Tax-induced international mobility of talent is a controversial public-policy issue, especially when tax rates differ substantially across countries and migration barriers are low as in the case of the EU. High top-tax rates may induce top earners to migrate to countries where the tax burden is lower, thereby limiting the redistributive power of governments and potentially creating harmful tax competition. Such concerns have featured prominently in recent tax policy debates in Europe, including the introduction of the 50% top marginal tax rate in the UK and the proposed 75% top marginal tax rate in France. Furthermore, the introduction in many European countries of preferential tax schemes for high-skilled foreign immigrants represents prima facie evidence of tax competition in internationally integrated labour markets. For example, preferential tax schemes for high-skilled foreign workers have been introduced in Belgium, Denmark, Finland, Netherlands, Portugal, Spain, Sweden, and Switzerland. A summary of all such existing schemes in OECD countries is provided by OECD (2011). The key empirical question is how responsive is international migration by high-skilled workers to tax differentials across countries.

New evidence from Denmark

While an enormous empirical literature has studied the effect of taxation on labour supply and earnings within countries, there is almost no empirical work on the effect of taxation on the mobility of workers across countries. In a recent paper (Kleven et al. 2013), we break new ground on the importance of tax induced migration effects among top earners. To study these questions, we use quasi-experimental variation created by a Danish preferential tax scheme for high-earning immigrants enacted in 1992. Under this scheme, the tax rate on labour earnings is reduced to a flat rate of about 30% for a total period of up to three years. Eligibility for the scheme requires annualised earnings above a threshold (indexed to average earnings growth and equal to about €100,000 in 2009), corresponding roughly to the 99th percentile of the distribution of individual earnings in Denmark. This scheme is much more generous than the Danish regular tax system, which imposes a top marginal tax rate of about 62% above €47,000 (as of 2009). Absent the special tax scheme, workers with earnings above the scheme threshold would face average income tax rates of around 55%, about twice as high as the scheme rate. When the three years of preferential tax treatment have been used up, the taxpayer becomes subject to the ordinary Danish tax schedule on subsequent earnings.

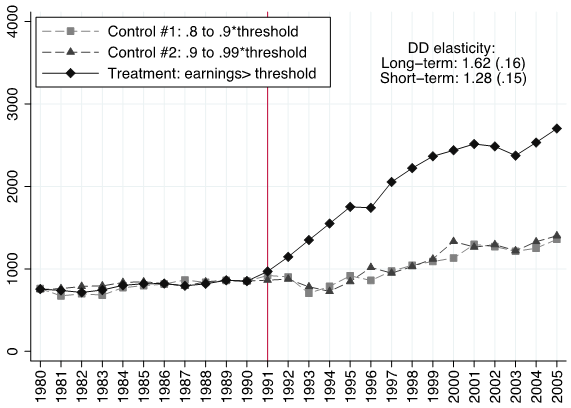

We find striking evidence that the scheme had a very large effect on the number of highly paid foreigners in Denmark. Figure 1 summarises our results. It shows that the number of foreigners in Denmark paid above the eligibility threshold (that is the group affected by the tax scheme) doubles relative to the number of foreigners paid slightly below the threshold (those are comparison groups not affected by the tax scheme) after the scheme is introduced. This effect builds up in the first five years of the scheme and remains stable afterwards. As a result, the fraction of foreigners in the top 0.5% of the earnings distribution is 7.5% in recent years compared to a 4% counterfactual absent the scheme. This very large behavioural response implies that the resulting revenue-maximising tax rate for a scheme targeting highly paid foreigners is relatively small (about 35%). This corresponds roughly to the current tax rate on foreigners in Denmark under the scheme once we account for other relevant taxes (VAT and excises). Importantly, the revenue-maximising tax rate on natives is much higher, because the response of migration with respect to the net-of-tax rate among expatriate natives is very small. In other words, highly skilled expatriates (who would be eligible for the scheme if they haven’t been in Denmark for three years) do not come back more because of the scheme.

Figure 1. Migration effects of the Danish preferential tax scheme: Number of eligible vs. ineligible foreigners over time

Notes: Figure 1 reports the number of foreigners with earnings above the scheme eligibility threshold (treatment series) from 1980 to 2005. As control groups, it reports the number of foreigners in Denmark with earnings between 80% and 90% of the threshold (control 1) and with earnings between 90% and 99.5% of the threshold (control 2). Both control series are normalised so that they match the treatment series in 1990–the year before the scheme was first implemented. The vertical line at year 1991 denotes the year the scheme was first implemented (the scheme was enacted in 1992 and applied retrospectively to all contracts starting after 1 June 1991).

Policy conclusion

It can therefore be desirable from a single-country perspective to adopt such preferential schemes targeting specifically highly paid foreigners. At the same time, these schemes impose negative fiscal externalities on other countries by reducing their capacity to collect taxes from top earners. This tension between country welfare and global welfare in the design of individual income tax policy has loomed large in the debate about tax competition for a long time, but our paper provides the first compelling evidence that this is indeed a major empirical issue. Absent international tax coordination, preferential tax schemes to high-income foreigners could substantially weaken tax progressivity at the top of the distribution. This will require international policy coordination and the design of rules regulating such special schemes in the EU in coming years.

References

Kleven, Henrik, Camille Landais, Emmanuel Saez, and Esben Schultz (2013) “Migration and Wage Effects of Taxing Top Earners: Evidence from the Foreigners' Tax Scheme in Denmark”, CEPR Discussion Paper 9410.

OECD. (2011). “The Taxation of Mobile High-Skilled Workers,” Chapter 4 in OECD Tax Policy Study No. 21: Taxation and Employment, OECD, Paris.