A spectre is haunting Europe – the spectre of the euro. In the wake of the European elections of 25 May, the debate on the pros and cons of the euro – in Italy and throughout the Eurozone – are dominated by partisan politics. The empirical evidence is often distorted to suit one’s need.

- For some, the euro must be defended at all costs as the only anchor that prevents peripheral countries, notably Italy, from drifting into default.

- For others, it is the cause of all evils, most notably de-industrialisation and unemployment.

The question economists must answer is: did Italy benefit or lose from the euro?

The counterfactual problem

Answering this question is difficult, for technical reasons. In macroeconomics, we typically lack a credible counterfactual – what would have happened had Italy not joined the euro. Thus, it is very hard to evaluate the effects of a policy choice. Antonio Fatas (2012), in his post on “The Euro Counterfactual”, discusses how pro- and anti-euro factions cleverly pick examples, comparing peggers and floaters, so as to support their thesis.

- The euro-enthusiasts will compare the successful stabilisation of Ireland, to the disastrous devaluation of Thailand.

- Euro-sceptics will compare the rise in the unemployment rate in Spain to the comparatively modest recession in the UK.

In order to avoid such arbitrariness, we try to let the data speak for themselves, with as little as possible interference from our opinions.

In order to do so, we use a statistical tool called 'synthetic control'.1 This starts from a group of potential 'control' countries which have not joined the euro, and constructs a thereof combination that best mimics the performance of the Italian economy before the entry in to the euro.

This synthetic control can be used to simulate what would have happened after the euro, had Italy not joined the single currency. For every economic variable of interest, say inflation, the algorithm constructs a weighted average of inflation rates of non-euro countries, with weights chosen so as to best mimic the Italian rate before the start of the euro. The difference between Italy’s and its synthetic control’s rates after the start of the euro shows how (something similar to) Italy would have behaved, had Italy not joined the euro.

As a starting date, we have considered 1 January 1999 (when exchange rates were irrevocably fixed), and, to check the robustness of the results, 1 January 2002 (the circulation date); the results are not affected by this choice. Our control countries belong to two groups: EU member states that have kept their national currencies, namely Bulgaria, Croatia, Denmark, Lithuania, Poland, the UK, Czech Republic, Romania, Sweden and Hungary; and non-European members of the OECD, namely Australia, Canada, Chile, South Korea, Japan, Switzerland, Iceland, Israel, Mexico, New Zealand, the US and Turkey. Obviously, we have left out euro-member countries, those countries that have joined from the start, as well as subsequent entrants.

There are many potential caveats to this exercise.

- First, the results may be affected by “contagion effects”, if for example the new currency also affects control countries which did not adopt the euro.

- Second, Italy and the control group may be differentially hit by shocks that are contemporaneous with the introduction of the euro, and whose effects may be erroneously attributed to the euro ('confounding effects').

Although the statistical model accounts for time-varying unobservable heterogeneity across countries, some caution is required in interpreting the results because of the small sample.

- Third, the exercise gradually loses its reliability as time moves further away from the entry date, since the likelihood of shocks of different nature increases.

- Finally, there may be 'anticipation effects', so that the consequences of the euro arise before the introduction of the single currency itself. Think for example of government bond yields that fall in anticipation of the elimination of depreciation risk.

Nonetheless, we believe that our exercise dominates the widespread 'cherry-picking' of potential counterfactuals in the political debate. We carry out this exercise on five variables which are at the centre of such a debate: international trade, inflation, the long-term interest rate on public debt, labour productivity and real per-capita GDP. In the following applications the solid line always describes the actual Italian variable, whereas the dotted line represents the counterfactual simulation (that is, the synthetic control).

International trade

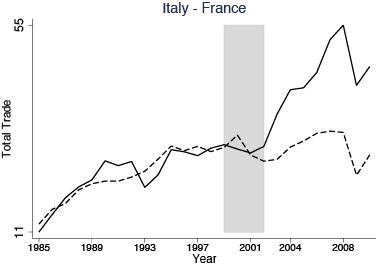

One of the euro’s original purposes was to foster trade integration by reducing transaction costs and eliminating the exchange rate risk. Here we focus on the effect of the single currency on Italian trade flows.2 First we look at bilateral trade flows (the value of exports and imports) between Italy and other countries. Figure 1 shows some of the main trade flows.

Figure 1 Bilateral trade flows

The bilateral flows between Italy and the other European countries have all increased, compared to the counterfactual, with the exception of the Italian trade with the UK.3

The estimated effect of the euro on trade between Italy and all its Eurozone partners, relative to the control group, is large (+38%). Moreover, this 'trade creation' effect was not compensated by a 'trade diversion effect', coming at the expense of trade with non-euro members. Both total exports and imports relative to GDP rose relatively to the synthetic control. On average, we calculate that each year following the euro entry, Italian exports and imports have exceeded those of the synthetic control by 0.5% and 2%, respectively. The fact that the rise in imports was larger than that of exports could likely be due the Italian loss of competitiveness, see Manasse (2013) in a context where high unit costs of Italian firms could no longer be offset by competitive devaluations. Overall, entering the euro, Italy’s trade increased. In this respect the single currency held up to its promise.

