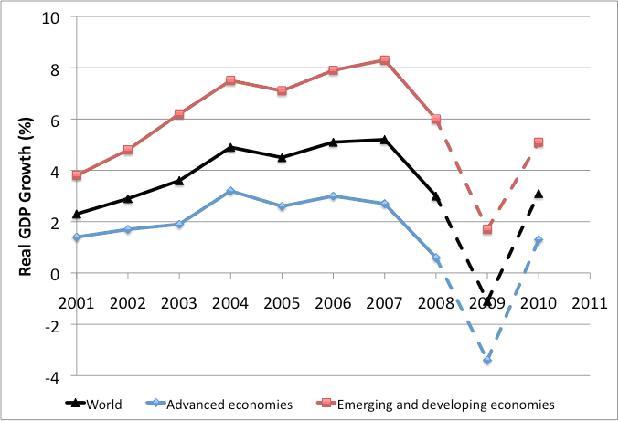

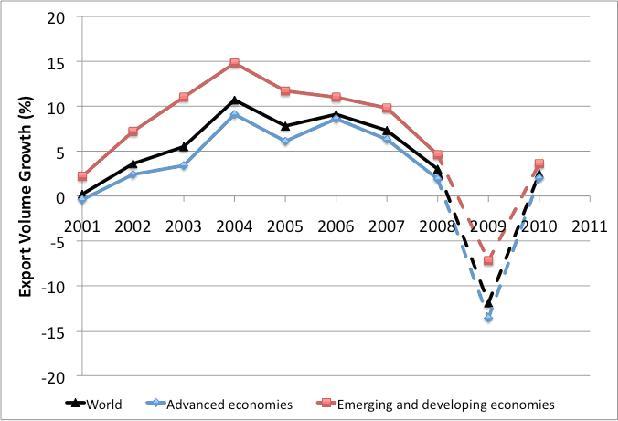

The world is in the midst of the most severe economic downturn in the post-war period. Two features of the current episode stand out. First, the recession is truly global, with virtually all economies in the world experiencing a marked deceleration in growth. Second, global trade has collapsed even more than overall economic activity (see Figure 1 and Eichengreen and O’Rourke 2009). How can we make sense of the behaviour of output and international trade flows during the current episode? Is the collapse in trade a conduit through which shocks are transmitted across borders? Or is it simply a by-product of the worldwide reduction in economic activity? More broadly, what is the role of goods trade in the international business cycle?

Figure 1. World GDP and exports

(a) World GDP growth

(b) World export growth

Source: IMF

Transmission vs. common shocks

The seminal paper by Frankel and Rose (1998) established what has become a well-known empirical regularity; country pairs that trade more with each other experience higher business cycle correlation (Figure 2). This finding has been confirmed in a series of subsequent studies (see, e.g. Fidrmuc 2004, Baxter and Kouparitsas 2005, Koo and Gruben 2006, Calderon, Chong and Stein 2007). The mechanisms underlying this relationship, by contrast, are still not well understood.

Figure 2. Business cycle co-movement and bilateral trade

Source: di Giovanni and Levchenko (2009).

In particular, ever since Frankel and Rose’s original contribution the debate has been about whether transmission or common shocks are responsible for business cycle co-movement between countries. Taken at face value, the Frankel and Rose result is about transmission. By emphasising the role of trade linkages, the authors in effect argue that shocks in one country – be it to demand or productivity – propagate to another country through trade.1

A competing hypothesis is that countries co-move simply because their shocks are correlated. An influential proponent of the common shock view is Imbs (2004). He argues that country pairs with a similar production structure exhibit greater business cycle synchronisation because individual industries are subject to common shocks. Therefore countries that have a similar industrial mix will be more synchronised. In its starkest form, the common shock view has no role for international trade. If industries are truly hit by common global technology or demand shocks, co-movement will occur even in the complete absence of trade (and therefore transmission).

It is evident that these two competing views deliver a very different economic interpretation of the joint evolution of global output and international trade in the current crisis.

- The transmission view puts the behaviour of cross-border trade front and centre in the global recession; some countries are experiencing output reductions simply because demand for their exports has collapsed.

- The common shocks view explains the collapse in international trade as a side effect of the global disturbance – the fact that all of the countries in the world have been hit by a shock at the same time.

What is troubling about this debate is that with country-level data, it is very difficult to sort out the relative importance of the transmission and common shock channels, or indeed estimate either one of them reliably. For instance, the positive relationship between overall bilateral trade and co-movement (Frankel and Rose 1998), or between intra-industry trade and co-movement (Fidrmuc 2004, Koo and Gruben 2006, Calderon et al. 2007) is not conclusive evidence of transmission, since it could be driven by the omitted common shocks. Countries that are close to each other have high levels of bilateral trade, but their production structure could also be more similar, or monetary policy more coordinated. In this case bilateral trade could be a proxy for greater common shocks rather than transmission.

New evidence on transmission using disaggregated data

In a recent paper (di Giovanni and Levchenko 2009), we use industry-level data on production and trade to examine the channels through which international trade affects aggregate co-movement. The use of sector-level data has two key advantages.

