Production segmentation across national borders has become an important feature of the world economy. With the rapid increase in intermediate trade flows, trade economists and policymakers have reached a near consensus that official trade statistics based on gross terms are deficient, often hiding the extent of global value chains. There is also widespread recognition among the official international statistics agencies that fragmentation of global production requires a new approach to measure trade, in particular the need to measure trade in value-added. This led the WTO and the OECD to launch a joint “Measuring Trade in Value-Added” initiative on 15 March 2012, which is designed to mainstream the production of trade in value-added statistics and make them a permanent part of the statistical landscape. A collection of papers in the volume edited by Mattoo, Wang, and Wei (2013) represents some of the latest thinking on the subject from both the scholarly community and international institutions such as the WTO, the OECD, the IMF, and the World Bank.

Leontief’s insight and method to estimate trade in value-added

All the estimation methods used in recent efforts to measure trade in value-added are rooted in Leontief (1936). His work demonstrated that the amount and type of intermediate inputs needed in the production of one unit of output can be estimated based on the input-output structures across countries and industries. Using the linkages across industries and countries, gross output in all stages of production that is needed to produce one unit of final goods can be traced. When the gross output flows associated with a particular level of final demand are known, value-added production and trade can be simply derived by multiplying these flows with the value-added to gross output ratio in each country/industry.

The intuition behind Leontief’s insight is as follows. When $1 of exports is produced, a first round of ‘direct’ value-added is generated. Producing those exports requires intermediate inputs, the production of which also induces value-added. This is the second round or ‘indirect’ domestic value-added generated by the $1 export. This process continues and can be traced to additional rounds of production throughout the economy, as intermediate inputs are used to produce other intermediate inputs. The total domestic value-added generated by $1 of exports is therefore equal to the sum of the direct and all rounds of indirect domestic value-added induced from the $1 of exports.

If one is only interested in estimating the domestic value-added embedded in a country’s or sector’s gross exports, applying Leontief’s insight is sufficient. However, for many economic and policy applications, one also needs to quantify other components in gross exports and their structures. In such circumstances Leontief’s original insight is not sufficient, as it does not provide a way to decompose intermediate trade flows across countries into various value-added terms according to their final absorption, as illustrated by a recent paper of ours (Wang et al. 2013).

From the 1930s to the 1960s, intermediate goods trade was relatively unimportant. Today, it is about two-thirds of gross world trade, so being able to decompose intermediate goods trade has become crucial in generating a complete value-added accounting of gross trade flows.

Decomposition of intermediate trade flows

Decomposition of intermediate goods trade flows cannot be achieved by simply applying Leontief’s insight because gross intermediate trade flows have to be solved first from the inter-country input-output (ICIO) models for any given level of final demand. In Wang et al. (2013), we find a way to solve this endogeneity issue by categorising all bilateral intermediate trade flows into major final demand groups according to their final destination of absorption. This key technical step successfully converts gross outputs (and gross exports) – usually endogenous variables in standard ICIO models – to exogenous variables in our gross trade accounting framework.

Figure 1 illustrates this idea in a three-country world. Intermediate exports are represented by blue arrows. Consider intermediate exports from Country S to Country R, which can be used in Country R to produce final goods, or to produce another type of intermediate input. Intermediate inputs produced in Country R are re-exported to Country S or to Country T. Any country’s final goods can either be consumed domestically (green arrows), or exported to one of the other two countries (red arrows). In all, there are nine different possible direct or indirect final destinations of absorption, which collectively decompose Country S’s intermediate exports to each of its partner countries according to where they are finally consumed.

The new gross trade accounting method

Building on the decomposition of gross bilateral intermediate trade according to the final destination of absorption, we decompose gross trade flows at any level of disaggregation into 16 value-added and double-counted components. Conceptually, these 16 components can be grouped into four buckets:

- Domestic value-added that is ultimately absorbed abroad (DVA for short).

- Returned value-added – the portion of domestic value-added that is initially exported but ultimately returned home by being embedded in imports from other countries and consumed at home (RDV for short).

While it is not a part of a country’s exports of value-added that stays abroad, it is a part of the exporting country’s GDP.

- Foreign value-added embodied in imports (FVA for short).

