Commonly-issued securities for the Eurozone have recently been proposed in various forms as an important element in solving the Eurozone crisis (see Frankel 2012). These proposals are aiming at three objectives:

- Circumvent the destabilising flight of investors from weak to strong sovereigns;

- Weaken the tie between a sovereign and its local banks; and

- Generate liquidity and cost advantages through a deeper market with larger debt volumes. These potential gains have immediate relevance to the ongoing euro crisis, with a promise that is enticing: the crisis can be financially-engineered away.

Underlying the financial engineering is, however, an economic transfer from strong to weak sovereigns. For some, the appeal of common securities relies on the expectation that such economic transfers will not actually have to take place. Support is, therefore, embedded in national guarantees rather than in the form of current outlays – the promises to pay in the future, typically joint and several, that support the issuance of a common security. National guarantees that back these common bonds are, however, more valuable from countries whose guarantees carry greater credibility today – implying already a current transfer. Thus, the act of issuing a common security ipso facto creates a fiscal union.

Governments, politicians and citizens – especially those of the stronger states – realise this and have been asking for greater fiscal discipline and other reforms to accompany any such guarantees. It is unrealistic to expect, however, that the accompanying fiscal discipline imposed will ensure that all guarantees remain mere promises to pay. For various reasons – some under the control of sovereigns and some not – any system of guarantees is likely to create some payments eventually. Thus the notion that a Eurobond can substitute for a fiscal union is untenable.

This does not mean that Eurobonds must necessarily await the formation of a fully-fledged fiscal union – with accompanying own tax revenues, centralised allocations, enhanced fiscal discipline, etc. Rather, the many proposals for Eurobonds can be seen, to varying degrees, to help chart an incremental path towards a fiscal union to be defined more precisely. Our review of five proposals for commonly-issued securities suggests three such paths (Claessens et al. 2012)

ESBies

The so-called European Safe Bonds (ESBies), proposed by the Euro-nomics group, are most clearly designed to deal with the immediacy of the crisis and avoid the need of a fiscal union (Euro-nomics Group et al. 2011).

- This proposal does not address new issuance of sovereign bonds (by those nations currently under stress) and focuses, instead, on repackaging of existing bonds available on secondary markets.

- The repackaging would create a senior tranche – the ESBies – and a junior tranche, the EJB.

- Because this structure is based on outstanding, traded bonds, there is no need for any sovereign guarantees, and hence has no implication for an accompanying fiscal union.

The purpose of the ESBies is to mitigate the market’s tendency to amplify the crisis. Any flight to safety would be from the EJBs to the ESBies and not, as now, from one sovereign to another; and banks holding ESBies would no longer be exposed to national sovereign risks, but to combined Eurozone risk.

The likelihood of multiple equilibria and instability would thereby be reduced. The viability of this proposal depends, however, crucially on the ability to attract buyers for the junior tranche.

Eurobills-Blue/Red Bond

Eurobills would create common short-term debt, amounting to about 10% of GDP (Philippon and Hellwig 2011).

- All short-term borrowings would be backed by joint and several guarantees.

- Borrowing costs would be lowered for the less-creditworthy member states and may not rise (significantly) for the more creditworthy if liquidity advantages lower overall costs.

- Banks would have a new safe asset dissociated from their sovereigns.

The short maturity has the potential benefit of imposing continuous discipline (as those not abiding by their fiscal obligations could be excluded). Because of its more limited nature, and specifically the predictability of the limited obligations, the proposal could be compliant with European and national legal constraints (especially those demanded by the German Constitutional Court).

A scaled-up version of Eurobills is the “Blue-Red bond” proposal (Delpla and Von Weizsäcker 2010). This extends the mutualisation of the debt to 60% of each member state’s GDP (the Blue bonds) with the remainder (Red bonds) to be issued on a national basis.

- The innovation here is the Blue Bond, which would carry the joint and several guarantees of the member states.

- Banks that hold the Blue Bond would be insulated from national sovereign risks, and, similarly, there would be reduced flight to “safe” sovereigns.

- The Red bonds would be junior and their costs would reflect the country’s own creditworthiness; this exposure to the market is expected to maintain incentives for country fiscal discipline.

