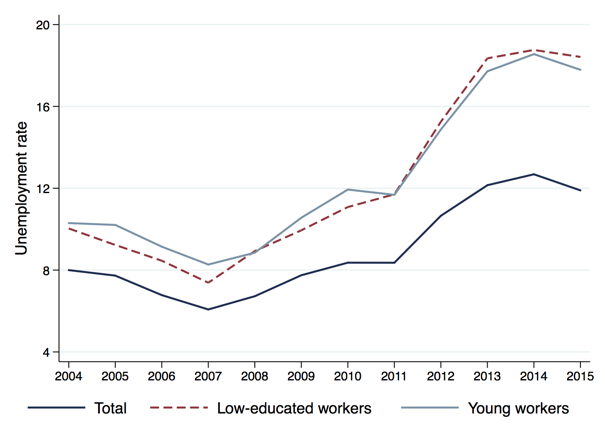

In the aftermath of the Global Crisis, a severe credit crunch has had long-lasting consequences for a number of economies. Trade has collapsed (Paravisini et al 2011), investment expenditure has shrunk significantly (Cingano et al. 2016), and unemployment rates have increased markedly (e.g. Clements et al. 2012). These developments have triggered a renewed interest in the real effects of financial shocks and, in particular, on the effects that credit supply shocks have on firms' employment decisions (Bentolila and Jansen 2014, Popov and Rocholl 2017). The labour market effects of the crisis have not been uniform, and young and less-educated workers have been particularly hit, especially in ‘dual’ labour markets such as those in Spain, France, and Italy (Hoynes et al. 2012, Bentolila and Jensen 2016). Figure 1 clearly shows this pattern in the aggregate data for Italy, which is the focus of our analysis.

Figure 1 Unemployment rate increased more for young and less educated workers

Notes: less educated workers are the ones with no educational degree or primary school certificate; young workers are the ones from 25 to 34-year-old.

Source: National Institute of Statistics.

However, the existing literature is generally silent about within-firm dynamics and labour reallocation. For instance, little is known about the impact of a decline in firm financing on different types of jobs, even though a differential impact of the crisis across demographic groups would have distributional implications. Moreover, the employment adjustment within firms – between workers and jobs characterised by a different skill content – can have a ‘cleansing’ effect, to the extent that the least productive jobs and firms are the ones relatively more affected by the financial shock.

Identifying the bank lending channel and firm employment response to credit supply shocks

In a recent paper, we take advantage of an extensive dataset of contract-firm-bank matched data to zoom in on the employment dynamics within the firm, and provide a series of novel findings on how firms adjust the level and composition of the labour force in response to credit shocks (Berton et al. 2017). The dataset contains daily information on individual job contracts and labour market flows of about 200,000 firms in one Italian region,1 matched with bank lending information from the Italian credit register. It spans the period from 2008:Q1 to 2012:Q4.

Our analysis has the advantage of bringing together three key elements that help in identifying the effects of a contraction in the supply of credit on within-firm personnel dynamics. First, the availability of loan-level data (rather that aggregate credit data) allows us to identify the bank lending channel at the firm level and to fully exploit individual heterogeneity. Second, we can investigate heterogeneous responses to a financial shock across workers and job contracts. Third, our data cover the universe of firms. While there is a wide consensus on the fact that smaller firms rely more on bank financing, the existing evidence rarely focuses on a representative sample of small firms. As such, we are able to obtain a more precise estimate of the employment effect of financial shocks.

Different employment effects of a financial shock

The implied patterns of employment at firms differently affected by the shock are illustrated in Figure 2, with those facing less favourable lending conditions experiencing a decreasing and divergent dynamic relative to firms with easier access to credit. Our point estimates indicate that, on average, a 10% supply-driven credit contraction reduces employment by 3.6%.

Figure 2 Credit supply and employment dynamics

Notes: the chart plots the averages values of the residuals of a regression of the logarithm of employees on firm and quarter fixed effects for two groups of firms, so that the residuals are on average equal to zero and their time patterns show the dynamics of employment for the two groups. Averages are computed for the group of firms facing a more favourable (solid line) and less favourable (dashed line) credit supply conditions; see Berton et al (2016) for additional details.

This average effect is the result of adjustments concentrated among workers on temporary contracts and occurring mostly through increased outflows (rather than decreased inflows).2 Moreover, we find that, among temporary workers, those with a low level of education (or employed in a low skill occupation) are most harshly hit by the credit crunch. In contrast, less educated workers with open-ended contracts were almost unaffected by the tighter financing constraints, possibly because of higher firing costs and a rigid employment protection legislation. Having a college degree makes the difference between temporary and open-ended contracts almost irrelevant.