- Pure double-counted terms (PDC for short) due to back-and-forth intermediate goods trade that crosses borders multiple times. These intermediate trade transactions are not part of any country’s GDP or final demand, similar to domestic inter-industry transactions that use one type of intermediate input to produce another. Since all cross-country trade transactions are recorded by each country’s customs authority, they show up in the official trade statistics. This is different from domestic intermediate input transactions, which are deducted from total gross output when official GDP by industry statistics are calculated.

Our gross trade accounting framework in fact allows one to further decompose each of the four major parts of gross exports above into finer components with economic interpretations. For example, FVA in a country-sector’s exports can be further decomposed into different source countries; DVA can be traced by channels, whether they are embedded in final goods exports, intermediate goods exports that are absorbed in the direct importing countries, or intermediate goods exports that are re-exported and absorbed outside the direct importing countries. The accounting relations between these different components are shown in Figure 2.

Examples of bilateral gross trade flows decomposition at sector level

Let us use the US–China bilateral trade in electrical and optical equipment from the WIOD database (Timmer 2012) as an example to illustrate how the gross trade accounting method works. Among all bilateral sector-level trade flows in recent years, this is the single biggest product group measured by the volume of gross trade, with the sum of the two-way flows reaching $212 billion in 2011. By the gross statistics, presented in column 1 of Table 1, the trade is highly imbalanced – Chinese exports to the US ($176.9 billion in 2011) are five times that of US exports to China ($35.1 billion in 2011). If we separate exports of final goods and of intermediate goods (reported in columns 2a and 2b of Table 1), we see that most of the Chinese exports consist of final goods, whereas most of the US exports consist of intermediate goods.

Figure 1. Accounting for gross bilateral intermediate trade between Country S and Country R

Figure 2. Gross trade accounting: Conceptual framework

Source: Condensed from Figures 1a–1c in Wang et al. (2013).

Notes: E can be at any level of disaggregation: country/sector, country aggregate, bilateral/sector, or bilateral aggregate. Both DVA and RDV are based on backward linkages.

Table 1. Gross trade accounting example: US–China trade in electrical and optical equipment (WIOD C14)

Year

|

TEXP

|

TEXPF

|

TEXPI

|

DVA

|

DVA_FIN

|

DVA_INT

|

DVA_Intrex

|

RDV

|

MVA

|

OVA

|

PDC

|

VAX_F

|

VAX_B

|

(1)

|

(2a)

|

(2b)

|

(3)

|

(3a)

|

(3b)

|

(3c)

|

(4)

|

(5)

|

(6)

|

(7)

|

(8)

|

(9)