Inflation

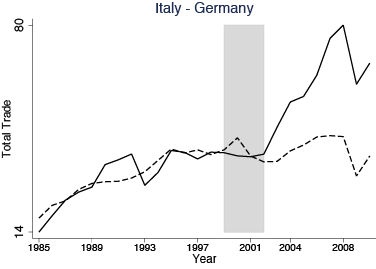

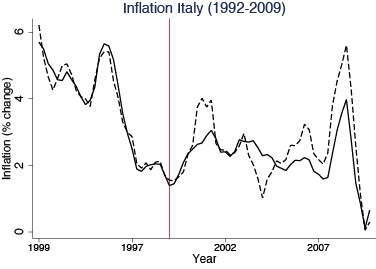

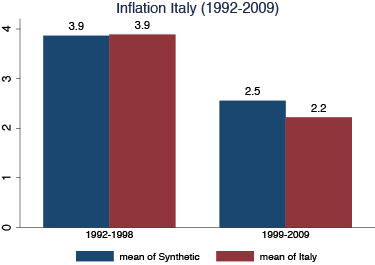

The primary objective behind Italy’s entry in the euro entrance was to control inflation. 'Monetary sovereignty' had been badly misused in the previous decades resulting in long periods of two-digit inflation. Yet, the changeover from the lira to the euro was perceived by the general public to have resulted in a large jump of the price level. Figure 2 shows the comparison between CPI inflation for Italy and for the synthetic control.

Figure 2 CPI inflation (1991-2009)

Note: Counterfactuals: Australia (.295), Canada, Chile (.218), Denmark, Iceland, Israel, Japan, Korea (.009), Mexico (.010), New Zealand (.192), Norway, Sweden (.136), Switzerland (.132), Turkey, United Kingdom, United States.

The graph shows that there was no jump in inflation after 1999. Rather, the euro has resulted in a reduction in Italy’s inflation vis-à-vis its synthetic control, albeit a temporary one. In the period 1999-2009 the cumulated fall in inflation attributable to the euro is 3% (0.3% per year), although a large part of the effect is concentrated in the period of 'irrevocably fixed' exchange rates which preceded the introduction of the euro. Also inflation volatility (not shown) has decreased considerably as a consequence of the euro.

Yet, this estimate is likely to be affected by contagion: if other European countries in the control group, such as Denmark and Sweden who pegged their currencies to the euro, also benefited from the euro by experiencing lower inflation through lower import prices (contagion), the previous calculation would underestimate the fall in inflation attributable to the euro. Thus we have repeated the exercise by considering only non-European countries in the control group, and indeed we find that the cumulative reduction of inflation attributable to the euro almost doubles, rising from 0.3% to 0.7% per year in the decade 1999-2009. Contrary to euro-sceptics’ claims, the euro has definitely curbed Italian inflation.

Government bond yields

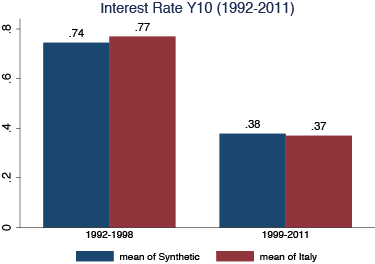

One of the recurrent arguments of euro-enthusiasts is that the euro has greatly reduced Italian interest rates on public debt. In the analysis we have used the interest yield on ten-year maturity government bonds (similar results, available in the original report in Italian, hold for three years bills and for different definitions of interest rates). Figure 3 shows the ten-year Italian government bond yield, together with its synthetic control, which here includes both European and non-European countries (interest rate are normalised to 1 at the beginning of the period so as to improve the control’s fit in the pre-euro sample).

Figure 3 10-year government bond yield (all counterfactuals)

Note: Counterfactuals: Australia, New Zealand, Sweden, Switzerland (.333), United Kingdom, United States, Denmark (.156), Japan (.51).

We see that both interest rates in Italy and in the control start to fall in the mid-90s. The Italian rate plunges below that of the control group around 1996, well in advance of the start of the euro, possibly reflecting an anticipation effect due to the elimination of the Lira-DM exchange rate depreciation risk. The reduction in the Italian ten-year yield, relative to the control group, that is attributable to the euro amounts here to a mere 2%, which applied to an average Italian interest rate of about 4.5 percentage points in the post euro period, gives a reduction of only nine basis points per year (=4.5/0.98 -4.5) during 1999-2011.

