In the early 2000s, the US economy experienced an unprecedented boom in mortgage debt and house prices. When this boom turned to bust, it precipitated a devastating financial crisis and an economic downturn of such severity that its ripple effects are arguably still affecting the global economic and political arena today.

According to many economists, the key driver of the boom was a significant expansion in the supply of credit (e.g. Mian and Sufi 2009, Dell’Ariccia et al. 2012, Levitin and Wachter 2012, Justiniano et al. 2016). Numerous potential mechanisms behind this supply shift have been discussed in the literature, but their relative role remains hotly debated. They include the advent of securitisation (Levitin and Wachter 2012, Keys et al. 2010), a glut of international savings directed towards the US financial markets (Bernanke et al. 2011, Shin 2012), over-optimism on the future trajectory of house prices (Lenhert et al. 2008), distortions in the ratings of asset-backed securities (Ashcraft et al. 2011), and many others. The common consequence of all these developments was that financial institutions became willing to issue more, and riskier, mortgages at lower interest rates. And in fact, mortgage interest rates fell at the same time as mortgage debt (and house prices) skyrocketed.

In a new paper, we document a crucial turning point in this dynamic – a large, sudden, and persistent fall in the spread between interest rates on mortgages and Treasuries that took place in the summer of 2003 (Justiniano et al. 2017). The emergence of this ‘mortgage rate conundrum’ is associated with a shift in originations towards the non-conforming loans that fuelled private-label securitisation. As we will show, these are precisely the loans that ended up defaulting at higher rates in subsequent years, including when the boom turned to bust. In the rest of this piece, we review the key developments of the summer of 2003, and connect them with the subsequent rise in delinquencies.

A granular view of the mortgage market during the credit boom

Mortgage finance underwent a profound transformation over the first part of the 2000s. Riskier and riskier borrowers gained access to credit and non-traditional mortgage products – such as interest-only, adjustable-rate, or balloon mortgages – became increasingly popular. Most of these non-conforming loans were then sold to private-label MBS issuers, rather than being purchased and guaranteed by the government sponsored enterprises. One implication of this transformation is that standard mortgage rate indicators measuring the cost of credit in the traditional segment of the mortgage market – conforming loans extended to prime borrowers – became much less representative of the overall market.

Therefore, getting a complete picture of the evolution of the cost of mortgage credit during this period requires a much more granular view of what interest rates were offered to what borrowers, and on what kind of mortgages, especially outside of the conforming segment. This is precisely what we can glean from the Private Label Securities Database. This rich, loan-level dataset covers the near universe of mortgages that became part of private-label securitisation pools. It includes many details about the characteristics of these loans and their borrowers, thus providing a comprehensive picture of the non-traditional segments of the mortgage market that gained popularity during the 2000s.

From this data, we compute a conditional spread of mortgage over Treasury rates. This spread is conditional because it controls for a long list of observable borrower and loan characteristics, such as the borrower's FICO score, the loan-to-value ratio, the type of mortgage contract, and so on. To the extent that these observable traits capture most of the well-documented changes in the mortgage industry during the boom, this spread should provide a measure of the cost of mortgage credit that is comparable over time and across mortgages, even as the underlying composition of the market was changing.

The mortgage rate conundrum

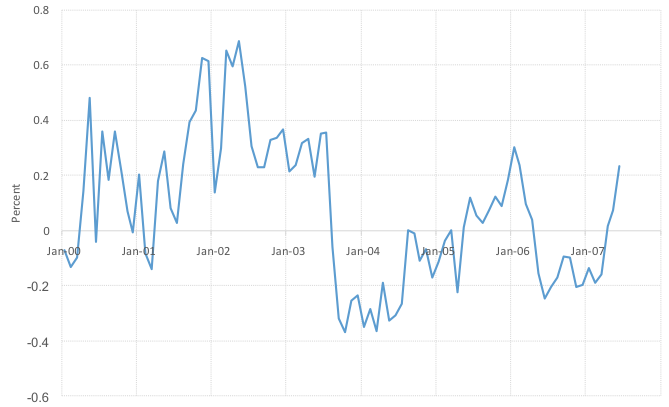

Figure 1 plots our estimate of the (demeaned) conditional mortgage spread relative to Treasuries, averaged across all loans in our dataset. This spread fluctuates around a roughly constant mean in the first part of the sample. However, it falls abruptly in the summer of 2003, giving rise to what we refer to as ‘the mortgage rate conundrum,’ echoing the disconnect between short and long-term Treasury rates noted by Alan Greenspan in 2005. Following this sharp initial decline, the cost of mortgage credit remained persistently lower until 2006-07. Moreover, the decline in the conditional spread was more pronounced for subprime mortgages (approximately 100 basis points), but less so for loans securitised by government sponsored enterprises or kept in banks’ portfolios (about 30 basis points), as we detail in Justiniano et al. (2017).

Figure 1 The conditional mortgage rate spread

Notes: Spread between mortgage and Treasury rates, controlling for borrower and loan characteristics. Average across all loans in the Private Label Securities Database. For additional details, see Justiniano et al. (2017).