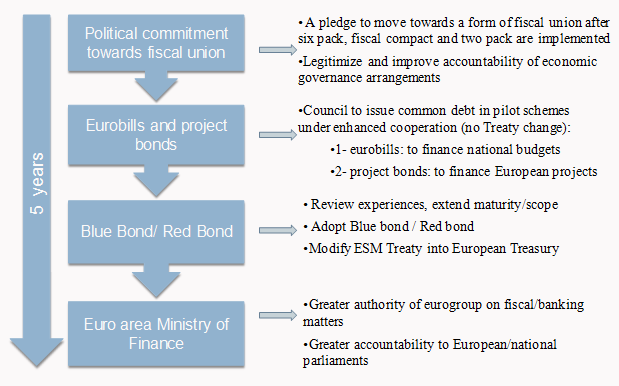

Figure 1. From Eurobills and project bonds to Eurobonds

There is in principle an evolution possible from Eurobills to Blue-Red Bonds (Figure 1). But the transition is not straightforward. With its large scale, the Blue-Red Bond proposal is a greyer legal zone than are Eurobills. Moreover, as with the ESBies, the challenges arise in the junior tranche, the Red Bond.

The values of Red Bonds are subject to national fiscal shocks and a run on these bonds could simulate the very conditions that are now prolonging the current crisis. If there were to be an eventual fiscal union, binding limits would need to be placed on the issuance of Red Bonds, balanced by counter-cyclical transfers from the union.

Redemption Bonds

Redemption Bonds are a response to the concern that several member states have public-debt to GDP ratios that are large and unsustainable and a first-order task is to allow them space to resume growth without the threat of losing access to financing (Bofinger et al. 2011).

- The so-called Redemption Pact would transfer the debt of a member state in excess of 60% of GDP (if any) into a European Debt Redemption Fund (ERF) for which all members would be jointly and severally liable.

- The total debt covered would amount to some 27% of Eurozone GDP, with Germany, Italy, and Spain the largest participants.

- In return, countries would agree to repay ERF the transferred debts within 25 years, with these obligations senior to remaining national debts and possibly backed up by collateral and dedicated tax revenues from each country.

The transparency and predictability of the contingent obligations under the guarantees supporting the Redemption Bonds may, the authors of the proposal believe, help overcome European and national legal barriers to implementation.

The Redemption Bond approach faces important challenges. The task of drawing down the debt will be eased somewhat to the extent that the interest payments for the most heavily-indebted countries will be reduced. Whether countries will be able to maintain the needed discipline during the extended period of the drawdown is, however, an open question. Were they are unable to do so – or face unanticipated increases in debt – they will be subject to rising costs on the first 60% of the debt-to-GDP ratio, which remains a responsibility on their own account.

The Redemption Bond is also not easily combined with Blue-Red Bond proposal since bringing the two together would mutualise virtually all the Eurozone debt. Only after a significant portion of the debt overhang was eliminated could such the Blue-Red Bond be contemplated. Of course, the Eurobills could operate in parallel at an earlier stage. As such, another path could be to start with the Redemption pact and then, when it runs out and debts are brought down to 60%, follow it with the Blue-Red Bond plan.

Conclusions

The principal short-term objective of all common securities for the Eurozone is to bring stability.

- The ESBies proposal is most focused on that objective, making no claim to larger gains in Eurozone fiscal discipline and governance.

- All other proposals are motivated by the further objective of adding financial incentives for fiscal discipline to support and expand on the existing fiscal governance mechanisms.

In each case, ESBies included, the open questions relate to the junior tranche, i.e., the debt not covered by mutual guarantees and/or subordinate to the collateralised debt.

- Whether there will be a sufficient market for the junior tranche and whether the instabilities faced today by some sovereigns will continue to be reflected in their lower tranches are matters that remain unresolved.

- There also remains the bigger question of what happens if the guarantees are called.

For that reason, any forward movements on financial engineering proposals must be embedded in – and supported by – the longer-term movements towards a fiscal union. A credible commitment to that combination could be a powerful spur to financial stability and economic growth in the Eurozone.

Authors' note: This work was carried out prior to Shahin Vallee joining the European Council and the views expressed here are those of the authors and should not be attributed to the IMF, its respective Executive Directors or Management, or the EC.

References

Bofinger, Peter, Lars P Feld, Wolfgang Franz, Christoph M Schmidt, and Beatrice Weder di Mauro (2011), “A European Redemption Pact”, VoxEU.org. 9 November.

Claessens, Stijn, Ashoka Mody, and Shahin Vallée (2012), “Paths to Eurobonds”, IMF Working Paper, WP/12/172.

Delpla, Jacques, and Jakob von Weizsäcker (2010), “The Blue Bond Proposal”, Bruegel Policy Brief.

Frankel, Jeffrey (2012), “Could Eurobonds be the answer to the Eurozone crisis?”, VoxEU.org, 27 June.

Euro-nomics group (2011), “ESBies: A Realistic Reform of Europe's Financial Architecture”, VoxEU.org, 25 October.

Philippon, Thomas and Christian Hellwig (2011), “Eurobills, not Eurobonds”, VoxEU.org, 2 December.