The G20 April 2009 London Summit put forward recommendations “to mitigate procyclicality, including a requirement for banks to build buffers of resources in good times that they can draw down when conditions deteriorate.” Many proposals have been published since. On 3 September 2009, the US Treasury stated that the principal options were adopting either

- “fixed, time-invariant target capital ratio(s) above the minimums, with capital distribution restrictions as the penalty for falling below the target ratios,” or

- “time-varying minimum capital ratio(s), where the applicable minimum capital ratio for banking firms at a particular time is a function of one or more contemporaneous macroeconomic indicators.”

It also added that “each of these proposals has its advantages and disadvantages, and additional work should be done to design a system of countercyclical capital buffers that would best promote financial stability.” This column discusses these options based on our research in Repullo, Saurina, and Trucharte (2009).

First, let us briefly review the nature of the problem. Under the internal ratings-based approach of Basel II, capital requirements are an increasing function of the probability of default, loss given default, and the exposure at default, and these inputs are likely to rise in downturns. Thus, when a recession worsens borrowers’ creditworthiness, it significantly increases banks’ capital requirement, contracting the supply of credit.

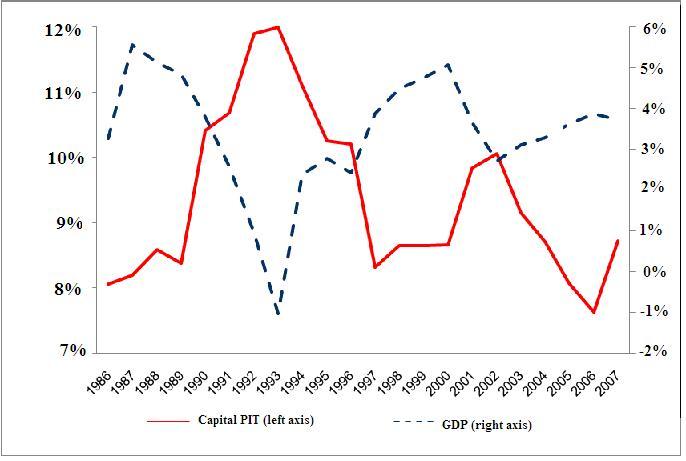

To assess the magnitude of the effect of the business cycle on Basel II capital requirements, we estimate a model of the one-year-ahead probabilities of default of all Spanish firms during the period 1987-2008, using data from the Credit Register of the Bank of Spain. The empirical model provides an estimate of the point-in-time default probabilities of the loans in Spanish banks’ portfolios of commercial and industrial loans, so we can compute the corresponding Basel II capital requirements per unit of loans (assuming an exogenous 45% loss given default). Figure 1 shows how point-in-time capital requirements would have evolved in Spain during the sample period if Basel II had been in place. We also plot the Spanish GDP growth rate, which has an amazing correlation of -0.8 with the Basel II requirements.

There is a very significant cyclical variation of the Basel II capital requirements when they are calculated with point-in-time default probabilities. In 1993, at the worst point of the business cycle in the sample period, capital requirements would have been 11.9%, falling to 7.6% in 2006, a year of high GDP growth. This variability of 57% in Basel II capital requirements from peak to trough contrasts with the flat 8% requirements of Basel I.

Figure 1. Basel II capital requirements and GDP growth, Spain 1986-2007

Approaches to mitigate procyclicality

According to Gordy and Howells (2006), there are two basic alternatives to mitigate the procyclicality of Basel II – smoothing the inputs of the Basel II formula by using some sort of through-the-cycle adjustment of the default probabilities or smoothing the output by using some adjustment of the Basel II capital requirements computed from the point-in-time default probabilities. We analyse both approaches.

Following the work of Saurina and Trucharte (2007) on mortgage portfolios, we first construct through-the-cycle estimates of the default probabilities by setting the value of the macroeconomic controls in the estimated model of default probabilities at their average level over the sample period and then compute the corresponding Basel II capital requirements. Second, we analyse different adjustments to the point-in-time capital requirements using a business cycle multiplier based either on aggregate information (the rate of growth of the GDP, the rate of growth of bank credit, and the return of the stock market) or on individual bank information (the rate of growth of their portfolio of commercial and industrial loans).

Our comparison of the procedures is based on the criterion of minimising the root mean square deviations of each adjusted series with respect to the trend of the original point-in-time series. This trend is computed by applying the Hodrick-Prescott filter, which is the procedure customarily used by macroeconomists to separate cycle from trend.

Our results show that the best procedures are either to smooth the inputs of the Basel II formula with through-the-cycle default probabilities or to smooth the output with a GDP growth multiplier. The multiplier makes capital requirements adjust (increase in booms and decrease in recessions) by 6.5% for each standard deviation in GDP growth, and it is equal to one when GDP growth is at its long-run average.

The ranking of the different procedures is robust to using individual bank data (for five Spanish banks that have opted for the internal ratings-based approach of Basel II plus a sixth fictitious bank comprising all the other banks in the system), considering a flat benchmark (instead of the Hodrick-Prescott trend), and introducing cyclically varying losses given default. Obviously, in this case the multiplier is much higher, increasing capital requirements by 10.6% for each standard deviation in GDP growth.