We also find that immigrant and young workers are hit disproportionately more by the credit shock, reflecting the prevalence of immigrants in low-skill occupations, and the lower tenure and the higher presence of younger workers in temporary jobs.

Finally, we find that these differential effects are mainly driven by the adjustment at the intensive margin, while the effects on employment due to firm exit are more homogeneous across contracts and workers.

Firm reactions to the shock

To shed light on the mechanisms linking the Global Crisis to employment outcomes, we show that the effect of the shock is concentrated among financially ‘fragile’ firms that entered the crisis with a lower credit rating, a higher debt overhang, and weaker relationships with banks. These results are consistent with the idea that firm balance sheets play a key role in the propagation of shocks, as highly levered firms find it more expensive to engage in labour hoarding when financially constrained (Giroud and Mueller 2016).

We also find that the elasticity of employment to credit supply is especially relevant for micro and small firms, for younger firms, and for those with lower ex ante labour productivity. In particular, a reduction in the supply of credit translates into a reduction of employment in low-productivity firms that is twice as large as the average, while there is no statistically significant effect in high-productivity firms. This result, together with the higher vulnerability of less skilled workers, is consistent with a productivity-enhancing reallocation and with recent evidence showing a cleansing effect of the Great Recession (Foster et al. 2016).

Implications for the policy debate

Our results inform the current debate on the real effects of financial shocks along different dimensions. First, we show that large credit contractions have distributional effects, as some demographic groups have been more affected than others by the global financial crisis. Second, our findings confirm that firm balance sheets matter for the propagation of shocks to the real economy, with more levered firms reducing employment more when facing financial constraints. Finally, our analysis indicates that financial shocks could foster a productivity-enhancing reallocation, given that less skilled workers and less productive firms are more likely to be hit by the credit crunch.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the Bank of Italy, IMF, its Executive Board, or its management.

References

Bentolila S, J Dolado and J Jimeno (2012) “The Spanish labor market: A very costly insider-outsider divide”, VoxEU, 20 January.

Bentolila S and M Jansen (2014) “Job losses from the credit crunch during the Great Recession”, VoxEU, 1 February.

Bentolila S and M Jansen (2016) “New eBook – Long-term unemployment after the Great Recession: Causes and remedies”, VoxEU, 14 November.

Berton F, S Mocetti, AF Presbitero and M Richiardi (2017) “Banks, Firms, and Jobs”, Temi di discussione (Working papers), Bank of Italy, forthcoming.

Cingano F, F Manarei and E Sette (2016) “The real effects of shocks to bank balance sheets: Evidence from Italy during the Great Recession”, VoxEU, 24 June.

Clements B, R de Mooij and G Schwartz (2012) “Confronting the job crisis under tight fiscal constraints”, VoxEU, 9 September.

Foster L, C Grim and J Haltiwanger (2016) “Reallocation in the Great Recession: Cleansing or not?”, Journal of Labor Economics, 34(S1): S293 – S331.

Giroud X and H M Mueller (2016) “Firm leverage, consumer demand, and unemployment during the Great Recession”, Quarterly Journal of Economics, forthcoming.

Greenstone M, A Mas and H Nuyen (2014) “Do credit market shocks affect the real economy? Quasi-experimental evidence from the Great Recession and ‘normal’ economic times”, NBER Working Paper 20704.

Hoynes H, D L Miller and J Schaller (2012) “Who suffers during Recessions?”, Journal of Economic Perspectives, 26(3): 27–48.

Paravisini D, V Rappoport, P Schnabl and D Wolfenzon (2011) “Dissecting the effect of credit supply on trade”, VoxEU, 27 July.

Popov A and J Rocholl (2017) “Do credit shocks affect labor demand? Evidence from employment and wages during the Financial Crisis”, Journal of Financial Intermediation, forthcoming.

Endnotes

[1] Our analysis relies upon unparalleled micro-level information about the entire population of workers, firms, and banks operating in Veneto, a large Italian region with a population of 4.9 million individuals and a workforce of 2.2 million workers. According to the National Institute of Statistics data, the region accounts for roughly 9% of the Italian value added and of total employment. Veneto’s industrial, financial and economic structure is representative of the Italian one.

[2] Firms cut their position mainly by letting their temporary contracts expire. These results are in line with the existence of a ‘dual’ labour market where temporary contracts absorb large parts of employment volatility (Bentolila et al 2012).