Since December 2012, the yen has depreciated sharply against the euro and the dollar. Traditional economic reasoning would view this a simple gain of Japanese competitiveness vis-à-vis the US and Eurozone. The standard approach to price competitiveness calculates a nation’s real effective exchange rate, which is based on the assumptions all traded goods are for consumption or investment, and that all the value added in these goods is produced 100% locally (Armington 1969; and McGuirk 1987).

The spread of global value chains, however, requires a more nuanced view. Production processes are fragmented internationally and intermediate goods account for more than two-thirds of total trade. The point is:

- Yen depreciation tends to reduce the price of goods made in Japan versus the US and EZ; but

- It also lowers the price of goods made in the US and EZ by lowering the cost of intermediate inputs from Japan.

Moreover, Japan supply parts to many nations, in particular in Asia, who in turn supply parts to the US and EZ, so the overall impact is ambiguous a priori.

New ways to reflect internationalised production

In recent years, two main approaches have emerged to incorporate the international fragmentation of production in measuring the real effective exchange rate. Our recent research on the macroeconomic implications of global value chains, reviews these approaches and explores their empirical relevance (IMF 2013). We find that they both provide useful new insights but with a slightly different focus.

- The first approach, developed by Bems and Johnson (2012), is to measure the competitiveness in 'factors' rather than 'goods'.

They argue that the effective exchange rate should reveal the competitiveness of 'factors' or 'tasks' traded as part of goods and not of the goods themselves. This version of the exchange-rate index (i.e. real effective exchange rate) uses (i) GDP deflators to measure changes in relative prices, because they are the most direct summary measure for factor (capital and labour) costs and (ii) bilateral trade in value added to construct weights.

- A second approach, used by Unteroberdoerster et al. (2011) and later developed in Bayoumi et al. (2013), is to measure the competitiveness of the goods produced in a country, while accounting for the presence of imported inputs in production.

Specifically, in the new formula, changes in the cost of intermediate inputs are reflected in the real effective exchange rate. This version of the real effective exchange rate uses (i) GDP deflators to measure changes in relative prices and (ii) bilateral gross trade and the foreign versus domestic composition of value added embedded in tradables to construct weights.

Alternative measures of competitiveness have pros and cons. The index developed by Bems and Johnson (2012) is parsimonious and better suited theoretically for measuring competitiveness of a country’s factors of production (i.e. labour and capital), value-added exports, or any other value-added variable including net exports. Empirical applications include forecasting of value-added trade patterns, net exports, and assessing a country’s long-term cost competitiveness. Their index, however, may not be optimal for examining goods-trade patterns themselves.

The approach by Bayoumi et al. (2013) on the other hand is better suited for measuring price competitiveness of gross output, gross trade, or any other ‘gross’ flows (exports and imports). Empirical applications include forecasting of gross trade patterns and assessing competitiveness of a country’s goods exports or imports.

What do different measures tell us about competitiveness?

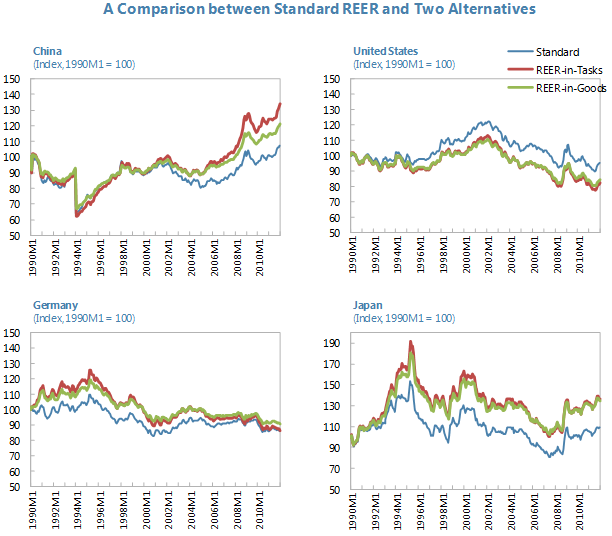

The empirical relevance of new measures is illustrated for selected countries in Figure 1 below. Each panel shows three lines: (i) the standard real effective exchange rate, (ii) the rate measuring competitiveness of “tasks” traded (a proxy for the index developed by Bems and Johnson (2012) and referred to as REER-in-Tasks hereafter), and (iii) the rate measuring competitiveness of goods traded but with an adjustment for imported intermediates (the index developed by Bayoumi et al. (2013) and referred to as REER-in-Goods hereafter) for the period between 1995M1 and 2012M12. Standard weights and value-added trade weights are computed for a sample of 42 countries where input-output tables are available.

Figure 1. Comparing measures of real effective exchange rates

Sources: OECD, Fund staff estimates.

