No one blames international trade in goods and services, supply chains and outsourcing, and migration for getting the world economy into its current state, but that doesn't mean that any profound policy shift away from open borders won't have systemic consequences. In the short- to medium-term such reversal could affect the depth of the recession and the speed of any eventual recovery. Over the longer term it may influence the future viability of export-led development strategies and jeopardize the potential for international trade cooperation for decades to come.

There is a lot at stake here, thus my purpose in this piece is to tackle head-on any complacency and describe several government policies which could form the basis of a package of measures adopted by G20 and other national governments.

Stimulating debate

As the goal is to stimulate debate on this webpage, my emphasis is on policy options rather than recommendations. Contributors to this webpage should not feel so constrained! Constraints on open-market policies vary radically across nations, so appropriate policy recommendations will naturally be diverse.

Four perspectives that lead to complacency

Some policymakers and analysts, even those well-versed in trade, seem to be taking a nonchalant view towards international commerce in the current severe global downturn. Why?

· Some reckon the lessons of the 1930s − when trade restrictions deepened the Great Depression − are well-known and that protectionism won't regain its hold.

· Paradoxically, others are more jaded about political leaders, and believe the latter will take mercantilist steps to promote exports and discriminate against foreign commerce, irrespective of any commitments made in trade accords, including the WTO "binding" agreements.

· Meanwhile, after the machinations of the Doha Round negotiations (launched in 2001 and still nowhere near finished) with its adverse impact on the credibility of trade negotiators, trade ministers, and the WTO, others are sceptical that even if government leaders knew the right thing to do, they couldn't get their acts together.

· Finally, some (typically generalists) in government reckon commercial policy is easy to fathom, unlike the complexities of international finance where expert advice is frequently sought, and so they believe there is little need for new policy thinking.

Unwise to take open markets for granted

Discussions of the possible steps to keep borders open during these troubled times need to take account of these 4 perspectives. In what follows, I draw upon very recent evidence to address some of these points, and I make the case that it is unwise to take the relatively open world trading system for granted.

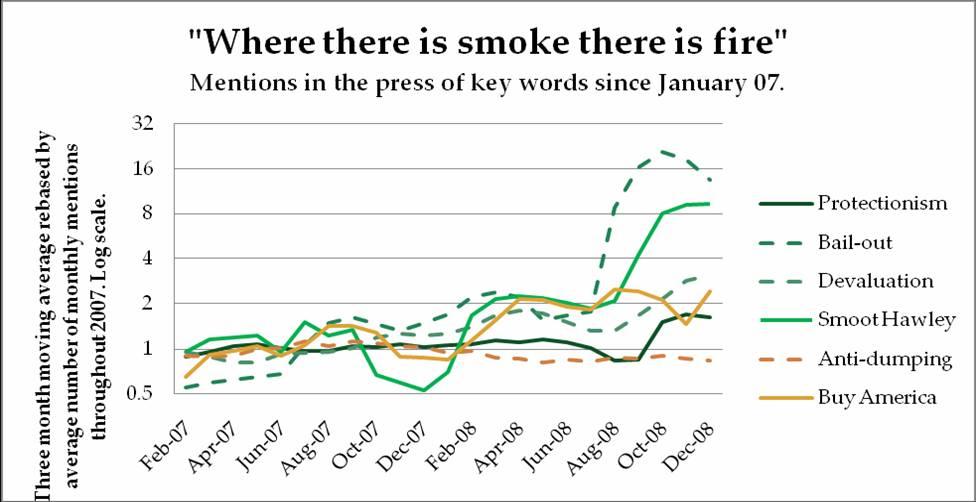

Fortunately, to date, no major trading nation has raised trade barriers across the board. Still, this has not prevented slews of unfair trade cases, reductions in export taxes and taxes on imported intermediate goods, and outright tariff increases from happening in certain sectors. No doubt these steps plus the souring mood accounts for the alarming rise in the frequency with which terms associated with protectionism are being reported in the world's newspapers. As shown in Figure 1, mentions of the infamous 1930s Smoot Hawley tariff were eight times as frequent in the last quarter of 2008 than in 2007. Mentions of devaluation, bailouts, "Buy America" measures, and protectionism are all up. While not every such mention relates to a protectionist act, collectively the world's journalists are reporting a clear shift in discussions on commercial policy away from the era of globalization and open borders that we have become accustomed to.