- First, by examining what happens across sectors within the same country pair, we can control for aggregate common shocks that plague the interpretation of results based on cross-country data and provide much more robust evidence of transmission.

- Second, using sector-level data, we investigate whether vertical production linkages across industries can help explain the impact of international trade on co-movement.

To measure the extent of vertical linkages, we use input-output matrices to gauge the intensity with which individual sectors use each other as intermediate inputs in production. We then condition the impact of bilateral trade on the strength of input-output linkages between each pair of sectors. This provides additional evidence of transmission, by focusing on a particular identifiable channel, i.e. the use of imported intermediate inputs in production.

Our examination of data covering 55 countries and 28 manufacturing sectors yields two main findings.

- First, the Frankel-Rose effect is present at the sector level; sector pairs that experience more bilateral trade exhibit stronger co-movement.

- Second, a given increase in bilateral trade leads to higher co-movement in sector pairs that use each other heavily as intermediate inputs.

That is, bilateral trade is more important in generating co-movement in sectors characterised by greater vertical production linkages. It turns out that vertical linkages alone explain some 30% of the overall impact of bilateral trade on aggregate co-movement in our sample of countries.

By using industry-level data and the structure of input-output linkages between sectors, our work provides strong evidence for the role of trade in the transmission of shocks across borders. Indeed, vertical production linkages appear to matter in the current crisis as well. Levchenko, Lewis, and Tesar (2009) analyse the collapse in US trade flows using disaggregated data and find that US imports fell systematically more in sectors that are used intensively as intermediate inputs in other sectors. This evidence suggests that transmission of shocks through international trade is an important feature of the current global slowdown.

Policy implications

What are the policy implications of our findings? The presence of transmission makes coordination of fiscal policy more important. Fiscal stimulus in one country will have positive spillovers on other countries through trade linkages. This will not in general be internalised by the domestic policymakers, resulting in too little stimulus, or, worse yet, in attempts to curb the positive cross-border spillovers through restrictions that the funds cannot be spent on foreign goods. Better coordination of fiscal policy, especially in closely integrated regions such as the EU or North America, would increase its efficacy.

Footnotes

1 Indeed, transmission is at the heart of the theoretical and quantitative literature on international business cycles (see, among many others, Backus, Kehoe and Kydland 1995, Kose and Yi 2006, and Burstein, Kurz, and Tesar 2008).

2 This is not the only mechanism through which common shocks can be rationalised. Monetary policy coordination would be another example.

References

Backus, David K., Patrick J. Kehoe, and Finn E. Kydland (1995), “International Business Cycles: Theory and Evidence,” in Thomas Cooley, ed., Frontiers of Business Cycle Research, Princeton: Princeton University Press, pp. 331–356.

Baxter, Marianne and Michael A. Kouparitsas (2005), “Determinants of Business Cycle Co-movement: A Robust Analysis,” Journal of Monetary Economics, 52 (1), 113–57.

Burstein, Ariel, Christopher Kurz, and Linda L. Tesar (2008), “Trade, Production Sharing, and the International Transmission of Business Cycles,” Journal of Monetary Economics, 55, 775–795.

Calderon, Cesar, Alberto Chong, and Ernesto Stein (2007), “Trade Intensity and Business Cycle Synchronization: Are Developing Countries any Different?,” Journal of International Economics, 71 (1), 2–21.

di Giovanni, Julian and Andrei A. Levchenko (2009), “Putting the Parts Together: Trade, Vertical Linkages, and Business Cycle Co-movement,” IMF Working Paper 09/181, July, forthcoming in American Economic Journal: Macroeconomics.

Eichengreen B. and K. H. O’Rourke (2009). “A Tale of Two Depressions”. VoxEU.org, 6 April.

Fidrmuc, Jarko (2004), “The Endogeneity of the Optimum Currency Area Criteria, Intra-Industry Trade, and EMU Enlargement,” Contemporary Economic Policy, 22 (1), 1–12.

Frankel, Jeffrey A. and Andrew K. Rose (1998), “The Endogeneity of the Optimum Currency Area Criteria,” Economic Journal, 108 (449), 1009–25.

Imbs, Jean (2004), “Trade, Finance, Specialization, and Synchronization,” Review of Economics and Statistics, 86 (3), 723–34.

Koo, Jahyeong and William C. Gruben (2006), “Intra-Industry Trade, Inter-Industry Trade and Business Cycle Synchronization,” mimeo, Federal Reserve Bank of Dallas.

Kose, M. Ayhan and Kei-Mu Yi (2006), “Can the Standard International Business Cycle Model Explain the Relation Between Trade and Co-movement?,” Journal of International Economics, 68 (2), 267–95.

Levchenko, Andrei A., Logan Lewis, and Linda L. Tesar (2009), “The Collapse of International Trade During the 2008-2009 Crisis: In Search of the Smoking Gun,” October, RSIE Discussion Paper 592.