From 2001 through 2008 one half of Europe received enormous capital inflows from the other half of Europe and the rest of the world.

- Starting in 2009, the recipients then experienced a sudden stop, a capital-account reversal, and an economic and financial crisis (Pisani-Ferry and Merler 2102).

From 1924 through 1928 one half of Europe received enormous capital inflows from the other half of Europe and the rest of the world.

- Starting in 1929, the recipients then experienced a sudden stop, a capital-account reversal, and an economic and financial crisis.

The fact that there are parallels between the economic and financial crises in Europe in the interwar years and today is invoked frequently, but mainly at an anecdotal level.

New research on the 1919-1932 sudden stop

In recent research, we fill this gap with a new analysis of the determinants of capital flows and capital-account reversals between the wars (Accominotti and Eichengreen 2013).

Whereas other historical studies of international capital movements rely on estimates of net capital flows computed from balance-of-payment statistics, we work here mainly with gross primary issues. We employ new estimates of private long-term European bond issues in six major financial centres: New York, London, Paris, Amsterdam, Stockholm and Zurich from 1919 to 1932. Recent research has emphasised the advantages of gross capital flows in empirical studies of sudden stops (Fostel and Kaminsky 2007, Forbes and Warnock 2012, and Cavallo et al. 2013).

Capital surges and reversals: Comparing 1919-1932 and 2006-2011

Figure 1 shows the value of long-term bonds floated by European countries from 1919 to 1932 in millions of 1990 dollars. The capital surge and sudden stop are both evident.

- Gross capital exports to European countries rose sharply starting in 1924 and peaked in 1927.

- New bond issues then declined by 64% in real terms in 1929.

Figure 1. Bond issues on account of European countries, 1919-1932 (millions of 1990 dollars)

Source: Anon (1943), “League of Nations - Europe’s Capital Movements, 1919-1932 – A Statistical Note”, unpublished manuscript, Mudd Library, Princeton University.

This was followed however by a recovery in 1930, due mostly to the Young plan loans to Germany.

- In 1931 gross long-term capital exports collapsed again.

While almost all major financial centres participated in this sudden stop, there were a few exceptions. The volume of bond issues actually rose in Paris and Stockholm between 1927 and 1931, for example.

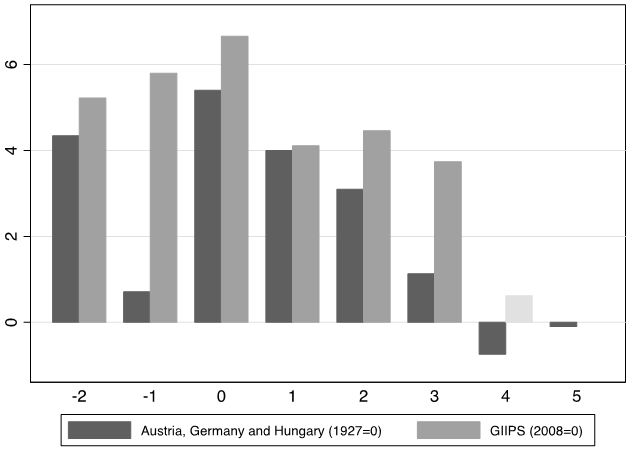

Figure 2 compares the current-account deficits of the largest European capital importers of the 1925-1932 and 2006-2011 periods. Current-account deficits were large in both periods. In 1927, the aggregate current-account deficit of Austria, Germany and Hungary was nearly 5% of their aggregate GDP. This was somewhat smaller than the collective current-account deficit of Greece, Ireland, Italy, Spain and Portugal in 2008 (6.7% of collective GDP).1 However, the subsequent reversal was even larger in the 1920s; the shift in Central European countries’ current-account deficit between 1927 and 1931 represented 6.0% of their collective GDP, whereas between 2008 and 2011 Greece, Ireland, Italy, Spain and Portugal experienced a current-account contraction amounting to 3.2% of their aggregate GDP (the most recent estimate for 2012 however suggests that the GIIPS' current-account deficit contracted further in that year).

Figure 2. Ratio of current-account deficit to GDP (%) 1925-1932 vs. 2006-2012

Note: The graph displays the ratio of aggregate current-account deficit to aggregate GDP for Austria, Germany and Hungary (1925-1932) and Greece, Italy, Portugal, Spain and Ireland (2006-2012). Year 0 corresponds to 1927 and 2008 respectively for the two groups. The figure for 2012 is an estimate. Sources: GIIPS: IMF World Economic Outlook Database, October 2012; Austria, Hungary and Germany: see appendix A.

Important differences between the two episodes

The larger provision of official financing in the more recent episode accounts for this difference. Indeed, one important difference between the two periods is the extent to which official capital inflows compensated for private outflows.

- In the early 1930s official flows took the form of loans for Germany, Austria and Hungary from foreign governments as arranged by the Bank for International Settlements and central bank finance of the balance of payments (central bank purchases and sales of gold and foreign exchange).

- After 2007 they took the form of rescue loans for Greece, Ireland and Portugal from foreign governments and arranged through the European Financial Stability Facility and transfers to the affected countries’ central banks through TARGET2, the EU’s real-time interbank payment system.

As apparent in figures 3 and 4, the decline in private capital inflows to Greece, Italy, Portugal, Spain and Ireland in 2008-2011 was larger than that experienced by Central European countries in 1927-1931. However, the rise in official inflows was also larger, making the resulting current-account adjustment less severe for the capital importers. To some extent, then, the Eurosystem has provided collective insurance against sudden stops. In 1929-31, in contrast, Central European countries were forced to rely on their individual insurance against sudden stops (in the form of international reserves), together with much more limited international emergency support.