|

China exports to the US

|

1995

|

Value

|

10,998

|

7,634

|

3,364

|

8,544

|

5,947

|

2,046

|

552

|

16

|

314

|

1,948

|

176

|

3,922

|

9,069

|

Share

|

100

|

69.4

|

30.6

|

77.7

|

54.1

|

18.6

|

5.0

|

0.1

|

2.9

|

17.7

|

1.6

|

35.7

|

82.5

|

2005

|

Value

|

87,608

|

53,492

|

34,116

|

53,784

|

33,399

|

16,329

|

4,056

|

341

|

3,665

|

26,332

|

3,485

|

25,682

|

60,108

|

Share

|

100

|

61.1

|

38.9

|

61.4

|

38.1

|

18.6

|

4.6

|

0.4

|

4.2

|

30.1

|

4.0

|

29.3

|

68.6

|

2011

|

Value

|

176,924

|

104,156

|

72,769

|

123,187

|

74,043

|

39,801

|

9,344

|

1,296

|

5,581

|

40,915

|

5,946

|

53,078

|

135,132

|

|

Share

|

100

|

58.9

|

41.1

|

69.6

|

41.8

|

22.5

|

5.3

|

0.7

|

3.2

|

23.1

|

3.4

|

30.0

|

76.4

|

US exports to China

|

1995

|

Value

|

3,400

|

1,284

|

2,116

|

2,691

|

1,097

|

1,215

|

379

|

182

|

13

|

383

|

130

|

1,746

|

3,288

|

Share

|

100

|

37.8

|

62.2

|

79.2

|

32.3

|

35.7

|

11.2

|

5.4

|

0.4

|

11.3

|

3.8

|

51.4

|

96.7

|

2005

|

Value

|

16,402

|

3,845

|

12,556

|

11,926

|

3,264

|

5,072

|

3,591

|

1,777

|

231

|

1,251

|

1,216

|

8,748

|

13,779

|

Share

|

100

|

23.4

|

76.6

|

72.7

|

19.9

|

30.9

|

21.9

|

10.8

|

1.4

|

7.6

|

7.4

|

53.3

|

84.0

|

2011

|

Value

|

35,059

|

10,584

|

24,475

|

28,314

|

9,377

|

12,195

|

6,742

|

2,470

|

718

|

2,044

|

1,513

|

23,754

|

29,896

|

|

Share

|

100

|

30.2

|

69.8

|

80.8

|

26.7

|

34.8

|

19.2

|

7.0

|

2.1

|

5.8

|

4.3

|

67.8

|

85.3

|

Notes: TEXP is the value of total export goods; TEXPF and TEXPI are the values of total final export goods and total intermediate export goods respectively; MVA is the sum of MVA_FIN and MVA_INT; OVA is the sum of OVA_FIN and OVA_INT. Column (1) = (2a) + (2b) = (3) + (4) + (5) + (6) + (7); Column (3) = (3a) + (3b) + (3c).

We provide a decomposition of the gross bilateral trade flows for selected years (1995, 2005, and 2011) in columns (3)–(7) of Table 1. More precisely, column (1) = (3) + (4) + (5) + (6) + (7), where column (3), DVA, represents the exporter’s domestic value-added that is ultimately absorbed by other countries, including both the direct importing country and other foreign countries; column (4), RDV, is the part of domestic value-added initially exported but ultimately returned home and absorbed domestically; column (5), MVA, is the part of the FVA that comes from the direct importing country; column (6), OVA, is the part of the FVA that comes from third countries; and finally, column (7) is the pure double-counted items.

Column (3) = (3a) + (3b) + (3c), that is, the DVA part is further decomposed into DVA in final goods, DVA in intermediate goods absorbed by the direct importer, and DVA in intermediate goods re-exported and ultimately absorbed in third countries.

The decomposition results show that the US and Chinese exports have very different value-added structures. First, the DVA as a share of the gross exports is much higher for the US exports (81% in 2011) than for the Chinese exports (about 70% in 2011).1 Second, correspondingly, the FVA share (MVA + OVA) is higher for Chinese exports than for US exports. This is especially true for the OVA share in China. In other words, the US exports rely overwhelmingly on its own value-added (only 2.1% from China and 5.8% from other countries in 2011), whereas the Chinese exports use more foreign value-added, especially value-added from third countries (with 3.2% from the US and 23.1% from Japan, Korea, and all other countries). Third, whereas the RDV share is trivial for China, it is non-negligible for the US (7.0% in 2011).

This reflects the different positions the two countries occupy in the global production chain. As the US produces and exports parts and components, it is on the upstream of the chain – part of its value-added in its exports returns home as embedded in imports from other countries. In comparison, China is on the downstream of the chain – very few of its value-added comes home as intermediate goods in other countries’ exports. This also evidenced by China having a much higher proportion of FVA used in producing its final goods exports to the US, while the US has a higher share of FVA in producing its intermediate goods exports to China.

The decomposition of DVA into (3a), (3b), and (3c) also reveals differences between the two countries’ exports. In particular, the DVA in Chinese exports to the US is dominated by DVA in final goods, whereas the DVA in US exports is dominated by DVA in intermediate goods that is absorbed by China and other countries.

As a consequence of these differences in the structure of value-added composition, the China–US trade balance in this sector looks much smaller when computed in terms of domestic value-added than in terms of gross exports. In column (8), we report forward-linkage-based value-added exports, or VAX_F. Because this concept captures value-added originated in that sector in all downstream sectors of exports from the exporting country, but excludes contributions of value-added from other (upstream) domestic sectors to the electrical and optical equipment sector, it is generally not the same as DVA at the bilateral sector level, and in our application, VAX_F is smaller than DVA (this is generally true for downstream sectors).

