standard deviation.

Source: Fontagné et al. (2017).

Two main results emerge from our estimation with export prices instrumented by firm-level electricity prices. The impact of electricity cost shocks on export prices is stable, suggesting that a 10% increase in the electricity price translated into a 0.4% increase in the export cost. This reaction is broadly consistent with the observed share of electricity costs in total costs. Second, using these shocks to the firms’ marginal costs, we estimate an export price elasticity of around 5.

The international elasticity puzzle augmented

The inclusion of tariffs and real exchange rates in the estimation does not alter our estimate of the export price elasticity, but we observe that the export price elasticity is systematically much larger than the elasticity for the tariff, which is itself larger than the elasticity for the exchange rate (respectively 1.9 and the 0.6). This is the reason why we conclude that the elasticity puzzle is worse than what the existing literature suggests.

The pass-through revisited

Including the (instrumented) export price in the export volume estimation is also key because this allows us to take into account firms’ reactions to shocks to tariff and exchange rates. If firms absorb in their export price part of these shocks, then existing estimates of the international elasticities that do not account for export prices are biased. We show that French firms, when faced with a 10% increase in tariff on their exports, decrease their export price by around 3.5%. Hence, the existing estimates are a mix of the true elasticity of exports to the increase in tariff on the one hand, and the elasticity of exports to the endogenous decrease in export price on the other hand. We show that in the case of tariffs (less so for exchange rates), the existing estimates of the international elasticity are therefore biased downwards. Based on our estimations, an increase in tariffs reduces export volumes via the elasticity of substitution effect (estimated as -1.77) but also induces a decrease in export prices (with elasticity -0.35) which per se increases exports (with elasticity 5.17) by the same order of magnitude (-0.35*-5.17=1.81). These two effects, in a standard estimation that excludes export price among covariates, cancel out and provide a strongly biased estimation of tariff elasticity.

We also have a new stylised fact to report. The exporter price is countercyclical. Exporters decrease their price when the destination country experiences an increase in GDP. This result is surprisingly robust across specifications. We show that a large part of the increase in exports towards countries with a boom comes from the decrease in export prices that comes on top of the standard demand effect. This robust stylised fact cannot be directly reconciled with existing trade models. Models with imperfect competition and variable mark-ups, such as Atkenson and Burstein (2008), could be good candidates to rationalise this fact because booming markets attract new firms that reduce market power of existing ones which then react by lowering their price.

References

Arkolakis, C, A Costinot and A Rodriguez-Clare (2012) “New Trade Models, Same Old Gains?”, American Economic Review 102(1): 94-130.

Atkeson, A and A Burstein (2008) “Trade costs, pricing to market, and international relative prices”, American Economic Review 98(5): 1998-2031.

Eaton, J and S Kortum (2002) “Technology, geography, and trade”, Econometrica 70(5): 1741-1779.

Fontagné, L, P Martin and G Orefice (2017) "The International Elasticity Puzzle Is Worse Than You Think", CEPR Discussion Paper 11855.

Krugman, P R (1979) "Increasing returns, monopolistic competition, and international trade," Journal of International Economics 9(4): 469-479.

Melitz, M J (2003) “The impact of trade on intra-industry reallocations and aggregate industry productivity”, Econometrica 71(6): 1695-1725.

Ruhl, K J (2008) “The International Elasticity Puzzle”, Working Paper 08-30, Leonard N. Stern School of Business, Department of Economics, New York University.