Figure 1

Protection in many wondrous forms

Discrimination against foreign commerce can take many forms. Malaysia, for example, just instructed its firms to layoff foreign nationals first.1 This is a big concern for the 300,000 Indonesians working in Malaysian factories, especially as recent estimates suggest a third of them will be fired soon. Migrant workers, such as these, sent home collectively $251 billion in remittances in 2007, which financed much consumption of essentials and investment in the world's poorer nations. Greater flows of people, parts, components, and investments across borders have substantially expanded the ways governments can discriminate against foreign commerce and its adverse impact. The knock-on effects are much more complex than in the postwar world of tariffs and quotas. Plus governments can be very good at disguising protectionist measures as benign domestic policy changes, such as altering health and safety standards to deliberately impose higher compliance costs on foreign than domestic firms.

Another cause of concern is that national living standards are dependent increasingly on sales in foreign markets, whether it is directly through exports, or indirectly through supply chains and subsidiaries established overseas. The latest annual report of the US Council of Economic Advisers stated that in 2006 20% of US manufacturing jobs were generated directly and indirectly by exports. Moreover, US exporting firms have per worker productivity levels a quarter higher than firms that do not engage in international trade and they pay their workers 13% to 18% more. Given most other economies are far more export dependent than the US, the contribution of exports to national living standards around the globe is substantial.

In addition, while experts still debate the finer points of East Asia’s emergence, almost every account points to the importance of export-led growth. Today, sophisticated supply chains organize production and sometimes product-design processes throughout East Asia, with the goal of ultimately shipping goods to North America, Western Europe, and Japan. The current crisis has been brutal on international supply chains, such as those operating in clothing and apparel. The number of apparel suppliers filing shipping manifests to US Customs fell from 22,100 in July 2008 to 6,260 in October 2008, a 70% fall. About 40% of the 70,000 foreign apparel suppliers tracked by one company, have seen a 75% or more year-on-year drop in export volume to the US.2 This is particularly worrying as many suppliers establish their credentials in the fourth quarter of each year in the rush up to Christmas.3

What affects exports soon affects jobs

The Chinese Ministry of Human Resources and Social Security reports that, by the end of November 2008, nearly 5 million jobless migrant workers had returned home, raising the total number of migrants out of work to over 10 million. One advisor to the Chinese State Council (cabinet) said that 670,000 firms had closed in 2008 because of the financial crisis and that nearly 7 million jobs had been lost. One in eight recent graduates, or roughly 1.5 million young professionals, were expected to be without jobs at the end of 2008.4

But rising unemployment is not confined to China. Indonesian business associations estimate that 1.5 million jobs will be lost in 2009,5 while the Federation of Indian Export Organisations estimated that up to 10 million jobs could be lost in the first quarter of 2009 in its labour-intensive export industries.6 Fears have been expressed in both Beijing and New Delhi that rising jobless will lead to social unrest.