What events might have triggered this fall in the conditional mortgage spread, and what were its consequences? We tackle these two questions next.

Triggers: The summer of 2003

The most notable economic event immediately prior to the emergence of the mortgage rate conundrum is the FOMC meeting of 24-25 June 2003. At that meeting, the Committee decided to cut the federal funds rate by 25 basis points, from 1.25 to 1%, a less aggressive move than was anticipated by financial markets. As it turned out, this was going to be the last cut in the easing cycle that accompanied the recession of 2000-01, a fact that became progressively clearer to market participants during the following days and weeks. As a result, the Treasury yield curve steepened significantly, with long-term yields increasing more than 1 percentage point by the end of July. In contrast, mortgage rates did not budge, creating the unusually large drop in their conditional spread that we have documented above.

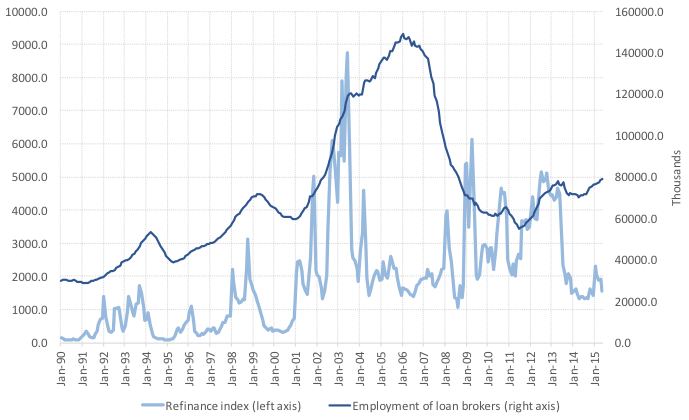

The end of the policy easing cycle also brought to an abrupt end the unprecedented mortgage refinancing wave that had been surging since 2002. Figure 2 shows that the Mortgage Bankers Association refinance index reached an all-time high in the summer of 2003, from which it dropped precipitously right after the FOMC meeting.

Figure 2 Refinance index and employment of loan brokers

Notes: Mortgage Bankers Association refinance index: Volume of mortgage loan applications for refinancing (seasonally adjusted, Mar-16-1990=100); and employment of mortgage and nonmortgage loan brokers (thousands, seasonally adjusted).

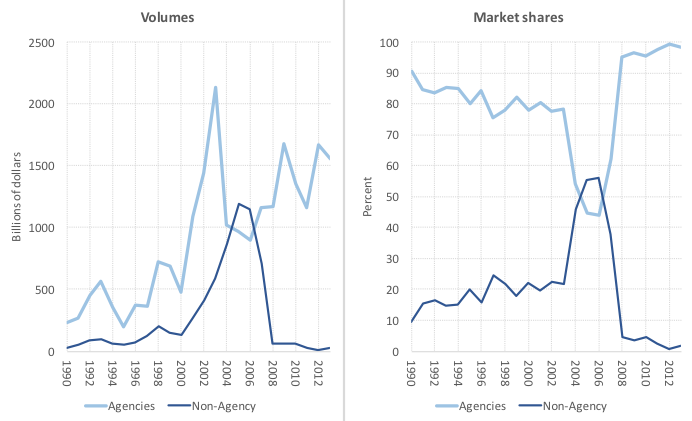

However, employment among loan brokers did not fall after the refinancing boom ended, also illustrated in Figure 2. This stability contrasts with the pattern observed at the end of the previous two refinancing waves in 1994 and 1999, when employment in the sector fell significantly in response to a sharp reduction in the level of refinancing activity. This fact suggests that instead of reducing employment and overall activity in response to the disappearance of refinancing opportunities, as they had done in previous similar episodes, mortgage lenders redirected some of their resources towards the origination of new loans. Furthermore, the data indicate that the majority of these newly originated loans were the non-conforming products that fed private-label securitisations, as evident from their surge after 2003, illustrated in Figure 3.

Figure 3 Securitisation of residential mortgages by programme

Notes: Volumes and market shares of MBS origination by agencies (government sponsored enterprises) and non-agency (private-label) issuers.

Consequences: Mortgage delinquencies

What were the consequences of the shift in the supply of credit towards marginal borrowers that accompanied the emergence of the mortgage conundrum? The literature has already documented the steady deterioration in the performance of mortgages originated over the course of the boom, in terms of delinquencies and foreclosures (e.g. Demyanyk and Van Hemert 2011, Foote et al. 2012, Santos 2015, Palmer 2015). We complement these results by demonstrating that this process started exactly in the middle of 2003, right after the emergence of the mortgage rate conundrum.