In column (9) of Table 1, we report backward-linkage-based value-added exports, VAX_B, reflecting all the exporting country’s value-added (from all upstream sectors) that is exported via this sector and absorbed by the direct importing country, including value-added embodied in the source country’s gross exports to third countries, but finally absorbed by the partner country. Because the exporter’s domestic value-added that is exported to and absorbed by a particular partner country indirectly via third countries can be either larger or smaller than the exporter’s domestic value-added embodied in its intermediate goods re-exported by the partner country and absorbed by third countries, VAX_B (e.g. 76.4% and 85.3% for Chinese and US exports in 2011 respectively) at the bilateral sector level is generally different from DVA (69.6% and 80.8% of Chinese and US gross exports in 2011 respectively).

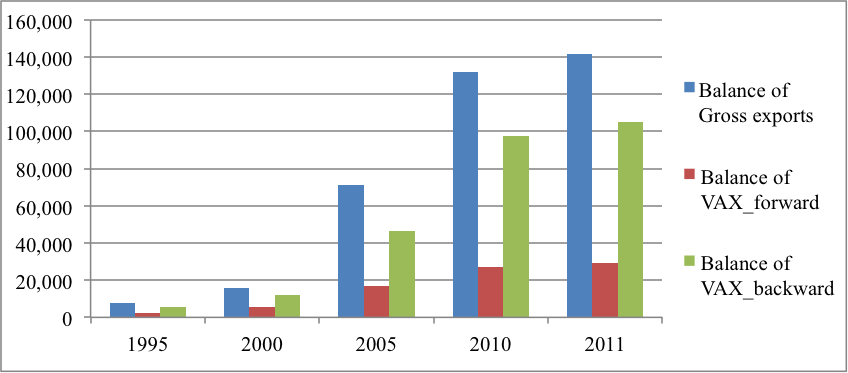

We report the US–China bilateral balance of trade in electrical and optical equipment sector by gross and the two value-added export measures in Figure 3. It is important to understand that at the bilateral/sector level, DVA, unlike both VAX_F and VAX_B (both of them deviate from gross trade flows), is only part of gross trade flows (so it is the only value-added measure that is consistent with bilateral gross trade flows), but not a measure of bilateral value-added trade flows, because it includes a portion of value-added that is absorbed by third countries (while both VAX_F and VAX_B are absorbed by the importing countries).

Figure 3. China–US trade balance in electrical and optical equipment ($ millions)

We perform a similar decomposition as above for gross bilateral trade in rubber and plastics between China and Japan as another example. We only plot the three different types of trade balance measures: in gross exports, VAX_F, and VAX_B respectively in Figure 4, and omitted all other details because of space limitations. As we can see, due to the vast differences in the structure of value-added in exports by the two countries, the trade balance looks different, often with a sign switch, as we move from one measure to the other.

Figure 4. China–Japan bilateral trade balance in rubber and plastics ($ millions)

Concluding remarks

Our gross trade accounting method provides a transparent framework for decomposing gross exports into components that provide insight into the real location of the value addition associated with exports. This decomposition breaks exports down into domestic value-added absorbed abroad, domestic value-added that returns home, foreign value-added, and double-counted intermediate trade. These conceptually different components sum up to 100% of the gross trade statistics at any level of disaggregation.

By identifying which parts of the official data are double counted and the sources of the double counting, our gross trade accounting method provides a transparent way to bridge official trade statistics (in gross terms) and national accounts (in value-added terms) consistent with the System of National Accounts standard. It can serve as a useful tool for economists to discover information about global value chains that is masked by the official trade data.

Footnotes

1. Because WIOD data do not distinguish processing and normal trade, the domestic value-added share for China is likely to be overestimated (Koopman et al. 2012).

References

Leontief, W (1936), “Quantitative Input and Output Relations in the Economic System of the United States”, Review of Economics and Statistics, 18: 105–125.

Koopman, R, Z Wang, and S-J Wei (2012), “Estimating domestic content in exports when processing trade is pervasive”, Journal of Development Economics, 99(1): 178–189.

Koopman, R, Z Wang, and S-J Wei (2014), “Tracing Value-added and Double Counting in Gross Exports”, American Economic Review, 104(2): 459–494.

Timmer, M (ed.) (2012), “The World Input-Output Database (WIOD): Contents, Sources and Methods”, WIOD background document, April.

Wang, Z, S-J Wei, and K Zhu (2013), “Quantifying International Production Sharing at the Bilateral and Sector Levels”, NBER Working Paper 19677, November.