Yet, the above estimate is likely to be distorted downwards by two factors. The first is that it includes the years of the European debt crisis, 2008-2011, when the euro failed to protect problem countries such as Italy from speculative attacks, and depreciation risk was back into asset prices (Manasse and Zavalloni 2013). The second is a contagion effect. The control group chosen by the algorithm includes countries such as Denmark, Sweden and Switzerland (in addition to the UK) which, by pegging to the euro, may have obtained the benefits of low interest rates, without formally joining the euro. Considering only non-Europeans in the control group and excluding the post-2007 years, the interest saving becomes much larger, 158 points per year, which applied to the average outstanding Italian government debt between 1999 and 2007 amounts to interest savings of 22.5 billion euro. This is a considerable amount, albeit one which is an order of magnitude smaller than that usually boasted by euro-enthusiasts.

Labour productivity

It is interesting to look at the dynamics of labour productivity, expressed as GDP per hour worked (base year=2005, source: OECD). Figure 4 shows that the Italian index of labour productivity slows down in the mid-nineties, and comes to a grind after the introduction of the euro, whilst that of the synthetic control (here including UK, Turkey, Denmark, and Israel) continues to rise.

Figure 4 Labour productivity

There are several interpretations of this slowdown.

- First, some “confounding factors” may be at play. The labour market reforms of the mid-1990s, which fostered temporary jobs in Italy, may have subsequently curbed labour productivity by reducing firms’ incentive to invest in human capital.

- Alternatively, as competitive devaluations ceased with the euro, a rise in the relative price of non-tradable relative to tradable goods may have transferred resources from the more competitive and productive tradable sector to the protected and less productive non-tradable sector.

Yet this explanation is not consistent with the result that Italian trade rose as a result of the euro. We favour the interpretation that the euro, fostering higher trade integration and preventing competitive devaluations, left no easy way to raise competitiveness other than implementing structural reforms, which Italy did not implement. These interpretations are not mutually exclusive and deserve more careful investigation.

Per-capita GDP: Italy and Germany

Sometimes euro-sceptics tend to caricature the euro as an ordeal that northern European countries (e.g. Germany) have conceived to exploit the poorer south. But did Italy’s per capita GDP lose out to Germany’s with the introduction of the euro? Figure 5 compares Italy’s real per capita GDP to that of its synthetic control (here a weighted combination of Sweden, Turkey and the UK).

Figure 5 GDP Italy and Germany

As the graph shows, the euro has a small negative effect on Italian per capita GDP, which in the period 1999-2011 shows a cumulated loss of 3.7 percentage points relative to the counterfactual. Repeating the same exercise for Germany (whose synthetic control is primarily composed by Switzerland, Denmark, and Japan) shows that German per-capita GDP stays consistently below that of its counterfactual, resulting in a cumulated loss of 7.4 percentage points. Thus, either the claims that Italy enormously benefited or was hugely damaged by the euro, or the claim that Germany hugely benefitted from the euro at the expenses of Italy, clearly belong to the myth category.

In conclusion, our analysis shows that many of the arguments used in the political debate on the euro on both sides are either not supported by the evidence (e.g. the euro in fact has reduced inflation, fostered trade, and hurt German per-capita GDP much more than Italy’s) or exaggerated (Italian interest rates did fall as a consequence of the euro, but interest savings were not so huge).

Authors' note: This column is a revised version of a report for Link Tank, think tank of the Italian newspaper Linkiesta.it. The full report (in Italian) can be downloaded here: http://www.linkiesta.it/effetti-euro-italia.

References

Abadie, Diamond, Hainmueller (2010), “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program”, Journal of the American Statistical Association 105(490).

Billmeier, and T Nannicini (2013), “Assessing Economic Liberalization Episodes: A Synthetic Control Approach”, Review of Economics and Statistics 95(3).

Manasse, P (2013), "The roots of the Italian stagnation", VoxEU.org, 19 June.

Manasse, P and L Zavalloni (2013), "Sovereign Contagion in Europe: Evidence from the CDS Market", DSE Working Paper n 863.

Saia, A (2013), “Choosing the Open Sea: The Cost to the UK of Staying Out of the euro”, mimeo, University of Bologna.

(1) For more information on the methodology of synthetic controls, see Abadie et al. (2010). See also Billmeier and Nannicini (2013).

(2) This part of this analysis is based on Saia (2013).

(3) There a large heterogeneity in the bilateral flows: those with Austria and the Netherlands exhibits the highest rise (49% and 47%, respectively). Trade between Italy and Germany and Italy and France has grown substantially, by 38% and 37% respectively, as a result of the euro. Similarly, trade with Spain has increased by 30%, whereas the effect for the Italian-Portuguese flow is positive but smaller (17%).