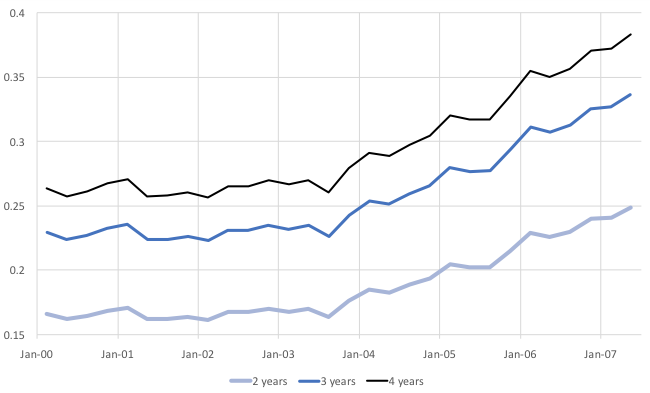

This result is illustrated in Figure 4, which shows the marginal effect of the date of mortgage origination on 60-day delinquency rates two, three and four years down the road. These estimates are based on a standard logit model of delinquency, which controls for essentially the same set of borrower and loan characteristics used in the construction of the conditional mortgage spread, as well as for the effect of local house prices and business cycle indicators. The pattern of delinquency across origination cohorts indicates that something started going wrong with the quality of mortgages issued exactly around the summer of 2003, even after controlling for a rich set of observables. This is precisely the time at which the conditional mortgage spread plunged, pointing to a strong connection between these two phenomena.

Figure 4 Impact of mortgage origination date on delinquency rates

Notes: Estimated marginal effect of the date of mortgage origination on 2, 3 and 4-year cumulative delinquency rates. Estimates based on the logit model of Justiniano et al. (2017).

In summary, the sharp and persistent decline in conditional mortgage spreads over the summer of 2003 was accompanied by the deterioration in the quality of the credit being extended. A natural interpretation of this evidence is that this period witnessed a shift in the supply of credit that ultimately resulted in the origination of mortgages with lower interest rates and of worse overall quality. A majority of these mortgages were non-conforming and were thus absorbed by private-label securitisation pools. The fact that an important dimension of these loans' lower quality was not observable ex ante helps to explain why these MBS performed especially poorly.

Concluding remarks

The work summarised in this column contributes to our understanding of the dynamics of the credit boom through the identification of a sharp discontinuity in the pricing and quality of mortgages, and of some of the factors behind it. In terms of timing, we pinpoint the emergence of a mortgage rate conundrum in the summer of 2003, and connect it to a process of progressive credit quality deterioration that ultimately led to the very high default rates experienced during the financial crisis. In terms of factors, we relate the conundrum to the attempt of originators to sustain their level of activity by entering new markets, following the collapse of an unprecedented refinancing boom.

Editor’s note: The views expressed in this column are those of the authors and do not necessarily represent those of the Federal Reserve Banks of Chicago, New York, or the Federal Reserve System.

References

Ashcraft, A, P Goldsmith-Pinkham, P Hull and J Vickery (2011), “Credit ratings and security prices in the subprime MBS market”, American Economic Review 101(3): 115-119.

Bernanke, B S, C Bertaut, L P DeMarco and S Kamin (2011), “International capital flows and the returns to safe assets in the United States, 2003-2007”, International Finance Discussion Papers 1014, Board of Governors of the Federal Reserve System (US).

Dell’Ariccia, G, D Igan and L Laeven (2012), “Credit booms and lending standards: Evidence from the subprime mortgage market”, Journal of Money, Credit and Banking 44: 367–384.

Demyanyk, Y and O Van Hemert (2011), “Understanding the subprime mortgage crisis”, Review of Financial Studies 24: 1848–1880.

Foote, C L, K S Gerardi and P S Willen (2012), “Why did so many people make so many ex post bad decisions? The causes of the foreclosure crisis”, Public Policy Discussion Paper 12-2, Federal Reserve Bank of Boston.

Justiniano, A, G E Primiceri and A Tambalotti (2016), “Credit supply and the housing boom”, CEPR, Discussion Paper no 10358.

Justiniano, A, G E Primiceri and A Tambalotti (2017), “The mortgage rate conundrum”, CEPR, Discussion Paper no 12265.

Keys, B J, T Mukherjee, A Seru and V Vig (2010), “Did securitization lead to lax screening? Evidence from subprime loans”, The Quarterly Journal of Economics 125(1): 307–362.

Lenhert, A, K Gerardi, P Willen and S M Sherlund (2008), “Making sense of the subprime crisis”, Brookings Papers on Economic Activity 39(2): 69-159.

Levitin, A J and S M Wachter (2012), “Explaining the housing bubble”, Georgetown Law Journal 100(4): 1177-1258.

Mian, A and A Sufi (2009), “The consequences of mortgage credit expansion: Evidence from the US mortgage default crisis”, The Quarterly Journal of Economics, 124: 1449–1496.

Palmer, C (2015), “Why did so many subprime borrowers default during the Crisis: Loose credit or plummeting prices?” University of California at Berkeley, Mimeo.

Santos, T (2015), “Credit booms: Implications for the public and the private sector”, Bank for International Settlements, BIS Working Papers 481.

Shin, H S (2012), “Global banking glut and loan risk premium”, IMF Economic Review 60(2): 155–192.