Smoothing inputs or smoothing outputs

We now discuss the choice between smoothing the inputs of the Basel II formula with through-the-cycle default probabilities or smoothing the output with a GDP growth multiplier. The use of through-the-cycle default probabilities has been criticised by Gordy and Howells (2006) on the grounds that “changes in a bank’s capital requirements over time would be only weakly correlated with changes in its economic capital, and there would be no means to infer economic capital from regulatory capital.” They also point out that “through-the-cycle ratings are less sensitive to market conditions than point-in-time ratings, (so) they are less useful for active portfolio management and as inputs to ratings-based pricing models.” Finally, they note that “despite the ubiquity of the term ‘trough-the-cycle’ in descriptions of rating methods, there seems to be no consensus on precisely what is meant.”

As noted by the Financial Services Authority (2009), adjusting default probabilities so that they reflect “an average experience across the cycle” involves a very significant challenge, since it requires “the ability to differentiate changes in default experience that are due entirely to the economic cycle from those that are due to a changing level of non-cyclical risk in the portfolio.” As a result, they note that “in general firms have not developed through-the-cycle ratings systems whose technical challenges are typically greater than those of point-in-time approaches.” The UK Financial Services Authority has been working with the industry to develop a so-called “quasi-through-the-cycle” rating approach, based on adjusting the point-in-time default probabilities by a cyclical scaling factor. However, calibrating such factor seems a difficult task. From this perspective, doing the scaling with the output of the Basel II formula, along the lines that we have proposed above, seems much easier.

The difficulty in making precise the notion of through-the-cycle ratings implies that this smoothing procedure may be implemented very differently across banks, especially across banks in different jurisdictions, so “level playing field” issues may emerge. These issues would be particularly difficult to resolve because of the lack of transparency of the procedure. From this perspective, it seems better do the adjustment with a single (and fully transparent) macro multiplier.

Finally, it has been argued that using one-year-ahead default probabilities is not appropriate for loans with longer maturities, and that for this reason a through-the-cycle procedure would be more appropriate. The reply to this objection is that, even for longer-term loans, a correct assessment of their risk should be done conditional on the state of the economy, not in an unconditional manner. Doing the latter, which is in the spirit of through-the-cycle ratings, produces a distortion in the measurement of risk that makes cyclically adjusted default probabilities inadequate for risk pricing and risk management purposes.

Thus, we conclude that smoothing the inputs of the internal ratings-based formula by using through-the-cycle default probabilities has many shortcomings. The alternative procedure, to smooth the output with a multiplier based on GDP growth, is better in terms of simplicity, transparency, low cost of implementation, consistency with banks’ risk pricing and risk management systems, and even consistency with the idea of a single aggregate risk factor that underlies the capital requirements of Basel II.

Implementing capital requirements adjusted for GDP growth

The proposed adjustment would be applied in each national jurisdiction, possibly with different multipliers for different portfolios, and only for banks that are under the internal ratings-based approach of Basel II, on the grounds that the standardised approach is only minimally risk-sensitive. Different capital requirements for different jurisdictions are an inevitable feature of any procedure designed to correct the effect of the business cycle on risk-sensitive capital requirements. The procedure would involve some complexity in its application to international banks, especially those that have significant cross-border lending activities, but a possible approach would be to use the jurisdiction of the borrower.

What about the idea of a fixed target capital ratio above the minimum, with penalties for falling below the target, mentioned at the beginning of this column? In our view, the idea does not help to mitigate procyclicality if capital requirements are computed with point-in-time default probabilities, because it implies that banks always have to satisfy minimum requirements that, as illustrated in Figure 1, may be around 12% per unit of loans in normal downturns and much higher in circumstances like the present. Such high requirements, if implemented, would probably lead to a credit crunch. The idea would make more sense if capital requirements were computed with through-the-cycle default probabilities, but we have already discussed the shortcomings of using that approach.

To conclude, it is important to stress that the proposed business cycle multiplier maintains the risk sensitivity of the Basel II capital requirements in the cross-section, so riskier loans (and hence banks with riskier portfolios) would bear a higher capital charge, but a cyclically-varying scaling factor would be introduced to increase capital requirements in good times and to reduce them in bad times. Such adjustment should contribute to reducing the incidence and magnitude of both credit bubbles and credit crunches.

Disclaimer: The views expressed in this paper are those of the authors and should not be attributed to the Banco de España or the Eurosystem.

References

Basel Committee on Banking Supervision (2006): International Convergence of Capital Measurement and Capital Standards. A Revised Framework, Basel: Bank for International Settlements.

Financial Services Authority (2009): “A Regulatory Response to the Global Banking Crisis,” Discussion Paper 09/02.

Gordy, M., and B. Howells (2006): “Procyclicality in Basel II: Can We Treat the Disease Without Killing the Patient?,” Journal of Financial Intermediation, 15, 395-417.

Repullo, R., J. Saurina, and C. Trucharte (2009), “Mitigating the Procyclicality of Basel II,” CEPR Discussion Paper 7382.

Saurina, J., and C. Trucharte (2007): “An Assessment of Basel II Procyclicality in Mortgage Portfolios,” Journal of Financial Services Research, 32, 81-101.

US Treasury (2009), Principles for Reforming the U.S. and International Regulatory Capital Framework for Banking Firms, September.