Figure 3. Private and official capital inflows, 1925-1932. Austria, Germany and Hungary (in % of aggregate GDP)

Source: See appendix A. The graph displays the aggregate ratios of net private and official capital inflows to GDP (in %) for Austria, Germany and Hungary. Private capital inflows correspond to the sum of the current account deficit and accumulation of gold and foreign exchange reserves. Official inflows correspond to international reserves outflows and loans arranged by the Bank for International Settlements.

Figure 4. Private and official capital inflows, Greece, Ireland, Italy, Portugal and Spain, 2002-2011, in % of aggregate GDP

Source: Data communicated by Jef Boeckx (originally from Thomson Datastream). The graph displays the aggregate ratios of net private and official capital inflows to GDP (in %) for Greece, Ireland, Italy, Portugal and Spain. Private capital inflows are calculated as the difference between the financial account and the net liabilities of the central bank and government reported under the “Other Investment” item of the balance of payment statistics (see Boeckx, 2012 for details). Official capital inflows correspond to a. TARGET2 liabilities; b. loans granted by the IMF, EFSF, EFSM, and other EU governments and c. changes in the central bank’s reserve assets.

Pull factors

In exploring the determinants of capital flows in the 1920s and 1930s, we distinguish between factors specific to the borrowing countries (pull factors) and factors specific to global capital markets (push factors).

Our results indicate that changes in borrowing countries’ conditions (pull factors) cannot account for the surge and sudden stop in European capital issues. Only a handful of borrowing country-specific variables successfully predict bond issues during this period. We find a large, negative and significant association between capital inflows and the level of borrowing countries’ public debt but only during the sudden stop (1929-1932). Evidently investors only grew seriously concerned with debt levels when liquidity dried up and growth rates declined.

Push factors

By contrast, our results indicate that changes in global capital markets’ conditions (push factors) were significant drivers of capital flows. In particular, we find a strongly negative relationship between the volume of capital issues in a given financial centre and the level of long-term interest rates and stock market volatility (a proxy for risk perceptions) in the same market. These effects are large. Evidently, risk perceptions and the cost of capital in international capital markets mattered importantly for the volume of new bonds issued.

The negative association between stock market volatility and capital flows resembles findings for the recent period. Milesi-Ferretti and Tille (2011), Forbes and Warnock (2012) and Rey (2013) also conclude that global risk perceptions have been important determinants of capital flow surges and reversals in the past 30 years.

This result also sheds light on contemporary perceptions of foreign lending. Authors like Harris (1935) and Nurkse (1944) expressed strong scepticism about international capital flows, arguing that they were economically and financially destabilising on balance. Their conclusions were informed by this interwar experience when, our results suggest, debtor countries were first inundated by and then starved of foreign capital, due as much to changing conditions in international capital markets as any changes in local economic circumstances and policies.

Conclusion

The parallels between capital flow surges and reversals in Europe in the periods leading up to the two great financial crises of the modern era, the Great Depression and the Global Credit Crisis, are more than skin deep.

- In both periods there was a flood of capital from one half of Europe to the other, as well as to the continent’s recipient half from the rest of the world.

There was neglect by lenders of public debt burdens and their implications for credit worthiness during the boom and then the sudden rediscovery of sovereign risk once capital dried up.

- In both periods, countries that imported foreign finance most liberally during the boom suffered the largest reversal and most serious dislocations when the surge of capital inflows came to an end.

But recipient-country characteristics explain only a part of trends and fluctuations in private long-term capital flows in the 1920s and early 1930s. At least as important were conditions in international capital markets. Among the important factors there was the level of interest rates, as emphasised in a host of earlier studies, but also perceptions of the riskiness of the investment environment, as captured by the volatility of equity prices, the same proxy utilised in studies of the recent period.

Interwar experience thus underscores the extent to which global factors largely exogenous to conditions in the borrowing countries shaped the capital inflows and outflows to which European countries were subject. This was a precedent of which European countries in the period leading up to subprime/global credit crisis of 2007-8 could have usefully taken heed.

References

Accominotti, Olivier and Barry Eichengreen (2013), “The Mother of All Sudden Stops: Capital Flows and Reversals in Europe, 1919-1932”, Berkeley Economic History Laboratory Working Paper 2013/7.

Boeckx, Jef (2012), "What is the role played by the Eurosystem during the financial crisis?", National Bank of Belgium Economic Review, September 2012, pp.7-28.

Cavallo, Eduardo, Mathieu Pedemonte, Andrew Powell, and Pilar Tavella, Pilar (2013), “A New Taxonomy of Sudden Stops: Which Sudden Stops Should Countries Be Most Concerned About?”, Inter-American Development Bank, working paper IDB-WP-430, August 2013.

Forbes, Kristin J. and Francis E. Warnock (2012), “Capital Flow Waves: Surges, Stops, Flight and Retrenchment”, Journal of International Economics, vol. 88(2), pp. 235-251.

Fostel, Ana and Graciela Kaminsky (2007), “Latin America’s Access to International Capital Markets: Good Behavior or Global Liquidity?”, NBER Working Paper no. 13194, June.

Harris, C.R.S. (1935), Germany’s Foreign Indebtedness, Oxford: Oxford University Press.

Milesi-Ferretti, Gian Maria and Cedric Tille (2011), “The Great Retrenchment: International Capital Flows during the Global Financial Crisis,” Economic Policy, vol. 26(4), pp. 285-342.

Nurkse, Ragnar (1944), International Currency Experience, Geneva: League of Nations.

Pisani-Ferry, Jean and Silvia Merler (2102), "Sudden stops in the Eurozone", VoxEU.org, 2 April.

Rey, Hélène (2013), “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, paper presented at the Jackson Hole Symposium, August 2013.

1 Computed by aggregating current-account deficits and GDP at market exchange rates.