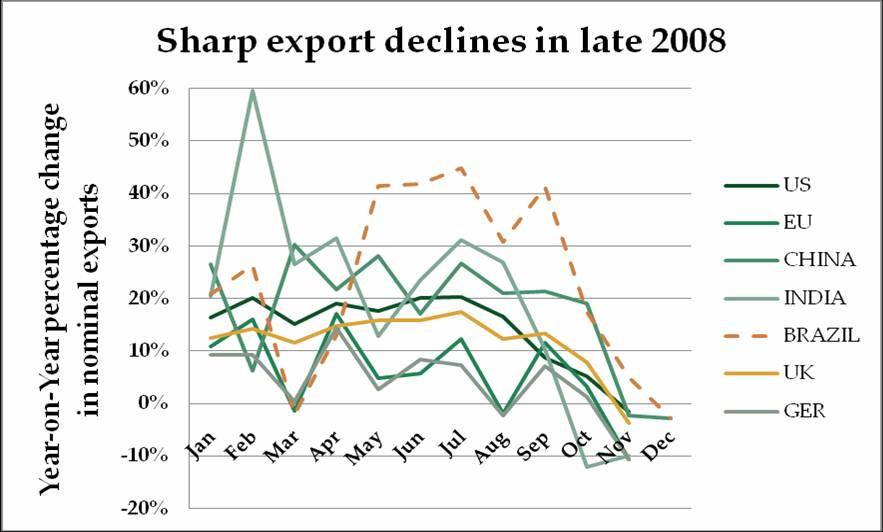

All in all, the sharp downturn in exports witnessed in the latter part of 2008 and confirmed in recent press reports and Figure 2 below is a source of major concern. This is so not just because of the immediate contractionary effect of falling exports but also because it calls into question the viability of a path to development that some say has lifted a billion people out of poverty.

Figure 2

Worse is still to come

The last quarter of 2008 may have been awful, but most commentators expect economic performance to deteriorate during the first half of 2009. Given that the bank bail-outs of last October and November have not restored lending to the private sector, firms now find themselves under enormous pressure to conserve cash and reduce outlays, which will inevitably push up unemployment. Those governments that can afford to do so − and it is worth remembering that many emerging market governments cannot − are effectively lending money to the private sector directly.

All manner of bail-outs have been announced. Leaving aside financing worries addressed by these moves for the moment, concerns have been raised about the eligibility for and strings attached to financial support and whether these bailouts tend to discriminate against foreign firms. So concerned was The Financial Times about this matter that yesterday it called for an international accord on state support for business during the downturn.7

The sheer scale of the fiscal stimuli and bail-outs being offered has also raised questions as to whether they will be voluntarily financed by private investors, even those governments with excellent credit ratings. On their current plans governments may issue over 3 trillion dollars in debt in 2009 – three times the 2008 total.8 Nasty questions will arise should governments find their funding plans dashed, because the alternative means for helping national firms tend to have a beggar-thy-neighbour aspect to them: deliberate currency devaluation, imposing tariff and non-tariff barriers, and resorting to the many loopholes in WTO agreements.

Government spending with protectionist slant

If financing isn't a problem, questions will arise inevitably as to whether the vast numbers of new government contracts are being deliberately funnelled away from foreign firms, including the subsidiaries of foreign firms.

All this adds to the potential for some pretty unpleasant international trade disputes. Indeed, 2009 may well be the year when the apparent consensus in favour of open borders faces its greatest test. The temptation to turn inwards will surely be greater than at any time in the recent past.

Keeping borders open: Some policy options

The fear that parochial concerns might trump longstanding commitments to open borders and the worrying parallels to the 1930s have motivated some policy makers and analysts to warn not only of the perils of protectionism but also to call for international initiatives to stop the clock from being turned back. Indeed, concerns about resurgent protectionism were mentioned in the communiqué of the G20 leaders at the November 2008 summit.

A number of collective measures were spelled out in an e-book with contributions from over 15 leading trade analysts that Richard Baldwin and I edited and circulated last December. 9 The reaction to that book and subsequent debate has identified a number of policy options, which participants in this dialogue may wish to evaluate, dismiss, or add to. Before enumerating those options, it may be worth reflecting on what the ultimate goal of any G20-led international initiative might be.

Seeking to prevent any discrimination against international commerce will no doubt be appealing to some. But do more pragmatic considerations lead to different goals for G20 initiatives, such as limiting the form of protectionism imposed, limiting the conditions under which such measures are taken, or constraining the time they are in place? Or should the G20 focus on improving the transparency of government decision-making or assuring procedural safeguards? Should the G20 mandate consultation mechanisms with trading partners be established and employed before any trade measures are imposed, as is the case in many free trade agreements? Commentators may want to opine on the "why's" as well as the "what's" of any future G20 trade initiative.

Thoughts on the merits of and ways to implement the following policy options could also inform policymaking in the run up to the G20 summit in April. These options are not necessarily mutually exclusive and some may feel that they can be coherently packaged together. Others may feel the tensions between them make certain options incompatible with one another.

1. Some have proposed that a surveillance mechanism be established to quickly identify any trade measure taken by governments, whether or not they are consistent with WTO accords. Given the lousy track record of governments reporting to the WTO the more sensitive aspects of their trade policies, questions arise as to which body or bodies have the capability to undertake this surveillance function. It may be the case, as some contend, that its current mandate allows the WTO to undertake this function, but is that the end of the matter?

