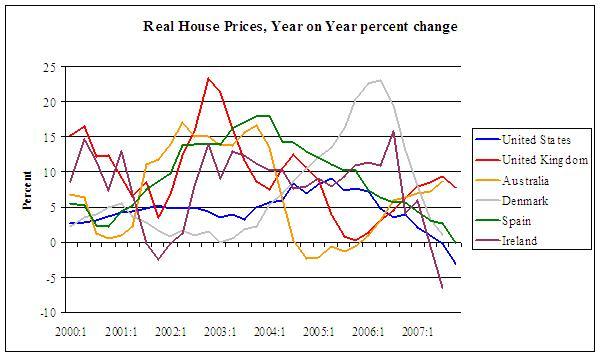

After several years of rapid price increases, house price growth has decelerated in many advanced economies, and in a few of them – the United Stated and Ireland – house prices have fallen during the past year (Figure 1). Real residential investment has also slowed in several countries, including the United States, Australia, and, especially, Ireland, where it has fallen by about 3 percentage points of GDP since its peak four years ago.

Figure 1.

Although few people would disagree that such developments may have important implications for the level of economic activity, considerable uncertainty still exists about the link between the housing sector and the business cycle. In particular, there are varying estimates of the extent to which house price fluctuations affect consumer spending and the dynamics of residential investment. Moreover, the prospect of a sharp boom-bust cycle in the housing sector in several advanced economies has reignited the debate on how monetary policy should respond to developments in the housing sector.

The uncertainty on the role of housing in the business cycle and in the monetary policy transmission mechanism has been compounded by dramatic changes over the past two decades in how housing is financed in several advanced economies. There has been a shift toward a more competitive housing finance model.1 The new model has made it easier for households to access housing-related credit through diverse funding sources, lender types, and loan products, contributing to the rapid growth of mortgage debt in a number of countries – including sub-prime lending to households with impaired or insufficient credit histories.

In Chapter 3 of the April 2008 World Economic Outlook, we investigate whether the changes in housing finance over the past two decades have altered the links between the housing sector and economic activity. We also explore the implications of housing sector developments for the conduct of monetary policy. In this column, we report the three main conclusions of our study.

Housing and the business cycle

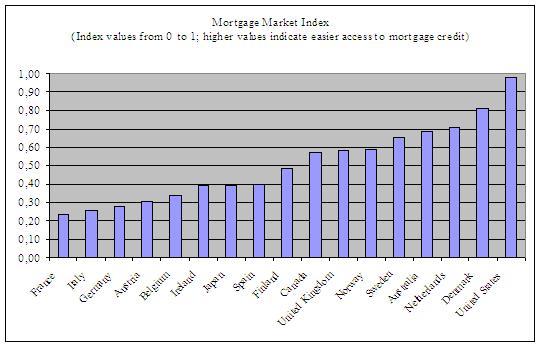

Our research shows that significant cross-country differences exist in mortgage contracts. We rank the development of mortgage markets in 18 advanced economies by the extent to which households find easy access to housing-related credit. We find that that the United States, Denmark, Australia, Sweden, and the Netherlands appear to have the most “developed” mortgage markets, which allow households greater access to housing-related financing, whereas households in continental Europe tend to have more limited access to such financing (Figure 2).

Figure 2.

These differences are relevant because movements in house prices influence household spending plans, mainly through the role of housing as collateral. Indeed, we show that both the correlation between consumption and house prices at business cycle frequencies and the marginal propensity to consume out of housing wealth are stronger in economies with higher values of the mortgage index.

While the changes in the system of housing finance over the last two decades may have increased the potential role for the collateral effects of house prices, in principle the effect of these changes on consumption and output volatility is ambiguous, as two countervailing effects may be at work. First, households’ ability to smooth consumption in the face of adverse income shocks may be enhanced through more ready access to financing collateralised by home equity.2 Second, macroeconomic fluctuations may be amplified by endogenous variations in collateral constraints tied to real estate values – the “financial accelerator” analysed by Kiyotaki and Moore (1997).3

We find that that the second effect may be prevailing: spillovers from the housing sector to the rest of the economy are estimated to be larger in economies where it is easier to access mortgage credit and use homes as collateral. This is because movements in house prices influence household spending plans through the role of housing as collateral – for example, increases in house prices raise the value of the collateral available to households, loosen borrowing constraints, and support spending.

Transmitting monetary policy

Can monetary policy smooth the impact of developments in the housing market on the broader economy? Some observers have raised doubts as to whether this is still the case, because greater integration of mortgage markets with the rest of the financial system may have reduced the importance of mortgage credit availability as a channel of monetary policy transmission.4

However, we find that financial deregulation may have strengthened the role of housing in monetary policy transmission, because easier access to housing collateral may have linked house prices more closely to monetary policy. We also find that the effects of monetary policy changes on output are larger in those economies where housing finance markets are relatively more developed and competitive.

More aggressive monetary policy stance

Based on these findings, we suggest that the response of monetary policy to changes in the housing sector should vary depending on the level of development of mortgage markets. First, monetary policy makers may need to respond more aggressively to a housing demand shock in economies with more developed mortgage markets – that is, with a higher loan-to-value ratio and thus, presumably, a higher stock of mortgage debt. They might also need to respond more aggressively to a financial shock affecting the amount of credit available for any given level of house prices. Hence, the model used in the chapter would “predict” a more aggressive reduction of interest rates in the United States compared to the euro area in the face of the recent turmoil in the credit markets – in line with what has been observed so far. Second, we suggests that, in economies with more developed mortgage markets, economic stabilisation could be improved by a monetary policy approach that responds to house price developments in addition to consumer price inflation and output developments.

Some key caveats apply to these findings. First, given the uncertainty over the factors driving house price dynamics – in particular, whether they reflect changes in fundamentals or speculative forces – and their impact on the economy, house prices should be considered within a risk management approach to monetary policy. Second, paying attention to house price developments does not require changing existing monetary policy approaches. Rather, these approaches should be interpreted in a more flexible manner, for example, by extending the time horizon over which inflation and output are returned to target. However, it is important that such an approach be applied symmetrically: an aggressive easing would be justified in response to concerns from a rapid slowdown of the housing sector, but some “leaning against the wind” may also prove useful to limit the risk of a build-up of housing market and financial imbalances.

Footnotes

1 See papers presented at the 2007 Jackson Hole Economic Symposium.

2 Dynan, Karen E., Douglas W. Elmendorf, and Daniel E. Sichel, 2006, “Can Financial Innovation Help to Explain the Reduced Volatility of Economic Activity?” Journal of Monetary Economics, Vol. 53 (January), pp. 123–50.

3 Kiyotaki, Nobuhiro, and John Moore, 1997, “Credit Cycles,” Journal of Political Economy, Vol. 105 (April), pp. 211–48

4 Bernanke, Ben S., 2007, “Housing, Housing Finance, and Monetary Policy,” speech at the Federal Reserve Bank of Kansas City’s Economic Symposium, Jackson Hole, Wyoming.