Differences between the standard real effective exchange rate and the new indices incorporating global value chains are significant. For China and Japan both REER-in-Tasks and REER-in-Goods suggest more appreciation over time than the standard real effective exchange rate. In cumulative terms, REER-in-Tasks suggests an additional 27% appreciation (relative to what is revealed in the standard rate) for both countries. For the US, the alternative measures suggest a gradual improvement in competitiveness over time (about 15% in cumulative terms) compared to the standard rate. For Germany, the compression in domestic labour costs has contributed to a decline in alternative measures from the mid-1990s onwards, compensating for the earlier increase. Most of the empirical difference between the standard and alternative approach is explained by differences in prices (CPI versus GDP deflator). The alternative measures reveal similar movements for these countries except for China where REER-in-Goods suggests a smaller appreciation relative to the REER-in-Tasks (14%). This difference reflects the relative cost savings on imported intermediate inputs that is captured by the REER-in-Goods.

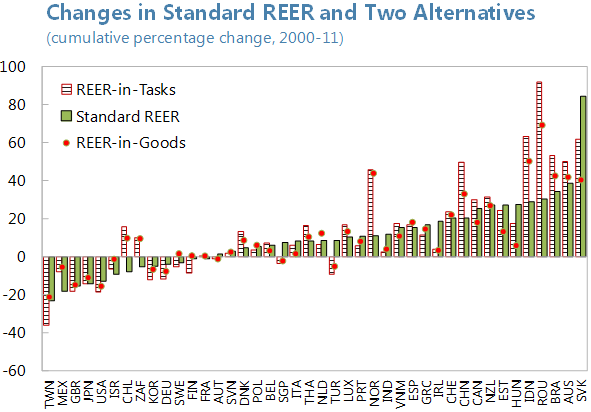

For a broader range of countries, cumulative differences between the REER-in-Tasks and the REER-in-Goods are frequent, but generally small (see Figure 2). When these differences do exist, however, they are quite informative. The largest cumulative differences between the two measures of competitiveness incorporating global value chains are observed among emerging-market economies in Europe (e.g. Estonia, Hungary, Romania and Slovakia) and those in Asia (e.g. China and Vietnam). For these countries, participation in global value chains has helped offset the impact of an increase in domestic costs, maintaining their competitiveness. While magnitudes are smaller, the reverse is true for many advanced economies that are well integrated in global value chains. Their competitiveness has been eroded by the increasing cost of imported production factors from emerging-market economies. This has partly offset the gains in competitiveness associated with the relocation of segments of the production process to emerging economies.

Figure 2. Changes in measures of real effective exchange rates

Sources: OECD, Fund staff estimates.

Overall, both appreciations and depreciations tend to be smaller when measuring competitiveness with the REER-in-Goods rather than the REER-in-Tasks. This indicates that the use of imported inputs generally mitigates changes in competitiveness. For instance, the depreciation of the yen would typically lead to a loss in competitiveness of Asian products vis-à-vis Japanese products. If they import a large portion of intermediate inputs from Japan, however, part of the adverse effects of the yen depreciation would be mitigated.

Conclusion

In summary, the main findings and policy implications so far are as follows:

- Incorporating global value chains in measures of the real effective exchange rate provides new insights on competitiveness compared to the standard approach.

- The difference from the standard approach comprises that in weights (gross versus value-added trade weights) and in prices (CPI versus GDP deflator).

Most of the differences stem from the latter. The empirical findings are therefore similar to studies comparing the use of different price indices in computing the real effective exchange rate.

- Differences between new measures are typically small. However, for emerging-market economies with larger roles in global value chains, larger differences are observed. When they exist, these differences provide useful information about the role of global value chains on goods competitiveness.

- New measures of real effective exchange rates incorporating global value chains are, therefore, helpful additions to the existing toolkit in assessing competitiveness, though further work on the measurement and the applicability of these indices is needed.

References

Armington, Paul S (1969), “A Theory of Demand for Products Distinguished by Place of Production,” IMF Staff Papers, Vol. 6, pp. 159-78.

Bayoumi T, M Saito, and J Turunen (2013), “Measuring Competitiveness: Trade in Goods or in Tasks?” IMF Working Paper 13/100, Washington: International Monetary Fund.

Bems, Rudolfs and Robert C Johnson (2012), “Value-Added Exchange Rates”, VoxEU.org, 6 December.

McGuirk, Anne K (1987), “Measuring Price Competitiveness for Industrial Country Trade in Manufactures,” IMF Working Paper 87/34 (Washington: International Monetary Fund).

International Monetary Fund (2013), “Trade Interconnectedness: the World with Global Value Chains,” IMF Policy Paper (Washington: International Monetary Fund).

Unteroberdoerster O, A Mohommad, and J Vichyanond (2011), “Asia’s Supply Chain”, VoxEU.org, 12 June.