2. Others have argued that governments’ commitment to open borders could take the form of a collective pledge to a standstill on imposing certain, specified trade measures for the duration of the global economic downturn. Given the many forms that protectionism can take, an immediate question arises as to what state measures will be restricted for the duration of the downturn. Plus, acceptability may require that any standstill be balanced across trading partners10 – i.e., that it imposes a comparable degree of restraint on all trading partners. This might involve developing countries committing not to raise their tariffs on manufactured goods while industrial countries commit not expand payments to farmers. What constitutes "balance" and are there different formulas that assure "balance"? Plus, what legal form would any standstill take and how would it be enforced?

3. An initiative to limit the potential for discrimination in the application of financial support − or bailouts − from governments to firms has been mentioned before. To use European parlance, could collective action to limit the use of state aids during the economic downturn be desirable, or indeed part of, a standstill? What would this involve?

4. Bearing in mind that, in many jurisdictions, government procurement policies are not very open to international competition, what steps can be taken to ensure that the large stimulus packages don't erode what little room there is for foreign bidders for state contracts? Can the avowed desire of governments to move fast in implementing spending increases be reconciled practical measures to keep state contracts open to a modicum of international competition? Is the case for such competition, on value for money grounds or bang-for-the-buck, greater during a downturn?

5. Taking steps to reduce the red tape that can bedevil international trade might offer another tangible way to demonstrate a commitment to open markets. In this regard some have argued that the well-advanced WTO negotiations on trade facilitation be completed and implemented immediately, with financial support provided to developing countries facing difficulties. Since any such WTO accord will likely require more reforms by developing countries than by industrialized countries, should the latter take additional steps (such as accelerating the implementation of duty-free quota-free market access for LDCs) to equalize contributions to such an initiative?

6. Some have also argued that the best possible expression of the world's collective desire to retain and further open borders is to complete the Doha Round negotiations. Given the potential for substantial backsliding by both developing and industrialized countries – backsliding that is all the more tempting in a recession – ironically the appeal of completing the Doha Round may have grown as the downturn has worsened. But is it feasible − especially given the considerable bad blood and missed deadlines experience since this round of negotiations was launched in 2001?

The merit of having a global debate on the global crisis is that commentators from around the globe can bring their perspectives on what will work best where and what the various options will mean for different regions and nations. Over to you.

Normal

0

false

false

false

MicrosoftInternetExplorer4

/*-->*/

/*-->*/

/*-->*/

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:"Table Normal";

mso-style-parent:"";

font-size:10.0pt;"Times New Roman";

mso-fareast-"Times New Roman";}

Editors' note: This column is a Lead Commentary on Vox's Global Crisis Debate page; see further discussion on Vox’s “Global Crisis Debate” page.

Footnotes:

1. "Malaysia bans foreign hiring for factories, stores," Associated Press. 22 January 2009.

2. "Suppliers to clothing trade in US fall by 70%". Financial Times. 10 December 2008; "Factory Evaluator Panjiva Readies Home Rankings," Home Textiles Today, 15 December 2008.

3. Recently actual data for container traffic dealt with by US reports confirmed an actual decline in US trade volumes in November 2008 and a further estimated month-on-month fall in December 2008. See "2008 Retail Container Traffic Markets Lowest Level in Four Years," States News Service, 9 January 2009.

4. "Millions Face Job Losses in Asia." Asian News Desk. 22 December 2008.

5. "Millions Face Job Losses in Asia." Asian News Desk. 22 December 2008.

6. "Indian business warns on loss of 10m jobs," Financial Times, 7 January 2009.

7. "Not a time for a one-man band. A global financial crisis requires global co-operation." Financial Times, 22 January 2009.

8. "Confident tone as UK debt sale nears," Financial Times, 22 January 2009.

9. "What should leaders do to halt the spread of protectionism?" Soon after the publication of this book Richard Baldwin and I offered some thoughts on "Restoring the G20's credibility on trade: Plan B and the WTO trade talks," which generated a number of comments.

10. See, in particular, the contents of a letter by the Indian Ambassador to the WTO in The Financial Times, "Standstill must avoid unequal burden on countries," 12 January 2009.